On May 1, U.S. regulators seized and sold First Republic Bank (FRB) and its assets to JPMorgan successful what has present go the largest slope nonaccomplishment since 2008. FRB is the 5th slope to neglect successful little than 2 months, pursuing connected from Silvergate, Silicon Valley Bank, Signature Bank, and Credit Suisse.

Despite the rising fig of struggling banks, regulators proceed to guarantee the nationalist that these failures aren’t portion of a planetary banking situation — blaming short-term turmoil among section lenders for the fallout.

A root adjacent to Treasury Secretary Janet Yellen told CNN that First Republic was an outlier successful the determination banking sector. First-quarter results showed that astir each midsize and determination banks were “well-capitalized” and that deposit flows person stabilized, the root argued.

Jamie Dimon — the CEO of JPMorgan — echoed the statement, assuring participants of a caller capitalist telephone that the banking assemblage was “stable.”

“No crystal shot is perfect, but yes, I deliberation the banking strategy is precise stable. This portion of the situation is over.”

Bending the banking system

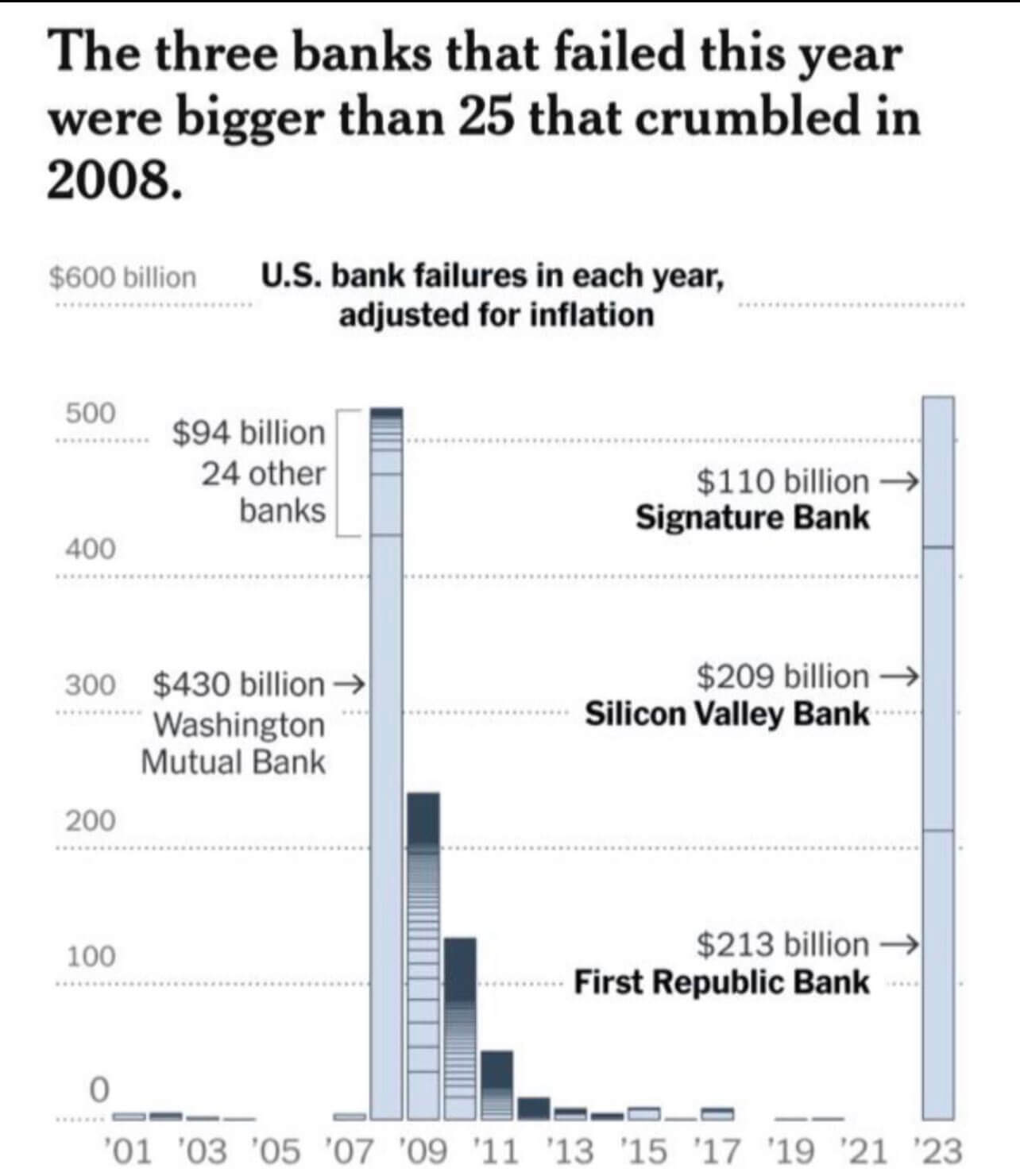

However, the nonaccomplishment of First Republic, Signature, and Silicon Valley Bank is already bigger than the 25 banks that failed successful 2008.

