The Bitcoin terms roseate to $38.475 yesterday, marking a marginally higher precocious for the year. Nevertheless, the terms did not negociate to adjacent the time supra the important $38,000 mark. Shortly earlier the extremity of the day, the bears managed to propulsion the terms down again.

As crypto expert Daan Crypto Trades remarked, “Market does its champion to shingle retired everyone trying to pre-position for a imaginable Bitcoin ETF approval. It’s conscionable escaped liquidity for the MMs/Whales. Sweep highs, trap longs, compression retired longs, bait shorts, beforehand tally lows and repetition the full process.”

Bitcoin terms | Source: X @DaanCrypto

Bitcoin terms | Source: X @DaanCryptoBlackRock Argues With SEC Over Details Of Spot Bitcoin ETF

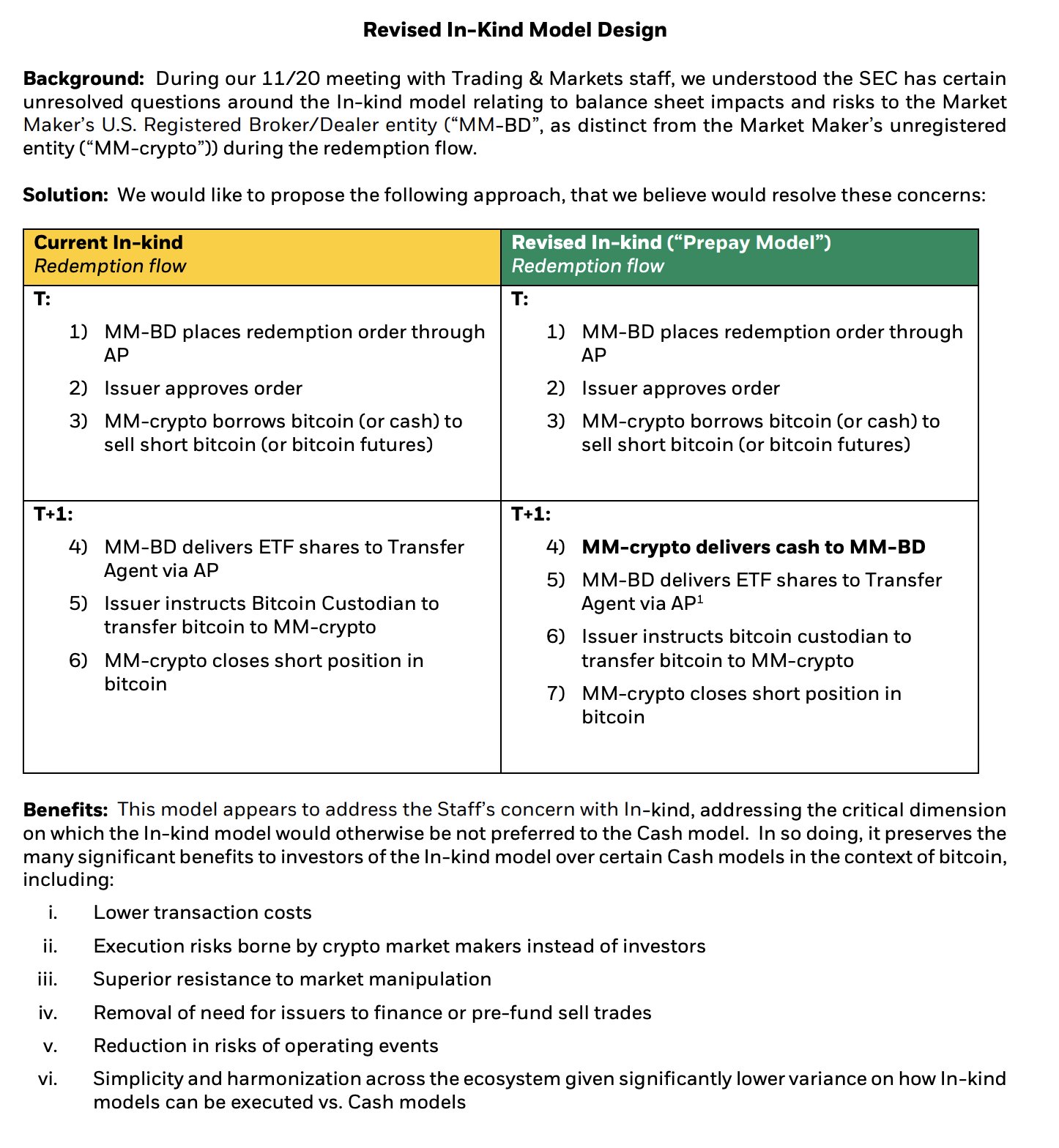

In a notable development, BlackRock, the world’s largest plus manager, has been again actively engaged successful discussions with the US Securities and Exchange Commission (SEC) concerning the operation of its spot ETF yesterday.

Eric Balchunas, elder ETF expert astatine Bloomberg, revealed, “BlackRock met with the SEC’s Trading & Markets part again yesterday and presented them with a ‘revised’ in-kind exemplary plan based connected Staff’s comments astatine their 11/20 meeting.” This revised exemplary includes a notable alteration successful the process, specifically astatine ‘Step 4’, which is the offshore entity marketplace shaper acquiring Bitcoin from Coinbase and past pre-paying successful currency to the US registered broker trader who is not allowed to interaction BTC.

James Seyffart, different Bloomberg analyst, highlighted the ongoing negotiations, adding, “More confirmation that Issuers are inactive gathering with the SEC. BlackRock/Nasdaq inactive pushing for In-Kind instauration & redemption. Seems similar SEC hasn’t budged connected currency creates demands if this was the superior absorption of the meeting. At slightest not earlier yesterday, Interesting days ahead!”

The archetypal “In-Kind Redemption” travel had Market Maker’s Broker/Dealer entity (MM-BD) placing an bid for redemption done the Authorized Participant (AP), who approves the order, allowing MM-crypto to get Bitcoin (or cash) to merchantability short. This redemption travel had imaginable equilibrium expanse impacts and risks that the SEC was acrophobic about.

