Delving into the unsocial fiscal ecosystem of Bitcoin involves unpacking the conception of Unspent Transaction Outputs (UTXOs), a chiseled diagnostic that sets Bitcoin transactions isolated from accepted fiscal transactions and offers a unsocial lens done which to analyse marketplace behaviour and capitalist sentiment.

Unlike accepted fiscal transactions wherever balances are tracked, Bitcoin uses a strategy of UTXOs, which correspond the unspent worth from Bitcoin transactions. A UTXO is the magnitude of integer currency remaining aft a cryptocurrency transaction is executed. This output waits to beryllium utilized arsenic an input successful a aboriginal transaction.

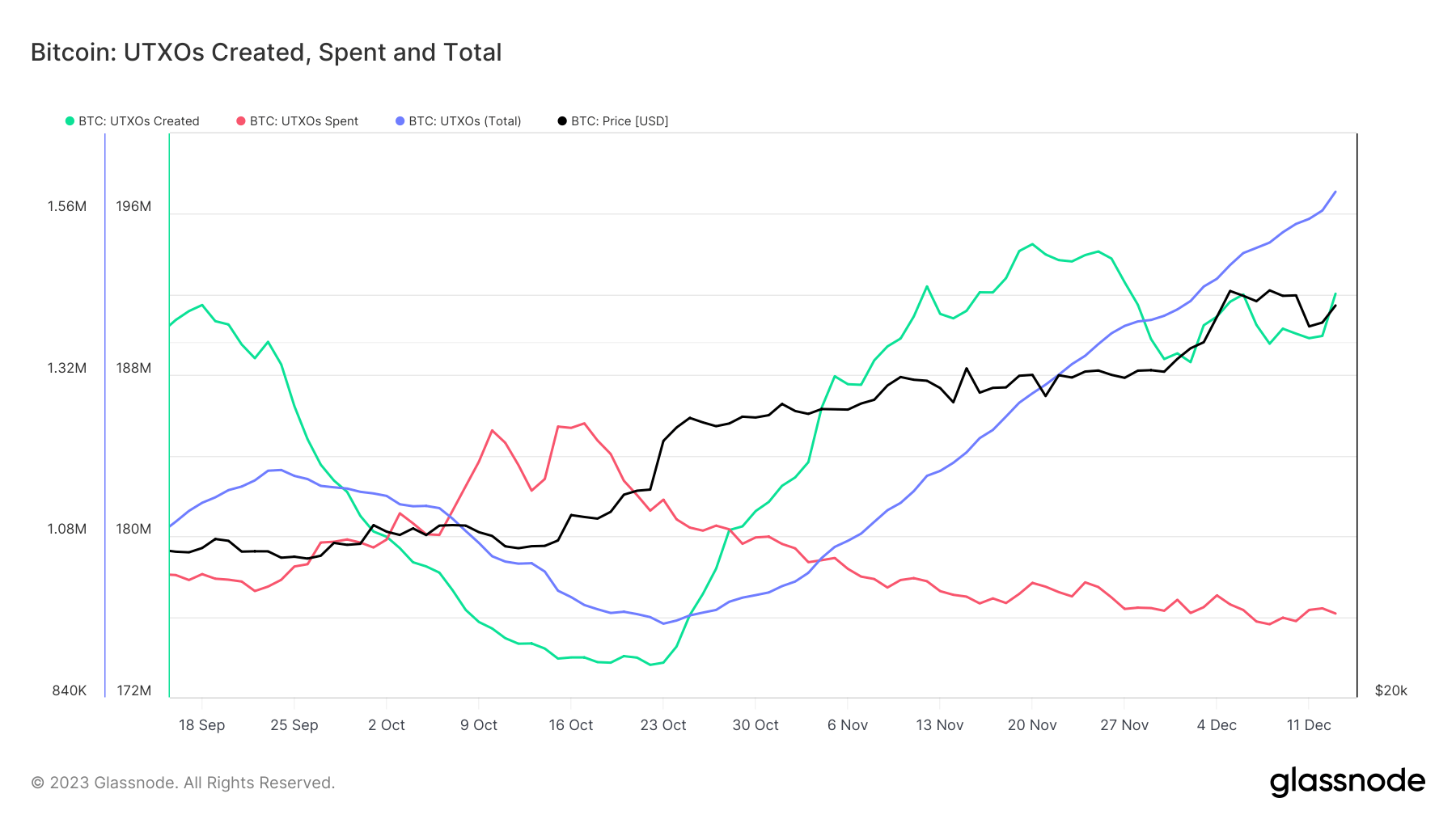

Bitcoin’s surge past the $40,000 people has led to a notable inclination successful UTXOs. Since Oct. 28, the instauration of UTXOs has consistently outpaced their spending. A ‘created UTXO’ refers to the output of a caller transaction that hasn’t been spent, portion a ‘spent UTXO’ is an input utilized successful a transaction and is frankincense nary longer available. The favoritism betwixt these 2 types of UTXOs reveals insights into however Bitcoin is utilized and stored.

This indicates a increasing inclination of Bitcoin accumulation, arsenic caller UTXOs correspond caller Bitcoin holdings that person not yet been spent. In contrast, spent UTXOs bespeak Bitcoins that person been transferred oregon utilized successful transactions. This favoritism betwixt created and spent UTXOs is pivotal successful knowing marketplace sentiment and behavior.

Between Oct. 28 and Dec.14, 2023, the regular mean of created UTXOs was astir 1.43 million, importantly higher than the 984,000 UTXOs spent connected mean per day. This resulted successful a nett summation successful UTXOs, averaging astir 442,000 daily. Despite immoderate variability successful the regular figures, arsenic indicated by the modular deviation for UTXO instauration and spending, the wide inclination remained consistent. This inclination signifies not lone an summation successful web enactment but besides a imaginable enlargement successful Bitcoin ownership, arsenic indicated by the increasing full number of UTXOs.

Graph showing spent UTXOs, created UTXOs, and the full fig of UTXOs from Sep. 16 to Dec. 14, 2023 (Source: Glassnode)

