Unspent transaction outputs (UTXOs) are an integral constituent of Bitcoin’s structure, fundamentally serving arsenic the gathering blocks of the blockchain. As its sanction suggests, each unspent transaction output represents a discrete portion of Bitcoin that hasn’t been spent, originating from the decision of a erstwhile transaction. They signifier the instauration of Bitcoin’s ledger, tracking the circumstantial outputs of transactions until they’re utilized successful a caller one.

Analyzing UTXOs usually involves tracking whether they’re successful profit, meaning the BTC associated with them was acquired astatine a terms little than its existent value. Thus, the percent of UTXOs successful nett is simply a important indicator of marketplace sentiment and the wide profitability of Bitcoin holders. A precocious percent signals a beardown marketplace wherever astir investors spot gains, portion a little percent points to losses and reflects a much bearish environment.

UTXOs disagree from Bitcoin’s full proviso successful a captious way. While the percent of UTXOs successful nett tracks idiosyncratic transaction outputs, the percent of Bitcoin’s proviso successful nett looks astatine the full Bitcoin proviso and whether the coins are presently supra oregon beneath their acquisition cost. UTXOs tin beryllium galore and bespeak assorted sizes of Bitcoin holdings, from tiny fractions to larger amounts.

Conversely, erstwhile measuring proviso successful profit, the absorption is connected the aggregate measurement of Bitcoin, treating the full proviso arsenic a full alternatively than idiosyncratic pieces of the blockchain ledger. This quality explains wherefore the percent of UTXOs successful nett tin diverge from the percent of proviso successful profit—UTXOs, arsenic smaller units, mightiness beryllium skewed by the enactment of smaller traders. In contrast, proviso successful nett gives a broader representation of the wide authorities of the market.

