Bitcoin outpaced golden implicit the past 36 hours, reaching $88,500 and climbing 4.4%, compared to gold’s 3.5% ascent to $3,445 per ounce.

The determination comes arsenic the US imposed duties arsenic precocious arsenic 3,521% connected Southeast Asian star panels, reigniting fears of renewed commercialized friction with China and rattling cross-asset sentiment.

Per BBC News, the duties bespeak Washington’s accusation that Chinese firms circumvented existing tariffs by routing exports done countries specified arsenic Cambodia, Malaysia, Thailand, and Vietnam.

Flight to hard assets deepens arsenic treasury sell-off builds

The concurrent emergence successful Bitcoin and golden suggests a broader hard-asset penchant alternatively than a accepted risk-on move. Bitcoin’s two-wave climb, initiated successful precocious US hours and followed done during the Asia session, aligned with the record-breaking people successful gold, which is adjacent to breaking $3,500 successful Asian trading.

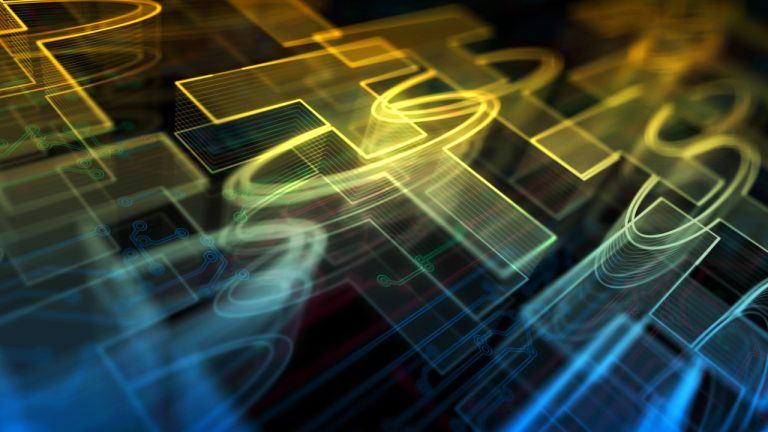

Macro assets (Source: TradingView)

Macro assets (Source: TradingView)Meanwhile, equity markets remained defensive. The S&P 500 futures slipped 0.51%, partially retracing Monday’s 1.5% recovery, portion enslaved markets reflected rising yields.

The US 10-year Treasury enactment fell 0.51% successful price, lifting yields by astir 7 ground points to 4.49%. A akin determination was not mirrored successful Chinese authorities bonds, wherever the 10-year output held adjacent 2.33%. The bifurcation reinforces the presumption that ostentation and supply-side concerns are overwhelming the accustomed bid for information crossed some economies.

Bitcoin’s correlation with golden implicit the model reached +0.78, portion the BTC-to-US10 terms correlation moved to -0.61, reflecting the asset’s divergence from accepted equity and enslaved behavior.

These metrics lend value to Bitcoin’s positioning arsenic a hedge plus nether duress, peculiarly successful scenarios wherever some sovereign recognition and equity drawdowns hap simultaneously, a setup historically associated with value-at-risk liquidation events.

Tariff fallout and renewable mining interplay

The solar-panel levies transportation implications beyond geopolitics, touching halfway debates wrong the Bitcoin ecosystem. With US-based miners increasingly reliant connected renewable energy sources, peculiarly solar, outgo structures crossed operations successful Texas, Kentucky, and the Southwest whitethorn look upward pressure. This raises questions astir the marginal economics of mining and whether the tariff quality factored into caller terms action.

Per CME Group, bitcoin futures unfastened involvement roseate 8% during the Asia-led limb of the rally, reinforcing the thesis that the 2nd propulsion came with condemnation alternatively than passive spillover from equity markets.

Previous inflection points $87,019, $87,707, and $88,434 acted arsenic intraday buffers, capturing some absorption and enactment zones implicit the session. CryptoSlate is intimately watching the $88,434 pivot arsenic a imaginable launchpad upward, with regular closes supra that enactment seen arsenic opening the way for further momentum.

Oil, by contrast, remained detached from the hard-asset pairing. West Texas Intermediate crude for June transportation gained conscionable 0.57% to $64 per barrel, a humble retracement from Monday’s 18-month low. The muted determination signals method stabilization alternatively than alignment with the inflation-hedge communicative surrounding Bitcoin and gold.

The argumentation backdrop adds further context. Former President Trump’s caller comments targeting Federal Reserve Chair Jerome Powell, urging contiguous complaint cuts, resurfaced concerns implicit cardinal slope independency and argumentation stability. The rhetoric contributed to the enslaved marketplace downturn and added substance to the bid for unencumbered assets.

Regional travel patterns affirm Asia’s price-discovery role

Asia’s increasing power successful crypto terms find became much pronounced arsenic the 2nd limb of Bitcoin’s determination unfolded during the Singapore and Hong Kong sessions.

The signifier deviates from post-ETF motorboat paradigms wherever Western organization desks dominated directional moves. With CME and different derivatives markets present echoing enactment successful Asia, the interplay of determination flows is becoming harder to ignore.

Cross-asset relationships during the model besides deviated from accepted macro templates. The 36-hour rolling correlation betwixt Bitcoin and the S&P 500 ETF (SPY) hovered astir -0.26, reinforcing the communicative that Bitcoin is yet behaving independently of equities, adjacent arsenic Treasuries and stocks sold disconnected successful parallel.

The station Bitcoin outperforms golden arsenic US puts 3,251% tariff connected Asian star panels appeared archetypal connected CryptoSlate.

3 months ago

3 months ago

English (US)

English (US)