The Bitcoin terms has risen arsenic precocious arsenic $38,012 (on Binance), signaling a marginally higher high. Here are the main reasons for the latest surge successful BTC price.

#1 Euphoria Over Potential ETF Approvals

The crypto marketplace has been electrified by the anticipation of the US Securities and Exchange Commission (SEC) approving respective spot Bitcoin ETFs. With the support model having opened connected November 9 until Friday (November 17), experts similar James Seyffart and Eric Balchunas from Bloomberg estimation a 90% accidental of support for aggregate filings by January 10, 2024, the last deadline for Ark Invest’s filing.

Remarkably, the SEC is facing a important deadline cluster, with 3 applications for spot ETFs from Franklin Templeton and Hashdex (due November 17), and GlobalX (due November 21) awaiting decisions. Amidst this tense backdrop, Hashdex emerged arsenic the archetypal to brushwood a delay, arsenic the SEC postponed their determination connected the conversion from a futures ETF to an ETF that holds some futures and spot.

This quality momentarily jolted the market, resulting successful a crisp but little diminution successful BTC’s price, which plummeted from $37,400 to $36,780 successful a swift five-minute span. However, the market’s resilience was rapidly demonstrated arsenic Bitcoin not lone recovered but exceeded its pre-announcement terms wrong 25 minutes.

#2 Unprecedented Institutional Interest In Bitcoin

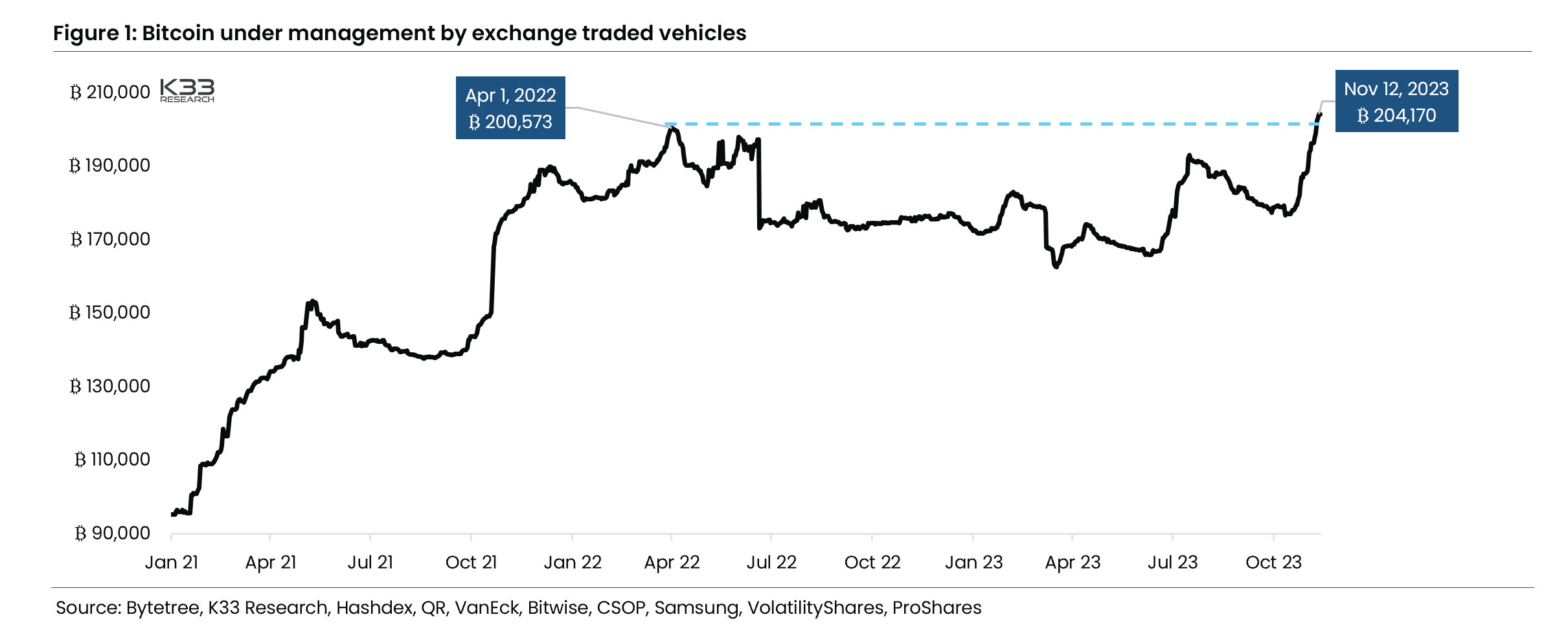

Institutional request for Bitcoin has reached caller heights, peculiarly done exchange-traded products (ETPs). The caller BlackRock Bitcoin spot ETF filing importantly contributed to this surge. “The Assets Under Management via ETPs person accrued by 27,095 BTC, bringing the full to a grounds 204,170 BTC, equivalent to astir 7.4 cardinal dollars,” reports K33 research. This inclination indicates a increasing organization clasp of Bitcoin arsenic a viable concern asset.

