In a elaborate marketplace update, Charles Edwards, laminitis of Capriole Investment, has provided an in-depth analysis of Bitcoin’s existent marketplace position, highlighting a pivotal displacement to an ‘expansion’ signifier successful the Bitcoin Macro Index. This modulation is peculiarly noteworthy arsenic it parallels conditions observed anterior to humanities terms surges successful Bitcoin’s valuation.

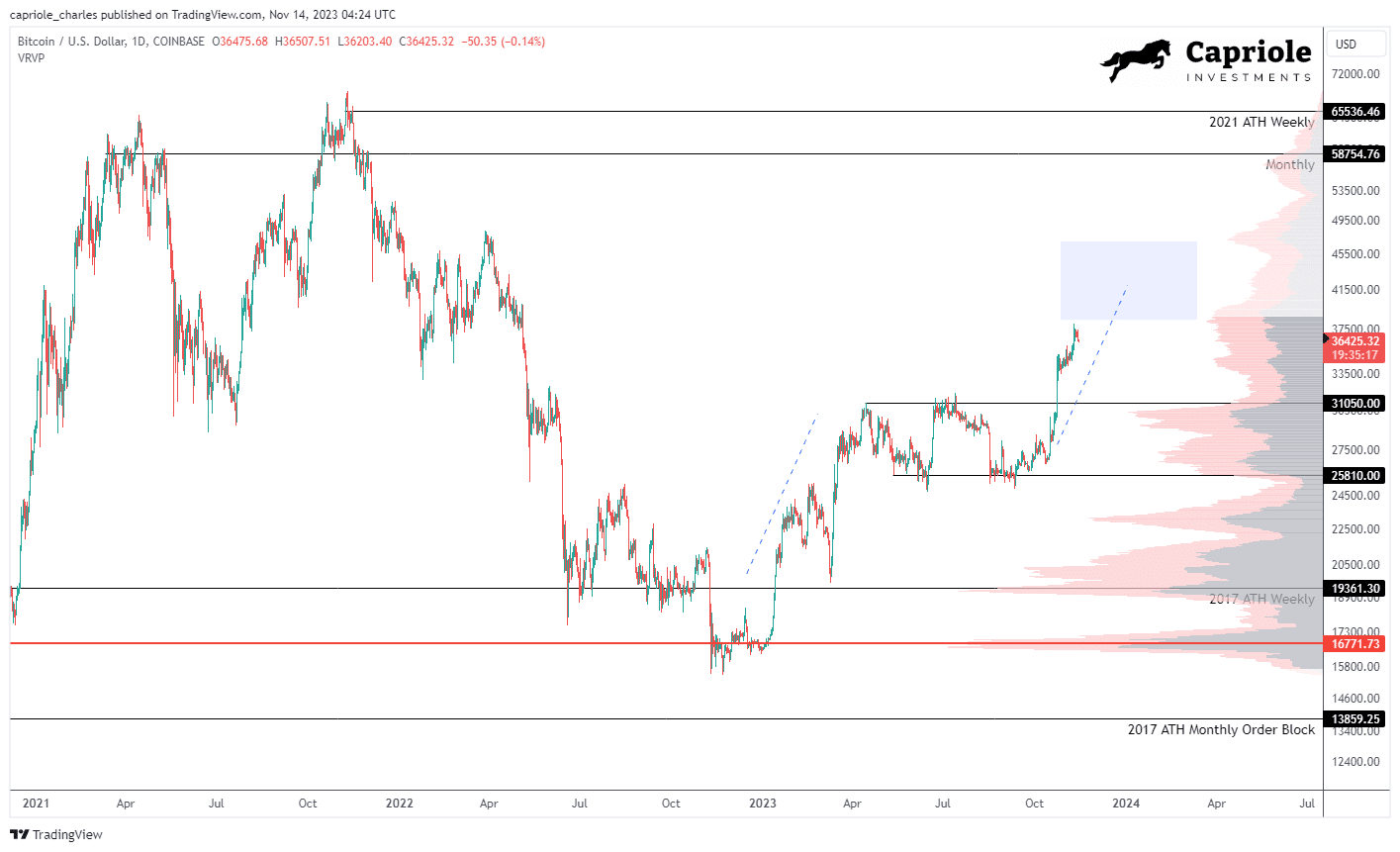

Bitcoin has precocious experienced a crisp uptick, ascending from $34,000 to an interim precocious of $38,000. After a little play of resistance, the terms corrected to astir $36,500. Edwards highlights this question arsenic a captious method victory, with Bitcoin overcoming and holding supra the large absorption benchmarks of $35,000 connected some the play and monthly timeframes.

This consolidation supra cardinal absorption levels sets a bullish discourse successful the precocious timeframe method analysis, positioning Bitcoin successful a beardown method stance according to accepted marketplace indicators. “The caller breakout into the 2021 scope offers the champion precocious timeframe method setup we person seen successful years. Provided $35K holds connected a play and monthly ground successful November, the adjacent important absorption is scope precocious ($58-65K).”

