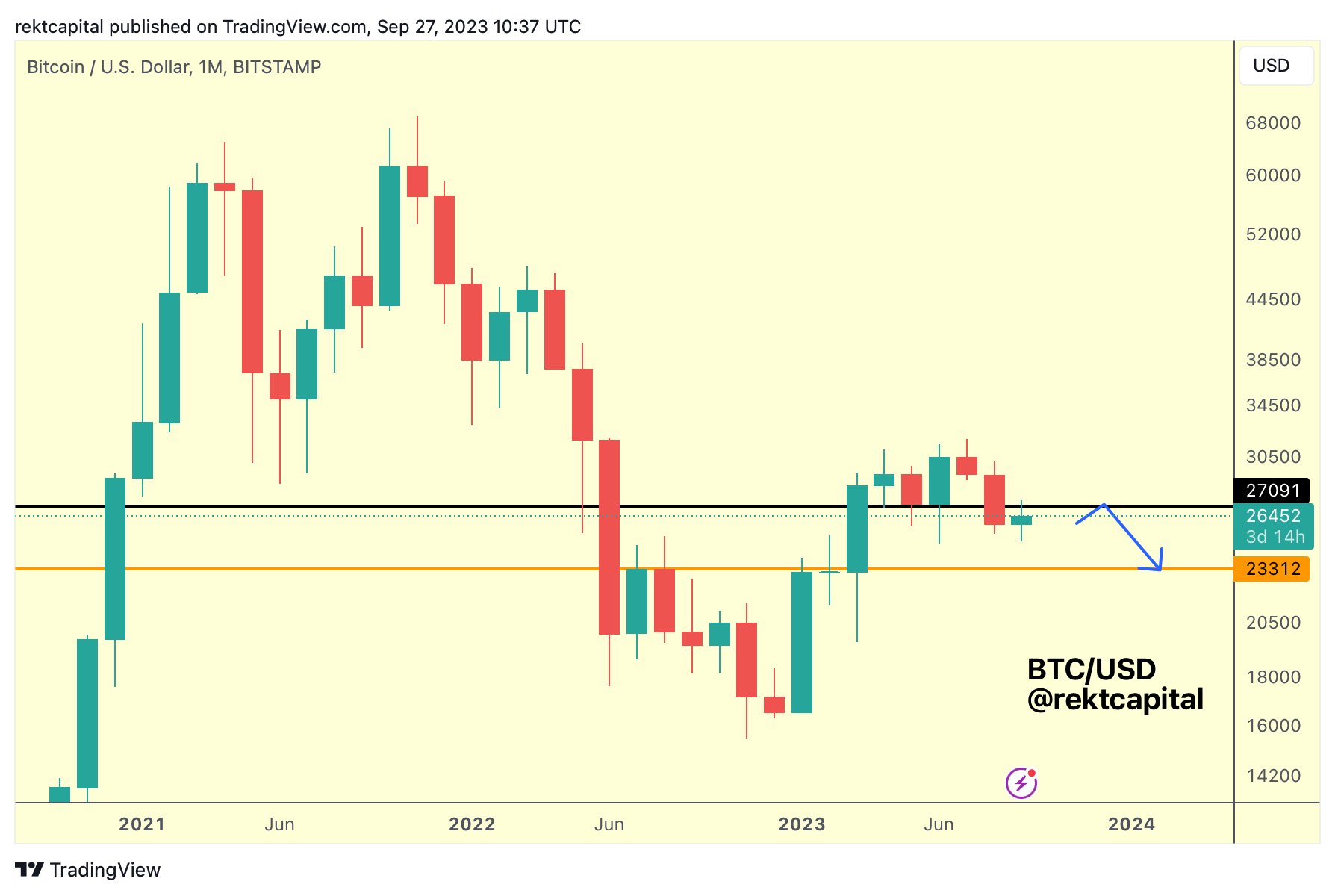

Renowned crypto expert Rekt Capital has precocious highlighted the pivotal quality of the Bitcoin price’s imminent monthly candle close. In a connection via X (formerly Twitter), helium elaborate that Bitcoin has tagged the $27,000 monthly level from the underside, meaning it is acting arsenic absorption for the clip being.

He explained that “the upcoming monthly candle adjacent is conscionable astir the corner. Bitcoin needs to monthly adjacent supra $27,091 for this to beryllium a fake-breakdown. Otherwise, the breakdown volition beryllium technically confirmed.”

To springiness this connection immoderate humanities context, the preceding period – August – saw a important improvement for the flagship cryptocurrency. BTC registered a bearish monthly candle close, finishing beneath astir $27,150. This information point, according to Rekt Capital, efficaciously confirmed it arsenic mislaid support.

Reflecting connected this improvement astatine the time, the expert had conveyed that it is imaginable BTC could surge to $27,150, “maybe adjacent upside wick beyond it this September. But that would apt beryllium a alleviation rally to corroborate $27150 arsenic caller absorption earlier dropping into the ~$23000 region. $23000 is the adjacent large Monthly enactment present that ~$27150 has been lost.”