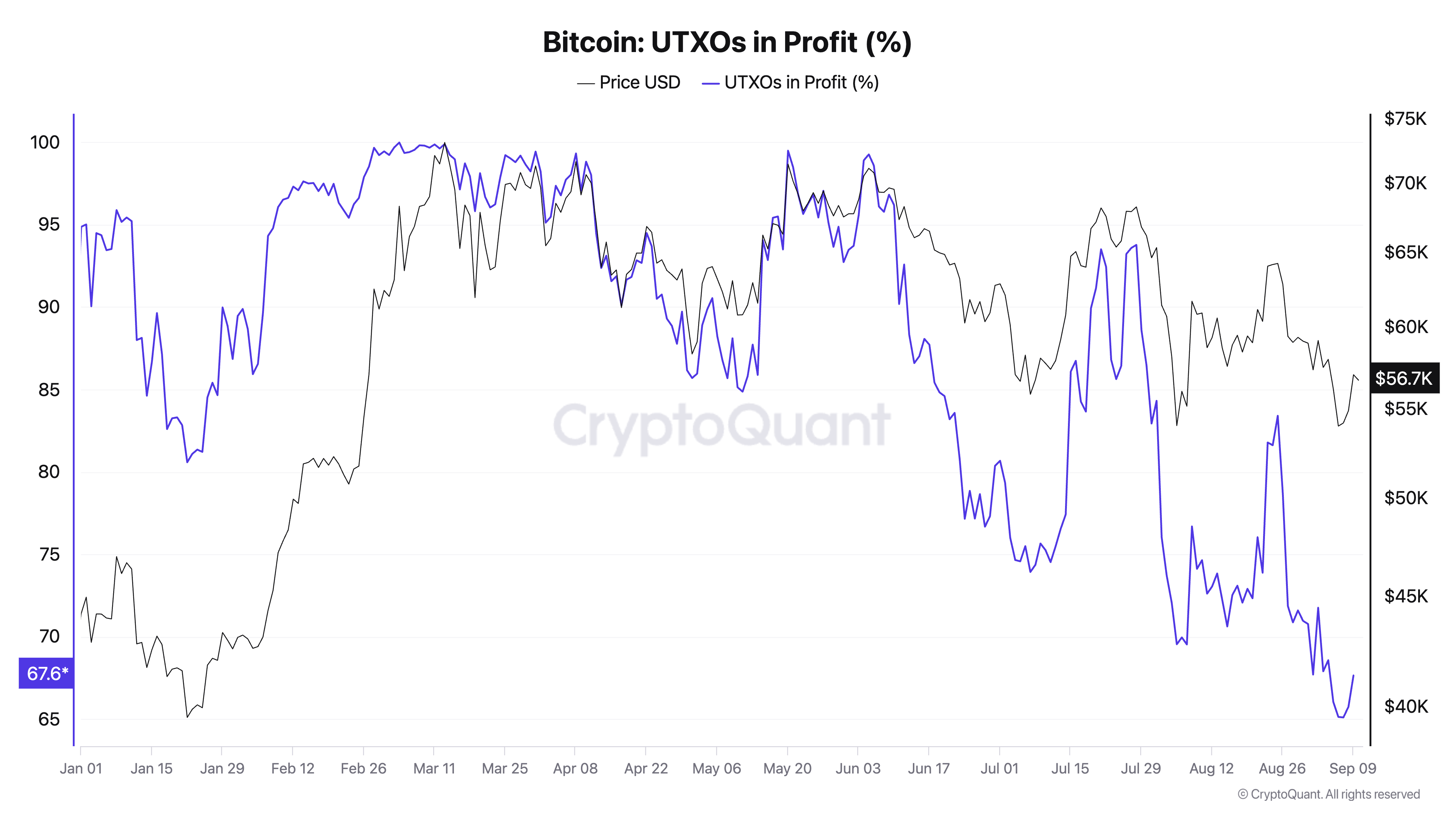

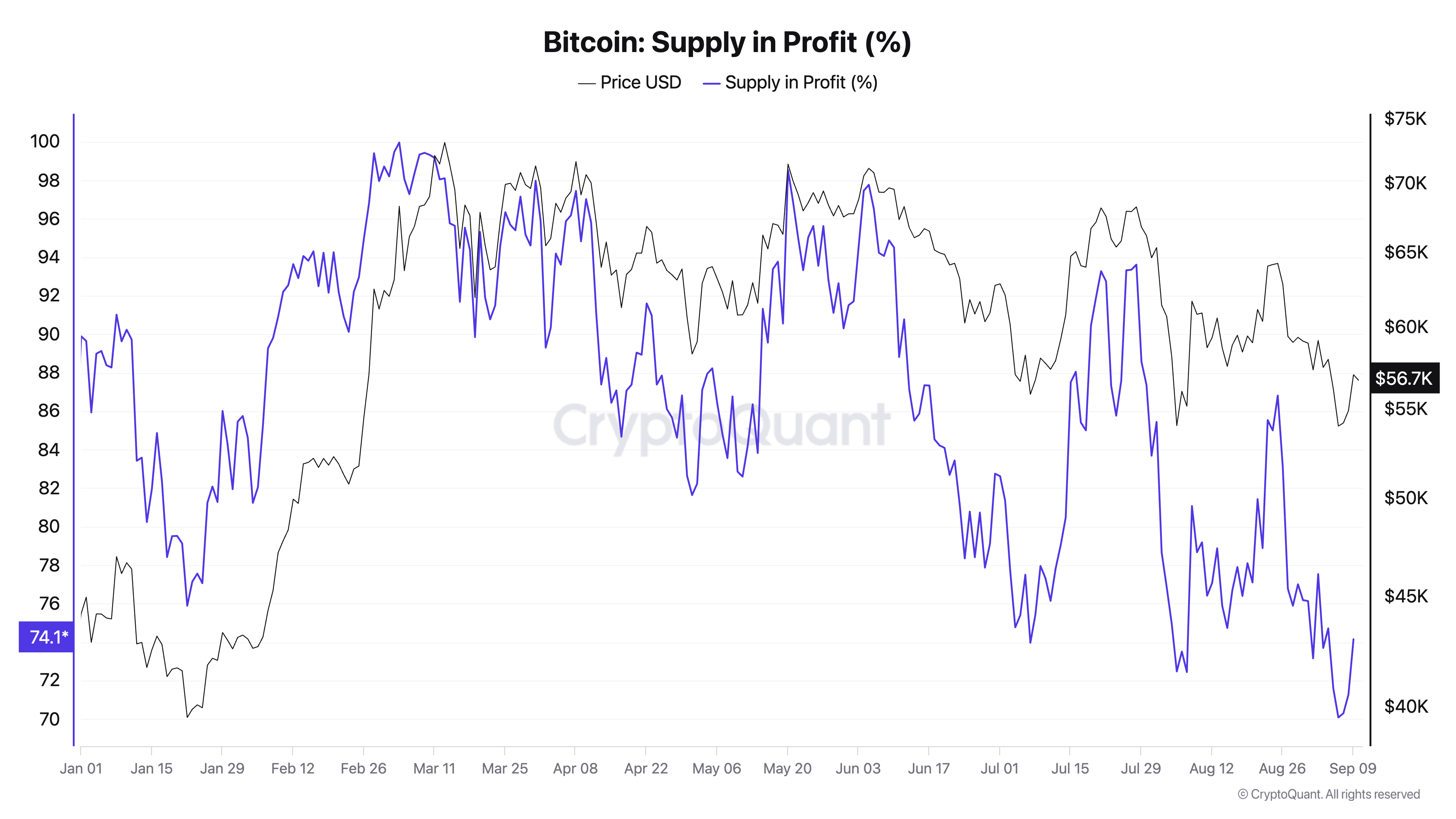

For example, erstwhile Bitcoin’s terms surged astatine the opening of March, some UTXOs successful nett and the proviso successful nett deed their year-to-date highs, with some metrics nearing 100%. At this point, astir each Bitcoin, careless of however it was distributed crossed UTXOs oregon successful full supply, was successful profit, reflecting the bullish situation that came with Bitcoin nearing $73,000. This play represents an optimal authorities for holders, with minimal losses and maximum marketplace confidence.

Graph showing the percent of Bitcoin UTXOs successful nett from Jan. 1 to Sep. 10, 2024 (Source: CryptoQuant)

Graph showing the percent of Bitcoin UTXOs successful nett from Jan. 1 to Sep. 10, 2024 (Source: CryptoQuant)Meanwhile, drops successful Bitcoin’s terms led to a driblet successful the percent of UTXOs and proviso successful profit. The percent of UTXOs successful nett deed a YTD debased of 65.09% connected Sep. 7 erstwhile Bitcoin dropped to $54,170, portion the proviso stood somewhat higher astatine conscionable implicit 70%.

Graph showing the percent of Bitcoin proviso successful nett from Jan. 1 to Sep. 10, 2024 (Source: CryptoQuant)

Graph showing the percent of Bitcoin proviso successful nett from Jan. 1 to Sep. 10, 2024 (Source: CryptoQuant)The divergence betwixt these 2 metrics during periods of terms volatility is telling. Given their sensitivity to transaction size and the frequence of question successful smaller amounts, UTXOs fluctuate much dramatically.

