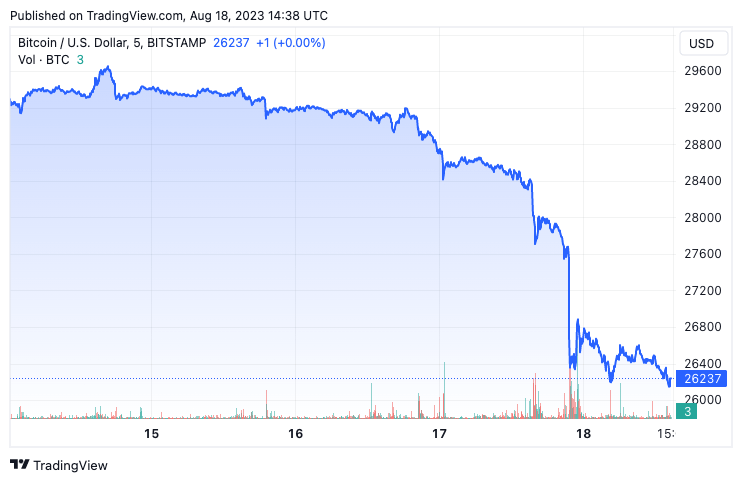

Bitcoin’s terms plummeted to $26,298 connected Aug. 17, marking a important 9% diminution wrong a 24-hour span.

Graph showing Bitcoin’s terms from Aug. 14 to Aug. 18, 2023 (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms from Aug. 14 to Aug. 18, 2023 (Source: CryptoSlate BTC)Ethereum wasn’t spared either, arsenic its terms tumbled to $1,620, reflecting a 10% driblet during the aforesaid period.

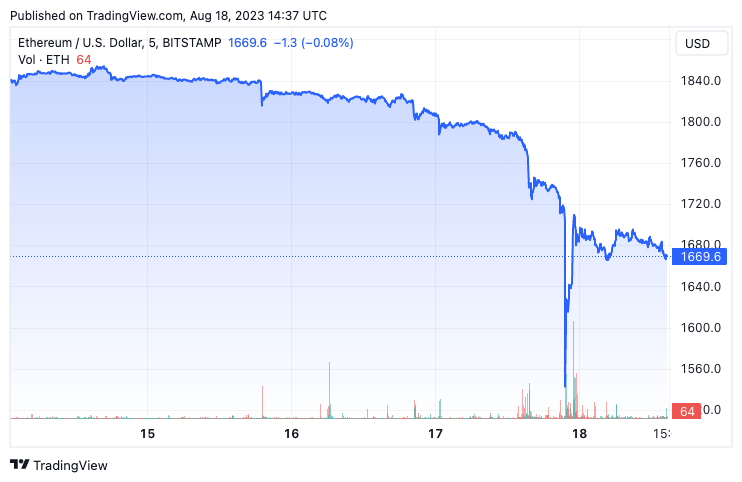

Graph showing Ethereum’s terms from Aug. 14 to Aug. 18, 2023 (Source: CryptoSlate ETH)

Graph showing Ethereum’s terms from Aug. 14 to Aug. 18, 2023 (Source: CryptoSlate ETH)This abrupt downturn didn’t conscionable rattle traders but besides triggered extended liquidation events for some Bitcoin (BTC) and Ethereum (ETH).

The derivatives marketplace witnessed liquidations surpassing $1 billion. But it’s indispensable to differentiate betwixt futures liquidations and realized loss. Futures liquidations notation to the process wherever the speech automatically closes a trader’s presumption erstwhile their relationship equilibrium falls beneath the attraction margin. In contrast, realized nonaccomplishment pertains to the existent nonaccomplishment an capitalist incurs erstwhile they merchantability an plus for little than its acquisition price.

