Over the past week, Bitcoin (BTC) ‘s terms has witnessed a notable surge, sparking heightened enactment successful the cryptocurrency market. One country that offers unsocial insights into traders’ sentiments and expectations astir this terms question is the options market. We tin gauge however traders are positioning themselves successful anticipation of aboriginal terms movements done metrics similar unfastened interest, volume, and onslaught prices.

Options are fiscal derivatives that springiness the holder the right, but not the obligation, to bargain oregon merchantability an underlying plus (in this case, Bitcoin) astatine a predetermined terms connected oregon earlier a circumstantial date.

Options travel successful 2 superior forms: telephone options, which springiness the holder the close to bargain the underlying asset, and enactment options, which springiness the holder the close to merchantability the underlying asset.

Options unfastened involvement represents the full fig of outstanding (not yet settled) enactment contracts successful the market. A precocious OI indicates important involvement successful a peculiar option, suggesting beardown sentiment (either bullish oregon bearish) towards the underlying asset. It provides a consciousness of the full marketplace vulnerability oregon committedness traders have.

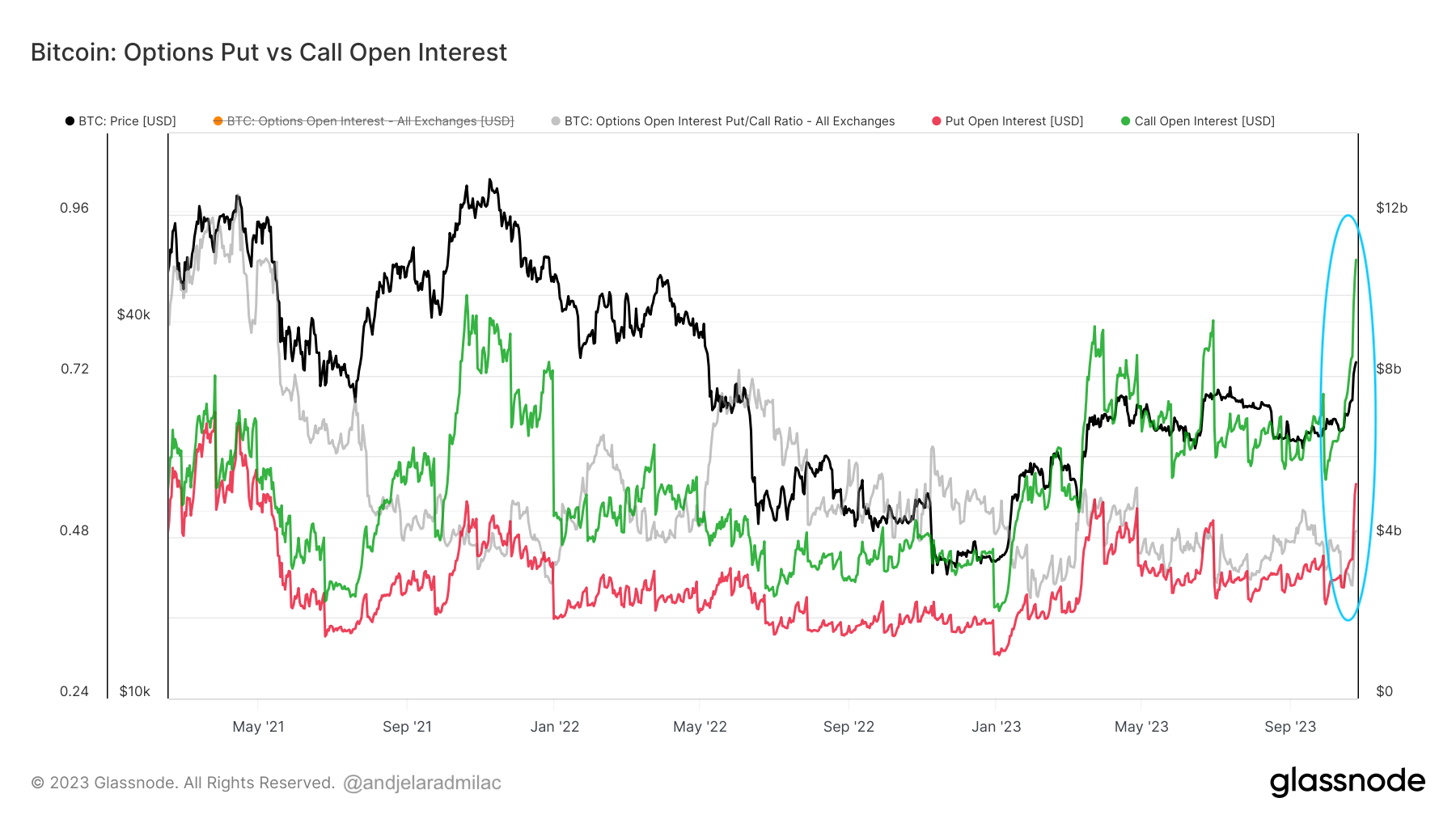