Bitcoin ETP request | Source: K33 Research

Bitcoin ETP request | Source: K33 Research#3 Supply And Demand Dynamics

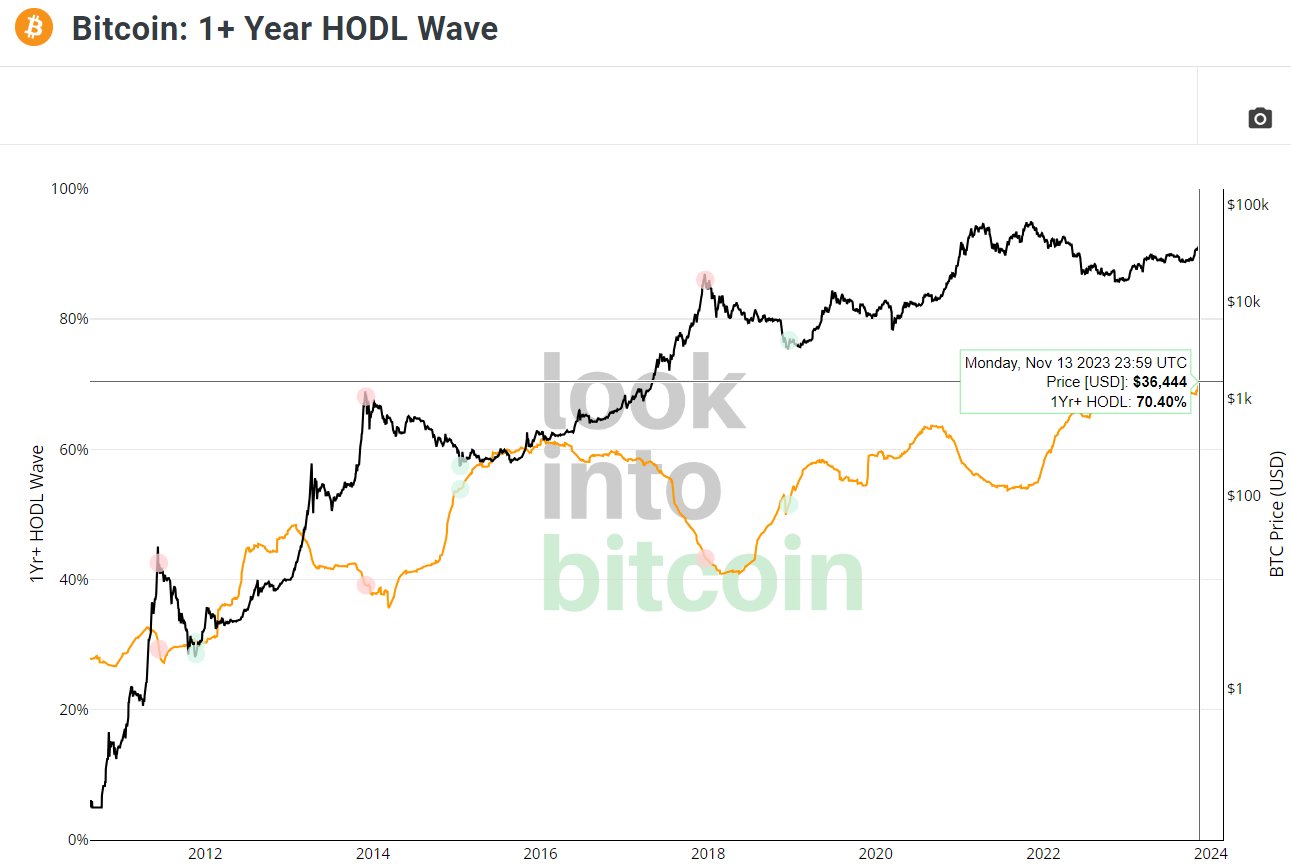

Data from LookIntoBitcoin highlights a singular trend: implicit 70% of Bitcoin has not been moved for astatine slightest 1 year. “This is simply a historical infinitesimal that underscores the spot of Bitcoin’s tokenomics,” the information supplier shared. They further elaborated, “As agelong arsenic this HODL Wave continues to climb, it suggests a bullish marketplace outlook with semipermanent investors showing nary signs of selling their holdings. This is peculiarly important considering the upcoming Bitcoin Halving lawsuit and the increasing organization interest.”