Bitcoin terms investigation | Source: Capriole Investments

Bitcoin terms investigation | Source: Capriole InvestmentsBitcoin Macro Index Enters Expansion

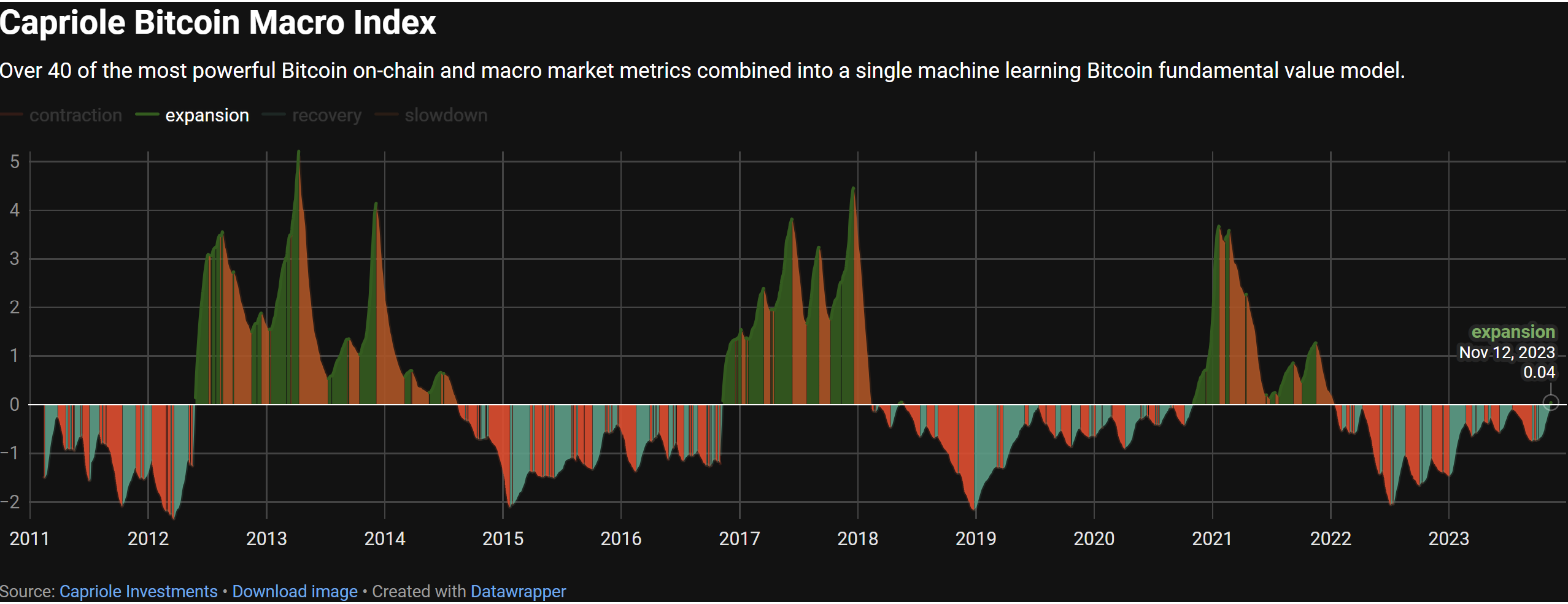

The crux of Edwards’ update is the displacement successful the Bitcoin Macro Index, a analyzable exemplary synthesizing implicit 40 metrics encompassing Bitcoin’s on-chain data, macro marketplace indicators, and equity marketplace influences. The scale does not instrumentality terms arsenic an input, frankincense providing a ‘pure fundamentals’ perspective.

The existent enlargement is the archetypal since November 2020, and lone the 3rd lawsuit since the index’s inception, with the 2 erstwhile occasions starring to important terms rallies successful the pursuing periods. Edwards elucidates this with a nonstop quote: “The modulation from betterment to enlargement is simply the optimal clip to allocate to Bitcoin from a risk-reward accidental for this model.”

A look astatine the Bitcoin illustration reveals that the Bitcoin terms roseate by a whopping 400% during the past bull tally from aboriginal November 2020 to November 2021, aft the Macro Index entered the enlargement phase. The archetypal humanities awesome was provided by the Macro Index connected November 9, 2016, which was followed by a monolithic bull tally of astir 2,600% until Bitcoin reached its past all-time precocious of $20,000 successful February 2018.

