Bitcoin has held up powerfully compared to the companies that person adopted it arsenic portion of their treasury strategy, but the spread betwixt the integer plus and these firms is becoming much pronounced.

Over the past 10 weeks, stocks of Bitcoin Treasury Companies (BTCTCs) person fallen sharply, shedding betwixt 50% and 80% of their value. This divergence shows an antithetic pattern, efficaciously creating a “1:4 ratio” successful rhythm behavior.

12 Mini-Bear Markets In 18 Months

Bitcoin’s terms enactment successful the past 18 months has mostly been successful a bullish rhythm connected the macro end, with the starring cryptocurrency creating caller terms highs upon caller terms highs wrong this period. This has caused an summation successful galore companies adopting a Bitcoin treasury strategy in their equilibrium books, besides known arsenic Bitcoin Treasury Companies (BTCTCs).

However, according to information from crypto commentator Mark Moss, the banal prices of companies with a Bitcoin strategy person diverged from Bitcoin, shedding betwixt 50% and 80% of their banal worth implicit the past 10 weeks. This divergence, Moss noted, shows an antithetic 1:4 rhythm ratio wherever firm Bitcoin holders acquisition 4 mini-cycles for each 1 Bitcoin marketplace cycle.

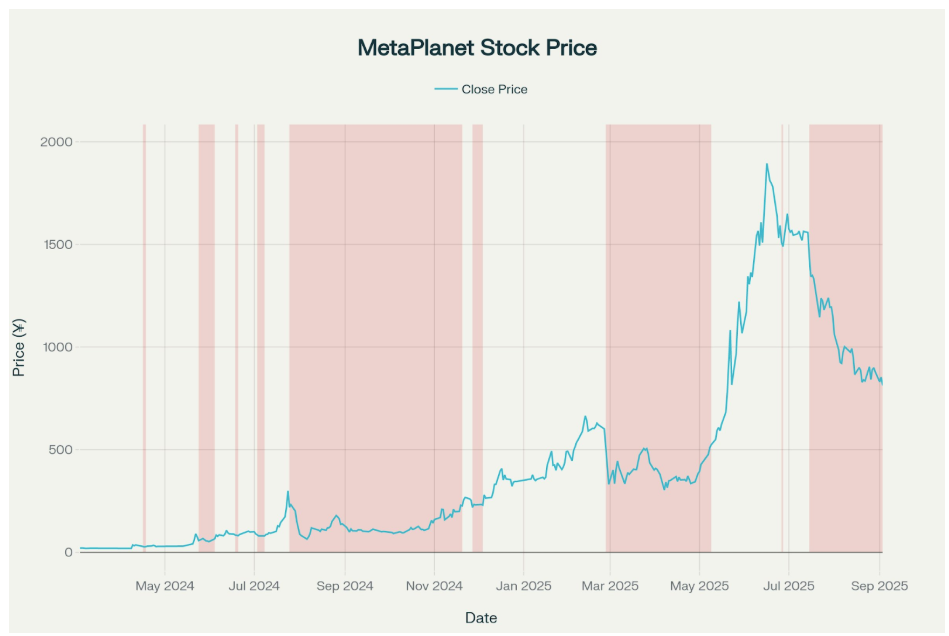

The Japanese steadfast MetaPlanet is the premier lawsuit survey for this occurrence. Over the past 18 months, its banal ($MTPLF) has gone done 12 chiseled drawdowns, ranging from crisp single-day plunges to prolonged declines stretching implicit months. On average, these downturns erased 32.4% of worth and lasted astir 20 days. The shortest correction was a brutal one-day descent of 22.2% successful April 2024, portion the longest and deepest clang lasted 119 days from July to November 2024, wiping retired 78.6%.

The illustration below, of MetaPlanet’s stock, shows repeated selloff cycles that look acold much compressed and utmost than Bitcoin’s terms corrections successful the past 18 months oregon so.

MetaPlanet Stock Price: Mark Moss connected X

Correlation With Bitcoin?

Interestingly, lone 41.7% of MetaPlanet’s drawdowns person straight lined up with Bitcoin’s corrections. Out of the 12 mini-bear markets identified, conscionable 5 occurred successful sync with BTC’s declines. The bulk (7 retired of 12) were unrelated to Bitcoin and were alternatively caused by company-specific factors. According to Moss, these factors see warrant exercises, fundraising activities, and compression of the Bitcoin premium that MetaPlanet trades astatine compared to its BTC holdings.

The 2 astir terrible drawdowns, however, did overlap with Bitcoin volatility. The -78.6% illness successful precocious 2024 and a -54.4% drawdown some coincided with periods erstwhile Bitcoin itself was undergoing corrections. These overlapping events suggest that portion BTC volatility sometimes adds to the drawdown, MetaPlanet’s banal selloffs thin to widen beyond Bitcoin downturns.

Essentially, what this means is that alternatively of BTC 4-year cycles, BTCTCs are present much similar 4 cycles successful 1 year.

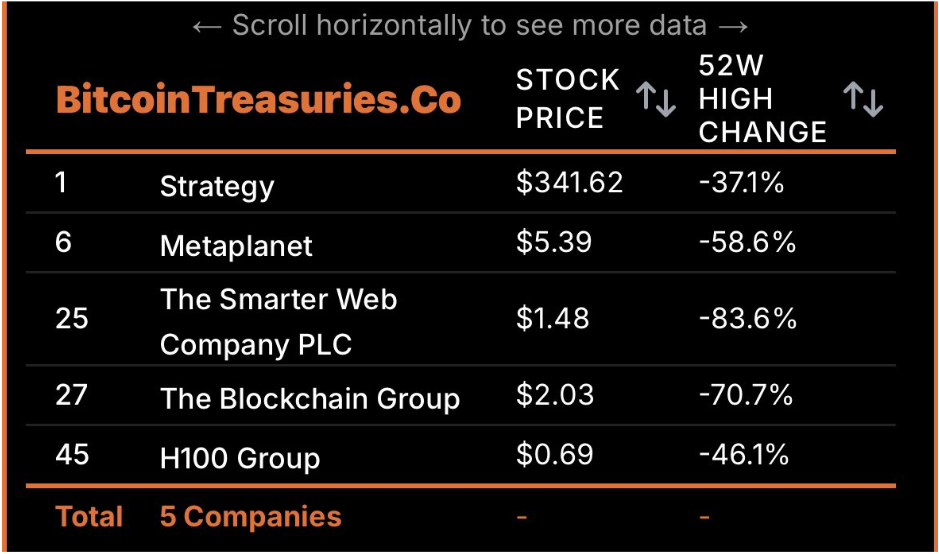

At the clip of writing, Bitcoin is successful a correction phase and is struggling to clasp supra the $110,000 enactment level. Popular BTCTC stocks are besides struggling with downtrends alongside Bitcoin. Strategy’s banal is down 37.1% from its 52-week high, portion MetaPlanet is down 58.6%. Others, similar The Smarter Web Company PLC (-83.6%) and The Blockchain Group (-70.7%), are astatine greater losses.

BTCTC Stock Prices: BitcoinTreasuries

Featured representation from Unsplash, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)