The Bitcoin terms trajectory has erstwhile again taken a crisp upward turn, marking its ascent past the $28,000 landmark for the archetypal clip since its notable surge connected August 29. This anterior leap had been attributed to Grayscale’s triumph implicit the US Securities and Exchange Commission (SEC) successful their ineligible conflict regarding the Bitcoin Trust (GBTC) conversion to a spot ETF.

In a striking objection of Bitcoin’s infamous volatility, the BTC experienced a terms escalation of implicit $800 wrong a minuscule 5-minute model connected Sunday evening, rocketing from $27,250 to a highest of $28,053 betwixt 6:15 and 6:20 p.m. ET.

Why Is Bitcoin Price Up Today?

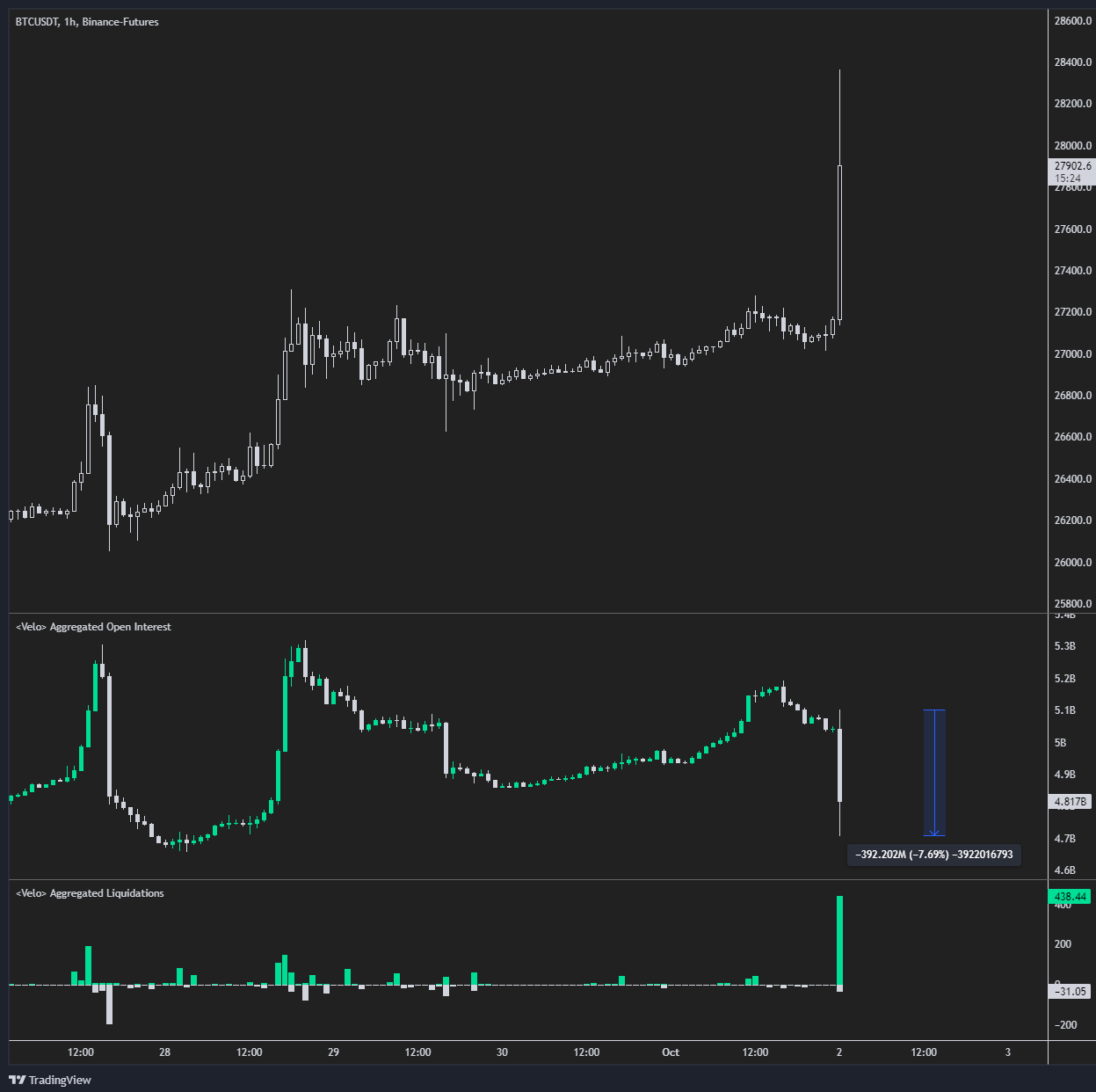

One superior catalyst down this melodramatic terms movement, arsenic pinpointed by the esteemed crypto expert Byzantine General, is the improvement known arsenic a “short squeeze.” In the realm of futures trading, a abbreviated compression is characterized by a accelerated terms increase, forcing traders who had stake against the asset’s terms (short sellers) to bargain it to forestall further losses. This reactive buying tin intensify the asset’s terms jump.

During yesterday’s surge, a staggering $392 cardinal successful Bitcoin abbreviated positions, oregon astir 7.7% of the full unfastened involvement successful the market, were swiftly liquidated. Byzantine General further elaborated connected the market’s resilience, observing that the Bitcoin unfastened involvement bounced backmost swiftly with an increment of $350 million, humorously suggesting the market’s willingness to clasp specified a volatile maneuver again: “The full marketplace was really similar ‘I’ll fucking bash it again.”

Bitcoin abbreviated compression | Source: X @ByzGeneral

Bitcoin abbreviated compression | Source: X @ByzGeneralCrypto expert Fabian D. deepened the investigation by pointing retired the intricate interplay betwixt abbreviated sellers being ousted and the imaginable for further Bitcoin appreciation. He indicated that the upward trajectory of Bitcoin from this constituent hinges connected 2 superior factors: the introduction of spot buyers driven by the fearfulness of missing retired (FOMO) and whether abbreviated sellers determine to re-establish their positions.

Fabian besides alluded to the lack of organization buying enactment successful the week preceding this surge but underscored the value of monitoring premium rates connected platforms similar Coinbase and CME upon marketplace opening today. Adding to the complexity of the marketplace landscape, Fabian flagged 2 impending events: the anticipation surrounding the Ethereum Future ETF inflows, and the tribunal proceeding concerning the Celsius platform, which mightiness perchance refocus attraction connected its creditor distributions.