Bitcoin Macro Index | Source: Capriole Investments

Bitcoin Macro Index | Source: Capriole InvestmentsShort-Term Technicals And Derivatives Market Analysis

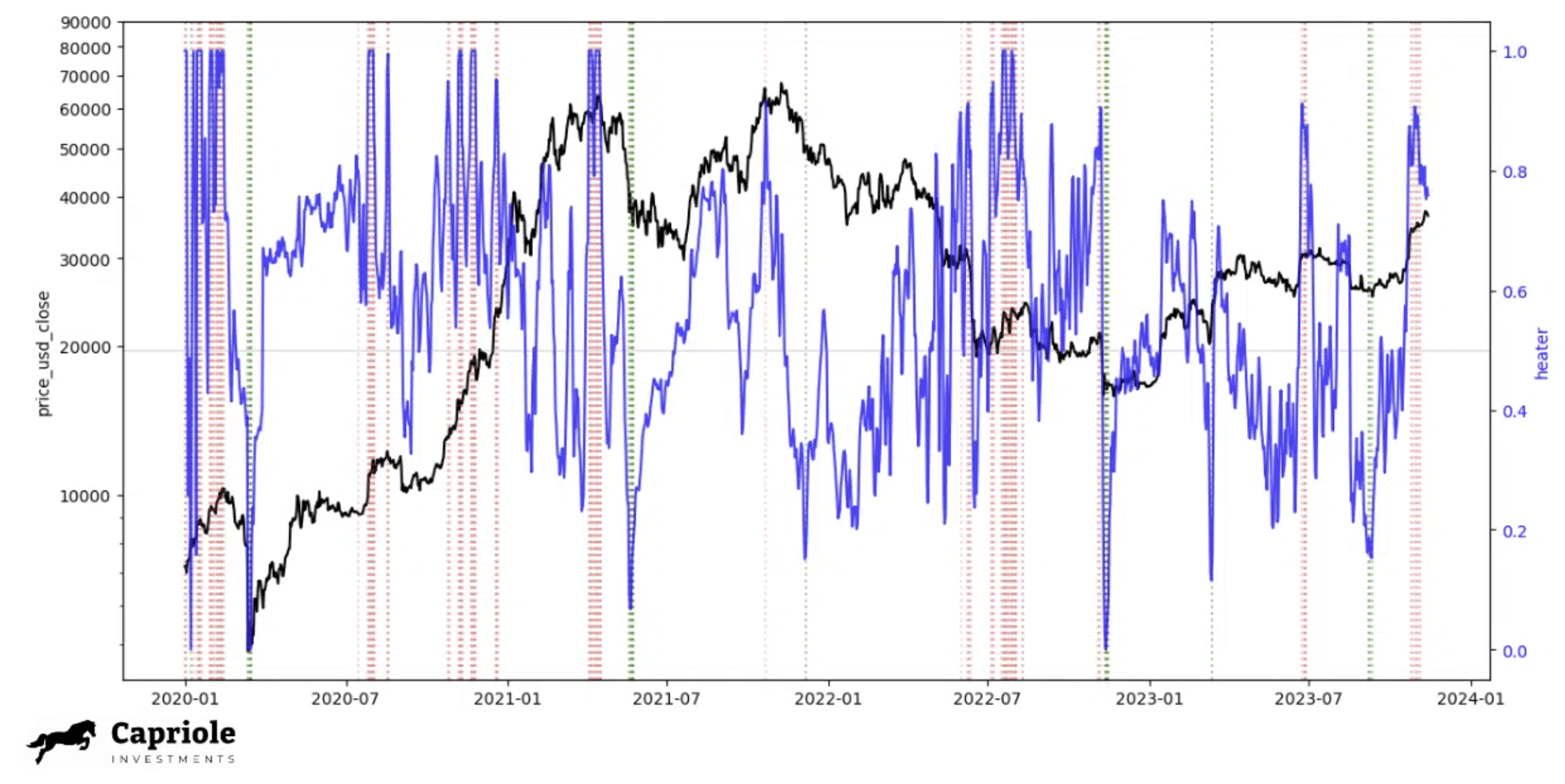

In the abbreviated term, the method outlook presents a mixed picture, according to Edwards. The derivative markets are indicating an overheated state, with debased timeframe investigation suggesting a retracement could beryllium imminent. Edwards introduces the ‘Bitcoin Heater’ metric, precocious launched connected Capriole Charts, which aggregate assorted derivatives marketplace information and quantify the level of marketplace hazard based connected the unfastened involvement and heating level of perpetuals, futures, and options markets.

The beneath illustration shows that astir of the clip erstwhile the Bitcoin Heater is supra 0.8, the marketplace corrects oregon consolidates. “But determination are ample exceptions to the rule: specified arsenic the superior bull marketplace rally from November 2020 done to Q1 2021. […] We should expect this metric to beryllium precocious much often successful 2024 (much similar Q4 2020 – 2021),” Edwards stated.

Bitcoin Heater | Source: Capriole Investments

Bitcoin Heater | Source: Capriole InvestmentsThe expert concluded that the wide inclination for Bitcoin remains positive, with large information points indicating a beardown bullish scenario. However, helium besides cautioned astir imaginable short-term risks successful the debased timeframe technicals and derivatives market. These, according to him, are communal successful the improvement of a bull tally and could connection invaluable opportunities if dips occur.

At property time, BTC traded astatine $35,626.

Bitcoin terms re-enters inclination channel, 2-hour illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms re-enters inclination channel, 2-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)