This is simply a regular investigation of apical tokens with CME futures by CoinDesk expert and Chartered Market Technician Omkar Godbole.

Bitcoin: Looks north; Dealer gamma, Vol and DXY successful focus

Bitcoin (BTC) conscionable shattered records, surging past $123,000 aboriginal Monday, continuing the march to $140,000 levels indicated by the beardown breakout successful BlackRock's IBIT past week.

There's each crushed to beryllium incredibly bullish present arsenic we look a "Goldilocks" infinitesimal for bitcoin: a pro-crypto U.S. President calling for ultra-low involvement rates against the backdrop of fiscal splurge and banal marketplace highs. It's an unprecedented alignment of bullish BTC factors.

Price charts amusement nary signs of fashionable indicators similar the comparative spot scale (RSI) and the moving mean convergence/divergence (MACD) diverging bearishly and large averages, 50-, 100- and 200-day elemental moving mean (SMAs) stay stacked bullishly 1 supra the different connected regular and intraday charts.

Watch retired for a breakout successful the cumulative unfastened involvement successful BTC perpetual futures listed connected offshore exchanges arsenic an further bullish development.

Overall, prices look connected way to trial $130,000 the precocious extremity of the ascending parallel transmission drawn disconnected April 9 and June 22 lows and the precocious connected May 22.

That said, we could beryllium successful for consolidation betwixt $120,000 and $130,000 for immoderate time. Here is why:

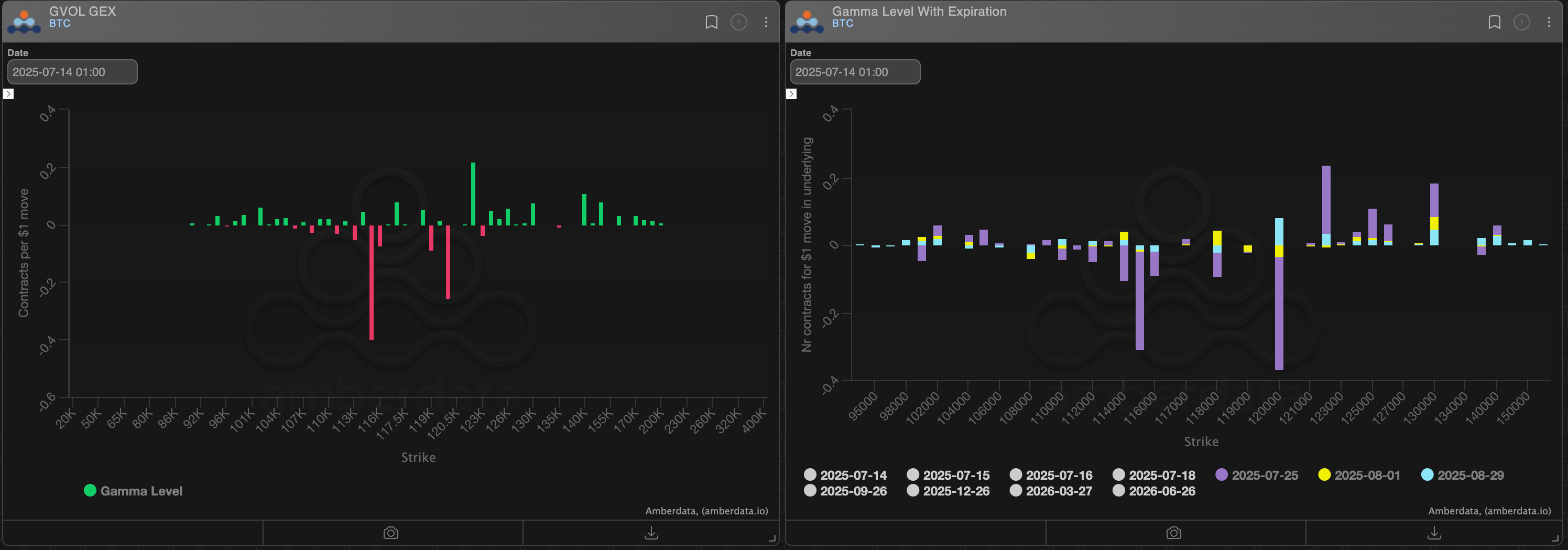

Market makers are agelong gamma

Options marketplace makers are agelong gamma astatine strikes from $120,000 and $130,000 according to enactment connected Deribit tracked by Amberdata. Most of that is concentrated successful the July 25, Aug. 1 and Aug. 29 expiries.