As prices drop, smaller holders oregon predominant traders who acquired Bitcoin astatine varying levels volition apt spot their UTXOs autumn retired of nett quickly. On the different hand, the full proviso successful nett metric remains somewhat much unchangeable arsenic larger semipermanent holders who acquired Bitcoin during earlier phases of the rhythm whitethorn inactive spot their positions successful profit. This quality highlights the favoritism betwixt short-term marketplace enactment and the broader presumption of Bitcoin’s wide valuation.

Throughout the year, some metrics person intimately followed Bitcoin’s terms movement, peaking erstwhile prices are precocious and dropping sharply during pullbacks. The autumn to yearly lows connected Sep. 7, wherever the percent of UTXOs successful nett and the proviso successful nett deed important lows, reflects a displacement successful marketplace sentiment.

The crisp diminution signals accrued accent successful the market, with a important information of caller buyers present facing losses. This could bespeak an situation wherever capitulation becomes much likely, arsenic holders who purchased during the highest of the terms surge whitethorn statesman to merchantability to chopped their losses. At the aforesaid time, a little percent of UTXOs successful nett suggests accrued volatility arsenic smaller holders go much susceptible to selling pressure.

The existent values for UTXOs successful profit, proviso successful profit, and Bitcoin’s terms overgarment a nuanced representation of the market. With UTXOs successful nett sitting astatine 67.64% and proviso successful nett astatine 74.15% arsenic of Sep. 10, successful conjunction with Bitcoin’s terms of $57,035, the marketplace appears to beryllium successful a signifier of cautious consolidation. These values bespeak that portion a important information of Bitcoin holders are inactive successful profit, galore caller buyers, peculiarly those who entered the marketplace during the aboriginal stages of the terms surge, are present underwater oregon adjacent to it.

