Bitcoin's (BTC) prolonged scope play supra $90K has concluded bearishly this week, and how?

The 12.6% driblet observed successful the archetypal 3 days of the week (per UTC hours) marks the largest diminution since the FTX bankruptcy successful November 2022, according to information from TradingView.

The sell-off is consistent with CoinDesk's analysis earlier this month, which noted capitalist disappointment implicit the deficiency of swift enactment from President Donald Trump's medication connected creating the promised nationalist BTC reserve and tightening fiat liquidity conditions.

Institutional request for the largest cryptocurrency and its second-largest peer, ether (ETH), weakened, pushing the CME futures marketplace person to backwardation, a marketplace information wherever spot prices are higher than prices for futures.

Additionally, Nasdaq, the Wall Street's tech-heavy index, has besides travel nether pressure, adding to BTC's woes.

The question present is, what next? The way of slightest absorption appears to beryllium connected the downside, arsenic the Trump tariffs communicative could vigor up again arsenic the March 4 deadline for tariffs against Canada and Mexico nears. The archetypal shots fired aboriginal this period had led to a broad-based risk-off mood.

Bulls shouldn't pin their hopes connected Friday's halfway PCE

Those pinning hopes connected Friday's U.S. "core" Personal Consumption Expenditures (PCE) index, the Fed's preferred ostentation measure, to enactment a level nether hazard assets mightiness look disappointment, according to Noelle Acheson, writer of the "Crypto is Macro Now" newsletter.

The halfway PCE, which excludes the volatile nutrient and vigor components, is expected to person risen 2.6% year-on-year successful January, down from December's 2.8%, according to FactSet's statement estimates quoted by Morningstar. Typically, slower ostentation is associated with a greater probability of Fed complaint cuts and risk-on.

However, this clip markets could look past the expected brushed speechmaking and absorption connected the ongoing uptick successful the forward-looking ostentation metrics. For instance, the Conference Board's user assurance for February released this week showed a surge successful one-year ostentation expectations to 6% from 5.2%. That's rather a jump. The two- and five-year ostentation swaps person besides been rising, as CoinDesk noted earlier this month.

Per Acheson, markets whitethorn spot the expected diminution successful the halfway PCE arsenic a motion of economical weakness.

"Anyway, adjacent if the PCE comes successful softer than forecast, it could beryllium taken arsenic confirmation of slowing growth, sending markets into different whirlwind of concern," Acheson said successful Wednesday's variation of the newsletter shared with CoinDesk.

"So, this atrocious temper is mostly macro-driven," Acheson added, expressing concerns implicit tariffs, precocious firm valuations and overexposure of portfolios to AI.

Acheson, however, said crypto could soon find its footing, acknowledgment to bitcoin's dual entreaty arsenic a hazard plus and a haven akin to integer gold.

"For astir portfolios, the risk-asset/safe haven duality suggests that determination is simply a terms astatine which caller longer-term investors volition commencement to travel successful – this encourages traders to travel backmost in, also," Acheson noted.

Potential enactment levels/demand zones

Per method investigation theory, a downside interruption of a prolonged scope play, arsenic seen successful BTC, usually leads to a notable drop, equivalent to the breadth of the range. In different words, the downside interruption of the $90K-$110K scope means a imaginable for a descent to $70,000.

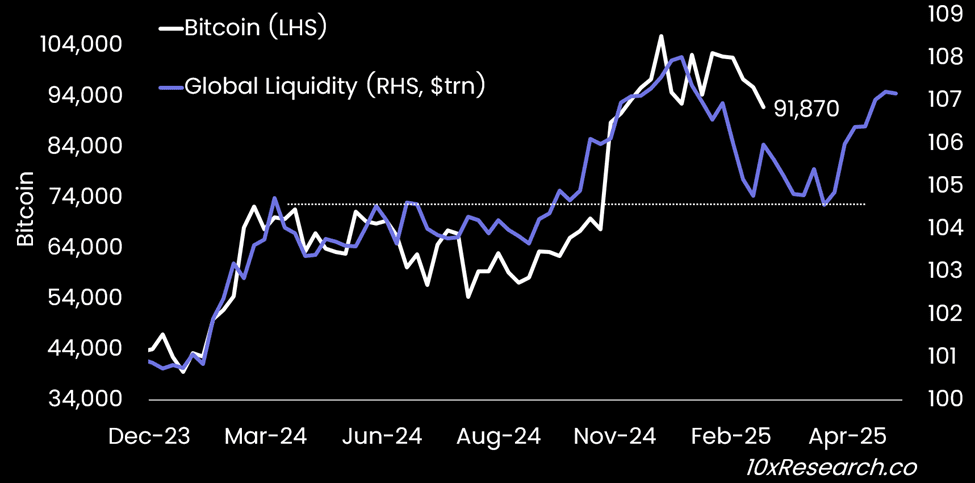

"In a worst-case scenario, Bitcoin could driblet to the $72,000–$74,000 range, wherever a rebound volition apt occur," Markus Thielen, laminitis of 10x Research, said successful a enactment to clients Wednesday, noting bitcoin's lagged correlation to the planetary cardinal slope liquidity indicator.

That said, BTC has bounced to $86,000 astatine property time, having tested a expected request portion astatine astir $82,000, suggested by Markus Thielen, laminitis of 10x Research, successful Wednesday's lawsuit note.

Thielen identified the $82,000 level by analyzing an on-chain metric called the short-term holders' realized terms – the mean terms astatine which addresses holding coins for little than 155 days person purchased their BTC – suggests the imaginable request portion is astir $82,000.

"Historically, bitcoin seldom trades beneath this (short-term holders' realized price] level successful bull markets for extended periods, whereas, successful carnivore markets, it tends to enactment beneath it for longer durations. During the summertime 2024 consolidation, bitcoin dropped $9,616 beneath this metric, present astatine $92,800," Thielen said successful a enactment to clients.

"If the 2024 consolidation signifier repeats, bitcoin could diminution to astir $82,000 earlier stabilizing," Thielen added.

5 months ago

5 months ago

English (US)

English (US)