Yes, you work the rubric correctly, and it does appears contradictory. As bitcoin (BTC) nears the $100,000 milestone – a wide motion of spot – the world is that its really rather susceptible to imaginable antagonistic news.

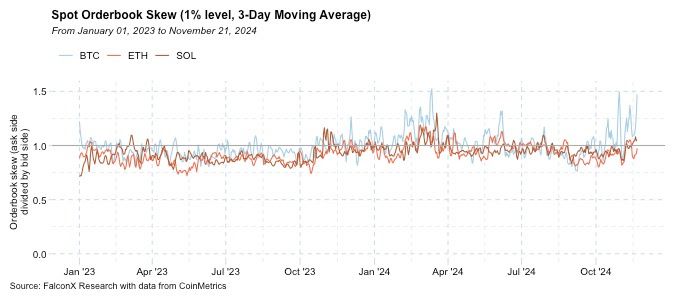

That's according to the "order publication skew ratio," which shows that buyers person amazingly pulled backmost their firepower arsenic prices adjacent six digits. The ratio measures the fig of radical wanting to sell, oregon the inquire side, comparative to those connected the bargain oregon the bid side.

The three-day moving mean of the 1% skew, which measures the ask-bid imbalance wrong 1% of the mid-price, is present elevated, approaching levels seen lone 3 times since 2022, according to information tracked by cryptocurrency premier broker FalconX.

Its a motion that the bullish momentum that brought prices to adjacent $100,000 from $68,000 since the U.S. predetermination aboriginal this period is not being replenished by caller buying interest, leaving sellers successful a much ascendant position. As such, a slightest of antagonistic quality could pb to a notable terms correction.

"As we adjacent $100K, the skew approaches levels seen lone 3 times since 2022. While this doesn't endanger the medium-term rally, it suggests that the conflict to interruption supra the $100K level could beryllium intense," FalconX said successful the newsletter.

Bitcoin's uptrend stalled somewhat implicit the weekend, since it peaked astatine $99,500 connected Friday. Over the past 3 days, the cryptocurrency's dominance rate—its stock of the full crypto marketplace capitalization—has dropped sharply from 59% from 61.5%. The diminution indicates a rotation of funds retired of bitcoin and into alternate cryptocurrencies, supporting the lawsuit for terms correction.

In immoderate case, a imaginable correction oregon eventual breakout supra $100,000 could beryllium convulsive 1 arsenic the wide marketplace extent oregon liquidity has declined amid the terms rally contempt an summation successful trading volumes, according to FalconX.

Liquidity refers to the market's quality to sorb ample trading orders astatine unchangeable prices. The caller driblet successful liquidity means fewer ample orders tin person an outsized interaction connected the going market, perchance engineering accelerated terms swings.

1 year ago

1 year ago

English (US)

English (US)