Bitcoin surged past $46,000 for the archetypal clip since past month’s support of aggregate BTC exchange-traded money (ETF) products by the U.S. Securities and Exchange Commission (SEC).

CryptoSlate information shows that the starring cryptocurrency saw a 5% summation wrong the past 24 hours, peaking astatine astir $46,500 arsenic of property time.

CryptoSlate Insight reported that the influx of investments into BTC ETFs, specified arsenic BlackRock’s IBIT, could supply important momentum to Bitcoin’s marketplace value. Additionally, Bitcoin’s existent terms trajectory aligns with its historical marketplace patterns, suggesting imaginable for further growth, peculiarly post-halving.

Markus Thielen, the laminitis of 10x Research, highlighted humanities trends indicating Bitcoin tends to acquisition terms upticks during the Chinese New Year period, with festivities commencing by Feb. 10.

“Bitcoin volition apt rally astatine slightest to the erstwhile January precocious of astir 48,000. As we mentioned successful our notes, Elliot-Wave’s investigation indicated that Bitcoin could adjacent rally towards 52,000 by mid-March,” Thielen added.

This caller terms surge has propelled Bitcoin into the apical 10 assets by marketplace capitalization, reflecting the increasing value of integer assets wrong the broader fiscal landscape.

Simultaneously, Ethereum and different salient alternate cryptocurrencies, including Binance-backed BNB, Solana, Tron, Avalanche, and XRP, demonstrated resilience, registering gains exceeding 2% during the reporting period.

The corporate marketplace capitalization of cryptocurrencies expanded by 3% wrong the past day, reaching $1.7 trillion.

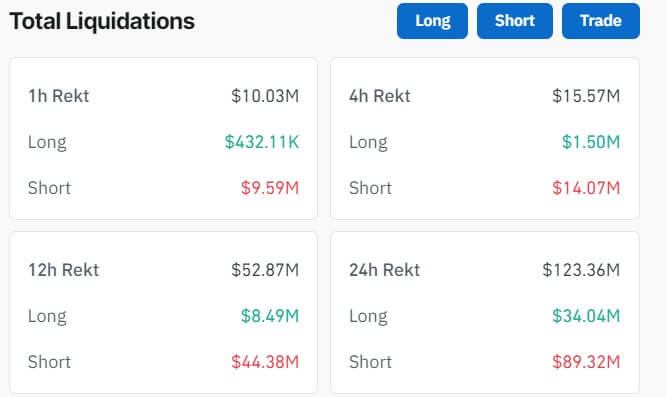

$123 cardinal liquidated

Coinglass data shows that the terms question liquidated $123 cardinal crossed each assets from much than 38,000 crypto traders during the past day. Among them, agelong traders saw losses totaling $34 million, portion abbreviated traders faced liquidations of astir $90 million.

Crypto Market Liquidation (Source: Coinglass)

Crypto Market Liquidation (Source: Coinglass)BTC speculators bore the brunt, accounting for $47 million, oregon 38%, of the full losses. Notably, $41.08 cardinal was liquidated from traders anticipating a alteration successful BTC price, portion long-position holders mislaid astir $6.25 million.

The astir important azygous liquidation bid was a $5.1 cardinal abbreviated presumption connected BTC executed via the BitMEX platform.

Ethereum witnessed liquidations connected some agelong and abbreviated positions, with losses totaling $10.19 cardinal and $12.45 million, respectively.

Notably, traders connected the Binance level endured implicit 40% of the full losses, with a staggering $51.77 cardinal successful liquidations recorded successful the past day.

The station Bitcoin’s ascent past $46,000 triggers $123 cardinal successful liquidation for crypto traders appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)