Bitcoin terms investigation by @rektcapital

Bitcoin terms investigation by @rektcapitalIs Bitcoin Following Historical Patterns?

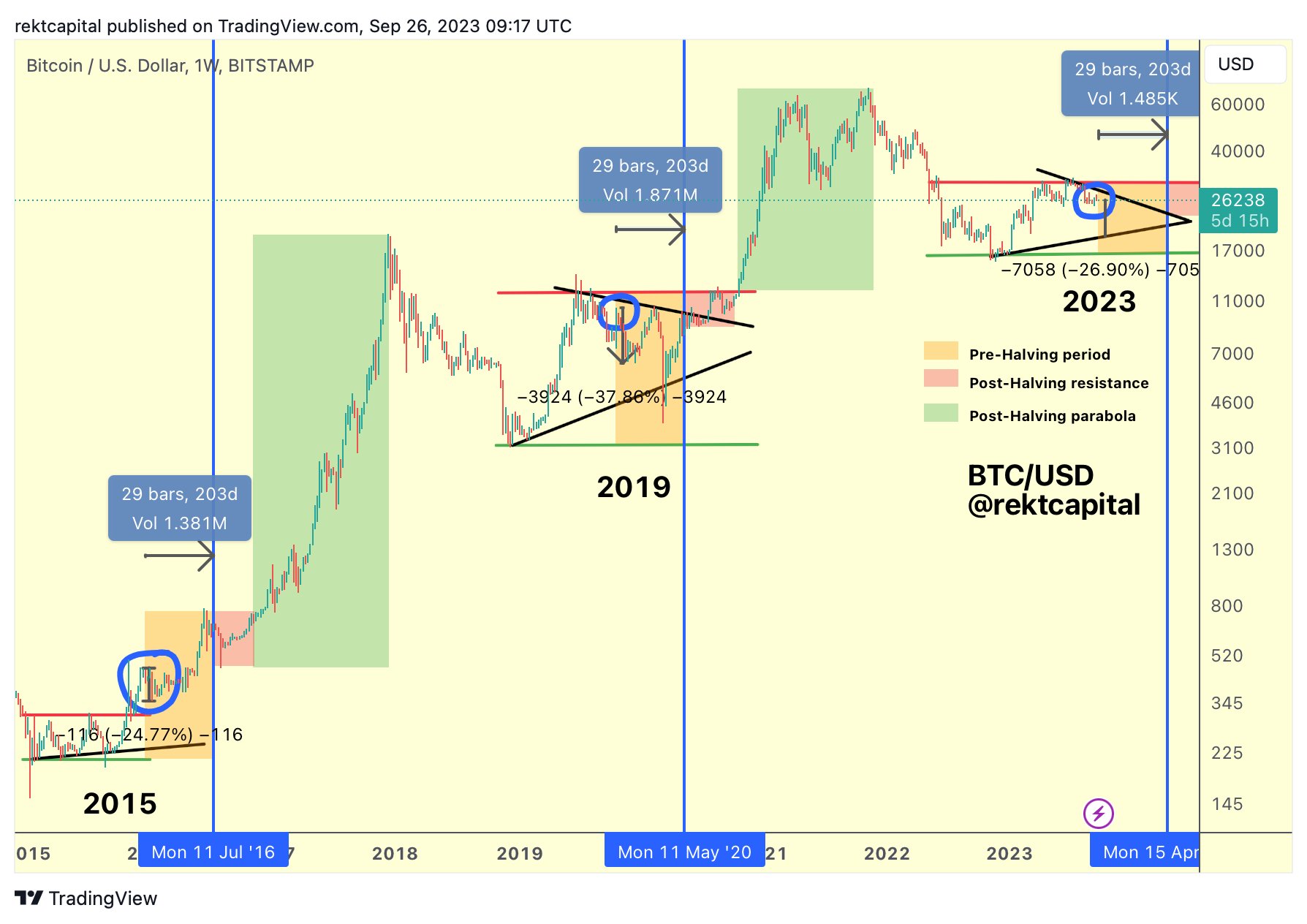

Rekt Capital’s observations astir Bitcoin aren’t made successful isolation but are profoundly rooted successful Bitcoin’s humanities terms and rhythm behaviors. Drawing parallels to erstwhile patterns, helium had antecedently shed airy connected Bitcoin’s tendencies astir 200 days earlier a halving event.

“At this aforesaid constituent successful the rhythm (~200 days earlier the halving): In 2015, Bitcoin retraced -24% wrong a re-accumulation range, but terms consolidated for months going into the halving. In 2019, Bitcoin retraced -37% arsenic portion of a downtrend that continued for months going into the halving.”

These humanities retracements astatine a akin juncture person fixed emergence to 2 indispensable insights, arsenic stated by Rekt Capital. First, an contiguous retracement has occurred astatine this aforesaid constituent successful the cycle. Second, a repeated retrace of betwixt -24% to -37% successful 2023 would pb Bitcoin to retest its macro higher low, perchance pushing its terms nether the $20,000 threshold.