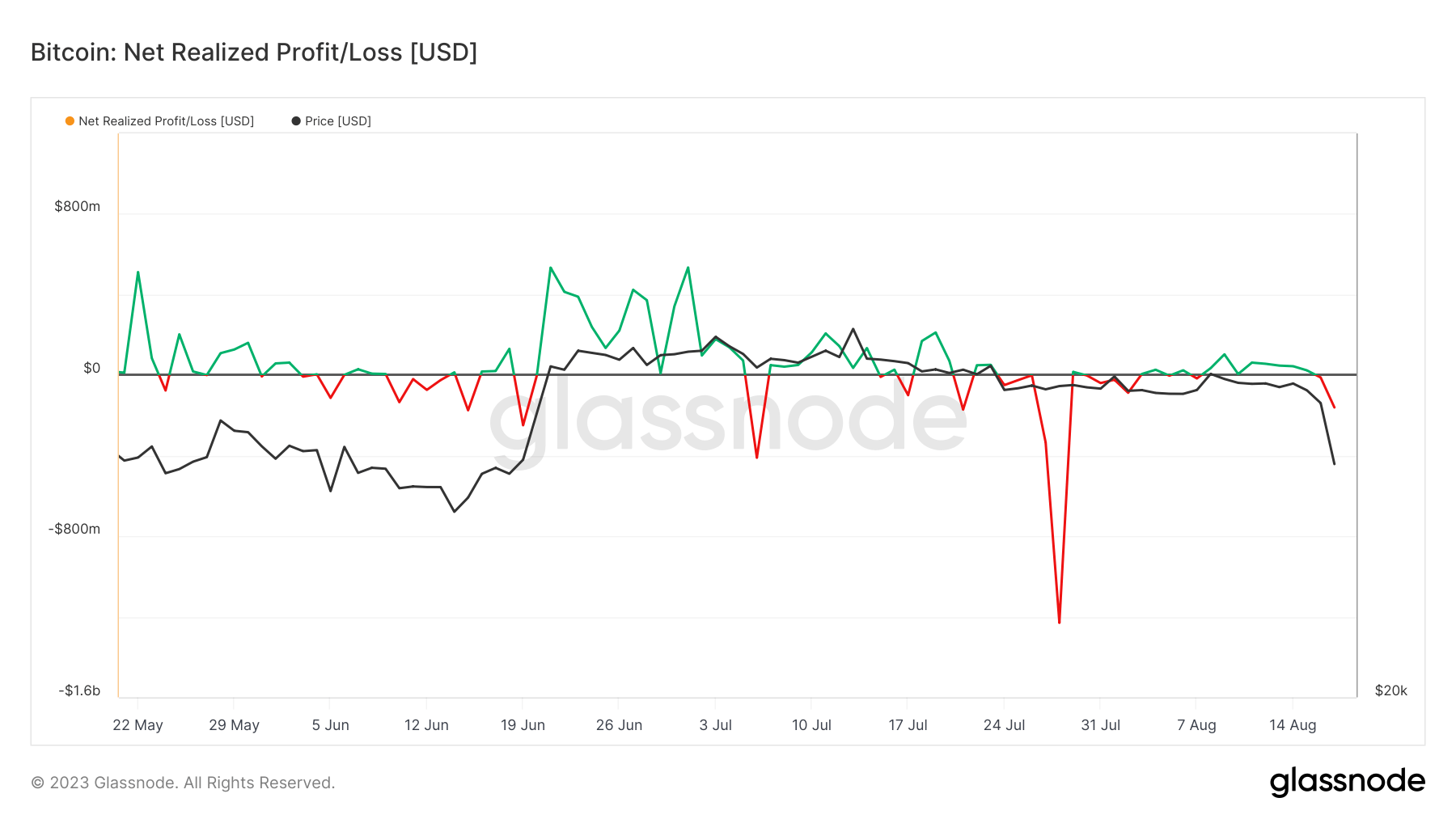

On-chain information revealed that the nett realized profit/loss, a metric that gauges the nett oregon nonaccomplishment of each transacted coins, saw $160 cardinal successful realized losses connected Aug. 17.

Graph showing the nett realized/profit nonaccomplishment for Bitcoin from May 21 to Aug. 18, 2023 (Source: Glassnode)

Graph showing the nett realized/profit nonaccomplishment for Bitcoin from May 21 to Aug. 18, 2023 (Source: Glassnode)While this fig mightiness look alarming, it’s worthy noting that it pales successful examination to the staggering $1.2 cardinal successful losses recorded connected July 28. However, what sets the Aug. 17 lawsuit isolated is the aftermath — dissimilar erstwhile important realized nonaccomplishment incidents this year, the Aug. 17 lawsuit was succeeded by an unusually crisp driblet successful Bitcoin’s price.