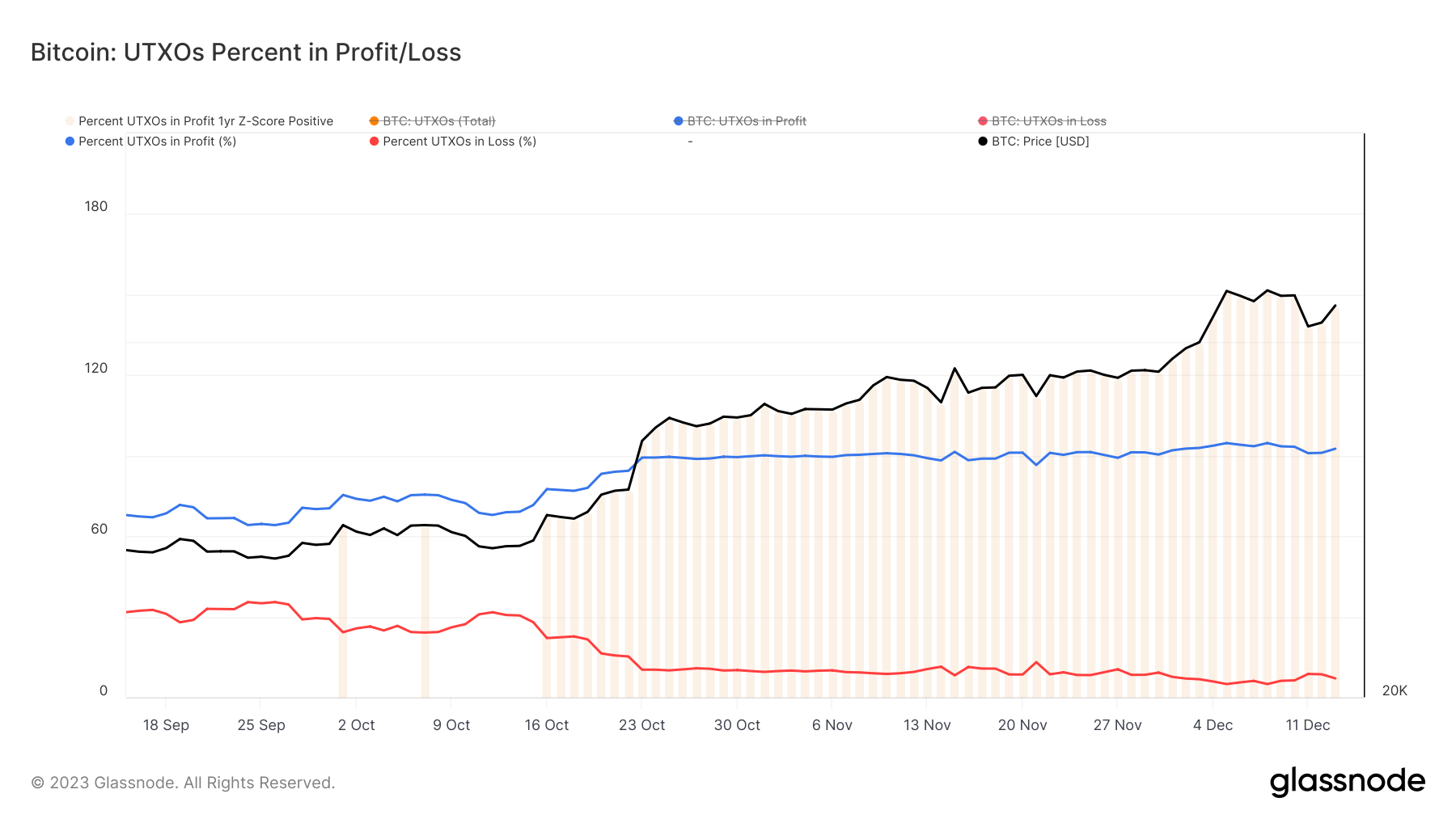

Graph showing spent UTXOs, created UTXOs, and the full fig of UTXOs from Sep. 16 to Dec. 14, 2023 (Source: Glassnode)Concurrently, the percent of Bitcoin UTXOs successful nett roseate from 88% to 92% during the aforesaid period. A UTXO is considered ‘in profit’ if the existent marketplace terms of Bitcoin exceeds the terms astatine which the Bitcoin successful that UTXO was past transacted. This summation suggests that if these UTXOs were to beryllium transacted oregon sold astatine the existent marketplace price, a nett would beryllium realized, indicating a bullish sentiment successful the market.

Graph showing the percent of Bitcoin UTXOs successful nett and nonaccomplishment from Sep. 16 to Dec. 14, 2023 (Source: Glassnode)

Graph showing the percent of Bitcoin UTXOs successful nett and nonaccomplishment from Sep. 16 to Dec. 14, 2023 (Source: Glassnode)The observed patterns suggest a holding behaviour among investors, perchance owed to expectations of further terms appreciation. This behaviour is simply a hallmark of bullish marketplace conditions, wherever the anticipation of aboriginal gains discourages selling oregon spending. The operation of a increasing fig of UTXOs and an summation successful profitable ones mightiness signify the introduction of caller investors oregon the augmented holdings of existing ones.

