According to information from Glassnode, Bitcoin‘s Over-The-Counter (OTC) holdings, an often-overlooked facet of cryptocurrency trading, person surged to their highest level successful the past year, with inflows consistently outpacing outflows since May 2023.

Source: Glassnode

Source: GlassnodeOver-The-Counter (OTC) trading denotes the nonstop speech of assets similar Bitcoin betwixt 2 parties, bypassing the accepted exchange. This off-exchange trading happens via a decentralized trader web and often involves important amounts of Bitcoin.

This is done done a decentralized trader network. In the discourse of Bitcoin, OTC trades are often utilized by whales who privation to bargain oregon merchantability Bitcoin without impacting the marketplace terms excessively much. This tin beryllium important arsenic ample trades connected nationalist exchanges tin origin important terms fluctuations.

OTC holdings notation to the magnitude of Bitcoin held by these OTC desks. These holdings tin connection insights into the behaviour of ample investors. For instance, an summation successful OTC holdings could suggest that much whales bargain Bitcoin done OTC trades, perchance indicating bullish marketplace sentiment. Conversely, a alteration successful OTC holdings could mean the opposite.

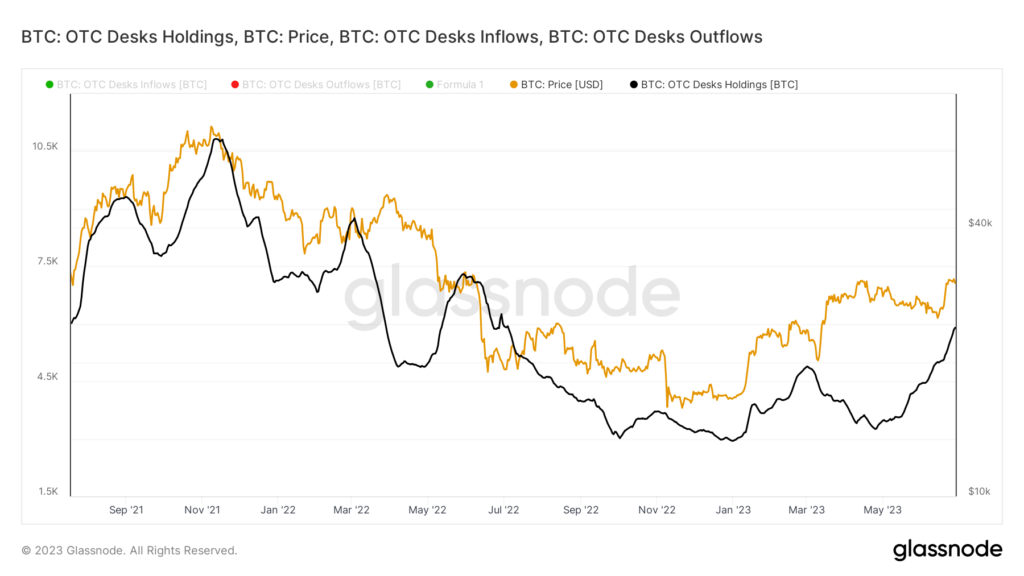

Bitcoin OTC holdings

Beginning the twelvemonth with a section debased of astir 2,969 BTC, OTC holdings person bounced back, hitting 6,285 BTC connected June 28, 2023, the highest level witnessed since May 2022.

Despite this caller surge, Bitcoin OTC holdings are yet to surpass their all-time precocious of 11,928 BTC, established connected August 17, 2020. This grounds was acceptable amidst Bitcoin’s highest terms of $68,692 connected November 10, 2021.

Source: Glassnode

Source: GlassnodeInterestingly, the terms of Bitcoin and the OTC holdings look loosely correlated, with OTC holdings lagging somewhat down BTC prices. For example, arsenic Bitcoin has traded comparatively level since June 21, OTC holdings person experienced an summation of 12.45%, climbing to 5,899 BTC from 5,244 BTC utilizing a 30-day EMA. This increment happened portion Bitcoin’s terms remained astir the $30k mark.

