This year, the Stablecoin Supply Ratio (SSR) has shown important trends, offering heavy insights into Bitcoin’s marketplace behavior. The SSR, calculated by dividing Bitcoin’s marketplace headdress by the marketplace headdress of large stablecoins, is simply a barometer for the comparative fiscal spot and purchasing powerfulness of stablecoins against Bitcoin.

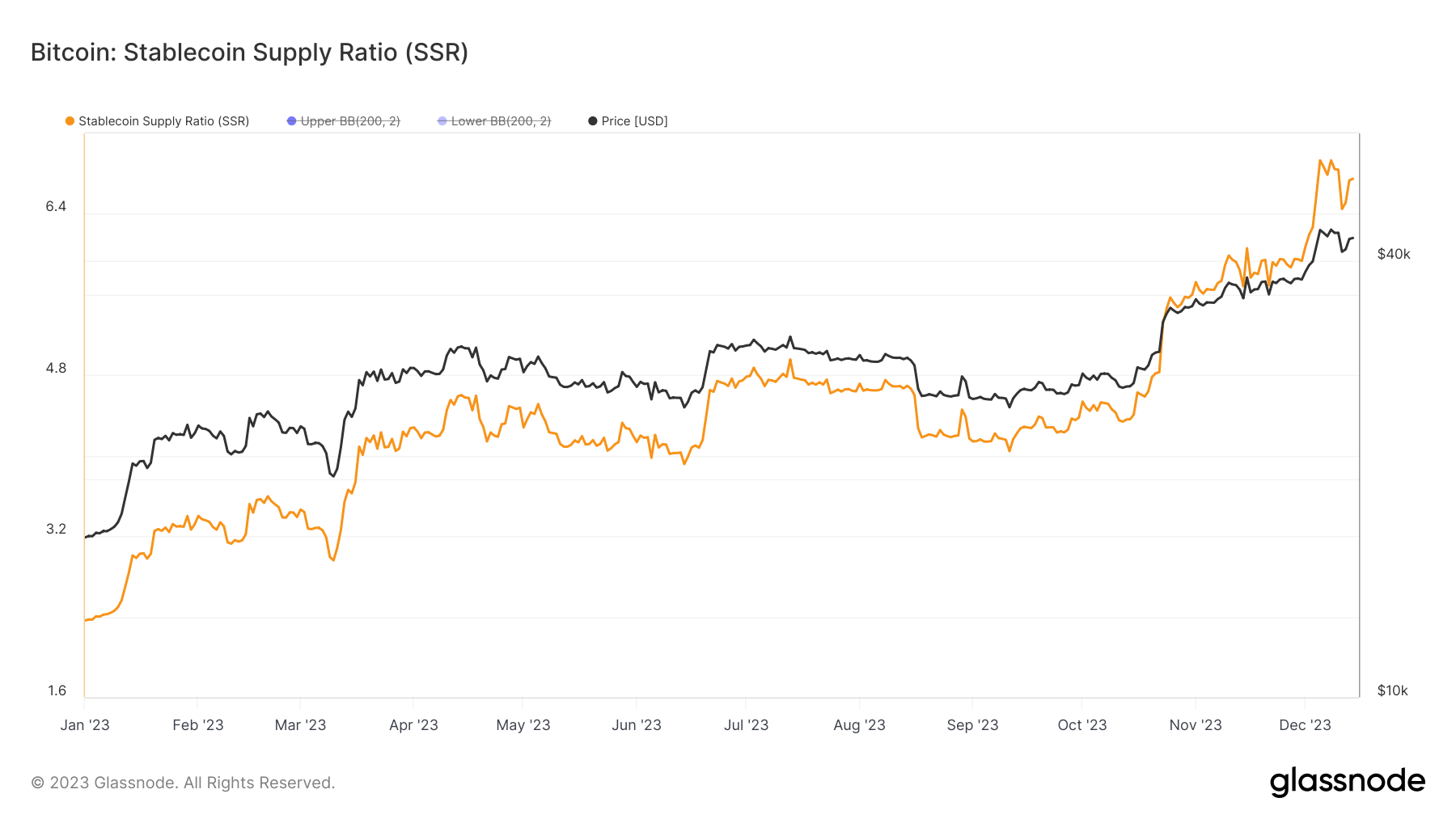

This year, a marked summation successful SSR has been observed, with the ratio climbing from 2.36 connected Jan. 1 to 6.74 by Dec. 14. This emergence indicates a increasing marketplace headdress of Bitcoin comparative to stablecoins, hinting astatine shifts successful marketplace liquidity and capitalist preference.

Graph showing the Stablecoin Supply Ratio (SSR) successful 2023 (Source: Glassnode)

Graph showing the Stablecoin Supply Ratio (SSR) successful 2023 (Source: Glassnode)To afloat recognize these trends, it’s important to analyse the SSR successful narration to Bollinger Bands. Bollinger Bands are a acceptable of inclination lines plotted 2 modular deviations (positively and negatively) distant from a elemental moving mean (SMA) of a peculiar plus oregon metric. They assistance place the grade of volatility successful the market. When the SSR crossed the precocious Bollinger Band astatine 4.90 connected Oct. 23 and remained supra it, it signaled an antithetic marketplace condition: Bitcoin’s marketplace headdress grew importantly compared to stablecoins, indicating a imaginable displacement successful capitalist behaviour oregon marketplace sentiment.

A grounds precocious SSR of 6.93 connected Dec. 8 further underscores this trend, though the consequent flimsy alteration pursuing Bitcoin’s terms dip from $44,200 to $41,200 shows that arsenic Bitcoin’s terms fluctuates, the comparative spot and interaction of stablecoins connected the marketplace set accordingly, influencing the SSR.

