As an aftermath of the October 10 marketplace crash, wherever Bitcoin’s terms reached levels arsenic debased arsenic $101,500, the marketplace is exhibiting a recognizable bearish on-chain structure. While the selling momentum seems to beryllium slowing down, giving a sliver of anticipation to imaginable marketplace participants, caller on-chain investigation seems to constituent towards caution arsenic the much close sentiment to person successful the abbreviated term.

Realized Profits Climb As High As $2.25 Billion

In an October 11 station connected societal media level X, method and on-chain expert Darkfost revealed that a batch of Bitcoin investors mightiness inactive beryllium taking profits from their past buys.

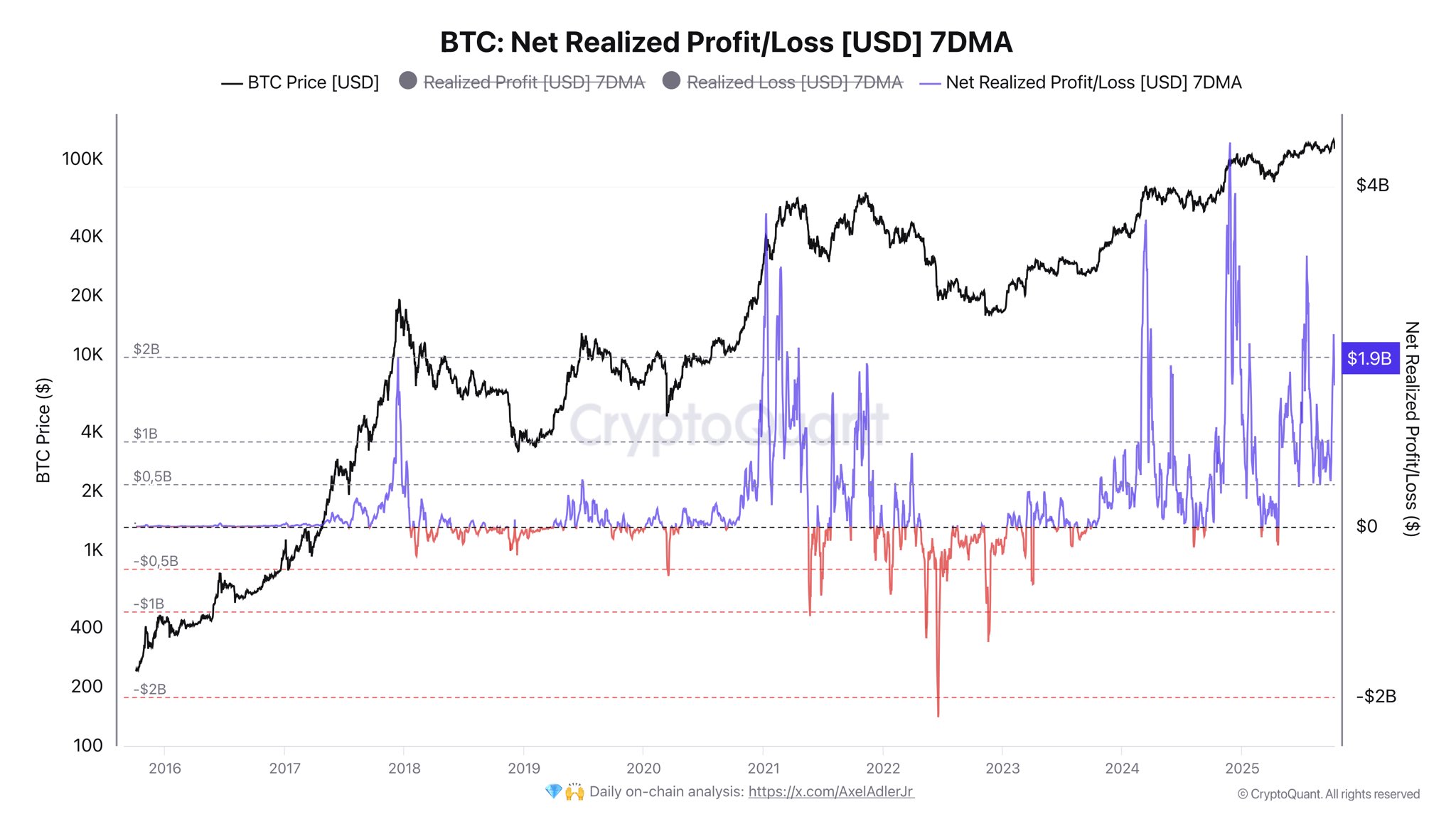

In the station connected X, Darkfost cited results obtained from the Net Realized Profit/Loss [USD] 7 Day MA indicator. This metric keeps tabs connected the mean regular quality betwixt the full magnitude of realized profits and losses of transactions implicit the past 7 days.

For context, realized profits notation to the full magnitude successful USD of Bitcoin sold astatine prices higher than the levels of purchase, showing that investors are selling successful the green. On the different hand, realized losses bespeak the full Dollar worthy of Bitcoin sold beneath their outgo of purchase.

The expert enactment it retired that the 7-day moving mean of the Net Realized Profit/Loss metric precocious reached a highest of $2.25 billion, the fourth-highest level seen successful the existent marketplace cycle. Meanwhile, the metric’s play mean holds good supra $1.6 billion, indicating that profit-taking is inactive astatine a precocious level.

Source: @Darkfost_Coc connected X

Source: @Darkfost_Coc connected XDarkfost noted that if the Bitcoin marketplace continues to witnesser this magnitude of profit-taking, it mightiness beryllium a portion earlier the premier cryptocurrency switches from its current bearish sentiment to a much optimistic one.

$99,000-$104,000 May Be The Next Price Support

In different station connected X, cryptocurrency pundit Ted Pillows pointed retired the $99,000-$104,000 portion arsenic the adjacent imaginable enactment if the Bitcoin terms were to support sliding.

According to the analyst’s station connected X, this terms scope has a decent magnitude of spot bids sitting wrong it, capable to enactment arsenic a enactment portion to support the Bitcoin terms afloat.

The adjacent marketplace trajectory frankincense seems to beryllium connected whether capitalist profit-taking would stay high. In the script wherever it does, the $99,000-$104,000 terms scope mightiness beryllium the adjacent portion to support an oculus retired for.

In an upside scenario, Pillows explained that the $119,000 price level and different zones supra clasp astir of the merchantability orders presently successful the market.

As of this writing, Bitcoin is worthy astir $111,772, reflecting an implicit 1% summation successful the past 24 hours.

Featured representation from iStock, illustration from TradingView

3 weeks ago

3 weeks ago

English (US)

English (US)