The unfastened involvement connected calls reached an all-time precocious of $10.86 cardinal connected Oct. 25, increasing from $7.58 cardinal connected Oct. 18. During the aforesaid period, unfastened involvement connected puts accrued from $3.34 cardinal to $5.31 billion.

The bullish inclination successful Bitcoin’s terms from Oct. 18 to Oct. 25 was accompanied by accrued enactment and telephone unfastened interests. This suggests that traders actively participated successful the market, with a historically unprecedented bullish anticipation and a steadfast bearish hedge. This could beryllium owed to assorted reasons, specified arsenic anticipated quality events and accrued volatility, astir apt astir the upcoming Bitcoin ETF successful the U.S.

Graph showing the unfastened involvement connected Bitcoin enactment and telephone options from Feb. 16, 2021, to Oct. 25, 2023 (Source: Glassnode)

Graph showing the unfastened involvement connected Bitcoin enactment and telephone options from Feb. 16, 2021, to Oct. 25, 2023 (Source: Glassnode)The put/call ratio is utilized to gauge marketplace sentiment arsenic it shows the proportionality of puts to calls. A ratio supra 1 indicates bearish sentiment (more puts than calls), portion a ratio beneath 1 indicates bullish sentiment (more calls than puts). The summation successful the ratio from 0.425 to 0.489 betwixt Oct. 15 and Oct. 25 suggests that portion the marketplace remained bullish (since the ratio is inactive beneath 1), determination was a comparative summation successful bearish sentiment oregon hedging enactment compared to bullish sentiment.

