Since the opening of 2023, a caller signifier of non-fungible tokens (NFTs), known arsenic Bitcoin Ordinals Inscriptions, has ignited wide involvement successful the crypto space.

The popularity of Inscriptions tin beryllium attributed to their novelty and the unsocial worth proposition they offer. They supply a mode for users to immortalize messages connected the immutable Bitcoin blockchain, adding a caller furniture of functionality to Bitcoin’s inferior arsenic a store of value. This has opened up a caller avenue for creativity and idiosyncratic look wrong the Bitcoin ecosystem, allowing users to make a lasting bequest connected the blockchain.

Moreover, the advent of Inscriptions signified a important milestone for Bitcoin, marking its introduction into the NFT space, a domain antecedently dominated by Ethereum and different astute declaration platforms.

However, the surge successful popularity of Inscriptions had a important interaction connected the Bitcoin network. The accrued request for these caller NFTs led to a important emergence successful transaction costs and web congestion, resulting successful an unprecedented spike successful mining revenue owed to the accrued transaction fees.

However, caller information suggests that the enthusiasm surrounding Inscriptions has cooled off. Various miner-related metrics bespeak a instrumentality to pre-Inscriptions levels, signaling marketplace normalization.

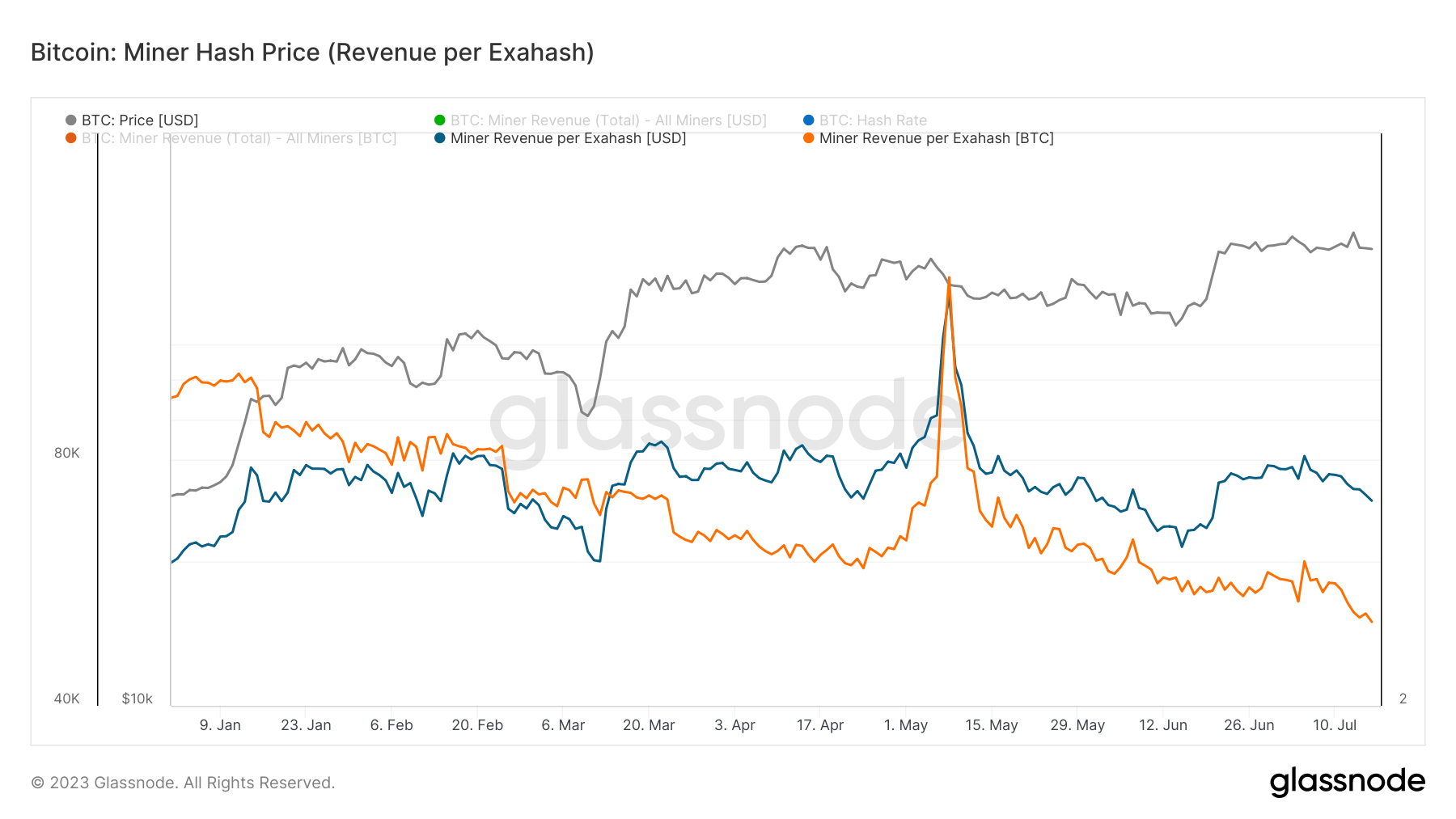

Miner gross per exahash, a measurement of the gross miners gain for each exahash of computational powerfulness they lend to the network, has seen a important alteration since its highest connected May 8, 2023. The USD-denominated gross per exahash decreased by much than 44% since May 8, pursuing a 110% emergence from January to May.

