Bitcoin BTC options worthy billions of dollars are acceptable to expire this Friday astatine 08:00 UTC connected Deribit, making the $95,000 to $105,000 scope a captious portion for imaginable volatility and directional cues.

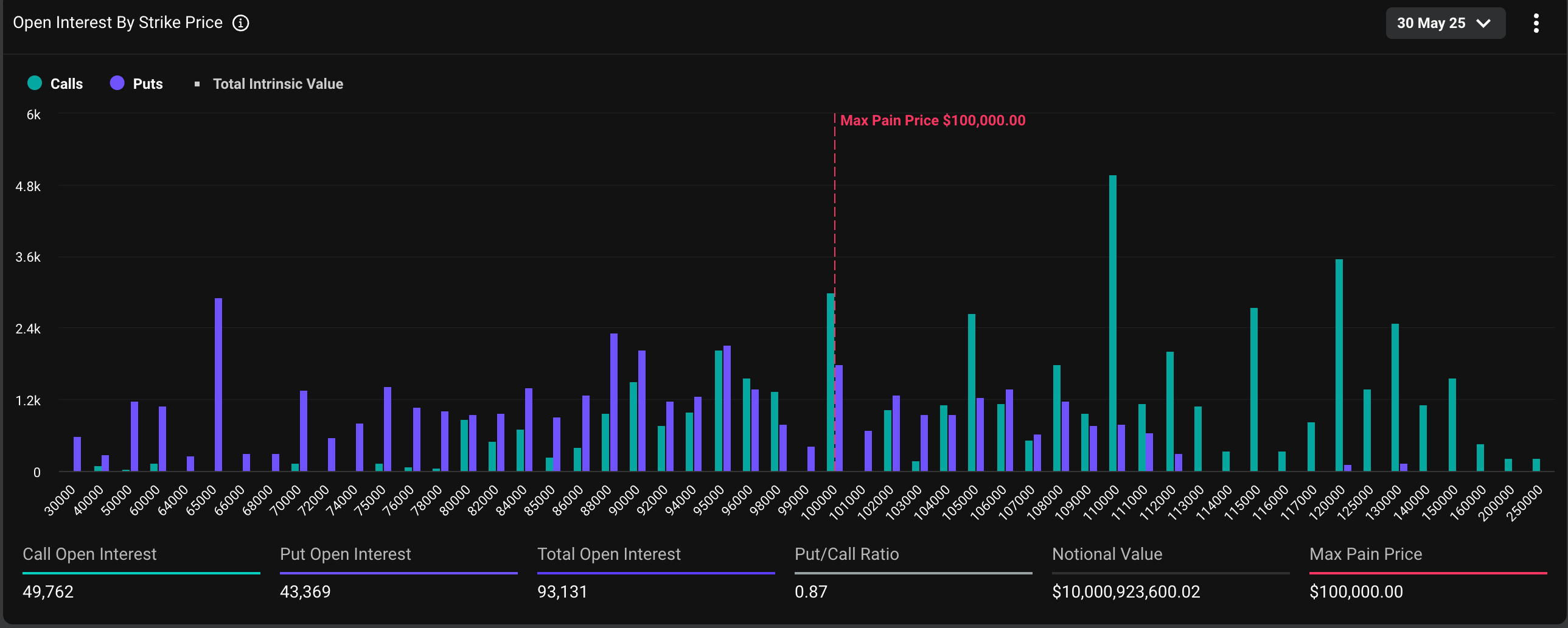

At property time, a full of 93,131 bitcoin monthly options contracts, worthy implicit $10 billion, were owed for settlement, with 53% being calls and the remainder being puts. A telephone enactment represents a bullish stake connected the market, portion the enactment enactment offers security against terms slides. On Deribit, 1 options declaration represents 1 BTC.

The unfastened involvement organisation is specified that a ample magnitude of "delta" vulnerability is clustered astatine the $95,000, $100,000 and $105,000 strikes. This means traders holding positions astatine these strikes person a important nett directional hazard to bitcoin's price.

Gamma, which measures the sensitivity of options to changes successful BTC's price, volition highest arsenic the expiration nears. Therefore, terms volatility could trigger wide hedging by some investors and marketplace makers (who are ever connected the other broadside of investors' trades), further exacerbating terms turbulence.

"The largest delta attraction is successful Deribit BTC’s May 30 expiry, with $2.8B delta vulnerability led by strikes astatine $100K, $105K, and $95K, which has a imaginable for beardown gamma-driven flows into month-end," decentralized crypto trading level Volmex said successful an explainer connected X.

"Any determination tin trigger assertive trader hedging, fragile gamma environment! Expect volatility!," Volmex added.

At property time, Bitcoin changed hands astatine $107,700, having reached grounds highs supra $111,000 the erstwhile week, according to CoinDesk data.

Deribit's DVOL index, which represents the options-based 30-day implied oregon expected volatility, continued to decline, suggesting minimal interest implicit volatility driven by the upcoming expiry.

Volmex's annualized one-day implied volatility scale ticked somewhat higher to 45.4%. That implies a 24-hour terms determination of 2.37%.

5 months ago

5 months ago

English (US)

English (US)