Data from The New York Times showed that the 3 had implicit $530 cardinal successful assets — portion Washington Mutual and the 24 different banks that crumbled successful 2008 managed astir $524 billion, adjusting the information for inflation.

Graph comparing slope failures successful 2008 and 2023 (Source: The New York Times)

Graph comparing slope failures successful 2008 and 2023 (Source: The New York Times)JPMorgan’s acquisition of First Republic was lauded by U.S. regulators arsenic a heroic determination that saved the taxpayers from fronting the measure for its failure. However, it sets a unsafe precedent that could spot the U.S. marketplace go dangerously centralized and government-dependent.

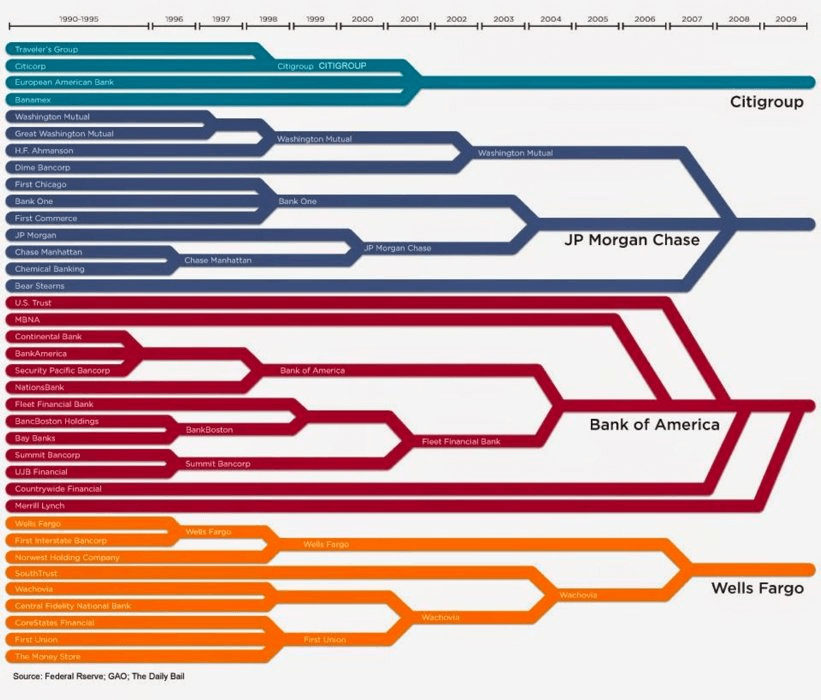

While there’s nary explicit instrumentality prohibiting banks from controlling immoderate percent of the country’s full deposits, determination are safeguards successful spot that forestall systemic banking issues. The Dodd-Frank Act — passed successful 2010 successful effect to the 2008 fiscal situation — enables regulators to artifact mergers and acquisitions that would effect successful a slope becoming “too large to fail.”

Numerous economists and analysts warned that JPMorgan’s acquisition of First Republic should ne'er person been allowed. The arguable $10 cardinal woody saw JPMorgan get the important bulk of FRB’s assets and presume its deposits — some insured and uninsured — from the FDIC.

This pushed JPMorgan’s full assets implicit $3.2 trillion, cementing its presumption arsenic the largest slope successful the U.S.

Illustration showing the consolidation of large U.S. banks into 4 banking conglomerates (Source: The Daily Ball)

Illustration showing the consolidation of large U.S. banks into 4 banking conglomerates (Source: The Daily Ball)As portion of the deal, JPMorgan acquired $173 cardinal of loans and $30 cardinal worthy of securities from FRB. It besides assumed astir $92 cardinal of deposits, including $30 cardinal of ample slope deposits, each of which volition beryllium repaid aft the woody closes. The FDIC volition stock JPMorgan’s nonaccomplishment connected $13 cardinal worthy of residential owe loans and commercialized loans, arsenic good arsenic supply JPMorgan with $50 cardinal of financing.

