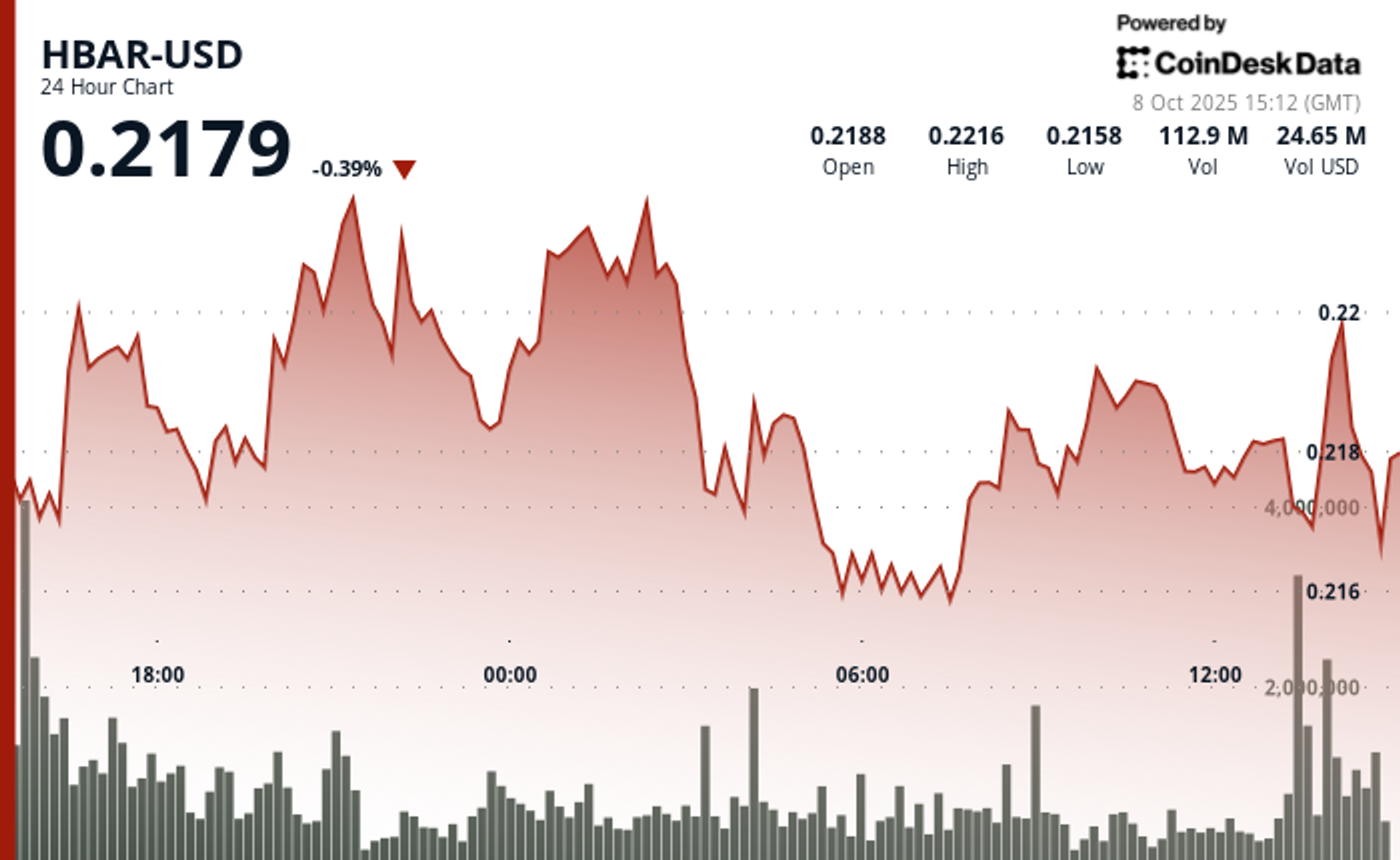

Some $7.8 cardinal worthy of bitcoin (BTC) options expire astatine the extremity of the period and, with the largest cryptocurrency trading good supra the alleged max symptom point, it's imaginable marketplace makers looking to maximize their profits volition effort to unit it little successful the coming days.

Data from Deribit, the largest decentralized options exchange, amusement arsenic overmuch arsenic $6 cardinal successful notional worth is acceptable to expire retired of the money, oregon without value, erstwhile the contracts adjacent connected Jan. 31 astatine 08:00 UTC. A afloat 50% of those are enactment options, which springiness holders the right, but not the obligation, to merchantability BTC astatine a predetermined terms wrong a circumstantial timer period.

"The max symptom level for this expiry stands astatine $98k, with important marketplace dynamics expected to power terms movements successful the adjacent term," Deribit CEO Luuk Strijers told CoinDesk. " The caller rescission of SAB 121 enables banks to custody bitcoin, perchance unlocking caller organization flows portion speculation astir a bitcoin strategical reserve announcement adds an further furniture of marketplace anticipation".

Put holders were astir apt either hedging against downside hazard oregon making bearish bets with the uncertainty surrounding President Donald Trump's inauguration.

The max symptom terms is wherever the enactment buyers acquisition the highest losses, portion the marketplace makers, the different broadside of the transaction, marque the most. Prices often thin to gravitate towards the max symptom terms arsenic expiry nears, which means $98,000 is the cardinal level to show successful the coming week.

"Next week Friday’s BTC options expiry represents a notable lawsuit arsenic astir 74,000 contracts are expiring. Total BTC Options notional unfastened involvement is present $28 cardinal of which, $7.8 cardinal is acceptable to expire, with astir 22.6% in-the-money (ITM), perchance triggering delta hedging flows successful the market. While, DVOL is presently astir 60, aligning with year-end levels," Strijers said.

DVOL is the Deribit scale for tracking bitcoin implied volatility (IV). CoinDesk research has noted that IV deed the highest level connected Jan. 20 since August owed to bitcoin breaking to caller all-time highs.

8 months ago

8 months ago

English (US)

English (US)