Bitcoin has plunged beneath the $27,000 people during the past day. Here are the marketplace segments that are perchance participating successful this selloff.

These Bitcoin Investors Have Been Spending Their Coins Recently

In a caller tweet, the on-chain analytics steadfast Glassnode has breached down the prices astatine which the mean coins sold contiguous were bought. Generally, the BTC marketplace is divided into 2 main segments: the long-term holders (LTHs) and the short-term holders (STHs).

The STHs comprise a cohort including each investors who acquired their Bitcoin wrong the past 155 days. The LTHs, connected the different hand, are investors who person been holding for much than this threshold amount.

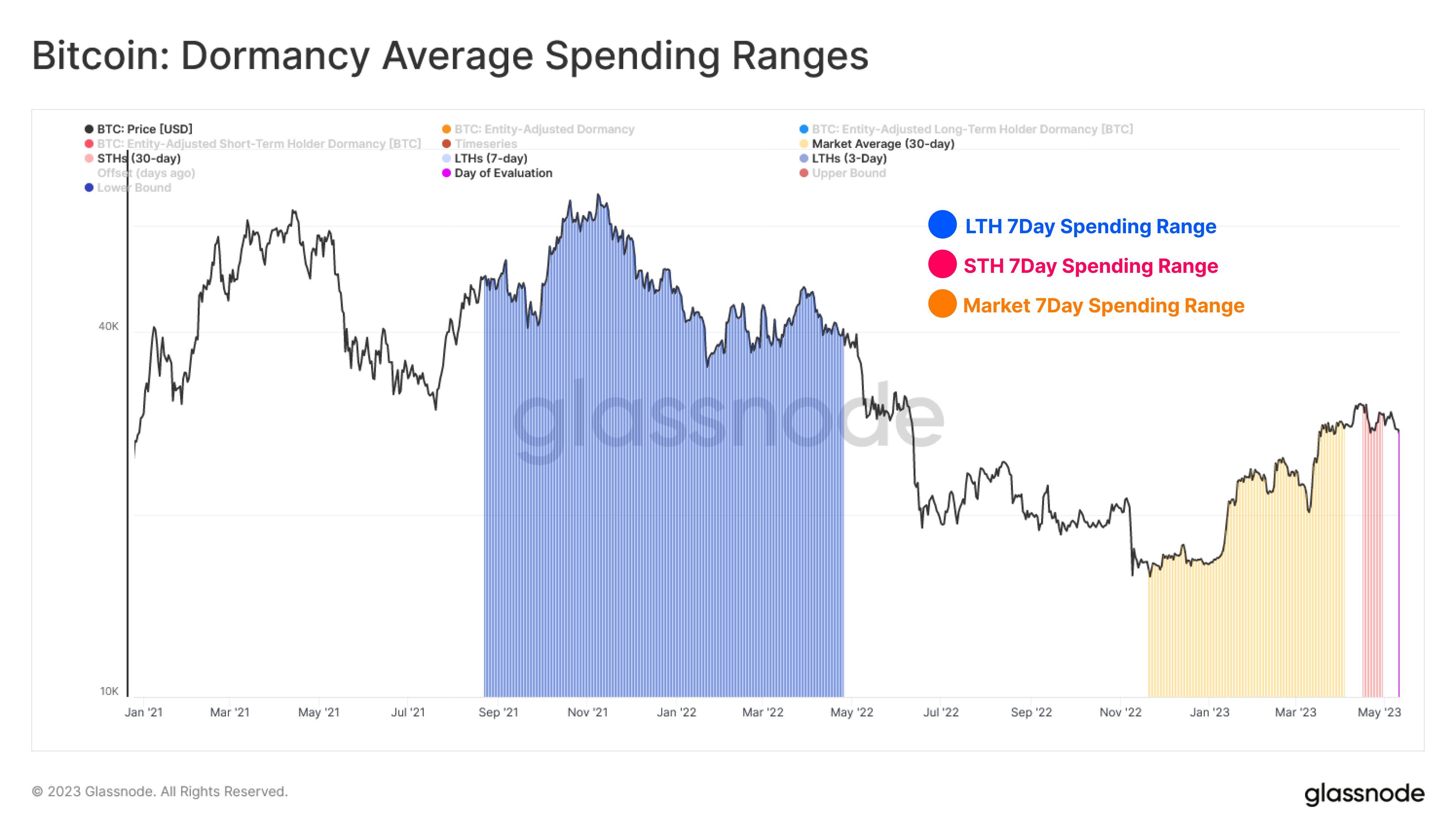

In the discourse of the existent discussion, the applicable indicator is the “dormancy mean spending ranges,” which finds retired the periods successful which the mean coins being spent/transferred by these 2 groups were archetypal acquired.

For example, if the metric shows the 7-day spending scope for the LTHs arsenic $20,000 to $30,000, it means that the coins these investors sold successful the past week were initially bought astatine prices successful this range.

Here is simply a illustration showing the information for the existent 7-day dormancy mean spending ranges for the STHs and LTHs, arsenic good for the combined market.

The graph shows that the 7-day mean spending scope for the STHs is rather adjacent to the existent prices astatine $30,400 to $27,300. Some of these sellers bought astatine higher prices than those observed successful the past week, truthful they indispensable person been selling astatine a nonaccomplishment (although not a peculiarly heavy one).

The indicator puts the LTHs’ acquisition scope astatine $67,600 to $35,000. As highlighted successful the chart, the timeframe of these purchases included the lead-up to the November 2021 terms all-time high, the apical itself, and the play erstwhile the diminution towards the carnivore marketplace archetypal started.

It would look that these holders who bought astatine the precocious bull marketplace prices person budged due to the fact that of the unit the cryptocurrency has been nether lately and person yet decided to instrumentality their losses and determination on.

Generally, the longer an capitalist holds onto their coins, the little apt they go to merchantability astatine immoderate point. This would possibly explicate wherefore the acquisition timeframe of the existent STHs is truthful recent; the fickle ones are those who person lone been holding a abbreviated while.

For the BTC LTHs, however, the probable crushed wherefore the acquisition play of the mean seller from this radical is truthful acold back, alternatively than nearer to 155 days agone (the cutoff of the youngest LTHs), is that a batch of the younger LTHs would beryllium successful profits presently arsenic they bought during the lower, bear-market prices.

As such, the Bitcoin investors much apt to waver successful their condemnation close present would beryllium those holding the astir terrible losses, the 2021 bull tally apical buyers.

The illustration besides includes the 7-day mean spending scope for the combined BTC sector, and arsenic 1 whitethorn expect, this scope lies successful the mediate of the 2 cohorts ($15,800 to $28,500), but the timeframe is person to the STHs, arsenic a batch of the sellers are bound to beryllium caller buyers.

BTC Price

At the clip of writing, Bitcoin is trading astir $26,300, down 10% successful the past week.

Featured representation from Kanchanara connected Unsplash.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)