Bitcoin (BTC) climbed backmost supra $43,000 during Asian trading hours pursuing quality that BlackRock amended its spot exchange-traded money (ETF) exertion to comply with the U.S. Securities and Exchange Commission (SEC).

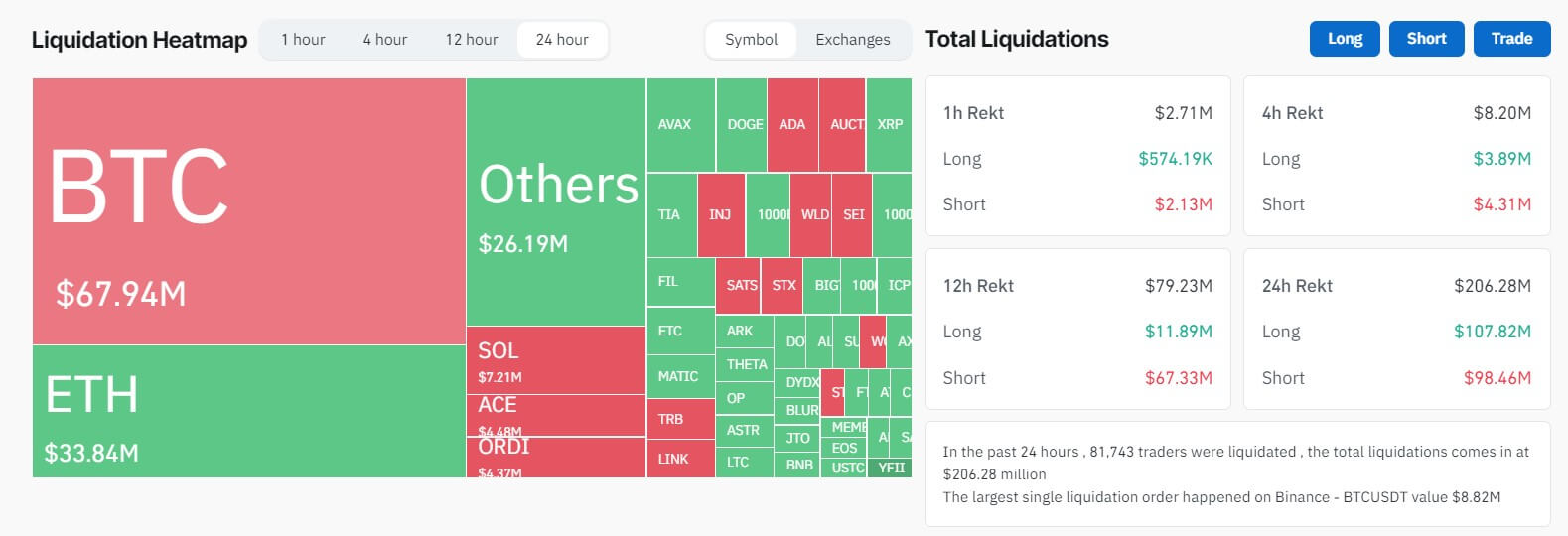

Coinglass information shows that the terms question liquidated $206 cardinal crossed each assets from much than 81,000 crypto traders during the past day. Long traders mislaid $107.82 million, portion abbreviated traders were liquidated $98 cardinal during the reporting period.

Crypto Market Liquidation. (Source: Coinglass)

Crypto Market Liquidation. (Source: Coinglass)Across assets, speculators connected BTC terms accounted for astir $68 million, oregon 32%, of the full losses incurred—$42 cardinal were liquidated from traders betting against further BTC terms increases. In comparison, astir $26 cardinal was liquidated from long-position holders.

Notably, Bitcoin has further reduced its debased Liquidation Sensitivity Index (LSI) people of conscionable $11.72 cardinal USD/%, the lowest level recorded by CryptoSlate. This alteration suggests markets are further maturing with little leverage successful the marketplace betting against Bitcoin, with lone $67.9 cardinal liquidated from a 6% terms swing.

Ethereum experienced liquidations crossed agelong and abbreviated positions, with $18.38 cardinal and $16.6 cardinal respectively.

Large-cap cryptocurrencies similar Solana, XRP, and Dogecoin besides witnessed notable liquidations totaling $7.66 million, $3.2 million, and $3.5 million, respectively.

Meanwhile, crypto traders utilizing the embattled Binance level accounted for much than 50% of the full losses suffered successful the market. The speech users mislaid $102.85 cardinal during the past day, with the astir important azygous liquidation bid being an $8.82 cardinal agelong presumption BTC.

Market rebounds

The existent terms show represents a reversal of luck for the apical cryptocurrency that had begun the week meekly, falling to astir $41,000 connected Dec. 18 amid a broader market drawdown.

However, its terms picked up pursuing quality that BlackRock, the world’s largest plus manager and 1 of the applicants for a spot ETF, revised its applications with the SEC.

BlackRock’s caller amendment revealed an IBIT marketplace ticker and that the applicable transactions volition hap successful speech for cash.

In a caller enactment to investors, Markus Thielen, the caput of probe astatine Matrixport, asserted that BTC is the superior plus for this year, adding that much investors are pondering whether to allocate much superior adjacent year.

Meanwhile, different apical 10 cryptocurrencies, including XRP, Ethereum, Solana, and Avalanche, saw gains of betwixt 3% and 9%, respectively.

The station Bitcoin rebound supra $43,000 sparks $67M BTC liquidation, indicating further marketplace maturity appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)