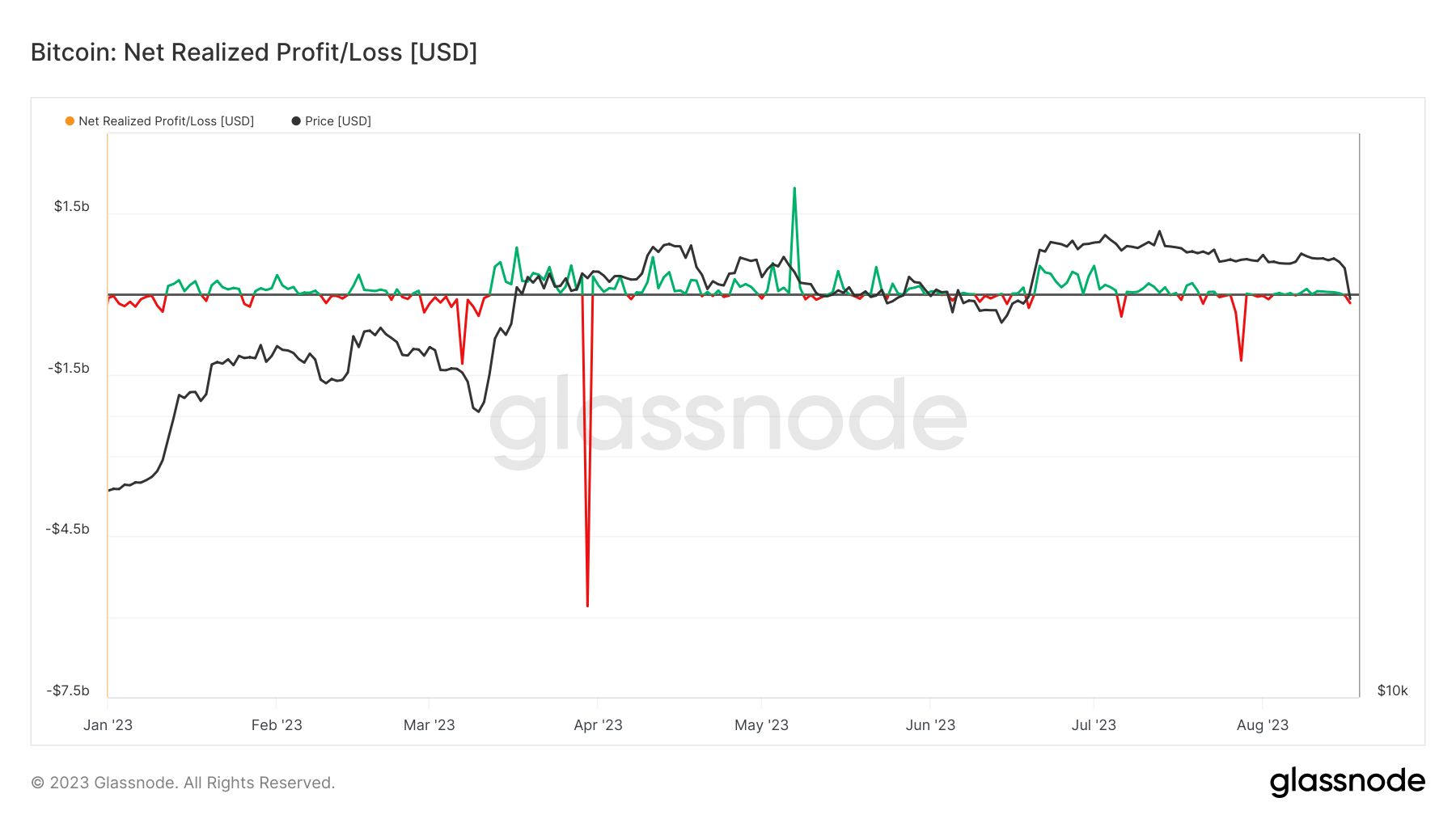

Graph showing the nett realized/profit nonaccomplishment for Bitcoin YTD (Source: Glassnode)

