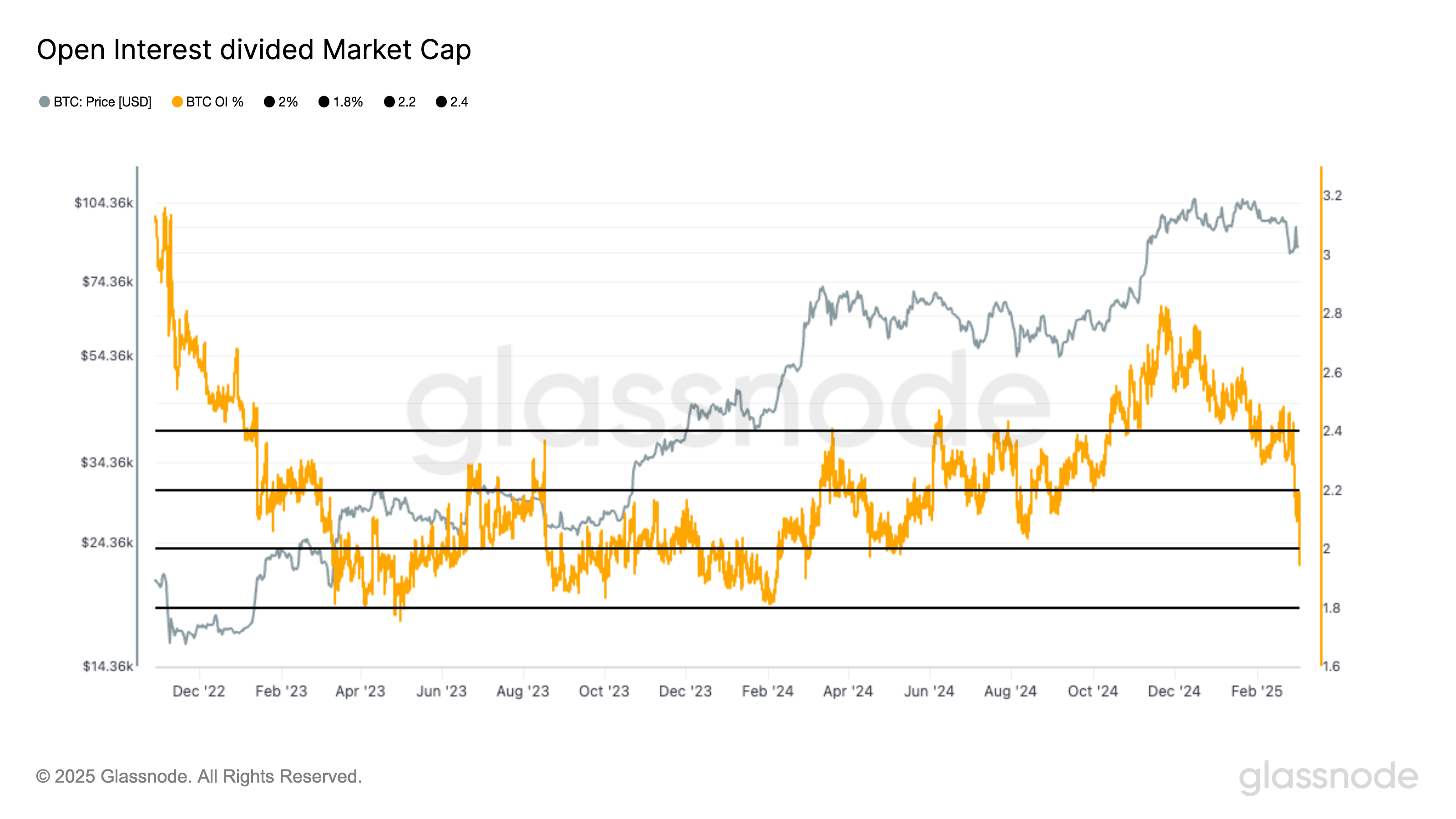

Bitcoin (BTC) unfastened involvement (OI) has fallen to its lowest level since August, presently lasting astatine 413,000 BTC ($36 billion), according to Glassnode data. OI represents the full funds allocated successful outstanding futures contracts, efficaciously measuring the magnitude of leverage successful the bitcoin system.

Since these contracts are denominated successful dollars, their worth fluctuates with bitcoin's price. To supply a much unchangeable measure, we measure unfastened involvement successful bitcoin terms, which eliminates price-based distortions.

Glassnode information shows that since November, bitcoin unfastened involvement has dropped from 546,000 BTC to 413,000 BTC crossed each exchanges, with a important information of this diminution attributed to the unwinding of CME unfastened interest, peculiarly successful the basis trade.

Meanwhile, bitcoin dropped from $109,000 to $78,000 and past recovered to $90,000. This would presume that a ample portion of this caller run-up has been spot-driven alternatively than leverage-driven.

Additionally, Binance—the second-largest speech by OI—has seen its OI driblet to a 12-month debased of conscionable implicit 100,000 BTC, indicating that leverage has been importantly reduced from a retail perspective. This diminution reflects a crisp simplification successful speculative activity, driven by bitcoin’s utmost terms volatility implicit the past fewer months.

Furthermore, unfastened involvement arsenic a percent of bitcoin’s marketplace headdress has fallen beneath 2% for the archetypal clip since February 2024, underscoring the crisp diminution successful speculation and leverage.

6 months ago

6 months ago

English (US)

English (US)