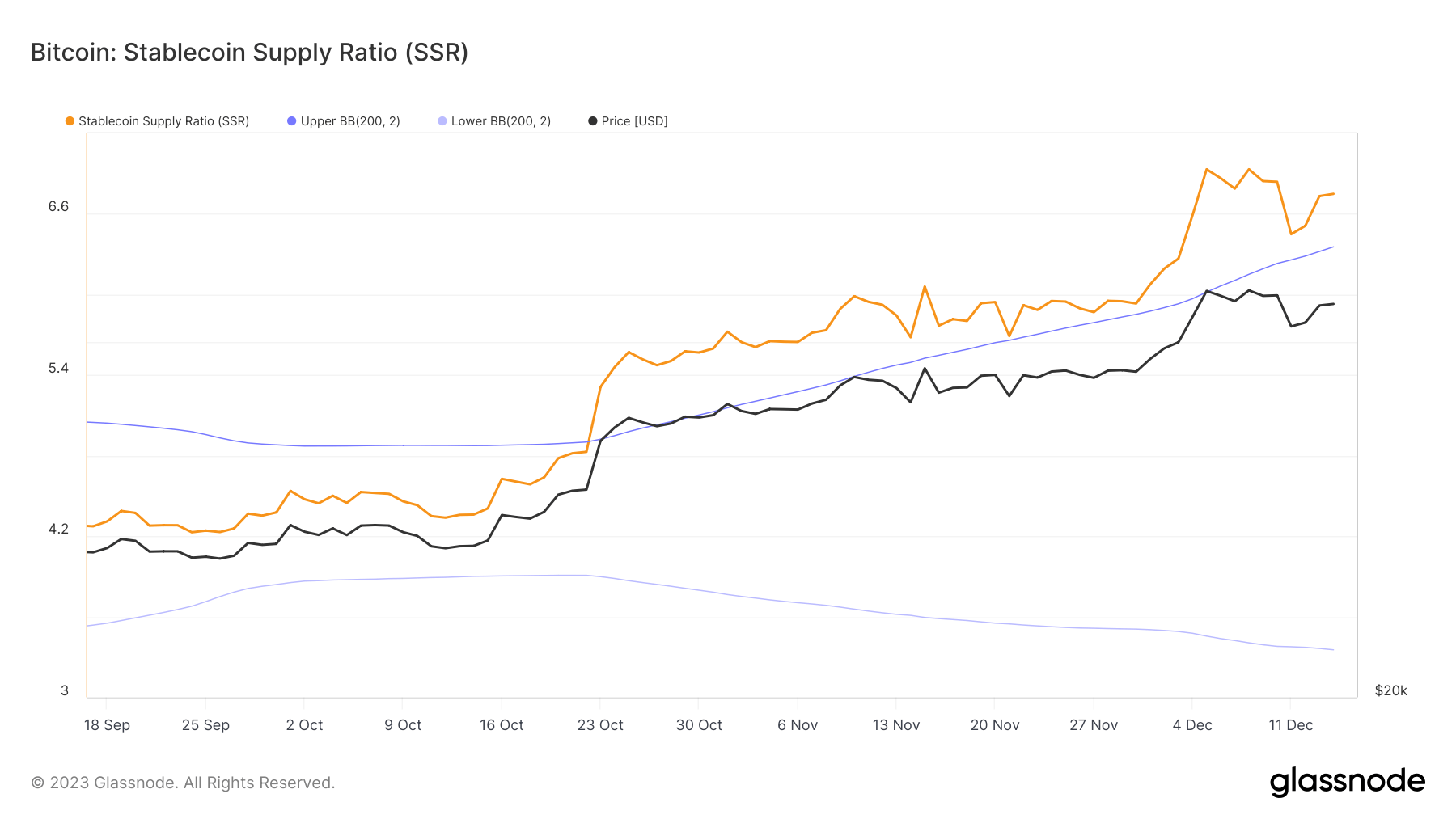

Graph showing the Stablecoin Supply Ratio (SSR) wrong the Bollinger Bands from Sep. 17 to Dec. 14, 2023 (Source: Glassnode)