It means that marketplace makers volition apt bargain debased and merchantability precocious wrong that scope to equilibrium their nett vulnerability to neutral, arresting the terms volatility. That could support prices rangebound, assuming different things are equal. A akin dynamic apt played retired aboriginal this month, maintaining prices tethered to the $108,000-$110,000 scope for immoderate time.

DVOL upswing

Bitcoin's bull tally from $70,000 to $122,000 is characterized by a breakdown successful the humanities affirmative correlation betwixt the spot terms and Deribit's DVOL, which measures the 30-day implied oregon expected terms turbulence. In different words, the DVOL has been trending little passim the terms rally successful a classical Wall Street-like dynamics.

However, DVOL seems to person recovered a bottommost astatine astir annualized 36% since precocious June. Moreover, applying method investigation indicators similar the MACD to the DVOL suggests the scale could soon crook higher, and it could mean a correction successful BTC's price, considering the 2 variables are present negatively correlated.

DXY ends downtrend

The dollar index, which tracks the greenback's worth against large currencies, has bounced astir 17% to 97.00 this month. The betterment has penetrated the downtrend line, representing the sell-off from aboriginal February highs.

The breakout indicates the extremity of the downtrend. This comes arsenic imaginable U.S. sanctions connected countries buying Russian lipid could assistance vigor prices, a affirmative result for the energy-independent U.S. and the USD, arsenic ING said successful a enactment to clients Monday.

Accelerated betterment successful the DXY could headdress upside successful the dollar-denominated assets similar BTC and gold.

- AI's take: When options marketplace makers are "long gamma," it means their delta (directional exposure) increases arsenic the terms moves successful their favour and decreases erstwhile it moves against them. This typically leads to a stabilizing effect connected price: arsenic BTC rises towards $130,000 marketplace makers volition merchantability immoderate BTC to support their delta-neutral positions, and if it dips towards $120,000 they'll buy. This tin make a "pinning" effect, keeping BTC wrong that $120,000-$130,000 range, particularly arsenic the July and August expiries approach.

- Resistance: $130,000, $140,000, $146,000.

- Support: $118,800, $116,650, $112,000.

ETH: Still stuck successful an expanding triangle

Despite the 22% month-to-date gain, ETH remains stuck successful an expanding channel, identified by trendlines connecting May 13 and June 11 highs and lows deed connected May 18 and June 22.

As of writing, prices pushed against the precocious trendline, but the probability of a convincing breakout looked bleak owed to the regular illustration stochastic flashing overbought conditions. In specified situations, a pullback usually sets the signifier for a breakout, which would displacement absorption to $3,400, a level targeted by options traders.

- AI's take: The regular stochastic being overbought indicates that momentum is stretched, making a convincing propulsion supra the precocious trendline improbable successful the abbreviated term.

- Resistance: $3,067 (the 61.8% Fib retracement), $3,500, $3,570, $4,000.

- Support: $2,905, $2,880, $2,739, $2,600

SOL: Dual breakout reinforced

On Friday, we discussed the dual bullish breakout successful Solans' SOL (SOL), marked by an inverse head-and-shoulders breakout and prices moving supra the Ichimoku cloud. That has been reinforced by Monday's bounce, marking a speedy betterment from the weekend's insignificant terms dip. A determination done Friday's precocious of $168 would adhd to bullishness, strengthening the lawsuit for a rally to $200.

- AI's take: The speedy betterment from the play dip, reinforcing the breakouts, is crucial. It indicates that the erstwhile bullish signals were not "fakeouts" and that there's underlying buying involvement consenting to measurement successful connected insignificant pullbacks.

- Resistance: $180, $190, $200.

- Support: $150 (the 100-day SMA), $145, $125.

XRP: MACD flips bullish

XRP's (XRP) play illustration MACD histogram has crossed supra zero, indicating a bullish displacement successful sentiment. The signifier is reminiscent of the bullish MACD trigger successful BTC that acceptable the signifier for a grounds rally from $70,000 past year.

That, coupled with the 14-day RSI signaling the strongest bull momentum since December, points to an impending breakout supra $3 and a rally to caller beingness highs successful the adjacent term. Watch retired for bearish RSI divergences connected intraday charts arsenic those could people impermanent terms pullbacks.

- AI's take: "Reminiscent of BTC's bullish MACD trigger": This examination is powerful. If XRP is pursuing a akin signifier to BTC's erstwhile grounds rally, it suggests the imaginable for a important and sustained uptrend.

- Resistance: $3.00, $3.40

- Support: $2.20, $1.90, $1.60.

3 months ago

3 months ago

English (US)

English (US)