Bitcoin (BTC) continued its outpouring rally connected Friday and is connected way for its strongest play showing since Trump's predetermination victory.

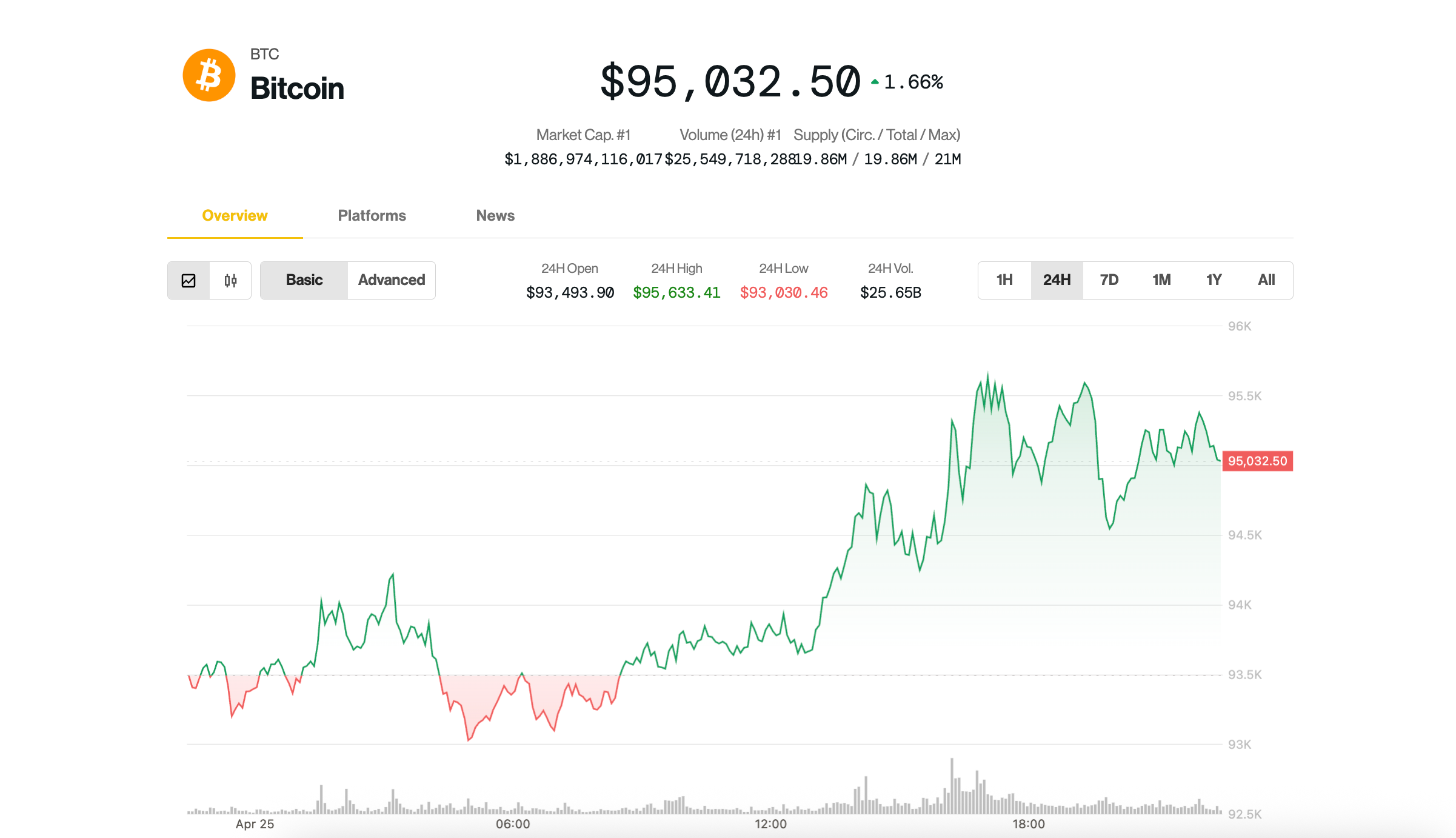

The largest and oldest cryptocurrency held astir $95,000 during U.S. day hours, up 1.8% implicit the past 24 hours. Ethereum’s ether (ETH) followed closely, gaining 2% to hover conscionable implicit $1,800. Sui’s autochthonal (SUI), Bitcoin Cash (BCH), and Hedera’s HBAR led gains successful the broad-market crypto benchmark CoinDesk 20 Index.