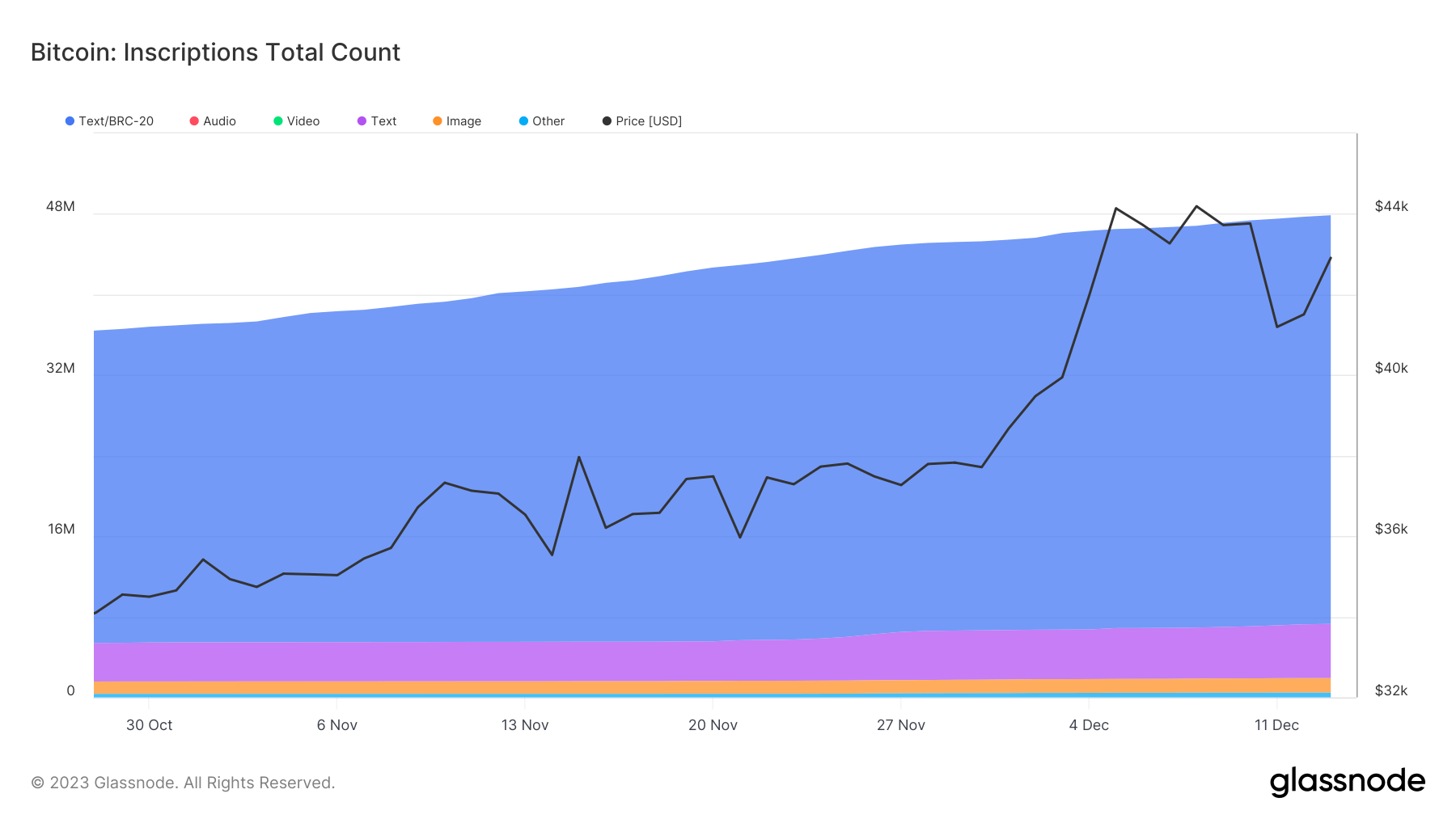

Another origin influencing this inclination could beryllium the important emergence successful Bitcoin Inscriptions. Between Oct.28 and Dec. 14, 11.4 cardinal caller Inscriptions were created. While not each Inscription results successful a caller UTXO, the notable summation apt impacted the fig of UTXOs created.

Graph showing the full number of Bitcoin Inscriptions from Oct. 28 to Dec. 14, 2023 (Source: Glassnode)

Graph showing the full number of Bitcoin Inscriptions from Oct. 28 to Dec. 14, 2023 (Source: Glassnode)The inclination of UTXOs created outpacing those spent has aggregate implications for the market. Primarily, it suggests a penchant for holding Bitcoin, indicating a affirmative marketplace sentiment. This trend, coupled with the emergence successful profitable UTXOs, which signifies the imaginable net if these were to beryllium sold astatine existent marketplace prices, reinforces the conception of Bitcoin arsenic a promising investment, perchance attracting much investors and starring to much stableness successful the Bitcoin ecosystem.

This trend, influenced by some capitalist behaviour and technological factors similar Inscriptions, points to a play of accumulation and optimism among Bitcoin investors, which is mirrored successful the beardown enactment Bitcoin seems to person created supra $40,000.

The station Bitcoin owners clasp choky arsenic caller UTXOs outstrip spending appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)