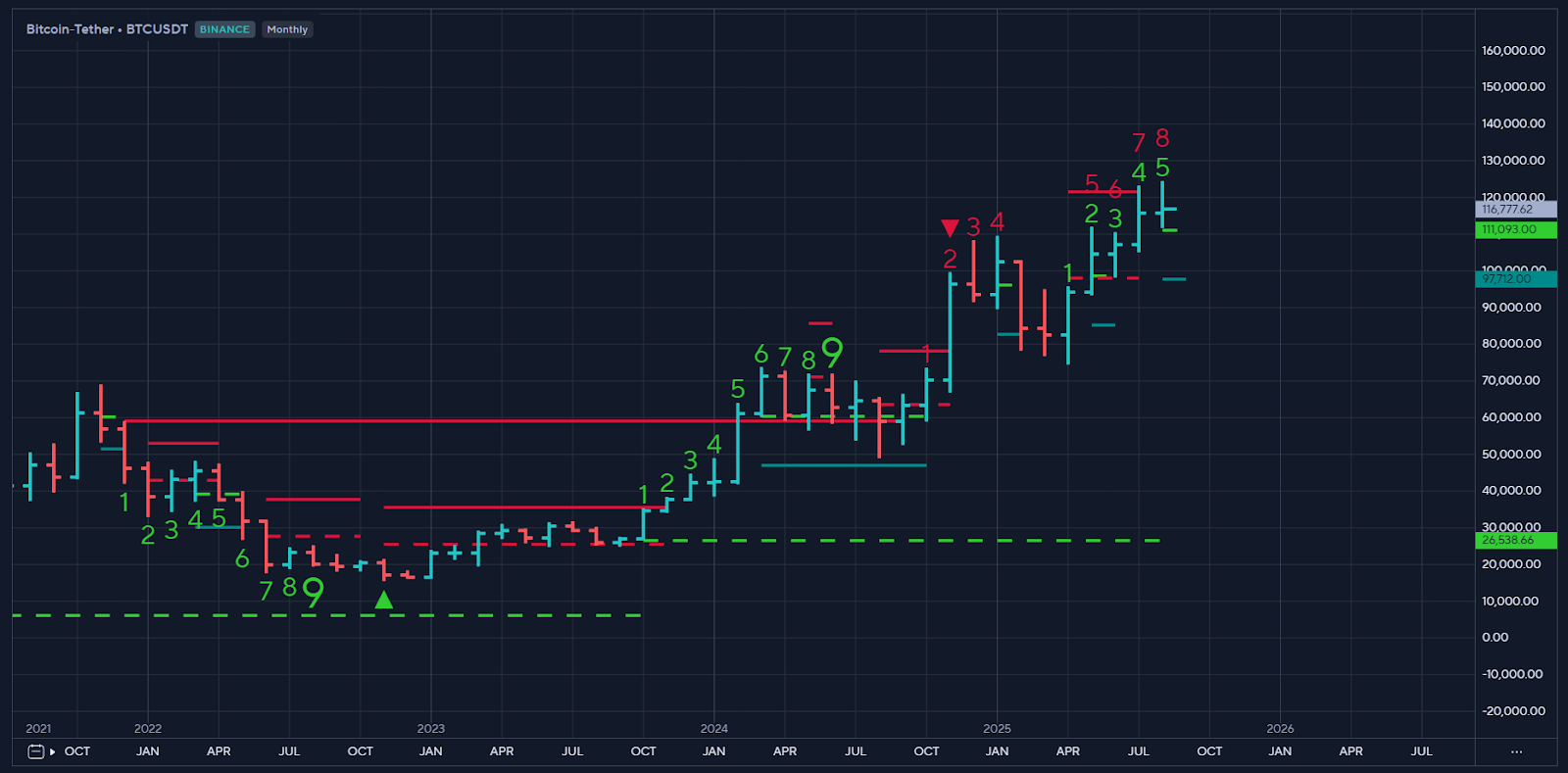

Price outlook

Our investigation for the remainder of 2025 forecasts bitcoin reaching a people of $150,000 to $160,000 driven by a Fed argumentation pivot and complaint driblet expectations successful the United States, beneficial liquidity conditions and the progressively affirmative crypto regulatory environment.

