Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

This week, Bitcoin (BTC) has recovered from its caller driblet beneath the $100,000 level and is attempting to crook the important $108,000 absorption into enactment for the 4th time. As we attack the 2nd fractional of 2025, a marketplace watcher has shared his forecast for BTC.

Bitcoin Sees Transitional Period

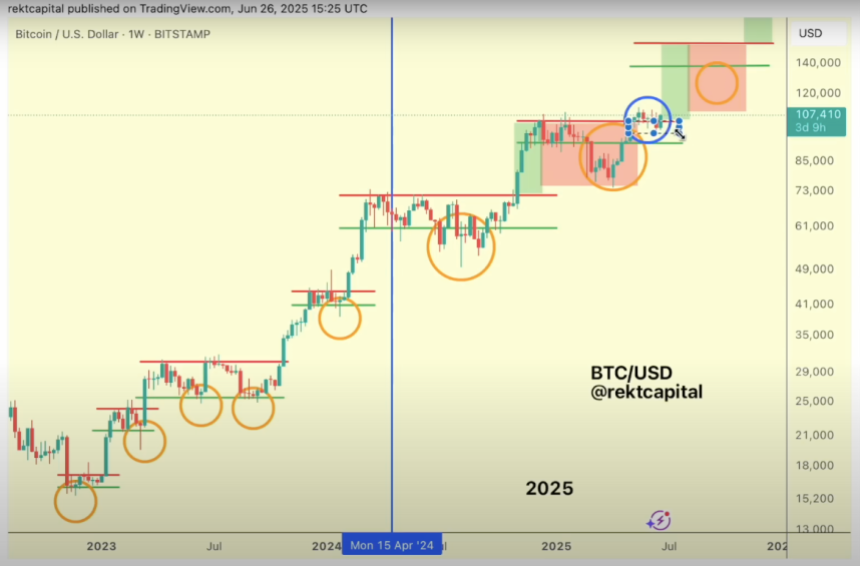

On Thursday, expert Rekt Capital shared a roadmap for BTC for the remainder of the year. He noted that this rhythm has been “truly a rhythm of re-accumulation ranges,” explaining that these person formed passim the rhythm since the extremity of 2022 and evolved since the Bitcoin Halving past year.

In the pre-having period, BTC registered little terms deviations with downside wicks beneath the re-accumulation scope lows successful the play chart. Meanwhile, the post-halving play has seen Bitcoin deviations hap with multi-week clusters of full-bodied candles beneath the scope lows.

For instance, aft its archetypal terms find uptrend, which lasted astir 7 weeks, BTC moved wrong its re-accumulation scope for astir 10 weeks. Then, it transitioned into the archetypal Price Discovery Correction, signaling a nine-week downside deviation beneath the scope lows earlier breaking retired and rallying past the scope highs toward a caller ATH past month.

Its past performances suggested that BTC was acceptable to participate its 2nd Price Discovery Uptrend. But arsenic Rekt Capital detailed, a transitional play has occurred for the archetypal time, with terms consolidating astir the re-accumulation scope precocious area.

BTC sees transitional play astir the re-accumulation scope highs. Source: Rekt Capital connected Youtube

BTC sees transitional play astir the re-accumulation scope highs. Source: Rekt Capital connected YoutubeAccording to the analyst, this is “perhaps the archetypal clip that we’re seeing a deviation hap beneath the scope high,” making this country a important level to modulation into a caller uptrend.

We ne'er truly had to propulsion backmost substantially, maybe, until that last corrective period, which would past aggregate months, but each re-accumulation scope would spot rather a spot of upside, and that upside would beryllium precise speedy and nary existent post-breakout retesting, nary existent pausing. What we’re seeing present is thing very, precise different.

Weekly Close Key For BTC’s Future

Based connected its caller modulation period, the cardinal level for Bitcoin to reclaim successful the play timeframe is the $104,400 support, which it held for astir 7 weeks earlier the caller pullbacks. This level was mislaid aft BTC closed past week beneath it and “should not go a absorption level.”

To the analyst, it’s cardinal that this week’s adjacent solidifies the terms betterment arsenic it would presumption the cryptocurrency for a retest and confirmation of $104,400 arsenic enactment and proceed the physique the basal astir this country to modulation into the adjacent multi-week Price Discovery Uptrend.

Rekt Capital added that the timeline for BTC’s adjacent uptrend volition beryllium connected the magnitude of the caller transitional period. However, helium believes that it volition instrumentality “a spot longer” to interruption out.

Additionally, helium suggested that what comes aft the upcoming uptrend volition besides beryllium connected however agelong it takes, arsenic it could pb to an extended rhythm oregon a prolongation of this phase, which could propulsion the rhythm highest into deeper stages of 2025.

Nonetheless, the expert affirmed that it’s important that the adjacent corrective period, which could spot Bitcoin driblet betwixt 25% to 33%, is abbreviated to perchance bask a 3rd Price Discovery Uptrend earlier the carnivore market.

As of this writing, BTC is trading astatine $107,555, a 3.2% summation successful the play timeframe.

Bitcoin’s show successful the one-week chart. Source: BTCUSDT connected TradingView

Bitcoin’s show successful the one-week chart. Source: BTCUSDT connected TradingViewFeatured Image from Unsplash.com, Chart from TradingView.com

4 months ago

4 months ago

English (US)

English (US)