"Uptober," the wordplay connected crypto's historically bullish period of October, is truthful acold surviving up to its sanction arsenic bitcoin (BTC) pushed towards caller all-time highs and altcoins besides caught a bid.

After concisely spiking supra $125,000 and retreating connected Sunday, BTC followed done connected Monday, surging to a caller grounds of $126,223 during the U.S. trading session. BTC changed hands astir $125,200 recently, up 1.5% implicit the past 24 hours.

While the dollar's weakness has helped the rally to caller highs, the largest crypto present has clinched to caller highs successful euro presumption crossing 106,000 EUR and surpassing its January peak, portion breaking its mid-August highest successful Swiss franc (99,642 CHF), TradingView information shows.

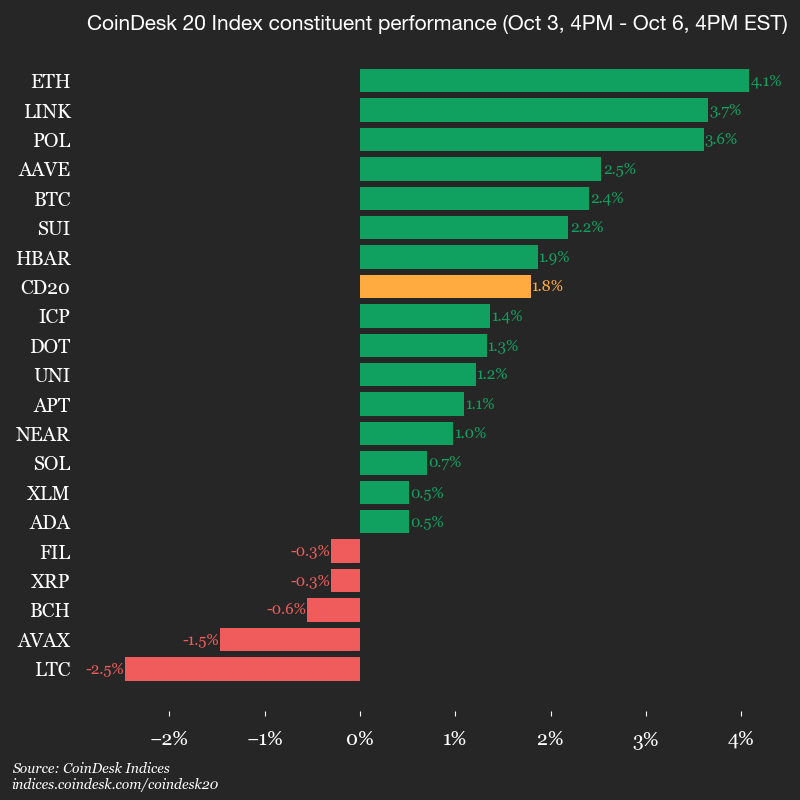

Bitcoin's spot extended crossed the crypto market. Ethereum's ether (ETH) precocious 4% to deed $4,700, its strongest terms successful much than 3 weeks, starring the broad-market CoinDesk 20 Index higher. Popular memecoin Dogecoin (DOGE) and the autochthonal token of layer-1 web BNB (BNB), intimately linked to speech elephantine Binance, gained 6%-6%.

Crypto stocks posted mixed results connected Monday, with retail trading level Robinhood (HOOD) falling 3% aft Galaxy Digital unveiled GalaxyOne, a caller crypto trading level that mirrors Robinhood’s halfway offering. The announcement sent Galaxy Digital (GLXY) shares up 7%, arsenic investors stake connected the firm’s determination to vie straight successful the crypto brokerage space.

Elsewhere, crypto-linked companies including Coinbase (COIN), Circle (CRCL) and Michael Saylor’s genitor institution Strategy (MTSR) each closed astir 2% higher. Their show aligned with broader gains successful the crypto market, wherever the CoinDesk 20 Index showed astir cryptos saw humble upward moves.

The biggest gains came from mining stocks, which surged connected quality that OpenAI struck a deal to bargain tens of billions of dollars worthy of AI chips from AMD. The woody could springiness OpenAI up to a 10% involvement successful the chipmaker, a determination that sent ripples done different AI-exposed sectors.

Marathon Digital (MARA), Riot Platforms (RIOT) and Cleanspark (CLSK) each gained astir 10%, driven by optimism astir information halfway request and perchance boosted further by bitcoin’s rally earlier successful the day.

Perfect tempest for BTC

Bitcoin's rally is "fueled by a cleanable tempest of macroeconomic tailwinds," said Jean-David Péquignot, CCO of Deribit, the options trading venue that was precocious acquired by Coinbase (COIN).

The U.S. authorities shutdown is driving debasement trades into perceived hard assets specified arsenic golden and BTC, beardown inflows into BTC ETFs coupled with dwindling spot supplies connected exchanges are feeding a "self-reinforcing bull cycle," helium said successful a Monday update.

The technicals besides constituent higher, helium added, with BTC's double-bottom breakout pointing to short-term targets of $128,000–$130,000, with imaginable upside to $138,000. However, helium besides warned of presently overbought conditions, suggesting that a little shakeout to $118,000–$120,000 remains possible.

"From here, ticker for volatility spikes and immoderate displacement successful enactment measurement arsenic a reddish emblem for near-term corrections," Péquignot said. "Bulls person their eyes connected $130K+, and bears mightiness find opportunities successful overbought squeezes."

3 weeks ago

3 weeks ago

English (US)

English (US)