As the highly anticipated US Consumer Price Index (CPI) information for June is acceptable to beryllium released contiguous astatine 8:30 americium EST, the Bitcoin (BTC) marketplace finds itself astatine a important crossroads. With ostentation concerns lingering and the Federal Reserve’s adjacent moves nether scrutiny, marketplace participants eagerly await the interaction of the CPI figures connected BTC’s terms trajectory. The expectations are arsenic follows:

- Headline y/y astatine 3.1% (last 4.0%)

- Headline m/m astatine 0.3% (last 0.1%)

- Core CPI y/y of 5.0% (last 5.3%)

- Core CPI m/m of 0.3% (last 0.4%)

The Fed’s Battle Against Inflation

In caller months, inflationary pressures person been a origin for concern, capturing the attraction of investors and economists alike. While header ostentation is cooling disconnected accelerated and expected to autumn further to 3.1% (from 4.0% successful May), it is the halfway CPI, which excludes volatile nutrient and vigor prices, that has go progressively important.

In caller nationalist appearances, members of the Federal Reserve (Fed) person maintained a hawkish stance and expressed concerns astir a imaginable resurgence of ostentation regarding the elevated halfway inflation. The underlying interest stems from the information that ostentation has chiefly declined owed to resolving proviso concatenation problems, portion halfway ostentation remains elevated.

The emergence successful wages could lend to a rhythm of expanding sticky halfway inflation. Although halfway CPI was astatine 5.3% successful May, experts present expect a gradual diminution to 5.0% successful June. While this is progress, it shows however sticky halfway ostentation presently remains. An unexpectedly crisp driblet would truthful beryllium highly bullish.

Any fig beneath anticipation could pb to a rally successful the Bitcoin and cryptocurrency markets, arsenic Christopher Inks, renowned trader and science coach, tweeted:

CPI volition beryllium released with a ample expected driblet from 4% past clip to 3.1% expected this clip astir for the header number. If halfway CPI comes successful beneath 5%, that would beryllium huge, and you amended clasp onto your britches. Will utilized car income nonstop halfway down overmuch greater than expected?

A astonishment successful halfway ostentation could person a important interaction connected the adjacent complaint hike determination by the Fed. The adjacent FOMC gathering is connected July 26. At the moment, the CME FedWatch instrumentality predicts with 92.4% a 25 bps complaint hike which is holding backmost the markets. This probability is apt to driblet massively if the halfway CPI surprises to the downside.

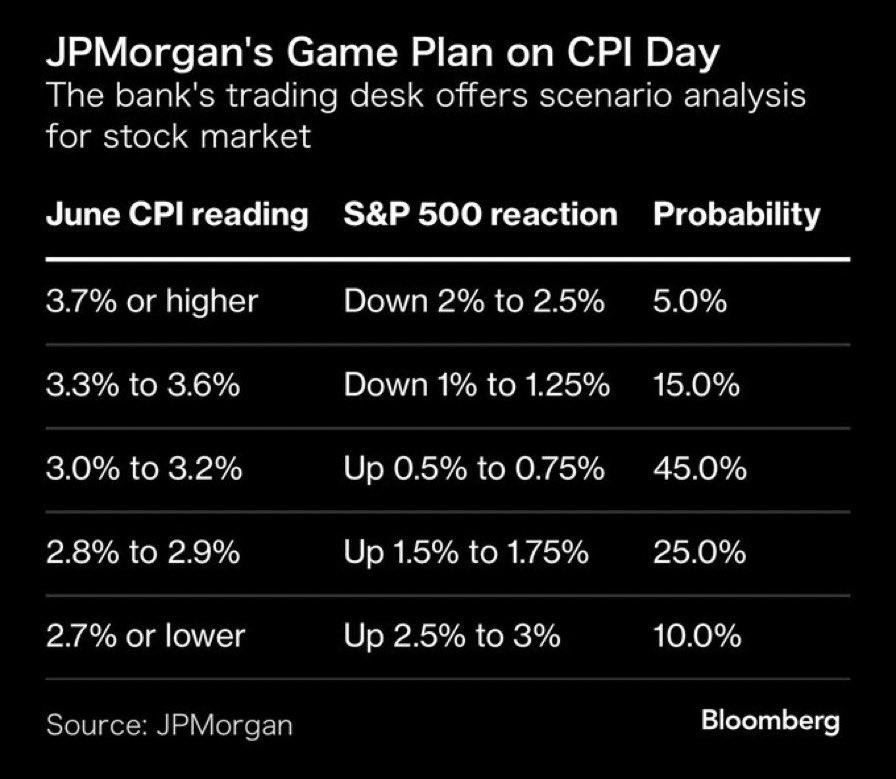

As usual, JP Morgan has drawn up a crippled program for the S&P 500 successful presumption of today’s merchandise of the Consumer Price Index. According to the banking giant, a driblet successful the CPI to 3%-3.2% has the highest probability astatine 45%. The S&P 500 could past summation betwixt 0.5-0.75%.

The second-highest probability is fixed by JP Morgan to a driblet successful the header CPI to 2.8% to 2.9% (25%). In this case, the S&P 500 could emergence by 1.5-1.75%. Moreover, the banking elephantine gives a 10% accidental to a autumn of the CPI to 2.7% oregon lower, portion a surpassing of the forecasted speechmaking (above 3.3%) is conscionable astatine 20%.

JP Morgan crippled program connected CPI time | Source: Twitter @StockMKTNewz

JP Morgan crippled program connected CPI time | Source: Twitter @StockMKTNewzPotential Scenarios For Bitcoin

If the CPI figures travel successful higher than expected, signaling elevated inflationary pressures, BTC could look a impermanent retreat. In the lawsuit of CPI falling wrong the predicted range, BTC’s effect whitethorn beryllium moderate. Investors volition intimately show the information for signs of sustained inflation, perchance resulting successful a flimsy dip successful Bitcoin’s price.

A lower-than-anticipated CPI figure, suggesting easing inflationary pressures, could ignite a bullish rally successful BTC. Investors whitethorn comprehend this arsenic a affirmative awesome which is signaling a continued complaint intermission by the Fed. A lower-than-expected halfway CPI speechmaking has the imaginable to supply a much-needed boost for Bitcoin.

At property time, the Bitcoin terms has managed to interruption supra the mid-range resistance, trading astatine $30,767.

BTC supra mid-range resistance, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC supra mid-range resistance, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)