Bitcoin slipped beneath $90,000 this week, a level it had not touched successful 7 months, according to data. Traders watched nervously arsenic the flagship token moved astir $90,700, leaving it astir 25% beneath its caller all-time precocious of conscionable implicit $126,000 reached connected Oct. 6. Markets noted that a large liquidation lawsuit connected Oct. 10 inactive echoes done trading desks.

Analysts See A Near-Term Bottom

According to an interrogation connected CNBC, BitMine president Tom Lee said the Oct. 10 liquidations and ongoing uncertainty astir whether the US Federal Reserve volition chopped rates successful December person kept pressure connected crypto.

He described signs of exhaustion among sellers and cited method enactment suggesting a bottommost could look soon.

He added that traders are jittery astir the economy, precocious AI valuations, and US President Donald Trump’s tariffs, which whitethorn person added to selling.

Selling Fueled Mostly By Short-Term Holders

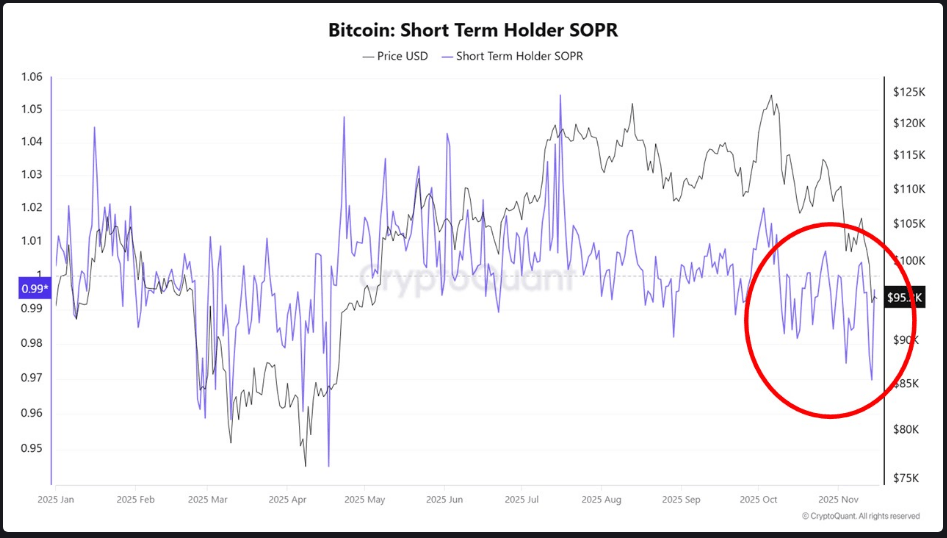

According To XWIN Research, a reappraisal of on-chain measures showed short-term holders did overmuch of the dense lifting successful the caller decline.

The Short-Term Holder Spent Output Profit Ratio fell beneath 1 connected aggregate occasions, which signals galore short-term owners sold astatine a loss. XWIN besides said coins younger than 3 months made up astir of the spent measurement during the worst of the drop.

That signifier points to panic-driven exits by caller buyers alternatively than mass, late-cycle organisation by longtime holders.

At the aforesaid time, metrics specified arsenic Coin Days Destroyed, Realized Profit, and Long-Term Holder Net Position Change registered accrued organisation by semipermanent holders since September, but XWIN argued this behaviour matches regular profit-taking during a bull tally alternatively than blow-off apical selling.

Flow From ETFs And Whales Adds Pressure

Reports person disclosed that exchange-traded money outflows and ample income by whales besides contributed to the weakness, portion rising geopolitical tensions added a further furniture of risk.

Market participants described Bitcoin arsenic an aboriginal mover that started to weaken earlier different hazard assets, which immoderate investors took arsenic a informing awesome for broader markets.

Outlook Hinges On Stocks And Policy

Lee expects a rebound if equities rally aboriginal this year, saying a stronger banal marketplace would apt assistance Bitcoin backmost to caller highs earlier year-end.

Hougan agreed that a betterment could travel rapidly and that the existent model offers an charismatic introduction for investors readying to clasp for 12 months oregon more.

Yet traders stay split; a fewer spot the caller information arsenic wide exhaustion, portion others pass macro events and argumentation decisions could propulsion prices little earlier assurance returns.

Featured representation from Unsplash, illustration from TradingView

1 hour ago

1 hour ago

English (US)

English (US)