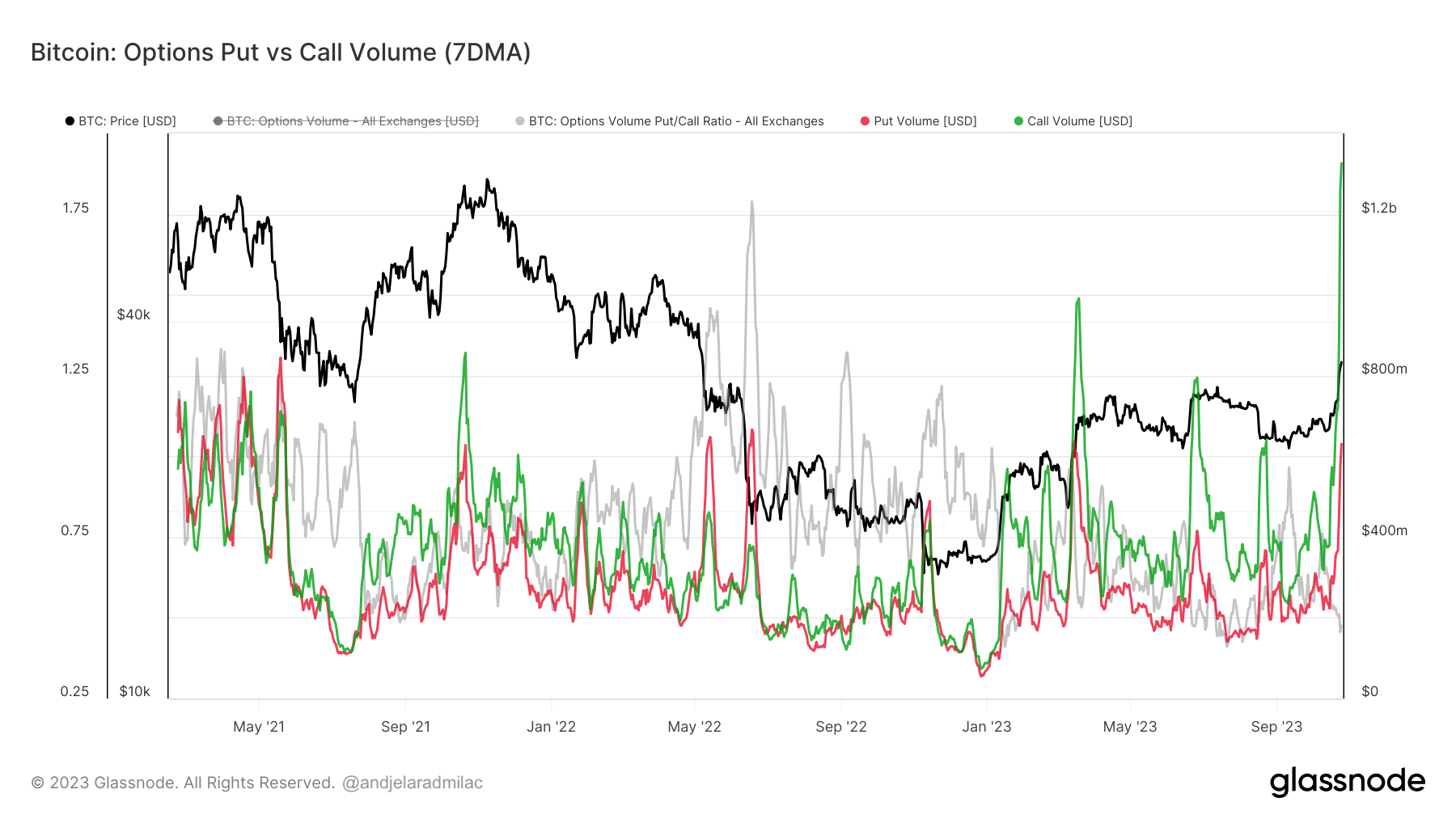

A akin summation was besides seen successful the options volume. While unfastened involvement represents the cumulative positions traders hold, the measurement shows the current activity and liquidity successful the market. A abrupt spike successful volume, particularly erstwhile accompanied by important terms moves, tin bespeak beardown sentiment and momentum.

From Oct. 18 to Oct. 25, the put/call ratio decreased from 0.538 to 0.475. This indicates a displacement towards adjacent much bullish sentiment implicit this period. The measurement of some puts and calls accrued significantly, but the telephone measurement saw a much pronounced increase, reaching the largest successful Bitcoin’s history, conscionable similar the telephone unfastened interest. The grounds telephone measurement connected Oct. 25 suggests a peculiarly progressive and bullish time successful the Bitcoin options market.

Graph showing the measurement of Bitcoin enactment and telephone options from Feb. 16, 2021, to Oct. 25, 2023 (Source: Glassnode)