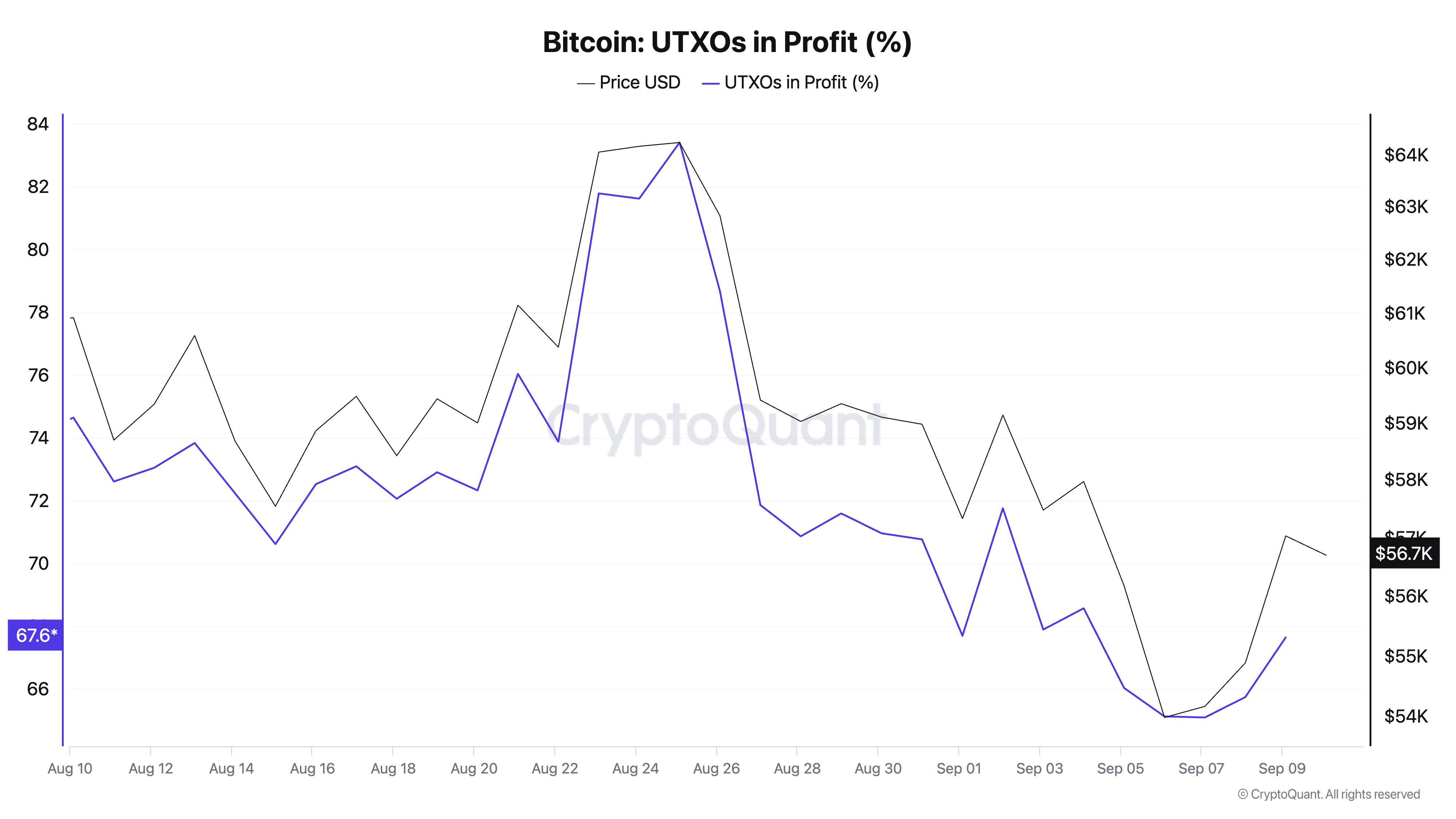

Graph showing the percent of Bitcoin UTXOs successful nett from Aug. 10 to Sep. 10, 2024 (Source: CryptoQuant)

Graph showing the percent of Bitcoin UTXOs successful nett from Aug. 10 to Sep. 10, 2024 (Source: CryptoQuant)The disparity betwixt UTXOs successful nett and proviso successful nett offers penetration into however antithetic groups of marketplace participants are faring. With proviso successful nett being higher, it suggests that larger oregon longer-term holders, who apt bought astatine little prices, are amended positioned compared to smaller oregon much caller buyers.

UTXOs, which are much delicate to smaller transactions, amusement that much caller oregon predominant marketplace participants are facing losses. This implies that determination has been a caller displacement successful marketplace sentiment, wherever short-term traders oregon smaller investors are feeling the unit of Bitcoin’s pullback from its highs.