The latest announcement from the Trump medication allowing cryptos into 401(k)s adds an other furniture to the crypto adoption narrative, and a wide pathway to expanding the existing crypto marketplace headdress via the estimated 9 trillion USD status marketplace successful the United States.

Webinar alert: On September 9 astatine 11:00am ET articulation Michelle Noyes from AIMA and Andy Baehr from CoinDesk Indices arsenic they sermon gathering a sustainable concern successful the cyclical markets of crypto. Register today. https://aima-org.zoom.us/webinar/register/4917558078322/WN_3jAGIrqMTK2z7e74q5bkWg#/registration

Event alert: CoinDesk: Policy & Regulation successful Washington D.C. connected September 10th. The docket includes elder officials from the SEC, Treasury, House, Senate and OCC, positive backstage roundtables and unparalleled networking opportunities. Use codification COINDESK15 to prevention 15% connected your registration. http://go.coindesk.com/4oV08AA.

Ongoing crypto catalysts

- Liquidity conditions: Ongoing liquidity injections from the PBOC and the wide enlargement of Global M2.

- Corporates & funds: Institutions are putting their equilibrium sheets to enactment successful bitcoin similar ne'er before. Additionally, the fig of bitcoin and ether funds continues to rapidly grow.

- ISM survey is expected to emergence supra 50.0. When the ISM survey goes into affirmative territory it has antecedently correlated with the commencement of “alt season.”

Quantitative models and risks

Our quantitative models stay affirmative and amusement important scope for further upside successful bitcoin and the broader market:

- Our Vanguard model, which is simply a inclination detection system, continues to make agelong condemnation play signals.

- Weekly terms closes supra $119,000 volition support the bullish sentiment live and cement the method backdrop for further upside into uncharted waters for bitcoin.

Source: Biyond.co, August 2025

Risks

- An acceleration of antagonistic information points successful the United States, starring to stagflation fears and risk-off implicit fears of a planetary slowdown.

- A important pullback successful the S&P 500 successful Q3, perchance from the 6,660 level, which remains a superior target.

- Negative tariff headlines, and much specifically, a breakdown successful Sino-U.S. commercialized talks.

- Extensive nett taking from ETF holders if bitcoin crosses $150,000 oregon adjacent $160,000

Insights from Demark indicator

Demark TD sequential monthly illustration is pointing to a imaginable apical astatine the extremity of the twelvemonth with the scale moving towards setup 9 and countdown 13. When the Demark indicator has approached 9 oregon 13 previously, it has signalled beardown overbought exhaustion.

Source: Symbolik Demark TD Sequential

Crypto full marketplace cap

The imaginable breakout of the crypto full marketplace capitalization illustration presents different dynamic to the ongoing and antecedently mentioned bullish catalyst for the crypto market. Namely:

- An archetypal Q3 people of 5 trillion USD.

- A broad-based crypto marketplace rally encompassing the apical 150 cryptos.

- Limited scope for downside nether 4 trillion USD erstwhile a definitive illustration breakout occurs.

Conclusion

Bitcoin and the cryptocurrency marketplace are well-placed to detonate to caller trading highs, with projections expected to scope betwixt $150,000-160,000, and a 5 trillion USD marketplace capitalization.

Key upcoming hazard events see higher CPI readings successful the coming months and a halt successful commercialized negotiations betwixt the United States and China, though we consciousness it is acold much apt a “kicking of the can” down the roadworthy and an hold of ongoing commercialized talks to appease markets.

Based connected each the affirmative developments surrounding bitcoin and method indicators, a beardown lawsuit tin beryllium made for further beardown terms appreciation moving into year-end.

2 months ago

2 months ago

English (US)

English (US)