Previous CryptoSlate analysis revealed that the crypto manufacture is dilatory getting retired of the carnivore market. However, the modulation from a carnivore marketplace to a bull marketplace is often a tumultuous and volatile process.

Long-term holders (LTH) are the astir important factors successful this portion of the cycle, arsenic their behaviour determines section bottoms and fuels aboriginal terms rallies.

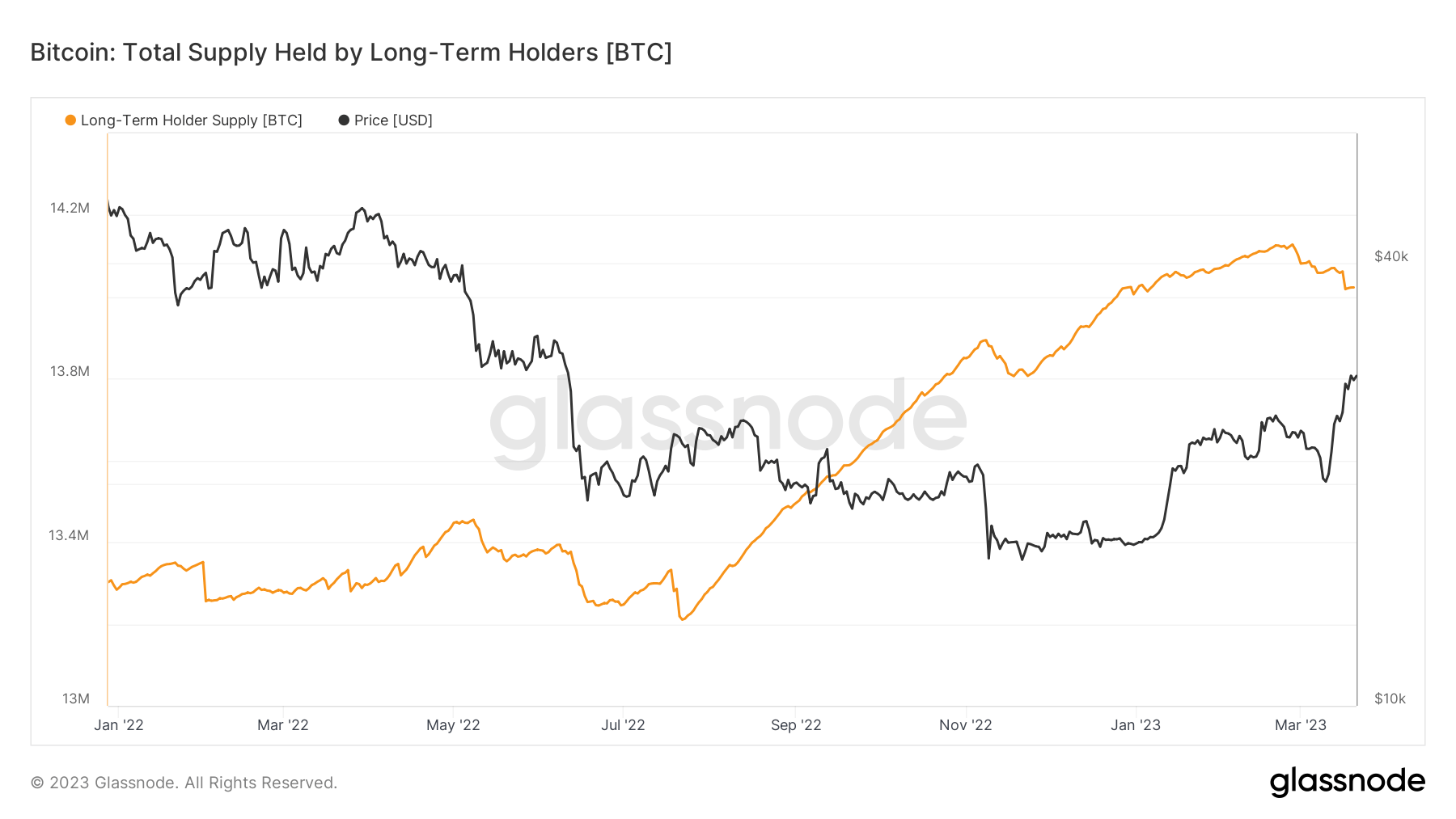

As Bitcoin (BTC) surged past $28,000, LTHs rushed to merchantability immoderate of their holdings for the archetypal clip successful astir a year. The erstwhile fewer months were spent successful dense accumulation, with LTHs expanding their holdings continuously from November 2022 until the extremity of February. The flimsy alteration successful their proviso that began successful February saw an astir vertical driblet betwixt March 15 and March 17 — erstwhile LTHs sold disconnected astir 43,543 BTC.