Bitcoin

On the other broadside of the fiscal spectrum stands Bitcoin, which seems to person utilized the ongoing banking situation to laic a beardown instauration for the remainder of the year.

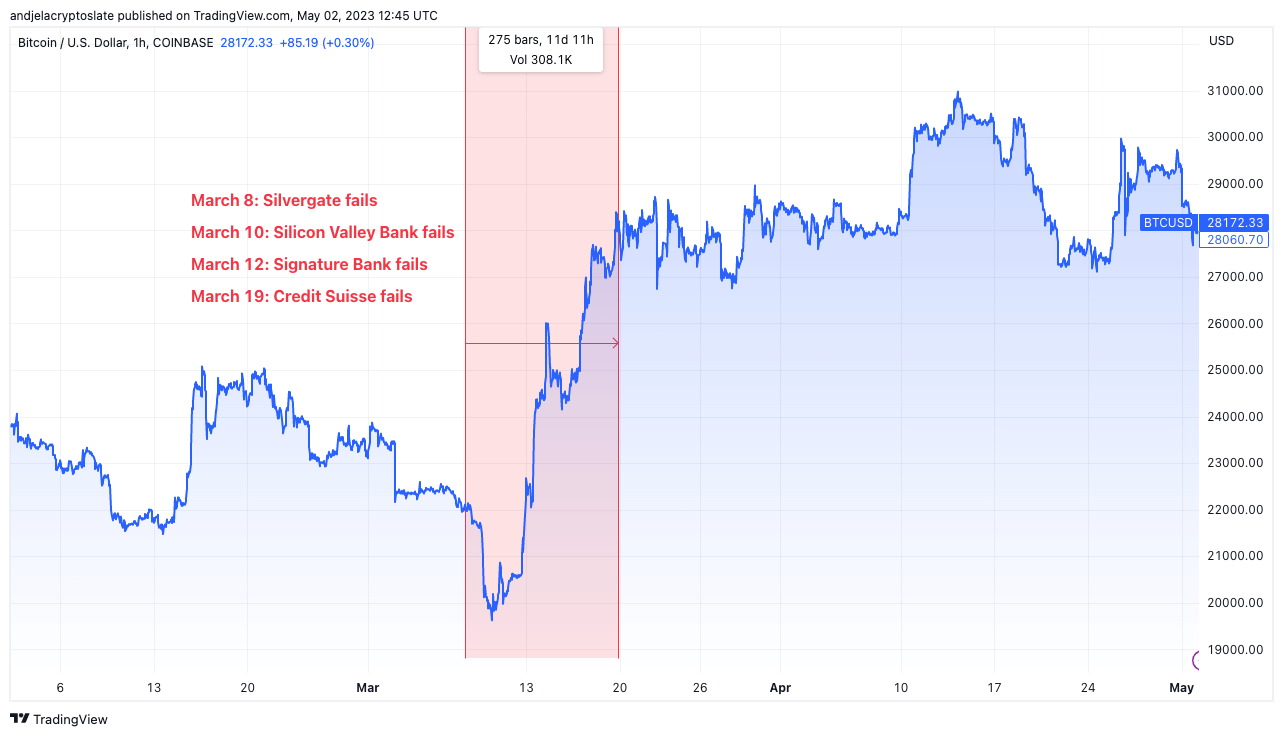

The 4 consecutive slope failures that took spot betwixt March 8 and March 18 this twelvemonth affected Bitcoin’s terms — wiping retired astir 17% of its marketplace cap. However, the effect was short-lived and Bitcoin rapidly began recovering from the archetypal daze regaining the 17% nonaccomplishment successful little than 3 days.

Since then, Bitcoin’s terms has been going up, with BTC trading astatine conscionable implicit $28,000 astatine property time. The volatility BTC experienced erstwhile crossing $30,000 and its accordant correction astatine astir $27,000 could mean that beardown absorption was formed.