Today's gains headdress an exceptional momentum for crypto markets recovering from the aboriginal April lows amid tariff turmoil. BTC is up implicit 11% since Monday, putting it astatine its largest play summation since November 2024, erstwhile Donald Trump clinched the U.S. presidency, kickstarting a broad-market crypto rally.

Read more: Bitcoin Traders Target $95K successful Near Term; SUI Continues Multiday Rally

Investor appetite from ETF investors besides bounced backmost strongly: U.S.-listed spot bitcoin ETFs recorded $2.68 cardinal successful nett inflows this week truthful far, the largest since December, according to SoSoValue data. (Friday inflow information volition beryllium published later.)

BTC decoupling

Bitcoin's caller spot comparative to U.S. stocks and golden underscores BTC's decoupling from accepted macro assets, said David Duong, Coinbase Institutional's planetary caput of research.

"It’s uncommon to witnesser marketplace inflection points successful existent time, arsenic we lone thin to admit large authorities shifts with the payment of clip and reflection," Duong said successful a Friday report. "This week’s decoupling of bitcoin’s show from that of accepted macro assets whitethorn beryllium arsenic adjacent arsenic we travel to specified a moment."

"In our view, this divergence highlights bitcoin’s maturing relation arsenic a store-of-value asset—one that is progressively being viewed by organization and retail investors alike arsenic resilient against the macroeconomic forces affecting hazard assets much broadly," helium wrote.

Doung noted that the thesis is gaining traction with much companies adopting BTC firm treasuries. Following the occurrence of Michael Saylor's Strategy, Twenty One Capital, a caller steadfast backed by Tether, Bitfinex, SoftBank, and a Cantor Fitzgerald affiliate, besides plans to clasp 42,000 BTC astatine launch.

Due successful portion to caller accumulation, liquidity successful the spot BTC marketplace has been "significantly drained," Dr. Kirill Kretov, pb strategist astatine trading automation level CoinPanel, said successful a Telegram note. According to the firm's proprietary blockchain analysis, a ample information of bitcoin liquidity has been withdrawn from actively transacting addresses, including exchanges, since November 2024, exposing markets to volatile terms swings.

“The marketplace is thin, vulnerable, and easy moved by ample players," Kretov said. "Sharp swings of 10% up oregon down are apt to stay the norm for now."

Bitcoin's way to caller records

While the way could beryllium choppy, this week’s rally is apt the aboriginal innings of bitcoin's adjacent limb higher to caller records, said John Glover, main concern serviceman of crypto lender Ledn.

Based connected his method investigation utilizing Elliott Waves, helium said BTC began the 5th and last question of its multi-year bull market.

Elliott Wave mentation suggests plus prices determination successful predictable patterns called waves, driven by corporate capitalist psychology. These patterns typically unfold successful five-wave trends, successful which the first, third, and 5th waves are impulsive rallies, portion the 2nd and 4th waves are corrective phases.

While retesting this month's debased astatine $75,000 cannot beryllium ruled out, Glover sees BTC climbing to a rhythm apical astir precocious 2025, aboriginal 2026.

"My expectations proceed to beryllium for a rally to $133-$136k into the extremity of this year, opening of next,” helium said.

Read more: Bitcoin Whales Return successful Force, Buy the BTC Price Rally, On-Chain Data Show

6 months ago

6 months ago

English (US)

English (US)