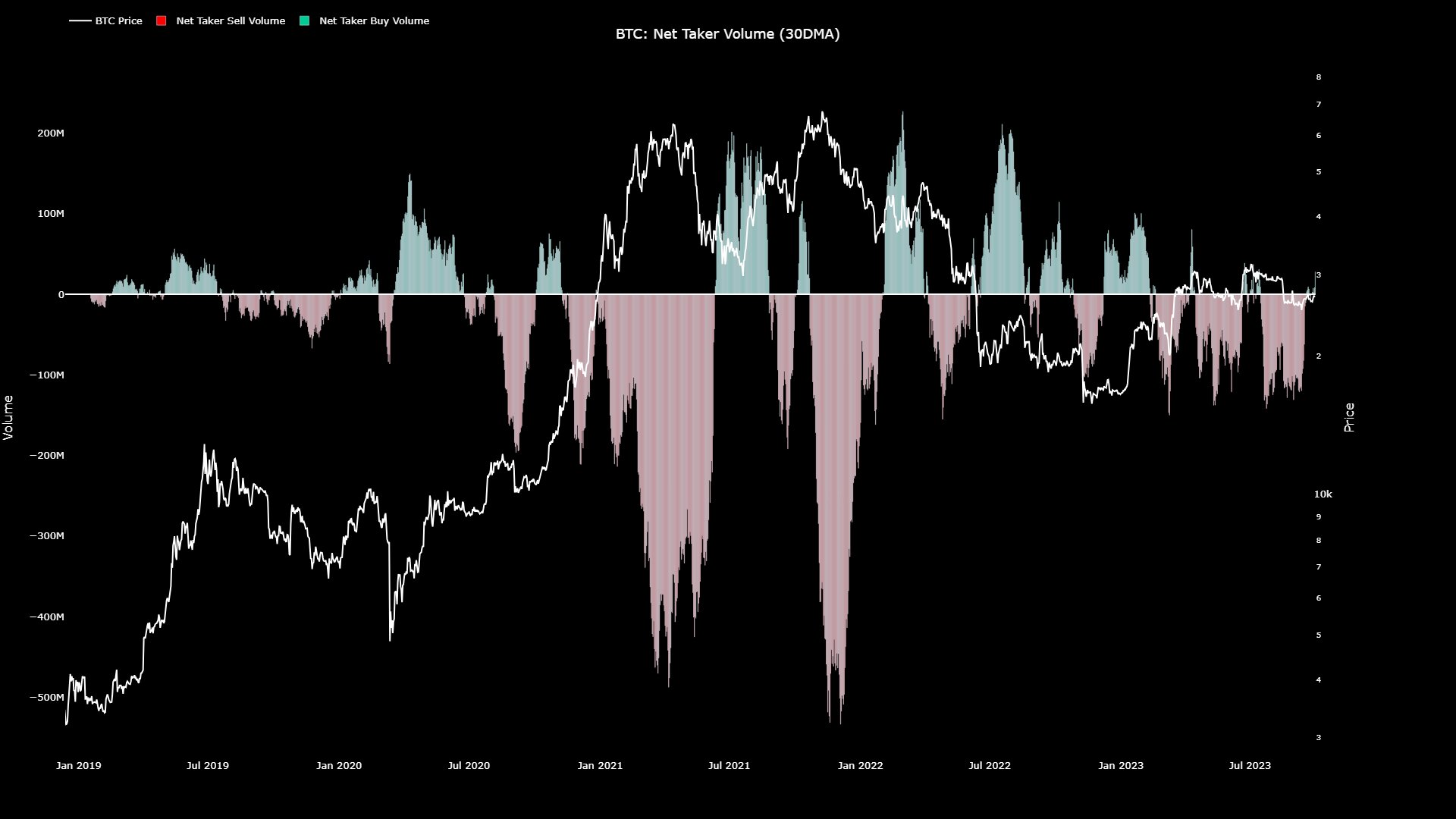

Drawing insights from on-chain data, expert Maartunn introduced different furniture of optimism, noting that “Net Taker Volume has crossed into the greenish zone, indicating that buyers are successful control. The past clip was 4 months ago.”

Bitcoin Net Taker Volume 30DMA | Source: X @JA_Maartun

Bitcoin Net Taker Volume 30DMA | Source: X @JA_MaartunDiving into granular analytics, quant trader Skew shed airy connected the dynamics astatine play connected platforms similar Binance and Bybit. He emphasized that the caller terms upswing wasn’t wholly unforeseen, peculiarly fixed the noticeable displacement distant from abbreviated positions and the robust perpetual bid starring up to the spike.