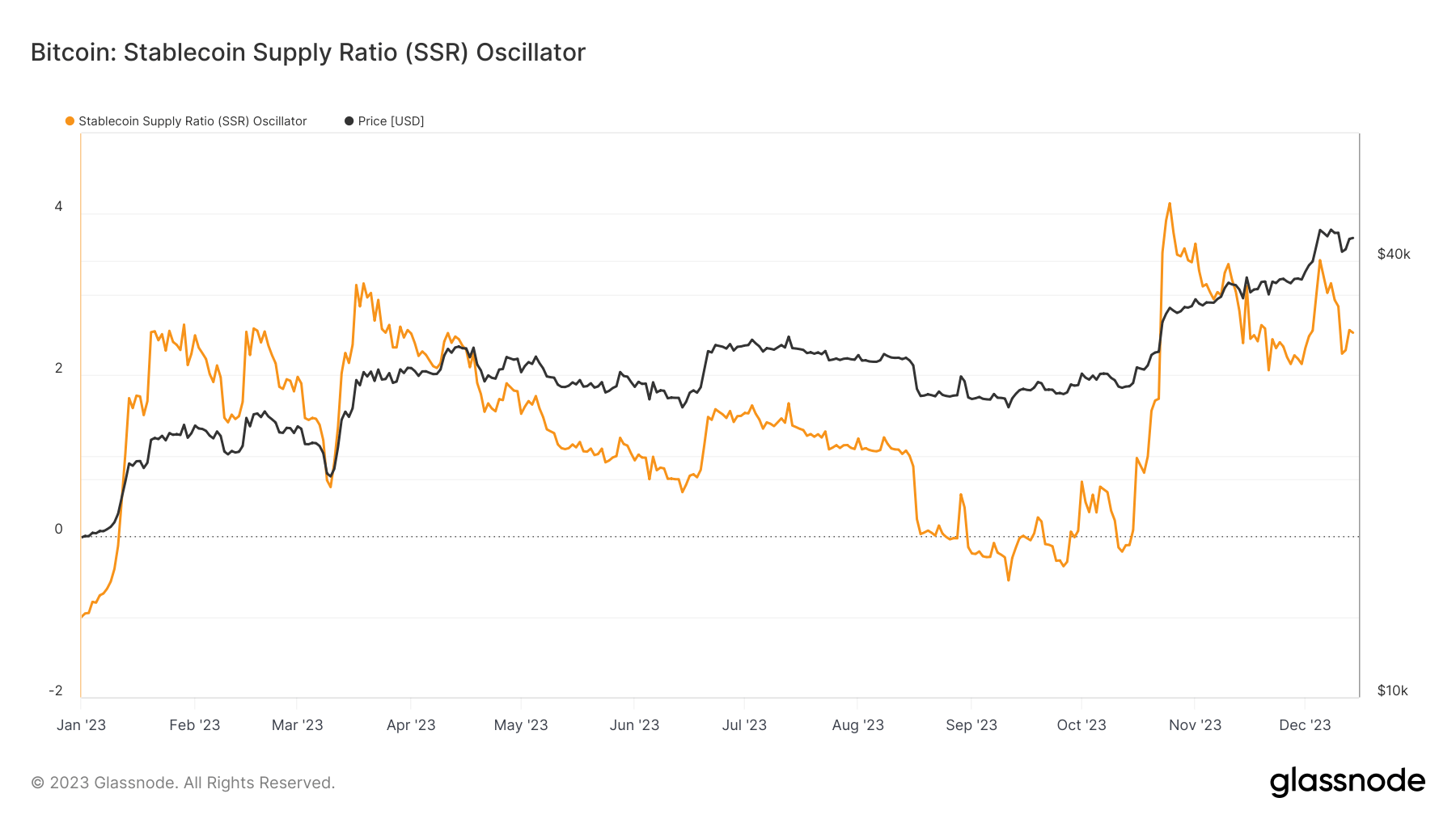

Graph showing the Stablecoin Supply Ratio (SSR) wrong the Bollinger Bands from Sep. 17 to Dec. 14, 2023 (Source: Glassnode)The Stablecoin Oscillator, a derivative of the SSR, tracks however the 200-day SMA of the SSR moves wrong its Bollinger Bands, providing a much nuanced presumption of marketplace trends. Between Dec. 8 and Dec. 14, the oscillator fell from 3.13 to 2.52 arsenic Bitcoin’s terms dropped and partially recovered. This shows a balancing enactment betwixt Bitcoin’s nonstop marketplace show and the comparative worth and inferior of stablecoins. As Bitcoin’s terms changes, it influences the SSR, which successful crook affects the oscillator, highlighting the continuous and analyzable narration betwixt these 2 important aspects of the cryptocurrency market.

The year-to-date (YTD) precocious for the oscillator was marked connected Oct. 25, reaching 4.13, contrasting with a YTD debased of -1 astatine the opening of the year. The oscillator’s YTD precocious and debased points bespeak the market’s changing sentiment and the evolving relation of stablecoins successful narration to Bitcoin.

Graph showing the Stablecoin Supply Ratio (SSR) Oscillator successful 2023 (Source: Glassnode)

Graph showing the Stablecoin Supply Ratio (SSR) Oscillator successful 2023 (Source: Glassnode)An expanding SSR, particularly alongside a rising Bitcoin price, points to a diversified concern landscape. Bitcoin’s marketplace headdress maturation outpacing that of stablecoins could beryllium driven by assorted factors, including nonstop fiat investments, conversions from stablecoins to Bitcoin, and speculative trading wherever stablecoins are retained arsenic a hedge portion Bitcoin is actively traded.

The station Bitcoin outpaces stablecoins successful marketplace headdress growth appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)