Graph showing the LTH BTC proviso from January 2022 to March 2023 (Source: Glassnode)

Graph showing the LTH BTC proviso from January 2022 to March 2023 (Source: Glassnode)This is the archetypal clip since May 2022 that semipermanent holders spent immoderate of their BTC successful profit.

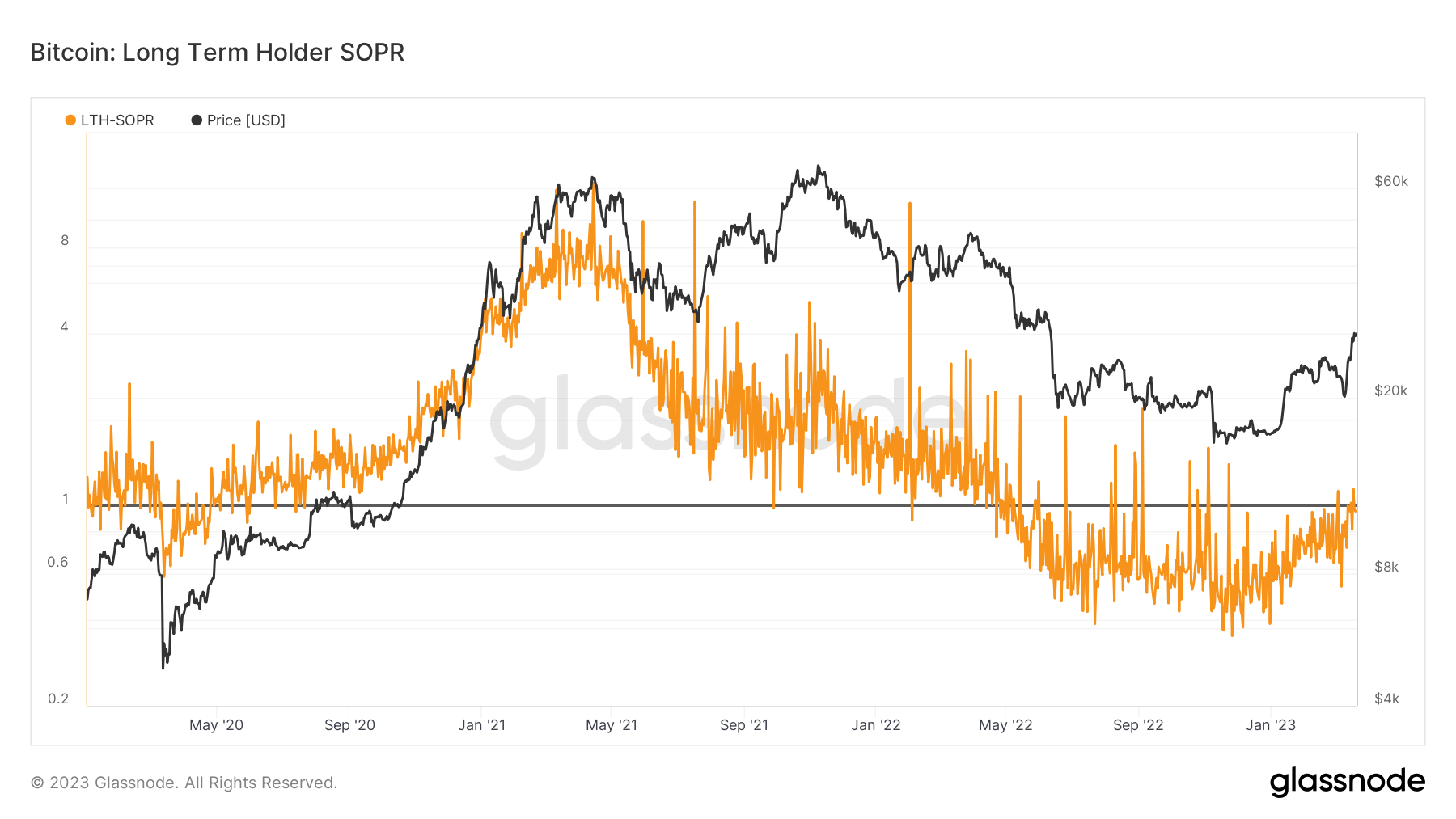

Bitcoin’s Spent Output Profit Ratio (SOPR) — a ratio that shows the profitability of spent BTC — reached 1.02 connected March 16. It surged past 1.14 again connected March 18 and stood astatine 0.98 astatine property time. A SOPR worth higher than 1 implies that the coins spent connected that time are, connected average, selling astatine a profit.