Bitcoin is ~200 days earlier the halving | Source: X @rektcapital

Bitcoin is ~200 days earlier the halving | Source: X @rektcapitalThe expert didn’t halt there. Accentuating the perfect accumulation phases for investors, helium noted, “The champion clip to accumulate Bitcoin was successful precocious 2022 adjacent the carnivore marketplace bottom. The 2nd champion clip to accumulate Bitcoin is upon a deeper retracement successful the pre-halving period.”

Shifting the absorption to imaginable aboriginal outcomes, Rekt Capital made an intriguing speculation astir the imaginable of BTC’s terms question post-halving: “If ~$31000 was the apical for 2023. Then the adjacent clip we spot these prices volition beryllium months from now, conscionable aft the halving. Only quality betwixt present and then? In this pre-halving period, BTC could inactive retrace from here. But aft the halving, BTC would interruption retired overmuch higher from existent prices.”

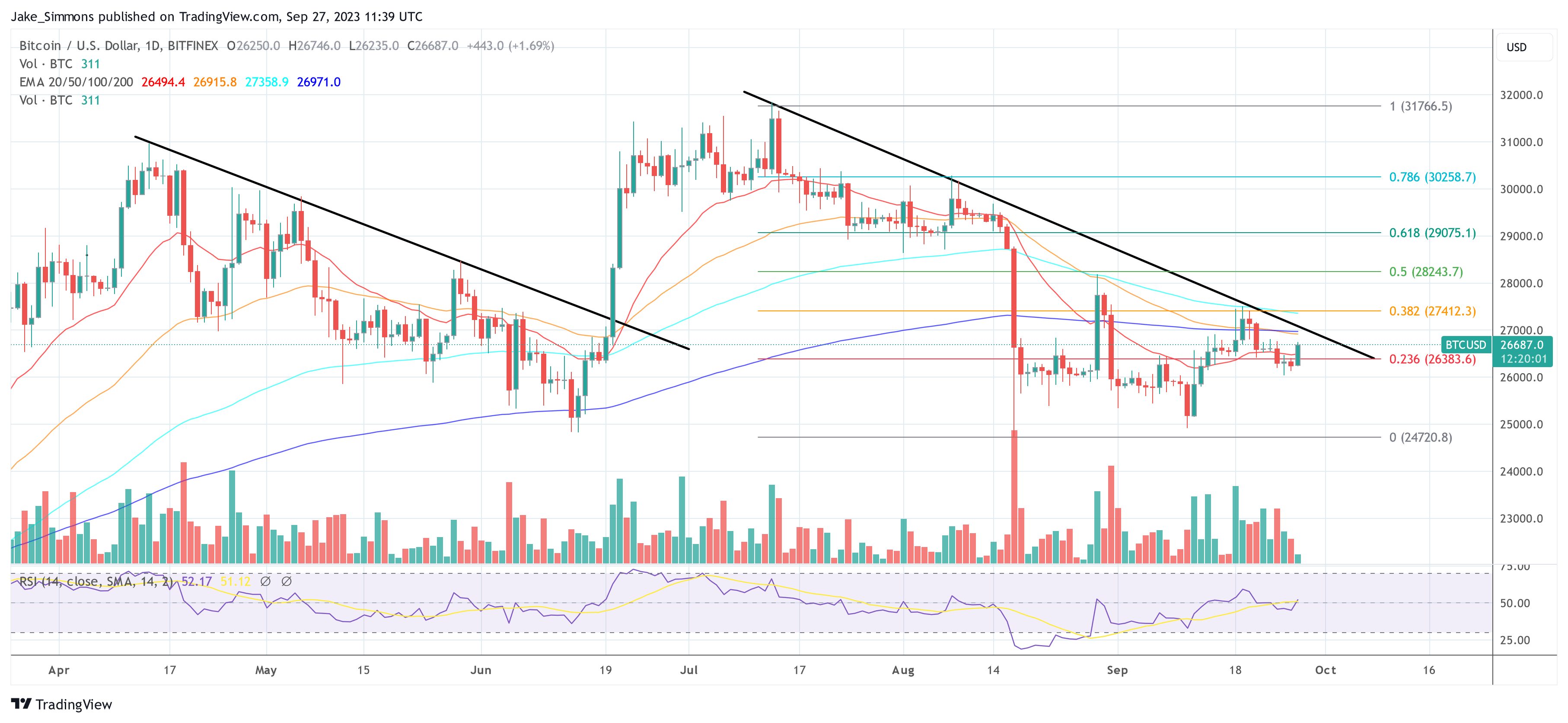

To summarize, the upcoming monthly candle adjacent for Bitcoin could person profound implications for the asset’s short-to-mid-term trajectory. All eyes volition present beryllium connected whether BTC manages to adjacent supra oregon beneath the captious $27,150 people – an indicator that could either corroborate a method breakdown oregon prevail implicit a historically untypical terms rally.

At property time, BTC stood astatine $26,687.

BTC terms sees flimsy uptick, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms sees flimsy uptick, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)