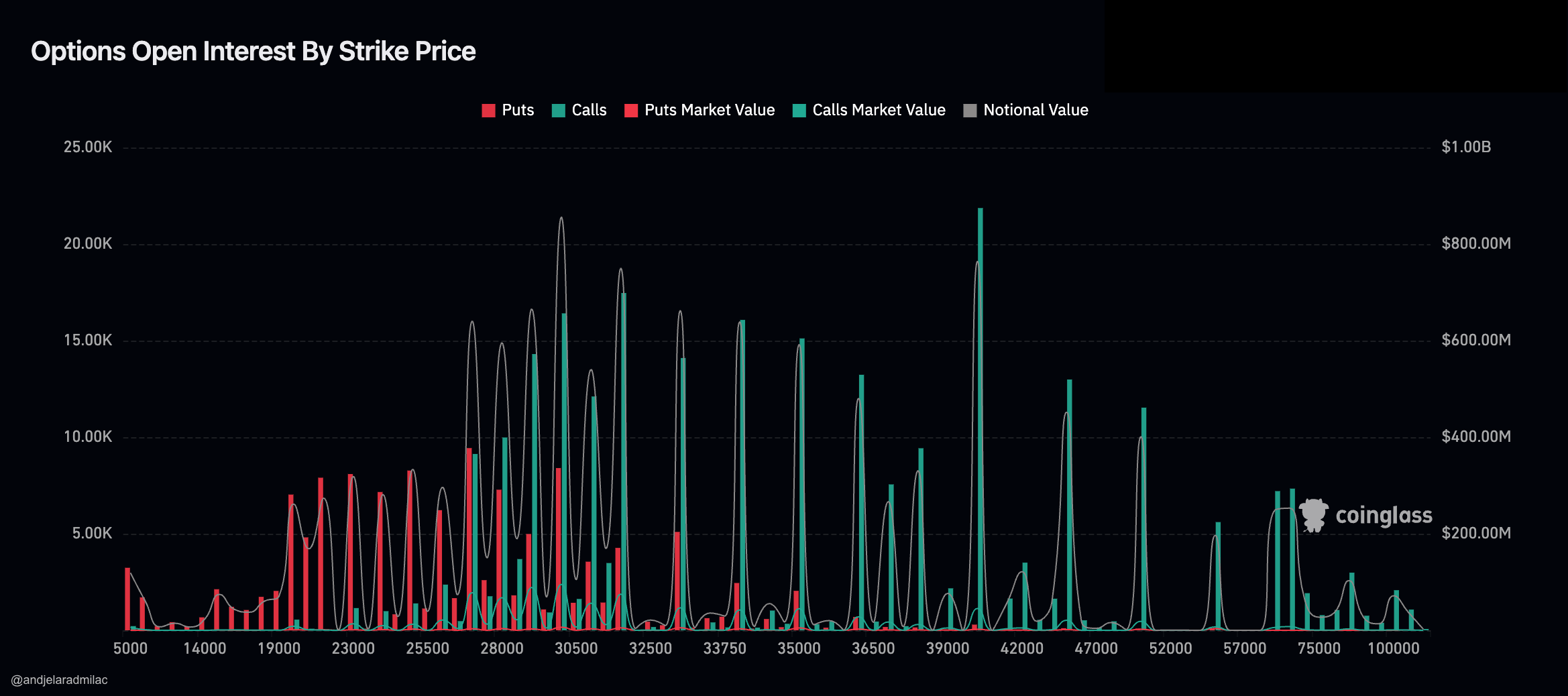

Graph showing the measurement of Bitcoin enactment and telephone options from Feb. 16, 2021, to Oct. 25, 2023 (Source: Glassnode)The precocious unfastened involvement astatine the $40,000 onslaught terms further supports this bullish sentiment. It indicates that galore traders expect oregon anticipation that Bitcoin volition scope oregon surpass $40,000 by the expiration day of these options. While the precocious unfastened involvement for the $40,000 onslaught terms shows optimism, the expanding put/call ratio we discussed earlier suggests that traders are besides hedging against imaginable downside risks. This means that portion galore are optimistic astir Bitcoin reaching $40,000, they are besides preparing for scenarios wherever it mightiness not. This is evident successful the spike of enactment options astatine onslaught prices beneath $27,000.

Chart showing the options unfastened involvement and marketplace worth by onslaught terms connected Oct. 25, 2023 (Source: CoinGlass)

Chart showing the options unfastened involvement and marketplace worth by onslaught terms connected Oct. 25, 2023 (Source: CoinGlass)The emergence successful some unfastened involvement and measurement indicates that the options marketplace for Bitcoin is becoming much progressive and liquid. It besides shows a notable emergence successful involvement from organization and blase traders, arsenic astir retail traders seldom stray from spot markets.

The station Bitcoin options marketplace shows grounds telephone unfastened involvement and volume appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)