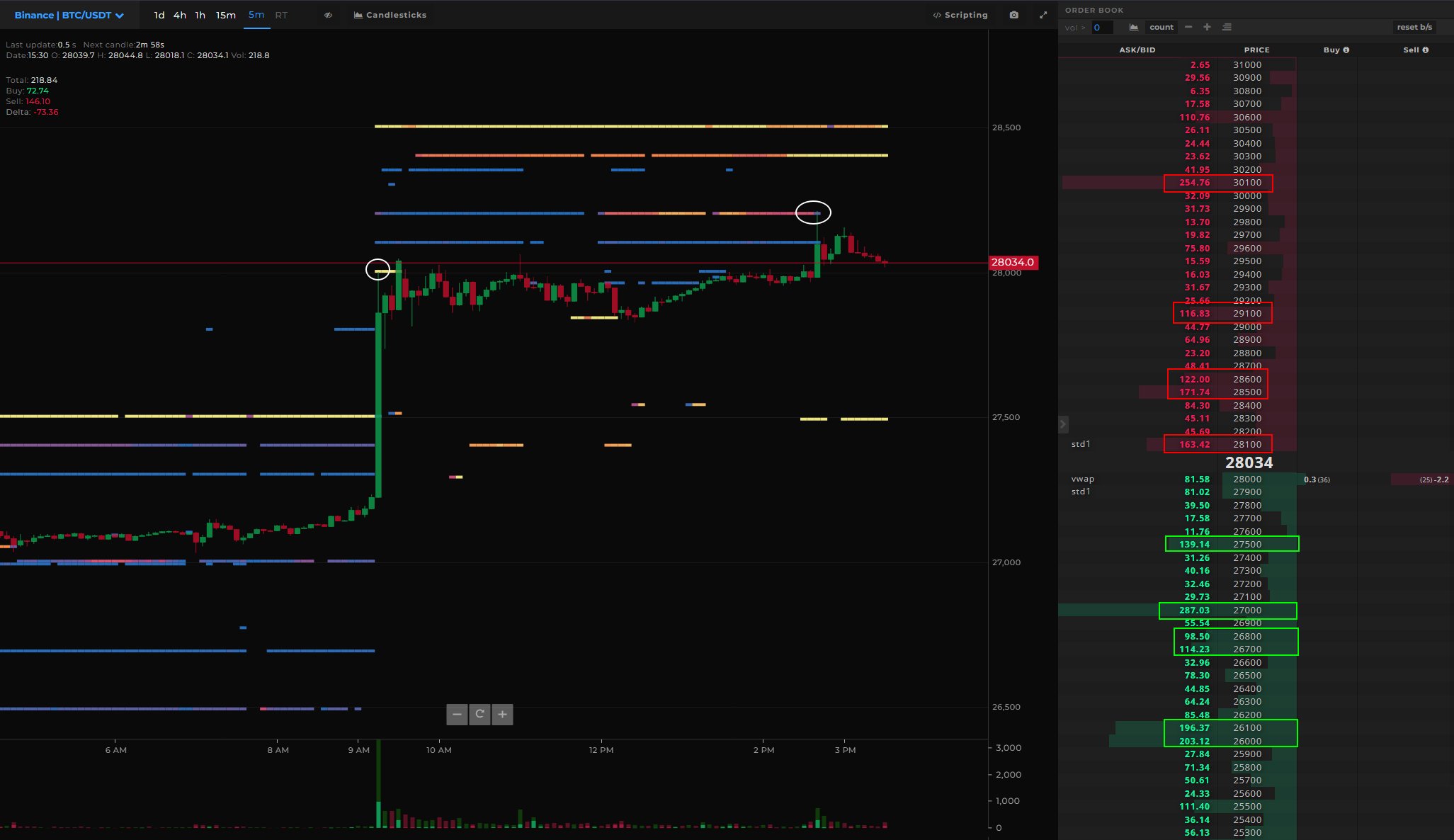

Looking astatine the Bitcoin aggregate CVDs & delta, helium further noted: “Mostly seeing merchantability unit conscionable successful perps for now. Price diminution with Perp CVD diminution & Perp merchantability delta picking up. Next determination that decides the destiny of this full determination is spot.”

Highlighting the evolving marketplace dynamics, Skew pointed out that the BTC Binance Spot exhibited a notably wide bid publication with a important magnitude of disposable and resting liquidity. He inferred that specified a setup could pb to much pronounced terms reactions.

Highlighting the evolving marketplace dynamics, Skew remarked that the BTC Binance spot marketplace exhibits a notably wide bid publication with a important magnitude of disposable and resting liquidity. He inferred that specified a setup could pb to different pronounced terms reaction. “Increasing inquire liquidity connected spot bid books; implies greater measurement needed by spot takers to wide $28K – $29K (Market operation shift),” helium warned.

