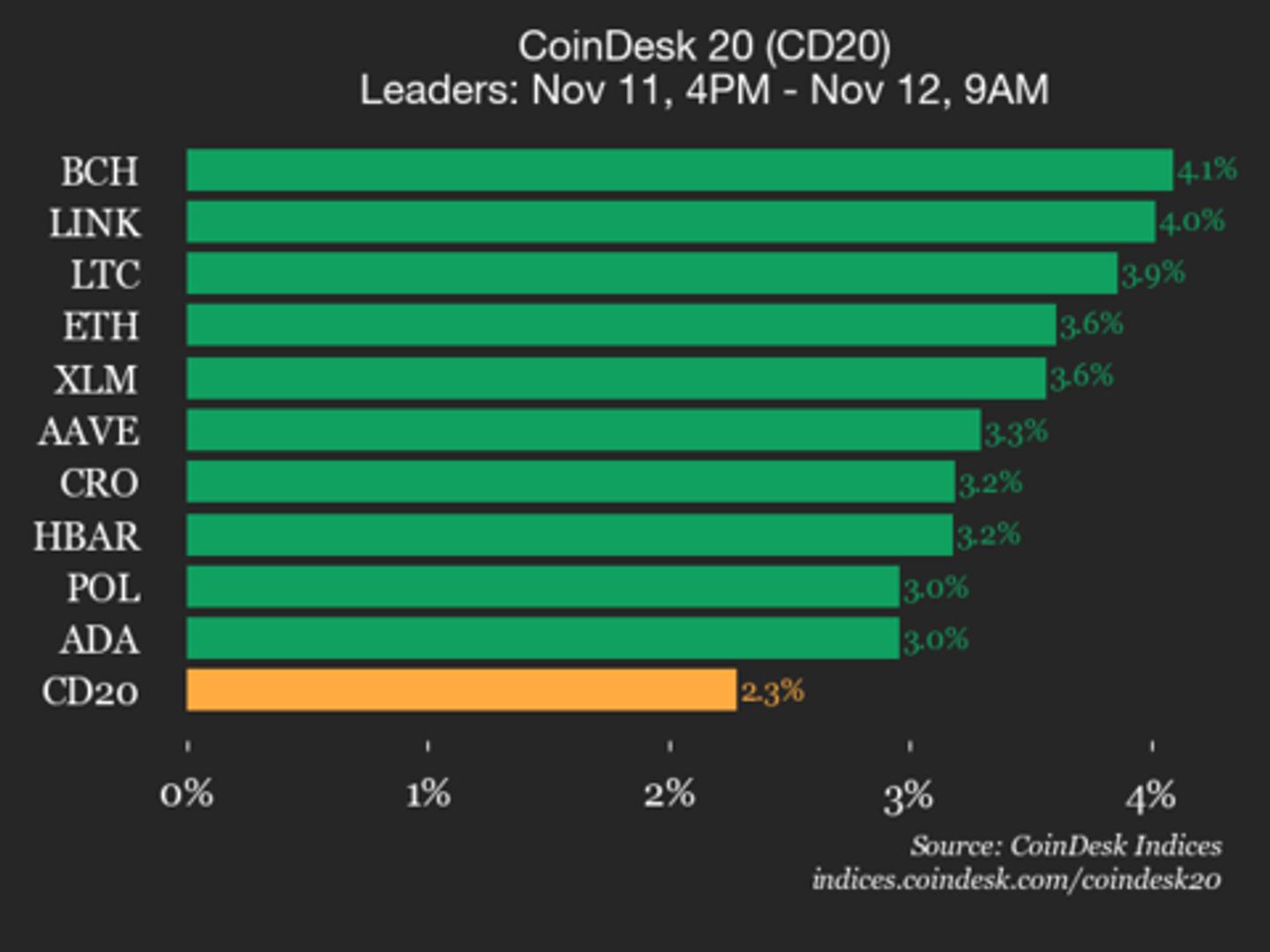

The terms of Bitcoin (BTC) has notched caller all-time highs against immoderate of the world’s astir inflationary fiat currencies.

