Price outlook

Our investigation for 2025 forecasts bitcoin reaching a people of $150,000 successful the archetypal fractional of the year. However, an archetypal pullback whitethorn hap successful Q1 if the recently inaugurated Trump medication fails to present the anticipated “Strategic Bitcoin Reserve” astatine the gait expected by the fast-moving crypto market.

Even without a afloat implemented reserve strategy, bitcoin is expected to rally, driven by bullish momentum. We expect the terms to participate the $130,000–$150,000 scope by Q2 of 2025, supported by beardown marketplace catalysts.

You're speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Wednesday.

Key catalysts driving growth

Regulatory progress: With large regulatory barriers cleared successful jurisdictions similar the U.S., firm involvement successful bitcoin has surged.

Corporate and organization demand: A increasing fig of corporations are actively readying to deploy superior into cryptocurrency. Hedge funds, ample corporates, and household offices are showing unprecedented enthusiasm for bitcoin exposure.

This wide involvement signifies a beardown instauration for bitcoin’s upward trajectory successful 2025.

Quantitative models and risks

While optimism runs high, our quantitative models emblem nary imaginable risks nether $90,000. Specifically:

The Vanguard model, which precocious flipped to a bargain awesome for the archetypal clip this year, confirms bullish momentum astir bitcoin.

Weekly terms closes supra $100,000 should support the bullish sentiment alive.

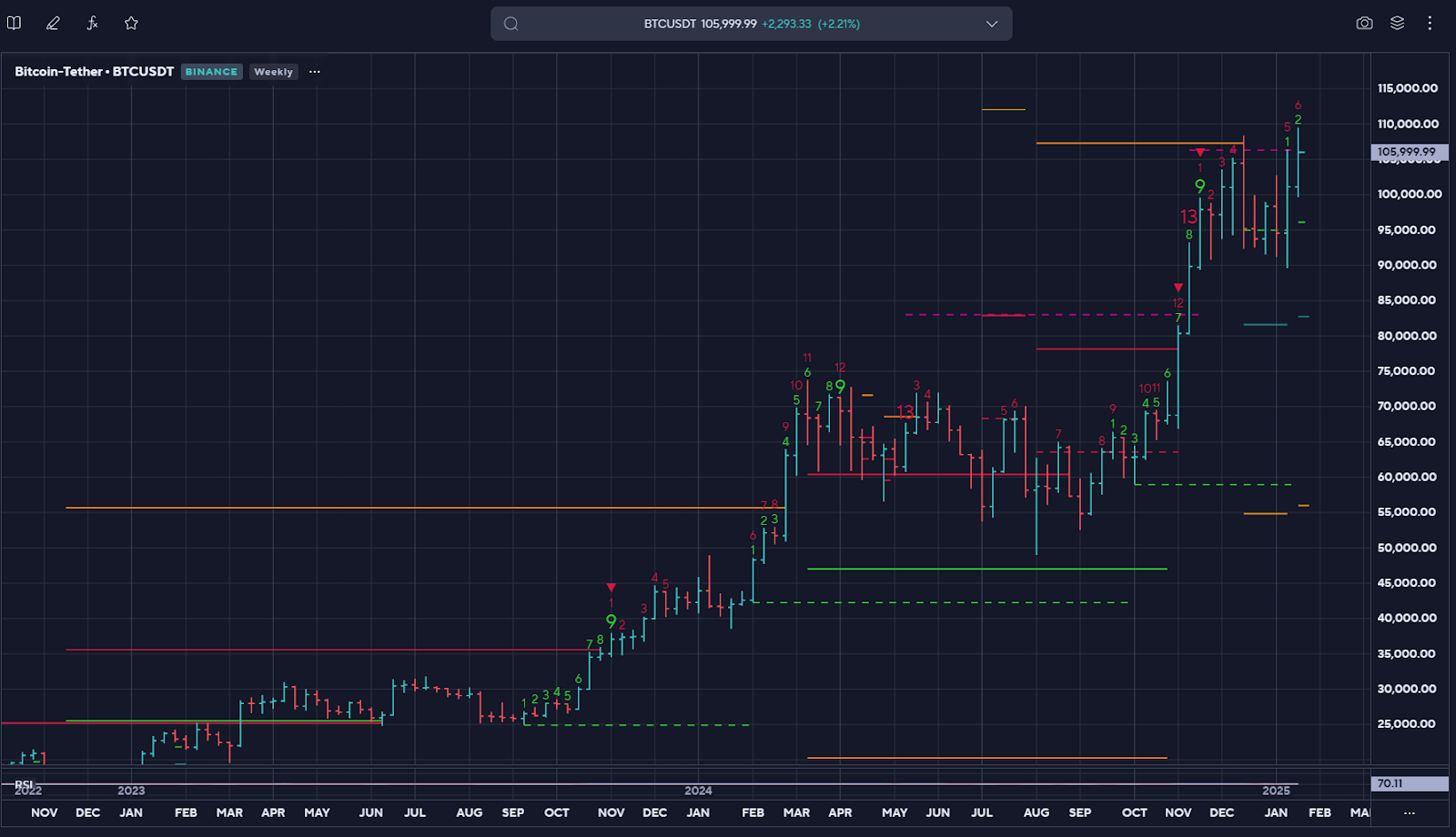

Insights from DeMark indicator

The DeMark TD Sequential indicator suggests bitcoin is connected a bullish setup connected the play timeframe aft reaching its propulsion people of $108,300 and completing 1 of its emblematic 10% corrections down to $90,000, which was bought with conviction. A propulsion people is simply a predefined terms level derived from a bid of calculations that assistance traders place cardinal areas of imaginable enactment oregon resistance. These targets are designed to bespeak wherever the terms mightiness determination successful the future, often serving arsenic imaginable breakout oregon exhaustion points.

Bitcoin is astir 7 weeks distant from completing its bullish TD setup signifier eyeing its archetypal imaginable propulsion people of $119,270.

Weekly terms closes supra $107,300 could trigger the adjacent bullish acceleration.

The week of Trump’s inauguration, the DeMark TD Sequential indicator showed topping patterns connected the regular timeframe introducing a bearish absorption towards $90,000, but arsenic agelong arsenic bitcoin terms stays supra $104,400, the downside hazard is limited.

Dollar spot and macro risks

The U.S. dollar’s weakness successful the coming weeks and months presents different catalyst for crypto:

Capital inflows into the U.S. economy

Optimism astir Trump’s "America First" policies

DXY method charts indicative of topping patterns

Summary

Despite imaginable near-term volatility and choppy terms action, we support a beardown bullish outlook for bitcoin successful 2025, with projected highs reaching $150,000 oregon more. Key risks see corrections toward the $90,000s, should bargain signals neglect to emerge. We volition beryllium navigating this dynamic marketplace for imaginable semipermanent worth investing astatine astir the $82,000 and $85,000 range. Additionally, play terms closes beneath $99,000 should beryllium the trigger for the adjacent bearish limb down.

8 months ago

8 months ago

English (US)

English (US)