BTC Binance Spot | Source: X @52Skew

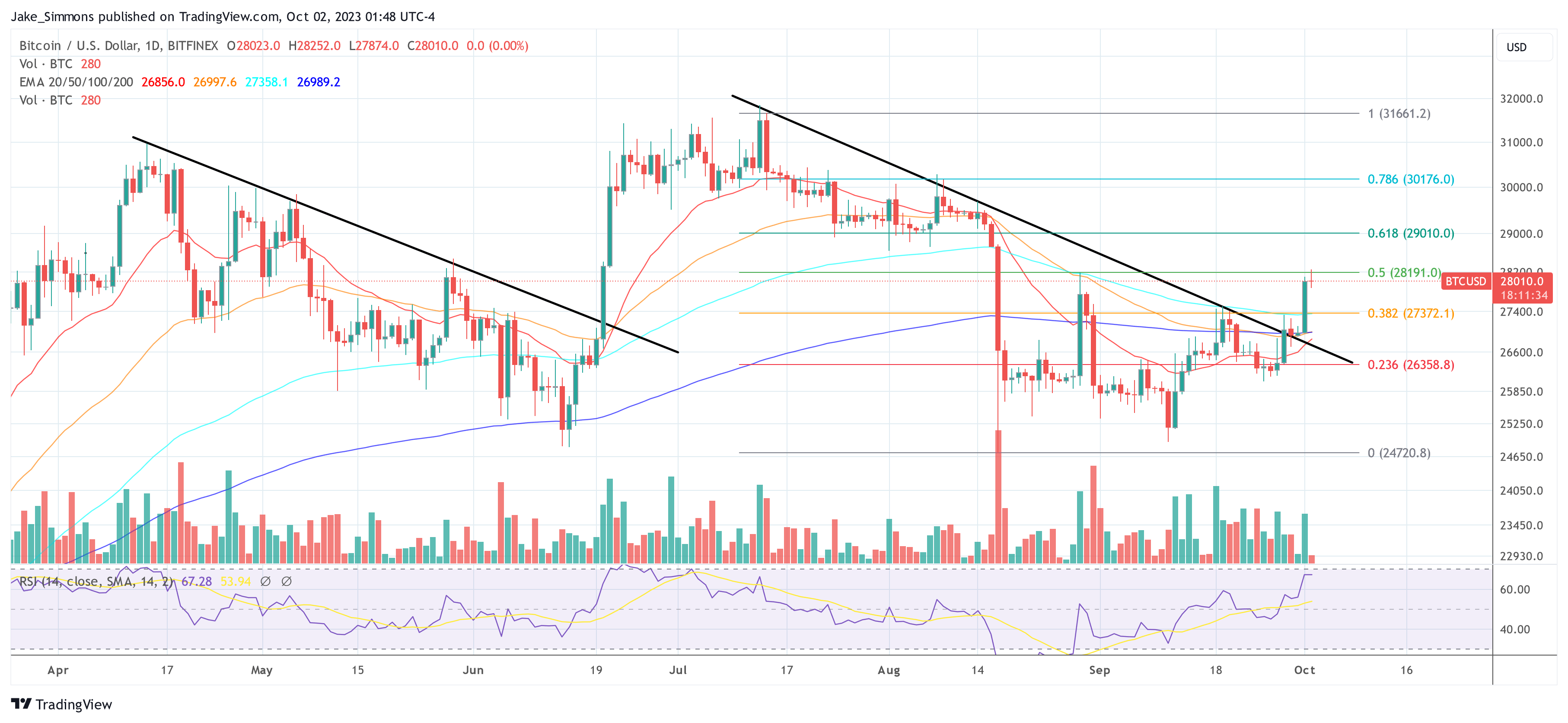

BTC Binance Spot | Source: X @52SkewIt is besides absorbing to enactment that the terms question was already evident successful the 1-day chart. As explained successful the past Bitcoin terms analyses, the terms broke done the (black) downtrend enactment established successful mid-July past Thursday. While the palmy re-test of the trendline took spot connected Friday and Saturday, confirming the bullish momentum, the expected bounce occurred yesterday.

Bitcoin terms rises supra $28,000, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms rises supra $28,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)