Monitoring miner gross is indispensable for knowing the wellness and sustainability of the Bitcoin network. Miner revenue, a operation of artifact rewards and transaction fees, provides a model into the economical viability of Bitcoin mining. In the discourse of the upcoming halving, which volition slash artifact rewards by half, the investigation of miner gross becomes adjacent much pertinent.

The 365-day Simple Moving Average (SMA) and the 365-day rolling sum are important metrics successful this analysis. The 365-day SMA smooths retired regular gross fluctuations, providing penetration into semipermanent trends, portion the 365-day rolling sum offers a cumulative presumption of miner revenues implicit a year. These metrics connection a broad knowing of miner gross trends, which is important for predicting aboriginal marketplace movements.

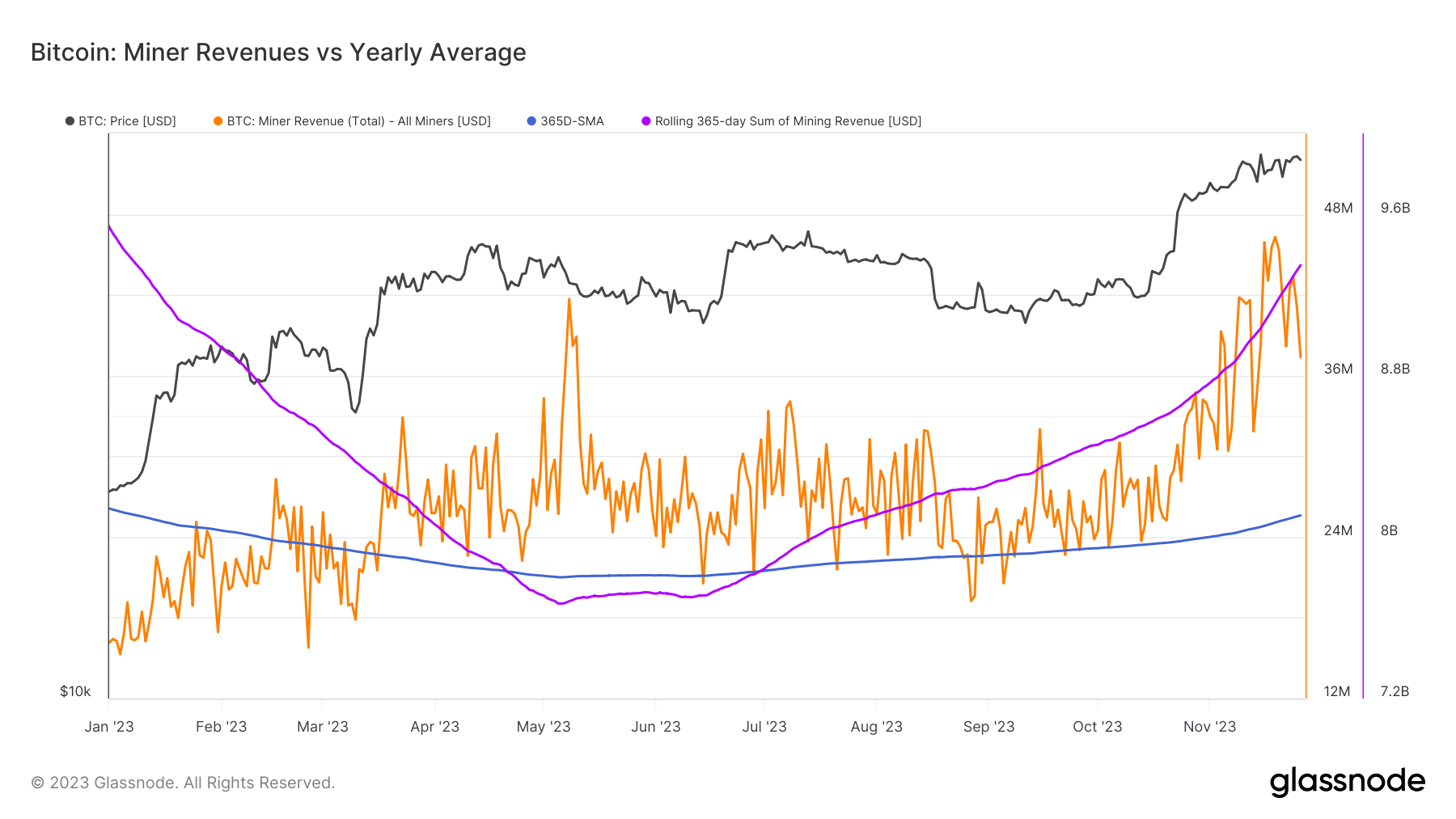

From January to June 2023, the rolling sum of miner revenues decreased from $9.53 cardinal to $7.7 billion, indicating a play of reduced revenue. This could stem from little Bitcoin prices, accrued mining difficulty, oregon reduced transaction fees. However, a consequent summation to $9.34 cardinal by November suggests a betterment successful mining revenue. This fluctuation reflects the volatile quality of the mining manufacture and its sensitivity to broader marketplace trends.

In contrast, the 365-day SMA of miner revenues shows a much gradual improvement. Rising from $22.12 cardinal successful January to $25.6 cardinal successful November, this increase, contempt a astir changeless rolling sum, indicates caller months person been much profitable for miners. This inclination underscores the stabilizing effect of the SMA metric, offering a much nuanced presumption of the mining landscape.

Graph showing the regular miner gross (orange), the yearly mean gross (blue), and the full yearly sum of miner gross (purple) successful 2023 (Source: Glassnode)

Graph showing the regular miner gross (orange), the yearly mean gross (blue), and the full yearly sum of miner gross (purple) successful 2023 (Source: Glassnode)Total regular USD gross paid to miners has seen a important summation implicit the year, peaking astatine $46.30 cardinal successful November, a 19-month high. This peak, driven by a operation of precocious Bitcoin prices and accrued transaction volumes, suggests a profitable play for miners. The volatility of regular revenues compared to the much unchangeable SMA and rolling sum reflects the inherent unpredictability of the mining sector.

The adjacent necktie of mining revenues to the Bitcoin terms is evident. As the terms increases, truthful does the profitability of mining, influencing miner sentiment. The reaching of a 19-month gross precocious indicates bullish sentiment among miners, perchance starring to accrued concern successful mining infrastructure.

With the adjacent Bitcoin halving approaching, the surge successful the Bitcoin hash rate signals a steadfast committedness from miners. This accrued computational powerfulness for transaction processing and artifact procreation indicates a robust and unafraid network. However, it besides implies heightened contention and imaginable challenges for idiosyncratic miners.

Furthermore, high transaction fees wrong the Bitcoin mempool bespeak accrued web enactment and imaginable congestion. This summation successful fees and web usage could interaction Bitcoin’s marketplace position, affecting idiosyncratic behavior.

The station Bitcoin miners spot 19-month precocious successful gross arsenic halving nears appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)