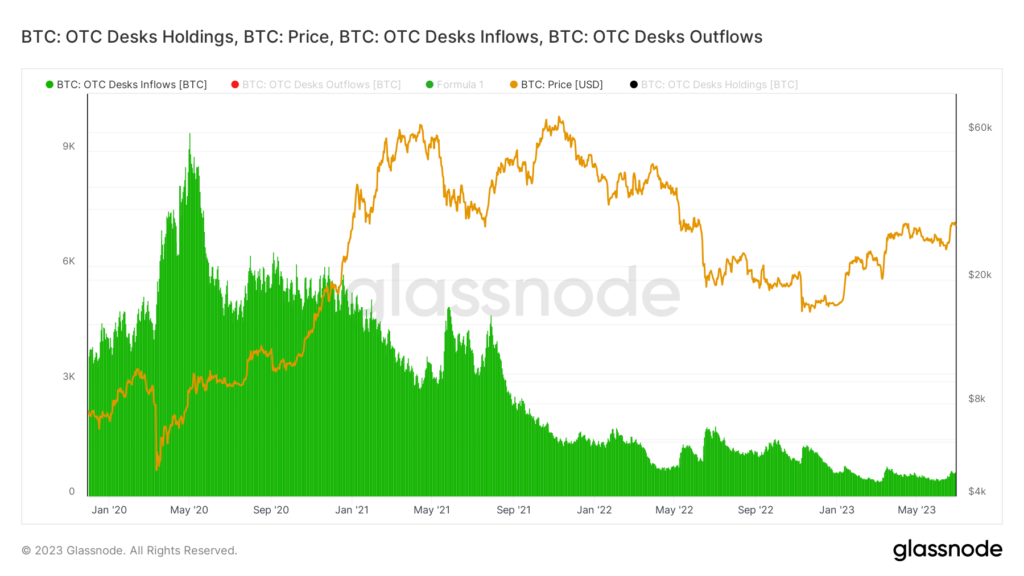

Bitcoin OTC inflows

Concurrently, Bitcoin OTC inflows person continuously declined since their highest astir the past Bitcoin halving successful May 2020. At that time, OTC desks regularly saw inflows good supra 6,000 BTC. However, arsenic evident from the simplification successful holdings, 2023 has been little favorable, with inflows plunging to a 30-day EMA debased of 394 BTC.

Source: Glassnode

Source: GlassnodeHowever, June appears to person reversed the trend, with inflows rising to astir 645 BTC, a important driblet from pre-pandemic levels.

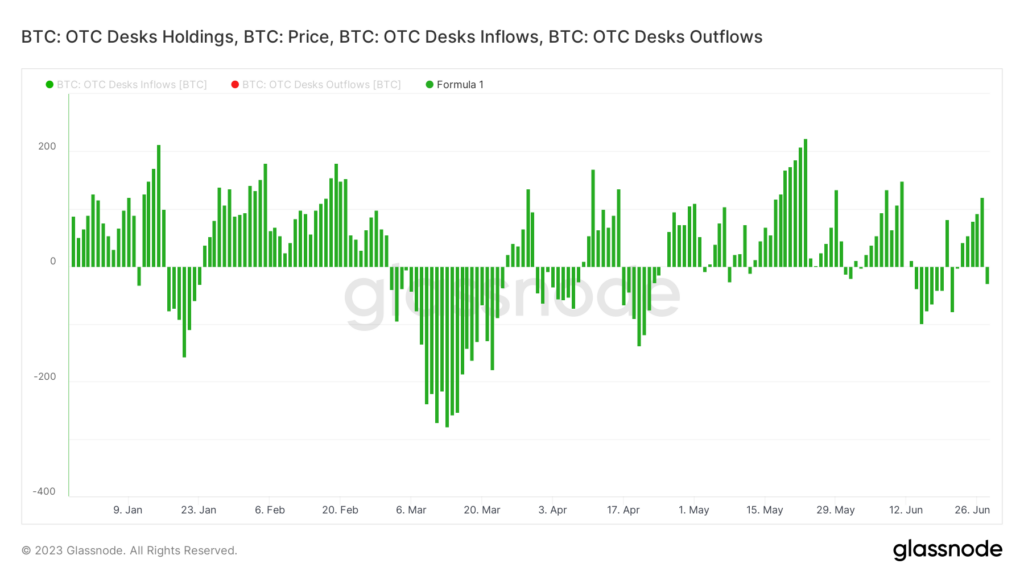

As per Glassnode data, a examination of OTC inflows and outflows reveals a accordant surplus of inflows since May 2023. This is peculiarly notable due to the fact that the past play of excess outflows was observed successful March 2023.

Source: Glassnode

Source: GlassnodeWhile caller trends successful OTC holdings and inflows hint astatine renewed marketplace assurance successful Bitcoin, the wide diminution successful inflows since 2020, on with OTC holdings inactive being importantly beneath their all-time high, indicates that the marketplace has important country for growth.

These trends and metrics are worthy watching for investors and enthusiasts, serving arsenic captious indicators of whale sentiment and imaginable concern opportunities. Further, fixed the myriad of bankruptcies, lawsuits, and different regulatory issues that person plagued the crypto manufacture implicit the past 12 months, OTC table trades are expected to spot continued enactment arsenic reserves are reorganized, oregon creditors are repaid.

The station Bitcoin OTC desks spot highest holdings successful a twelvemonth arsenic inflows rise appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)