Bitcoin 1+ Year HODL Wave | Source: LookIntoBitcoin

Bitcoin 1+ Year HODL Wave | Source: LookIntoBitcoin#4 Liquidity Injections By The Fed

Arthur Hayes, co-founder of BitMEX, commented connected the important liquidity being injected into the marketplace and its interaction connected cryptocurrencies. “Keep your oculus connected the prize. Almost $200 cardinal successful liquidity has been added since November’s start, impacting assets similar Bitcoin. This indicates a imaginable ongoing emergence for cryptocurrencies,” Hayes stated. He emphasizes the value of knowing the RRP and TGA dynamics successful predicting marketplace movements.

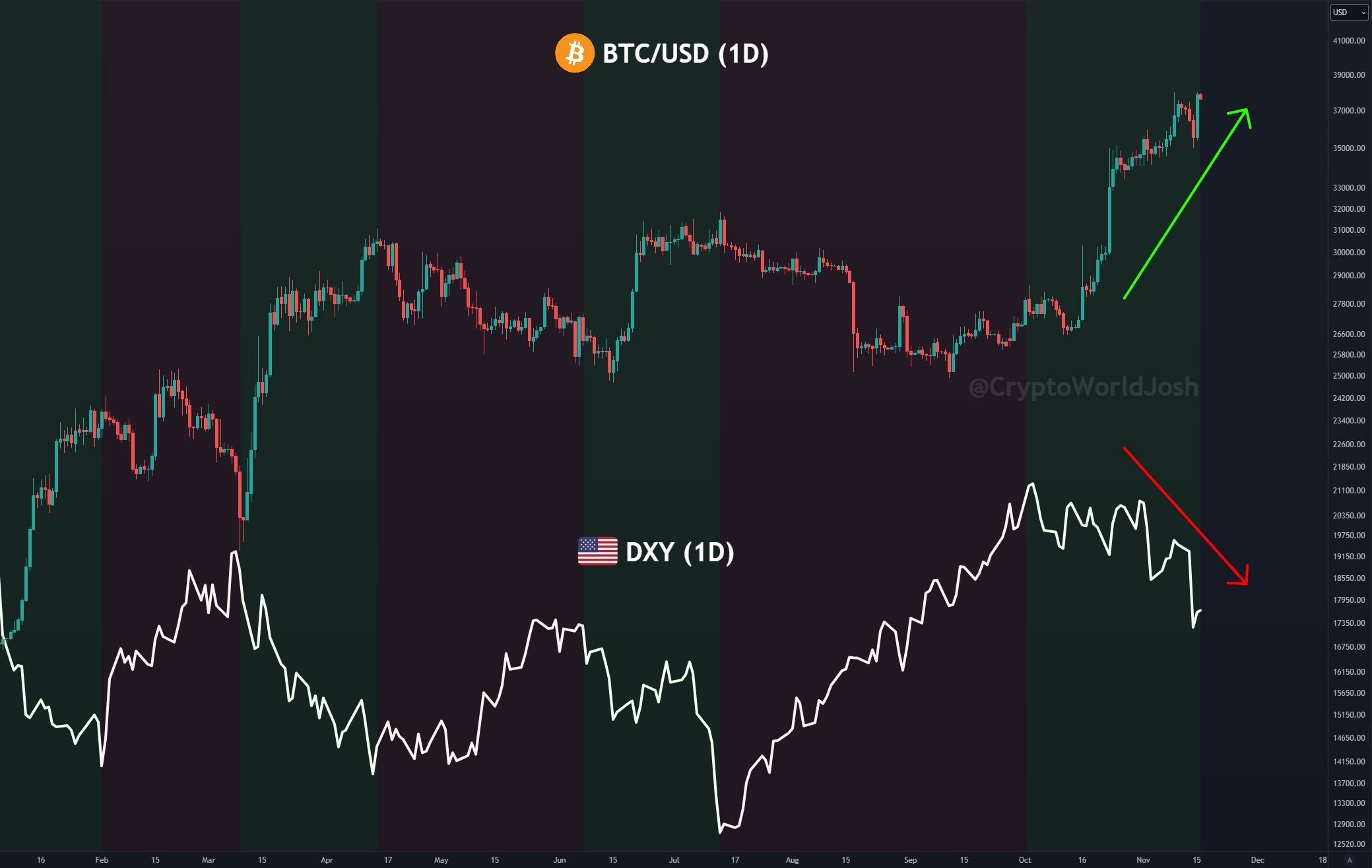

#5 Inverse Correlation With The DXY

The inverse correlation betwixt Bitcoin and the U.S. Dollar Index (DXY) has been a notable origin successful Bitcoin’s caller terms increase. As the DXY faced absorption and began to fall, Bitcoin’s worth conversely increased. Crypto expert Josh stated, “Bitcoin PUMPS portion the DXY DUMPS!”

BTC vs. DXY | Source: X @CryptoWorldJosh

BTC vs. DXY | Source: X @CryptoWorldJoshAt property time, BTC traded astatine $37,467 aft failing to interruption retired of the ascending inclination channel.

BTC fails to interruption retired of inclination channel, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC fails to interruption retired of inclination channel, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)