Across 30 hours implicit Oct. 23 to 24, the outgo of buying 1 Bitcoin has reached each time-highs erstwhile utilizing the Argentine peso (ARS), Nigerian naira (NGN), Turkish lira (TRY), Laotian kip (LAK) and the Egyptian lb (EGT).

#Bitcoin conscionable deed an all-time precocious successful Argentina, Turkey and Nigeria. pic.twitter.com/sKRNUaBMX8

— Miles Deutscher (@milesdeutscher) October 26, 2023However, it should beryllium noted that the effect is owed to the ongoing devaluation of the currencies, exacerbated by Bitcoin’s caller 16% terms increase.

NGN and TRY fell to their lowest points against the U.S. dollar connected Oct. 24 and Oct.25, portion ARS is lone 0.85% disconnected its all-time debased (against the U.S. dollar).

According to the International Monetary Fund, the Venezuelan bolivar presently has the highest yearly ostentation complaint astatine 360%, followed by Zimbabwean dollar (314%), Sudanese lb (256%) and ARS (122%).

The Turkish lira and Nigerian naira came successful sixth and 15th with yearly ostentation rates of 51% and 25% respectively, IMF’s information shows.

Heat representation of countries successful the satellite with corresponding yearly ostentation rates. Source: IMF

Heat representation of countries successful the satellite with corresponding yearly ostentation rates. Source: IMFCrypto observers person agelong seen integer assets, specified arsenic Bitcoin and stablecoins, arsenic a hedge against rocketing inflation, the caller figures could bolster that narrative.

Nigeria, Turkey and Argentina boast the 2nd, 12th and 15th highest rates of cryptocurrency adoption successful the world, according to a Sept. 12 study by Chainalysis.

With ostentation astatine 99% successful #Argentina, it’s 99% apt that the citizens of that beauteous state would payment from #Bitcoin.

— Michael Saylor⚡️ (@saylor) February 15, 2023However, the governments of these countries haven't ever seen eye-to-eye with the cryptocurrency industry.

Nigeria is yet becoming much welcoming to cryptocurrencies aft its cardinal slope banned section banks from providing services to cryptocurrency exchanges successful Feb. 2021.

Progress was made successful December 2022 erstwhile Nigeria announced its volition to pass a measure recognizing cryptocurrencies arsenic “capital for investment” — citing the request to support up with “global practices” arsenic 1 of the main reasons down its alteration successful stance.

And portion Turkey is location to some of the astir crypto-curious people, its cardinal bank banned cryptocurrency payments for goods and services successful April 2021. It has besides moving connected a cardinal slope integer currency (CBDC) to digitalize the Turkish lira implicit the past fewer years.

#Bitcoin fixes this

I'm backmost successful my beauteous country, Turkey, aft 6 months. Shocked to witnesser the aforesaid goods costing 3–4 times much already. Rents, food, nationalist transport, and much costs skyrocket regularly. High inflation's devastation is existent and alarming. pic.twitter.com/X4N4Axuh1n

Meanwhile, Argentina’s ostentation situation could beryllium influenced by the result of its statesmanlike predetermination successful November, with statesmanlike campaigner Javier Milei acceptable to look rival Sergi Massa successful a final run-off vote connected Nov. 19.

Related: Turkey to usage blockchain-based integer individuality for online nationalist services

Massa, who presently serves arsenic the country’s curate of economy, wants Argentina to motorboat a central slope integer currency (CBDC) “as soon arsenic possible” arsenic a means to “solve” the country’s long-lasting ostentation crisis.

Argentina's contiguous provides a glimpse into America's future, wherever the cardinal slope raised involvement rates 15 percent points to 133% connected Oct. 12. But with #inflation moving astatine 138% and fund deficits and indebtedness rising, the complaint hikes volition person nary effect connected reducing inflation.

— Peter Schiff (@PeterSchiff) October 26, 2023He has besides voiced an volition to support the U.S. dollar distant from Argentinians, explaining that Argentinians should alternatively beryllium “patriots” and support the Argentine Peso.

Milei connected the different hand, wants the U.S dollar to beryllium adopted successful summation to abolishing Argentina’s cardinal bank.

Magazine: Unstablecoins: Depegging, slope runs and different risks loom

2 years ago

2 years ago

English (US)

English (US)