When denominated successful BTC, miner gross saw a akin trend, decreasing by 48% since May 8.

Graph showing miner gross per exahash YTD (Source: Glassnode)

Graph showing miner gross per exahash YTD (Source: Glassnode)The Inscriptions craze had a important interaction connected the creation of miner revenue. On May 8, transaction fees accounted for 42.59% of each miner revenue, marking the second-highest recorded level. The all-time precocious was recorded connected December 22, 2017, during Bitcoin’s rally to $20,000, erstwhile transaction fees comprised 43.57% of full revenue.

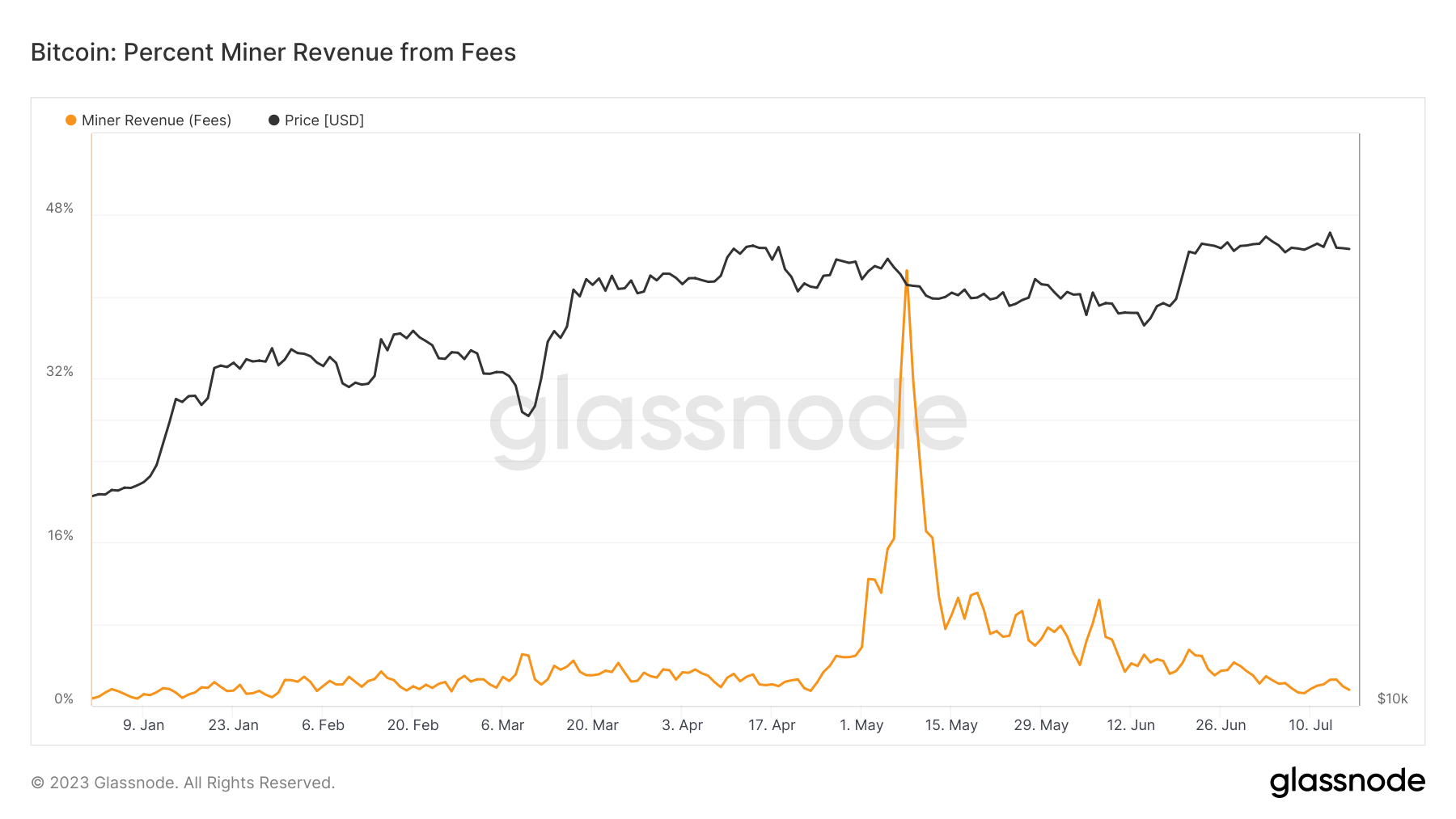

To enactment this into perspective, the percent of miner gross from transaction fees connected January 1, 2023, was a specified 0.73%. As of June 16, 2023, transaction fees relationship for astir 1.56% of miner revenue, indicating that astir income is derived from artifact rewards.

Graph showing the percent of miner gross from transaction fees YTD (Source: Glassnode)

Graph showing the percent of miner gross from transaction fees YTD (Source: Glassnode)The normalization of miner gross and the alteration successful transaction fees suggest that the marketplace has adjusted to the Inscriptions phenomenon. While the Inscriptions inclination provided a impermanent fiscal boon for Bitcoin miners, it appears that the Bitcoin web is returning to its accustomed operations.

This instrumentality to normalcy is simply a affirmative motion for the Bitcoin network, indicating its resilience and quality to accommodate to caller developments and trends.

The station Bitcoin miner gross stabilizes arsenic Inscriptions request wanes appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)