Graph showing the Bitcoin LTH SOPR from January 2020 to March 2023 (Source: Glassnode)

Graph showing the Bitcoin LTH SOPR from January 2020 to March 2023 (Source: Glassnode)CryptoSlate investigation besides showed that the semipermanent holder spending outgo ground has astir met Bitcoin’s spot price. On March 20, LTH spending outgo ground reached conscionable implicit $29,000 — portion BTC reached $28,400.

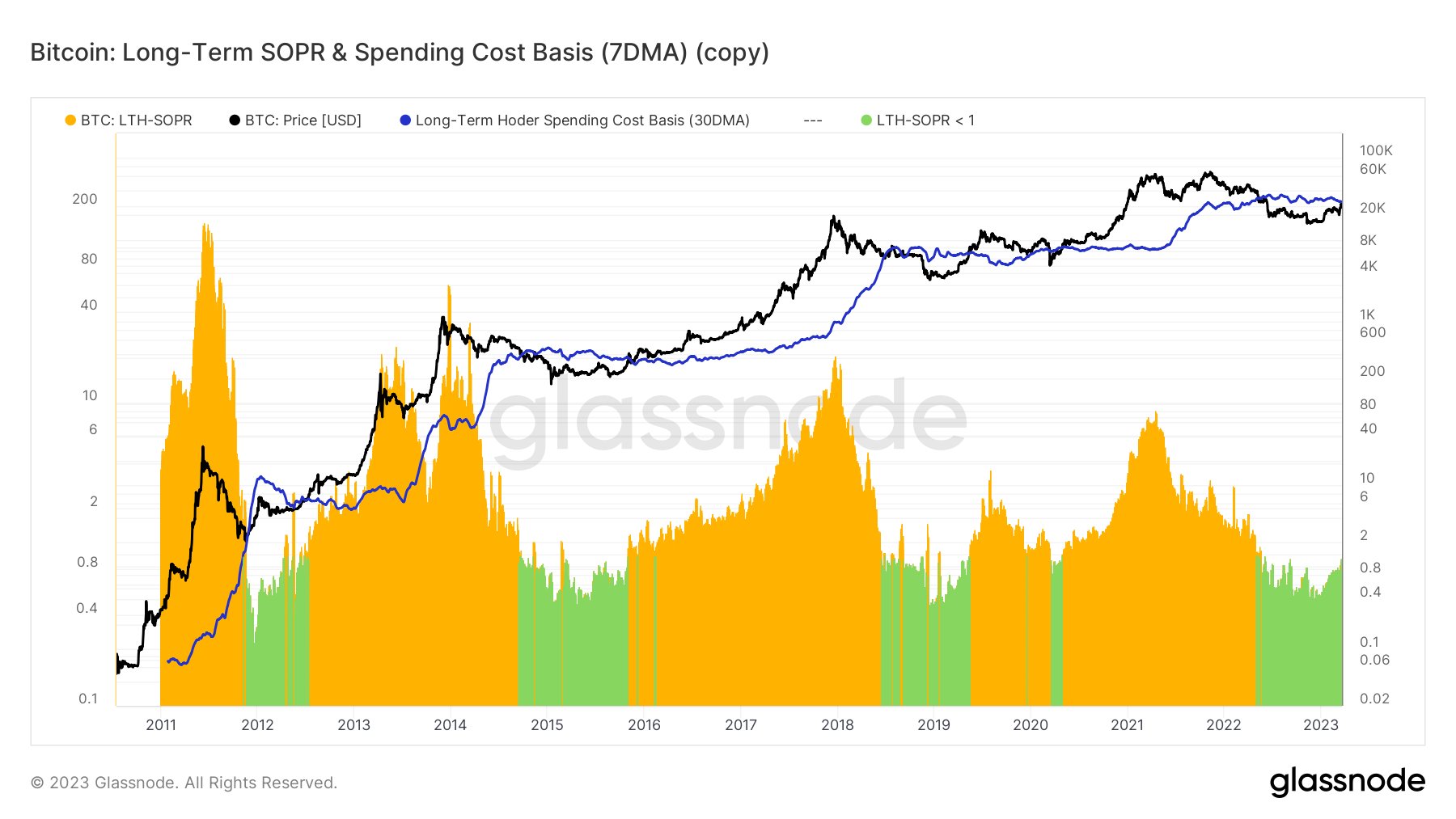

Graph showing Bitcoin LTH SOPR and spending outgo ground from 2011 to 2023 (Source: Glassnode)

Graph showing Bitcoin LTH SOPR and spending outgo ground from 2011 to 2023 (Source: Glassnode)This is the archetypal clip since January 2020 that semipermanent holders sold their BTC to fastener successful profits. All LTH selloffs since past person been a effect of capitulation. This behaviour is seen successful the summation successful transportation measurement from LTHs to speech addresses.

