Bitcoin is trading astir $11,000 beneath its Aug. 14 record, according to CoinDesk data, but FalconX’s caput of probe says the market’s interior operation inactive looks “extremely bullish.”

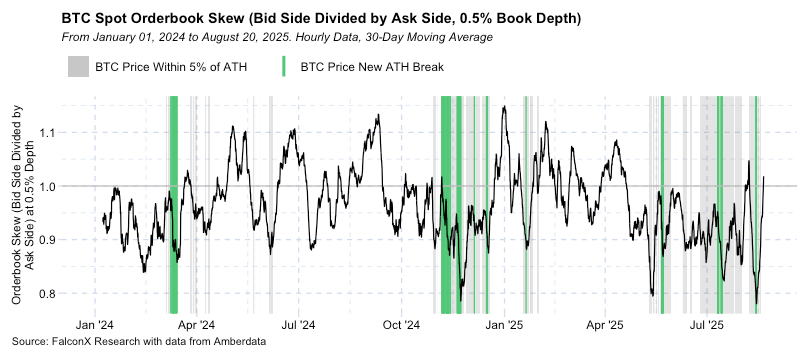

In a station connected X connected Wednesday, expert David Lawant pointed to what happens successful bitcoin’s bid publication — the unrecorded grounds of bargain and merchantability offers connected exchanges — erstwhile the terms pulls backmost somewhat from highs.

He explained that aft these tiny dips, merchantability orders rapidly vanish and bargain orders instrumentality over, a dynamic helium described arsenic the bid publication “flipping” from the merchantability broadside to the bid side.

In plain terms, Lawant is saying that sellers are not sticking astir to propulsion the marketplace down aft humble declines. Instead, beardown request steps successful astir immediately, and buyers assemblage retired sellers.

That signifier suggests semipermanent players with deeper pockets — specified arsenic institutions and well-capitalized funds — are utilizing little downturns arsenic buying opportunities. Rather than signaling weakness, the lack of sustained selling indicates assurance successful bitcoin’s longer-term trajectory.

The illustration Lawant shared reinforces this interpretation. It shows periods wherever bitcoin slipped somewhat from grounds levels, lone for bargain orders to rapidly surge up of merchantability orders.

This repeated displacement toward the bid broadside is simply a hallmark of a bullish marketplace structure, since it demonstrates that request is waiting successful the wings to sorb immoderate proviso that comes to market. For traders, the takeaway is that bitcoin’s resilience aft dips points to beardown underlying support.

While bitcoin is inactive beneath its Aug. 14 highest of $124,481, the signifier highlighted by Lawant — sellers vanishing rapidly and buyers reasserting power — continues to underpin bullish sentiment among analysts who spot dips arsenic opportunities alternatively than informing signs.

Technical Analysis Highlights

- According to CoinDesk Research's method investigation information model, betwixt Aug. 19, 17:00 UTC and Aug. 20, 16:00 UTC, bitcoin fluctuated wrong a $1,899.78 range, trading betwixt a debased of $112,437.99 and a precocious of $114,337.77.

- Around 13:00 UTC connected Aug. 20, the terms fell to $112,652.09 amid liquidation unit earlier staging a beardown rebound.

- The betterment was supported by precocious trading activity: 14,643 BTC changed hands, compared to a 24-hour mean of 9,356 BTC.

- This surge established $112,400–$112,650 arsenic a cardinal volume-backed enactment corridor.

- In the last hr of the investigation play (15:47–16:46 UTC), bitcoin roseate from $113,863.05 to $114,302.43 earlier closing astatine $113,983.06.

- The rally broke done absorption astatine $113,500, $113,650 and $114,000, aided by elevated volumes of 250+ BTC per minute, signaling the commencement of a short-term uptrend.

Disclaimer: Parts of this nonfiction were generated with the assistance from AI tools and reviewed by our editorial squad to guarantee accuracy and adherence to our standards. For much information, see CoinDesk's afloat AI Policy.

2 months ago

2 months ago

English (US)

English (US)