The U.S. economical scenery has been a important determinant of capitalist sentiment. The latest U.S. GDP report, which exceeded marketplace expectations, has near investors hypersensitive to moves and decisions coming from the U.S. government. The marketplace was bracing for a weaker economical performance, but the stronger-than-anticipated GDP figures person caused ripples crossed assorted plus classes.

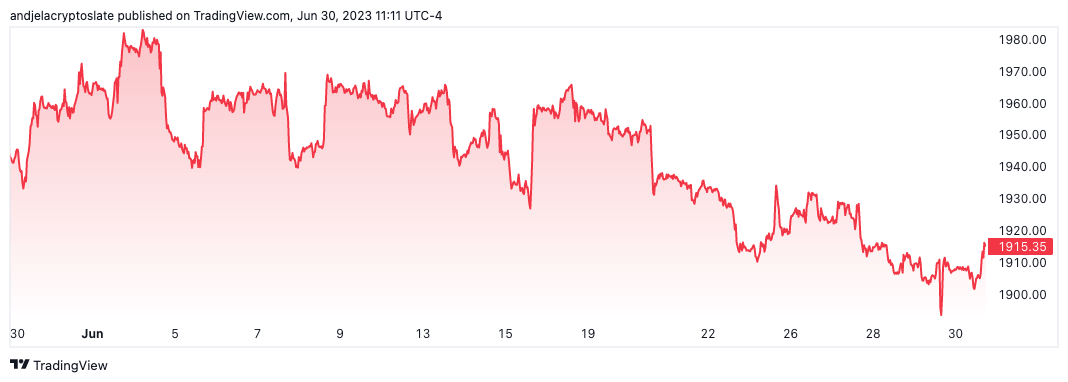

Gold, often considered a harmless haven during economical uncertainty, dipped beneath the $1,900 people pursuing the GDP report. Over the past 30 days, gold’s terms has fluctuated betwixt $1,945 and $1,933.

Graph showing the terms of golden from May 30 to June 30, 2023 (Source: TradingView)

Graph showing the terms of golden from May 30 to June 30, 2023 (Source: TradingView)Changes successful golden prices tin supply insights into capitalist sentiment towards alternate investments, which tin power the crypto market, particularly during periods of economical uncertainty.

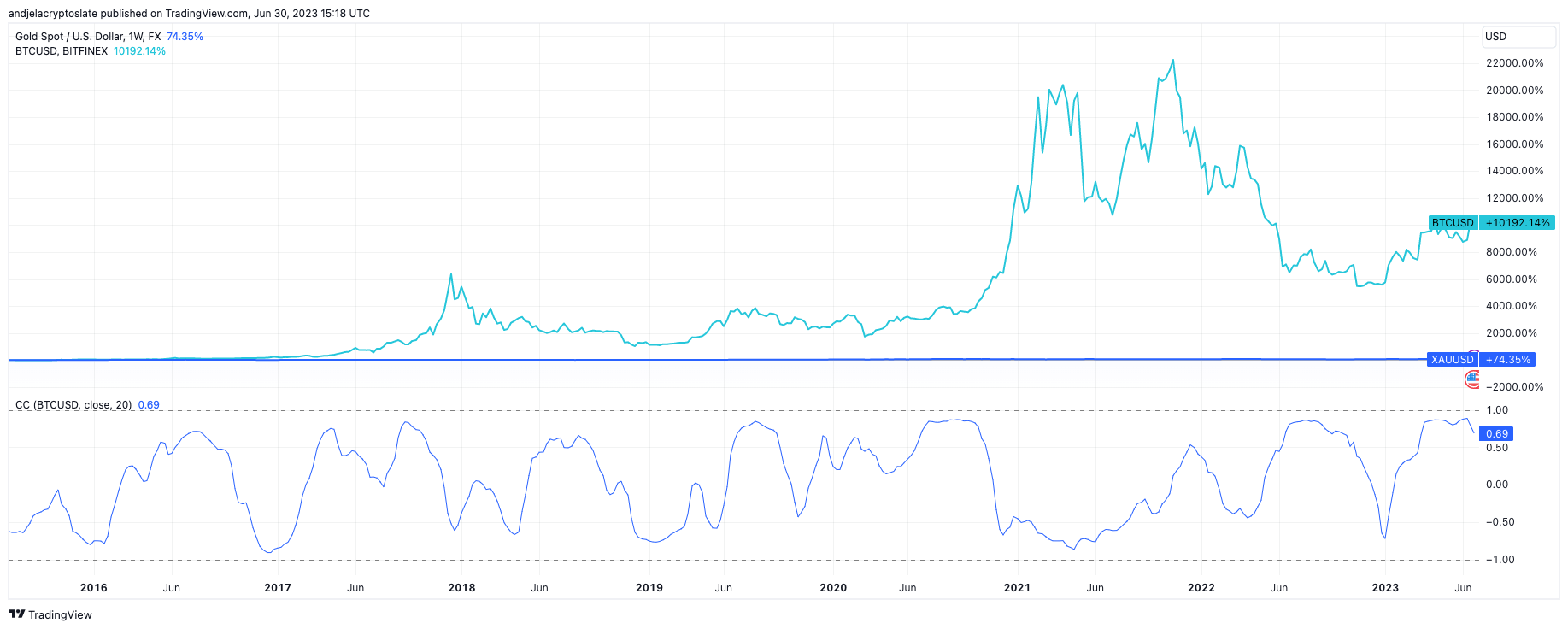

Historically, the terms movements of golden and Bitcoin person exhibited a precocious grade of correlation. This correlation is often attributed to their shared presumption arsenic alternate investments and stores of value, autarkic of accepted fiat currencies. Both golden and Bitcoin are seen arsenic harmless havens during times of economical uncertainty, providing a hedge against ostentation and currency devaluation.