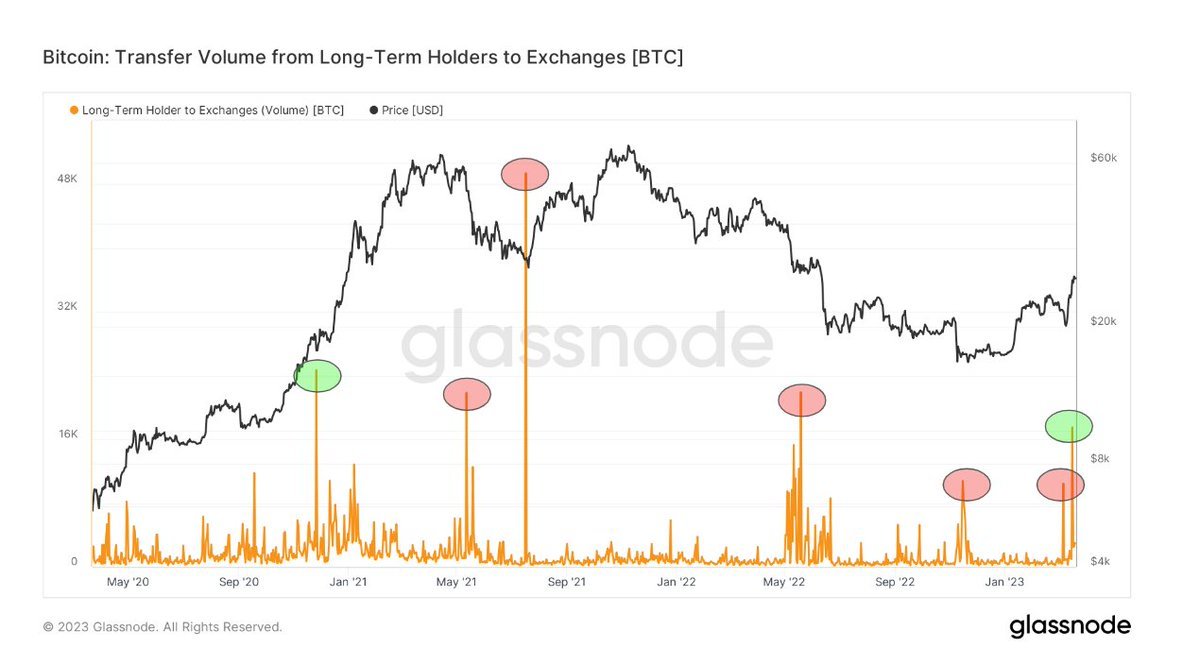

Graph showing Bitcoin’s transportation measurement from semipermanent holders to exchanges from January 2020 to March 2023 (Source: Glassnode)

Graph showing Bitcoin’s transportation measurement from semipermanent holders to exchanges from January 2020 to March 2023 (Source: Glassnode)If LTHs proceed to merchantability their BTC, we could spot a terms pullback successful the coming weeks. The marketplace tends to respond with volatility whenever semipermanent holder proviso decreases, which could erase astir of the gains Bitcoin made since the ongoing banking situation began.

The station Bitcoin semipermanent holders locking successful profits could pb to BTC terms pullback appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)