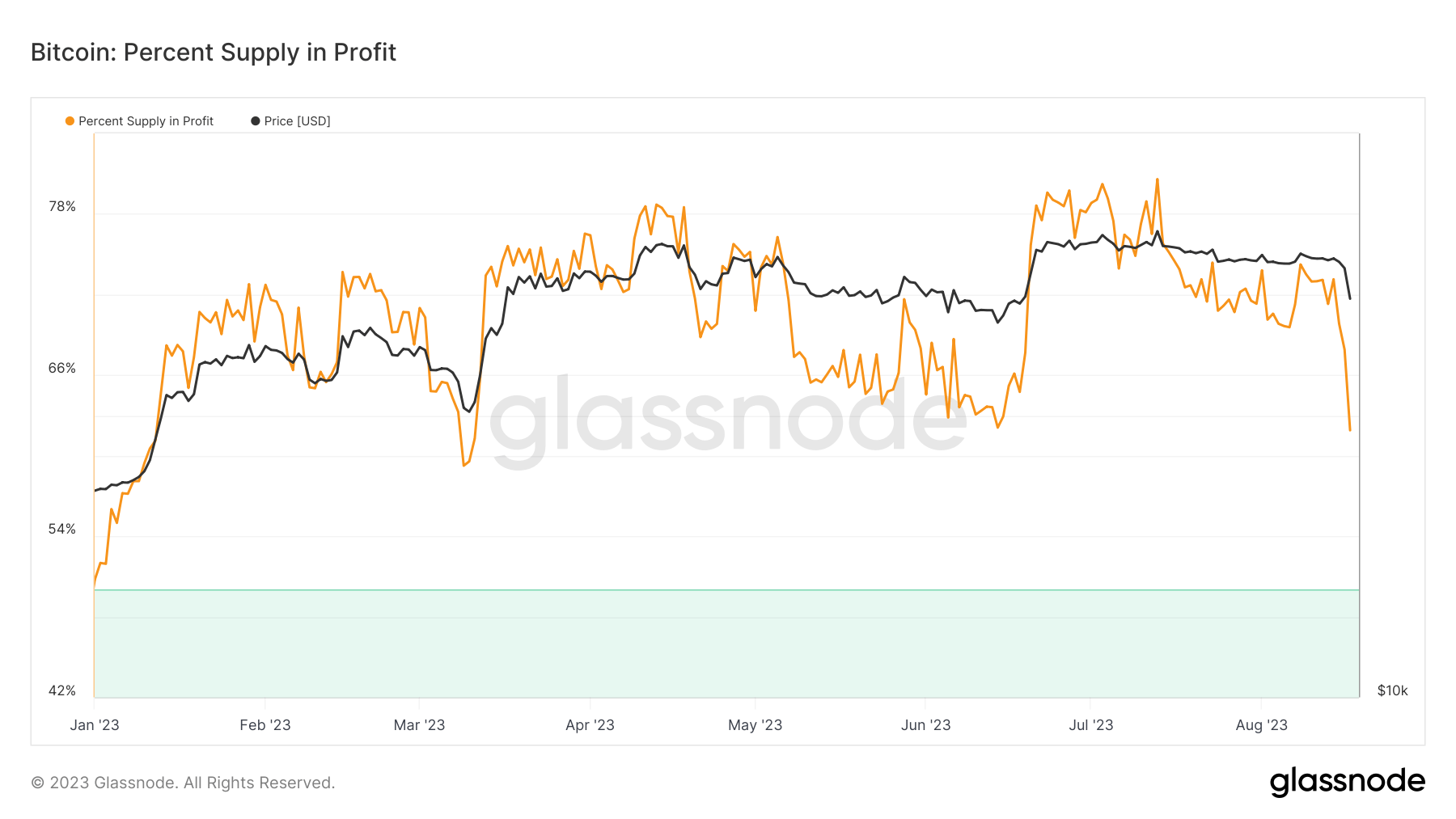

Graph showing the nett realized/profit nonaccomplishment for Bitcoin YTD (Source: Glassnode)On Aug. 18, Bitcoin’s terms showed resilience and bounced backmost somewhat to $26,600 astatine property time. However, the percent of proviso successful profit, which indicates the proportionality of circulating Bitcoins that were bought beneath its spot price, took a important deed and presently stands astatine conscionable supra 61%.

Graph showing the percent of Bitcoin’s proviso successful nett YTD (Source: Glassnode)

Graph showing the percent of Bitcoin’s proviso successful nett YTD (Source: Glassnode)The station Bitcoin’s driblet to $26.6K sees implicit $160M successful realized losses appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)