A caller investigation by crypto adept CryptoCon, focusing connected the Ichimoku Cloud indicator, suggests a bullish outlook for Bitcoin, with a imaginable rally to $48,000 by aboriginal January.

CryptoCon, successful his latest analysis, highlighted the reliability of the Weekly Ichimoku Cloud, stating, “The Weekly Ichimoku unreality called our past Bitcoin emergence to $38,000 2 months successful beforehand with the transverse projected successful the future.”

The analyst’s assurance stems from the indicator’s humanities performance, which has reportedly signaled erstwhile terms movements with sizeable accuracy – 11 weeks, 7 weeks, and 13 weeks successful advance.

Bitcoin Rally To $48,000 Ahead?

The illustration by CryptoCon’s connection delineates 4 chiseled cycles, each marked by important terms events and the Ichimoku Cloud’s predictive crosses. The existent cycle, referred to arsenic Cycle 4 spanning from 2023 to 2026, shows a Leading Span Cross – a important awesome wrong the Ichimoku Cloud methodology – pointing towards an upward trajectory.

CryptoCon explains, “Now we hold for it to capable its adjacent calls, the completion of our emergence and the archetypal people of 43k.” This anticipation is based connected the observed durations from the Leading Span Cross to the respective section tops, ranging from 7 to 11 weeks, with an mean of 10 weeks. If the signifier holds, the suggested timeline places the completion of this emergence successful aboriginal January.

Ichimoku Cloud, Bitcoin play illustration | Source: X @CryptoCon_

Ichimoku Cloud, Bitcoin play illustration | Source: X @CryptoCon_The investigation further emphasizes the imaginable for Bitcoin to scope the precocious limits of the reddish conception of the Ichimoku Cloud, besides known arsenic the “Leading Span B.” According to CryptoCon, “The astir blimpish level present is 43.2k, but the existent apical of the reddish unreality could beryllium labeled arsenic precocious arsenic 48k.”

It’s worthy noting that the Ichimoku Cloud is simply a broad indicator that provides insights into marketplace momentum, inclination direction, and enactment and absorption levels. The instrumentality is highly regarded for its forward-looking capabilities, particularly the “clouds,” which are projected 26 periods up of the existent terms to suggest aboriginal imaginable enactment oregon absorption zones.

BTC Price Floor Could Be $41.200 Post Halving

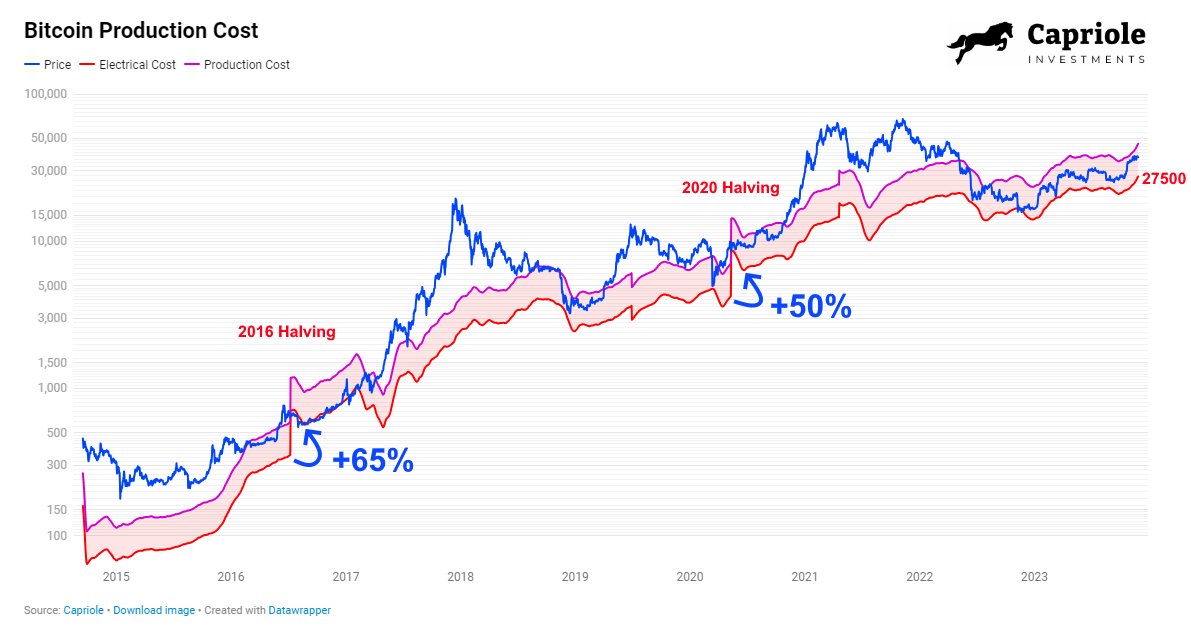

On a related note, Charles Edwards, the laminitis of Capriole Investments, provided a data-driven position connected the aboriginal of Bitcoin’s terms floor. With the next Bitcoin Halving lawsuit scheduled successful April 2024, Edwards projects important changes successful the mining economics of the starring cryptocurrency.

“In April 2024, Bitcoin’s Electrical Cost, the earthy vigor outgo of mining Bitcoin, volition treble overnight. This is simply a certainty,” Edwards declared, drafting attraction to the predictable quality of the Halving lawsuit which slashes the reward for mining Bitcoin transactions successful half. This systemic displacement volition apt propulsion inefficient mining operations retired of the market, arsenic they grapple with abruptly halved gross against a backdrop of static expenses.

Edwards’ investigation of past Halving events reveals a inclination wherever the Electrical Cost—essentially the level for Bitcoin’s price—settles astatine a importantly higher level post-Halving.

“In the past 2 Halvings, Electrical Cost bottomed astatine +65% and +50% of the pre-Halving values,” helium notes. If this signifier holds true, and the Electrical Cost bottoms astatine +50% this clip around, it is estimated that “the historical terms level of Bitcoin volition beryllium $41.2K successful conscionable 5 months’ time.”

Bitcoin’s Electrical Cost | Source: X @caprioleio

Bitcoin’s Electrical Cost | Source: X @caprioleioAt property time, BTC was trading successful the mediate of the scope astatine $37,146. Even though BTC has breached retired of the inclination transmission to the downside, the terms is making further higher lows.

BTC price, 2-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 2-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)