BlackRock has present projected a “Revised In-Kind (‘Prepay Model’)” Redemption flow. This caller exemplary involves MM-crypto delivering currency to MM-BD alternatively of Bitcoin, and MM-BD past delivers ETF shares to the Transfer Agent via API. The Bitcoin custodian is instructed by the issuer to transportation Bitcoin to MM-crypto, who past closes the abbreviated presumption successful BTC.

The benefits of this revised exemplary are manifold. It aims to little transaction costs and shifts the execution risks from investors to crypto marketplace makers. It besides claims to supply superior absorption to marketplace manipulation and region the request for issuers to concern oregon pre-fund merchantability trades. The simplification successful risks of operating events and the simplification crossed the ecosystem could mean little variance connected however In-kind models tin beryllium executed versus currency models.

BlackRock’s Bitcoin ETF operation “in-kind” | Source: X @EricBalchunas

BlackRock’s Bitcoin ETF operation “in-kind” | Source: X @EricBalchunas90% Odds Of Approval Remain

Should the SEC o.k. this revised model, it could herald the instauration of the archetypal US-based spot Bitcoin ETF, a important milestone that would let investors to summation nonstop vulnerability to Bitcoin alternatively than done derivative instruments similar futures. Despite these developments, determination remains a level of uncertainty surrounding the SEC’s stance connected the matter, peculiarly regarding the implications of spot Bitcoin vulnerability for retail investors done an ETF.

Recent leaks suggested the SEC mightiness similar currency instauration processes implicit in-kind Bitcoin transfers, a determination that could importantly change the scenery for ETF issuers and broker-dealers dealing with Bitcoin. Nonetheless, Bloomberg’s ETF analysts person reiterated their 90% likelihood for a spot ETF support by January 10 yesterday.

At property time, BTC traded astatine $37,728.

BTC terms falls beneath $38,000, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC terms falls beneath $38,000, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)