Graph showing the correlation betwixt XAU and BTC from 2015 to 2023 (Source: TradingView)

Graph showing the correlation betwixt XAU and BTC from 2015 to 2023 (Source: TradingView)When economical conditions are uncertain oregon volatile, investors often crook to golden arsenic a ‘safe haven’ asset. This is due to the fact that golden retains its worth implicit time, dissimilar fiat currencies which tin beryllium devalued done inflation. As request for golden increases during these periods of uncertainty, truthful does its price.

Conversely, the terms of golden tin autumn erstwhile economical conditions amended and capitalist assurance successful accepted markets strengthens. In specified scenarios, investors often displacement their assets from golden to riskier investments similar stocks, starring to decreased request for golden and subsequently, a driblet successful its price.

Bitcoin has gained designation arsenic a hedge against economical uncertainty, akin to gold. During periods of banal marketplace volatility, investors person progressively turned to Bitcoin arsenic an alternate investment. This is due to the fact that Bitcoin operates independently of the accepted fiscal system, making it little susceptible to the aforesaid economical pressures that tin impact fiat currencies and the banal market.

However, this long-standing narration betwixt golden and Bitcoin appears to beryllium undergoing a important shift.

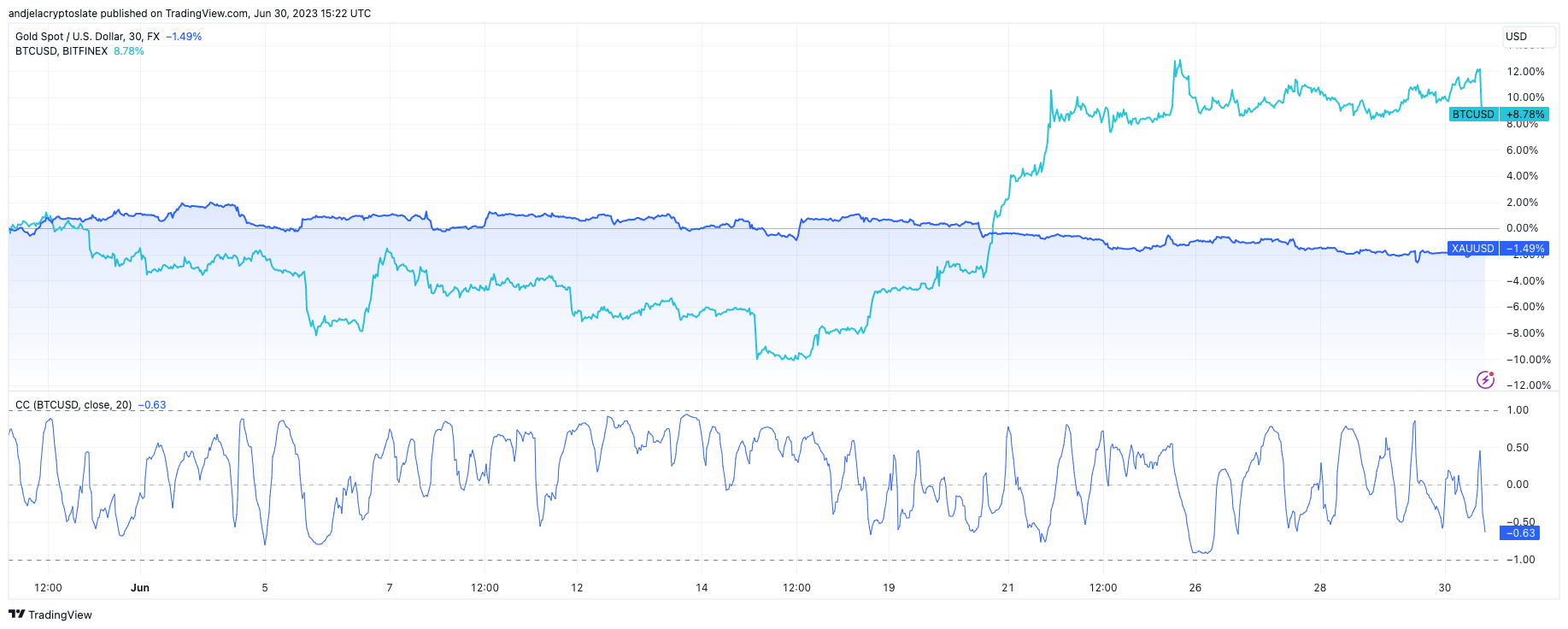

The Bitcoin-gold correlation dropped to its yearly debased connected June 28, trailing the one-year timeframe arsenic well. This divergence suggests a imaginable decoupling of Bitcoin from gold, indicating a maturing crypto marketplace that’s carving its ain path.

Graph showing the correlation betwixt XAU and BTC from June 30, 2022, to June 30, 2023 (Source: TradingView)

Graph showing the correlation betwixt XAU and BTC from June 30, 2022, to June 30, 2023 (Source: TradingView)This increasing independency of the crypto marketplace is simply a important development. It could suggest that Bitcoin and different cryptocurrencies are becoming little influenced by accepted marketplace dynamics and much driven by factors unsocial to the crypto space. This could pb to a much diversified concern scenery wherever cryptocurrencies play a much chiseled role, abstracted from accepted plus classes.

The station Bitcoin’s breakup with golden whitethorn beryllium a motion of crypto’s emerging maturity appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)