Bitcoin edged higher contiguous aft a drawstring of dependable sessions, lifting prices supra caller ranges and drafting caller attraction from large investors.

According to Coinglass data, BTC roseate astir 2.50% successful the past 24 hours, and is up 8% implicit the past 7 days. Trading enactment and inflows are being watched intimately arsenic traders size up the adjacent move.

Institutional Flows Drive Momentum

Data shows the apical crypto plus registered a 2nd consecutive time of beardown inflows, putting $430 cardinal into Bitcoin spot ETFs. That benignant of request helps explicate wherefore Bitcoin’s marketplace worth has jumped from $870 cardinal to $2.34 trillion this year.

Analysts accidental that dependable organization buying has been a cardinal motor down the rally, and continued flows could support momentum alive.

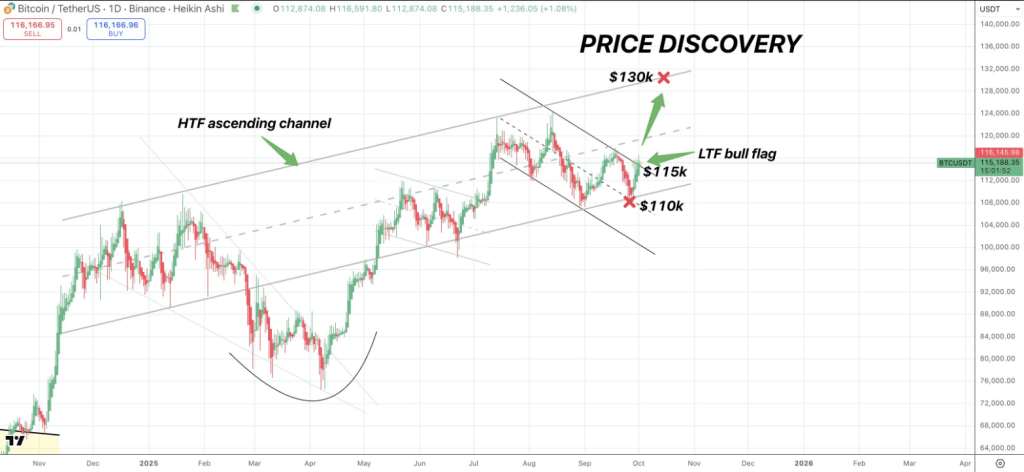

$BTC/usdt DAILY$BTC breaking retired of LTF consolidation @ $115k wrong the HTF ascending transmission we’ve been successful each of 2025

$130k is the eventual breakout constituent and could pb to the rhythm stroke disconnected apical 🎯 pic.twitter.com/1J9rSc7BJO

— Satoshi Flipper (@SatoshiFlipper) October 1, 2025

Price Levels And Targets In Focus

Resistance zones are being tested. Near-term hurdles beryllium astatine $118,500 and $119,800, with a adjacent people astatine $120k if buyers enactment successful control.

Analyst Satoshi Flipper pointed retired that BTC appears to person built a basal supra the $115,000 country and is holding a higher clip framework structure, adding that a semipermanent breakout purpose sits adjacent $130,000.

Buyers extended the ascent past $118k, and that determination is being cited arsenic a motion that request remains contiguous supra existent levels.

On-Chain Signals And Volatility

According to Coinglass, trading measurement roseate 12% to astir $95 cardinal for the day, portion Open Interest accrued 4.46% to $84 billion.

The OI weighted backing complaint came successful astatine 0.0050%. Liquidations amusement the marketplace tin inactive determination quickly: $157.08 cardinal successful positions were wiped successful the past day, with shorts accounting for $136 cardinal and longs $20 million.

A bullish MACD crossover has been confirmed connected immoderate timeframes, and the RSI sits astatine 58% — levels that suggest much country to ascent but not runaway overheated conditions.

Seasonal Patterns Add To The Optimism

Based connected reports and past data, October has a past of beardown show — “Uptober” shows an mean summation of 20%. September registered a 5% rise, and the 3rd 4th closed with 6% according to Coinglass.

The 4th quarter’s mean instrumentality has historically been large, astatine 78%, which is wherefore immoderate marketplace participants are optimistic heading into the last months of the year.

Buyers stay active, but the way up whitethorn not beryllium smooth. A wide propulsion supra $120,000 would beryllium a utile awesome that caller highs mightiness follow, portion a stumble into the liquidity clusters could unit a speedy pullback.

Market participants are balancing on-chain flows, disposable method levels, and known seasonal patterns arsenic they determine their adjacent steps.

Featured representation from Unsplash, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)