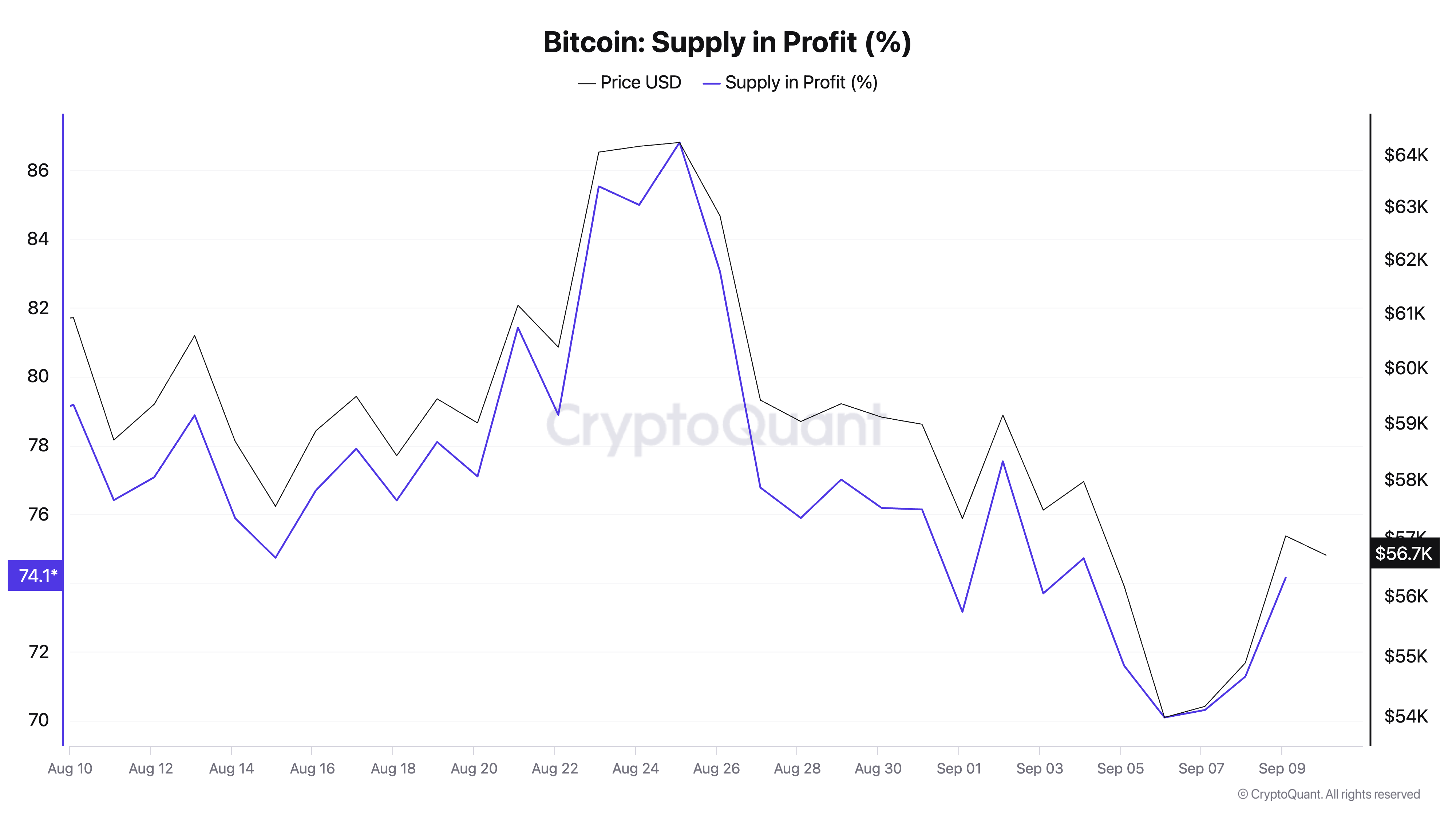

Graph showing the percent of Bitcoin proviso successful nett from Aug. 10 to Sep. 10, 2024 (Source: CryptoQuant)

Graph showing the percent of Bitcoin proviso successful nett from Aug. 10 to Sep. 10, 2024 (Source: CryptoQuant)Since Bitcoin’s terms is present higher than its caller debased of $54,170 connected Sep. 7, but some UTXOs successful nett and proviso successful nett stay comparatively debased compared to earlier successful the year, the information suggests the marketplace is successful a betterment signifier but has not yet afloat regained confidence. The little percentages bespeak that portion Bitcoin’s terms has rebounded slightly, the harm from erstwhile terms declines is inactive evident successful the marketplace structure.

This operation of factors typically points to a marketplace successful consolidation, wherever immoderate participants are waiting for much evident signs of a sustained terms betterment earlier re-entering oregon committing to holding their positions. The marketplace seems to beryllium successful a transitional signifier — nary longer successful afloat bull marketplace territory but not successful a full capitulation portion either.

If prices stabilize oregon emergence from existent levels, the percent of UTXOs and proviso successful nett should commencement to increase, signaling renewed confidence. However, if Bitcoin’s terms dips further, peculiarly beneath cardinal intelligence levels, it could propulsion much holders into nonaccomplishment territory, heightening the hazard of further sell-offs.

The station Bitcoin terms stabilizes but profitability spread points to unease appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)