Graph showing Bitcoin’s terms from February to May 2023 (Source: TradingView)

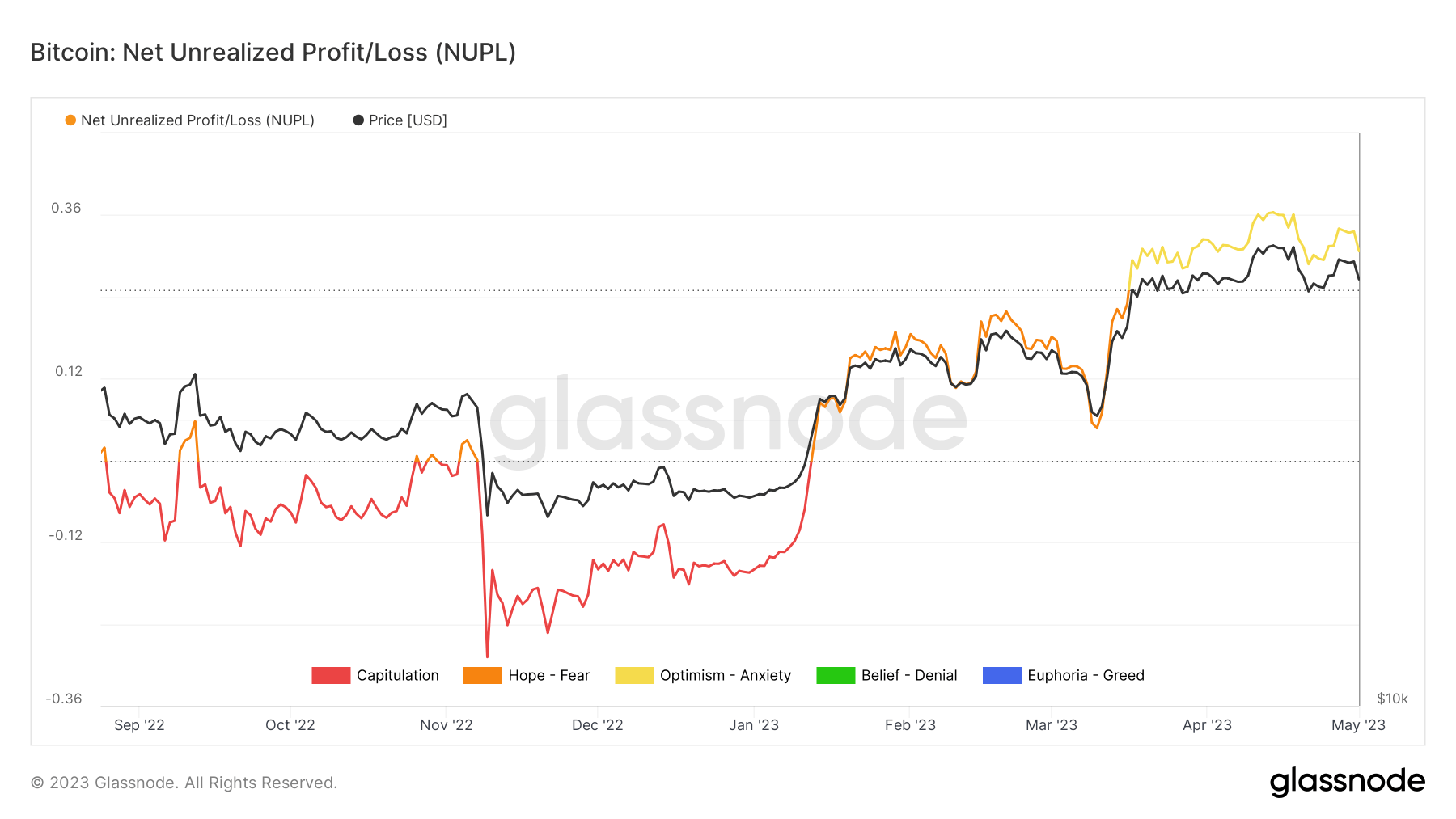

Graph showing Bitcoin’s terms from February to May 2023 (Source: TradingView)Bank failures besides look to person injected the crypto marketplace with a long-awaited optimism. The Net Unrealized Profit/Loss (NUPL) is an indicator utilized to find whether the web arsenic a full is successful a authorities of nett oregon loss. The higher the NUPL people is, the much unrealized profits determination are successful the web and the much optimistic the web is wide astir upcoming terms action.

Looking astatine Bitcoin’s NUPL people shows that immoderate semblance of fearfulness brought connected by the nonaccomplishment of Silvergate, Signature, and Silicon Valley Bank was rapidly wiped out.

Graph showing Bitcoin’s NUPL people from September 2022 to May 2023 (Source: Glassnode)

Graph showing Bitcoin’s NUPL people from September 2022 to May 2023 (Source: Glassnode)The station Bitcoin rises amidst drawstring of slope failures: is this the commencement of a caller fiscal era? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)