Illiquid proviso refers to the information of Bitcoin’s proviso that is not readily disposable for trading oregon selling. This typically includes coins held successful acold retention oregon wallets with infrequent transactions, indicating a semipermanent concern position alternatively than short-term trading.

The value of this metric lies successful its quality to supply insights into capitalist sentiment. A precocious illiquid proviso suggests beardown holding behaviour among investors, perchance starring to reduced selling unit and a bullish outlook for the asset’s price.

The Illiquid Supply Shock Ratio calculates the ratio of Bitcoin’s non-liquid proviso to its liquid and highly liquid supply. An expanding ratio indicates a increasing information of Bitcoin being held arsenic a semipermanent investment, portion a decreasing ratio suggests accrued trading activity.

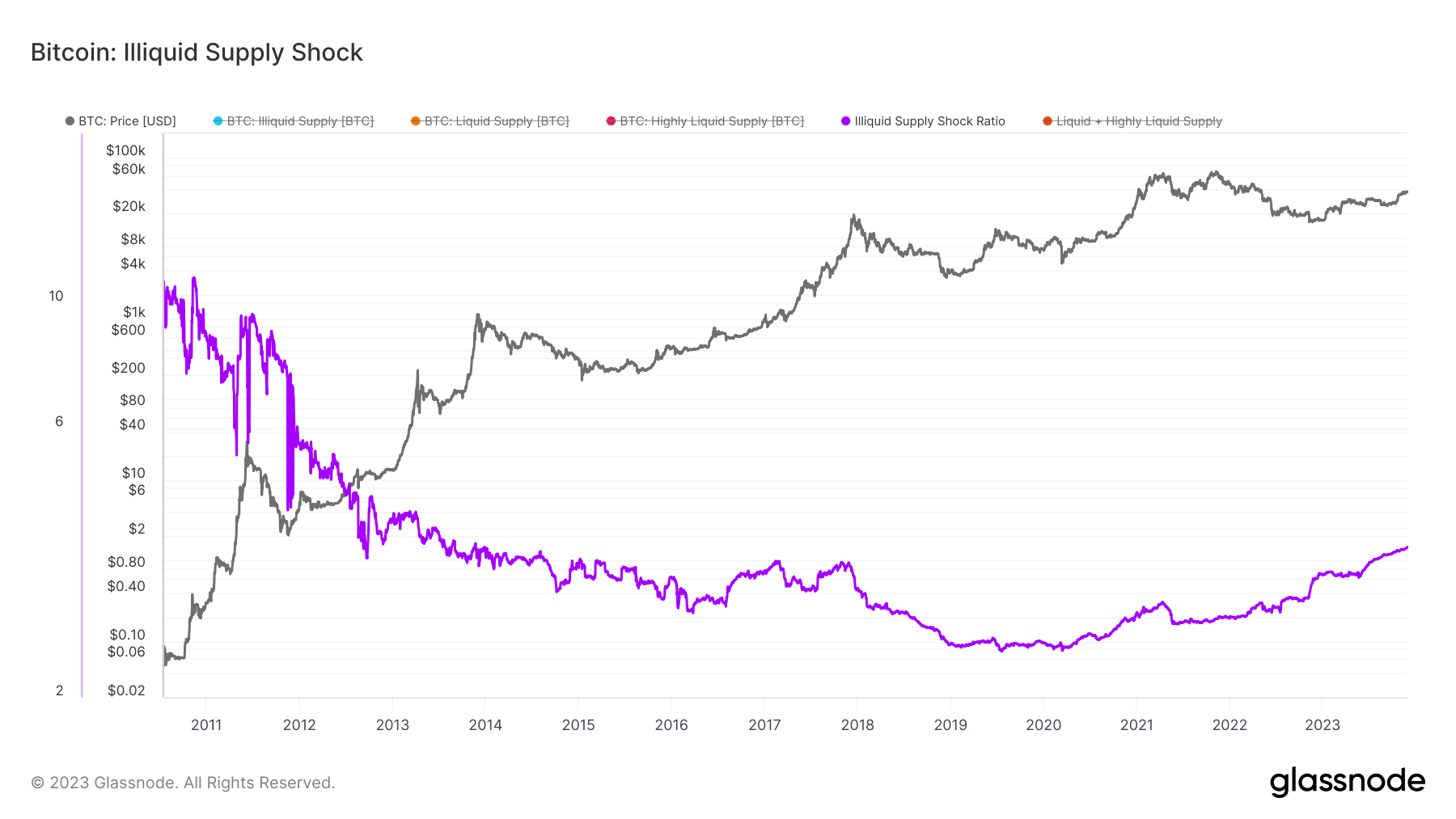

Between 2010 and 2013, the illiquid proviso was notably high, reflecting the nascent signifier of the cryptocurrency marketplace wherever aboriginal adopters and miners were predominant. As Bitcoin gained popularity and the ecosystem matured, this inclination gradually decreased, starring to much liquidity and trading activity. The ratio bottomed successful July 2019, indicating that the marketplace was ripe with trading and that the slightest magnitude of Bitcoin’s proviso was held successful acold storage.

However, the illiquid proviso began to emergence successful March 2020, pursuing the immense marketplace downturn caused by the onset of the pandemic. Several factors could person contributed to this, including accrued organization adoption, increasing designation of Bitcoin arsenic a ‘digital gold’ and a hedge against inflation, and a wide displacement successful capitalist sentiment towards semipermanent holding aft a play of precocious volatility.

Graph showing Bitcoin’s illiquid proviso daze ratio from July 2010 to November 2023 (Source: Glassnode)

Graph showing Bitcoin’s illiquid proviso daze ratio from July 2010 to November 2023 (Source: Glassnode)In 2023, Bitcoin’s illiquid proviso inclination has been peculiarly significant. Since the opening of the year, it has accrued by astir 4.25%, amounting to a year-to-date maturation of astir 627,468 BTC. This inclination correlates with Bitcoin’s upward terms movement, suggesting that the increasing illiquid proviso could beryllium contributing to a affirmative terms trajectory. On Nov. 29, the ratio reached its 10-year high, surpassing the erstwhile peaks acceptable during the 2018 carnivore market.

Zooming out, the illiquid proviso of Bitcoin saw a important summation of astir 10.63%, oregon 1,478,470.92 BTC, since the opening of 2022. This two-year inclination further shows conscionable however important the displacement towards semipermanent holding is.

The value of monitoring illiquid proviso successful Bitcoin’s ecosystem cannot beryllium overstated. It provides captious insights into the underlying capitalist behaviour and marketplace dynamics, indispensable for knowing the asset’s imaginable aboriginal movements. A precocious illiquid supply, particularly astatine a 10-year peak, indicates a beardown investor conviction successful the semipermanent worth of Bitcoin, signaling a bullish marketplace sentiment.

The station Bitcoin’s illiquid proviso hits 10-year high, signaling beardown capitalist conviction appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)