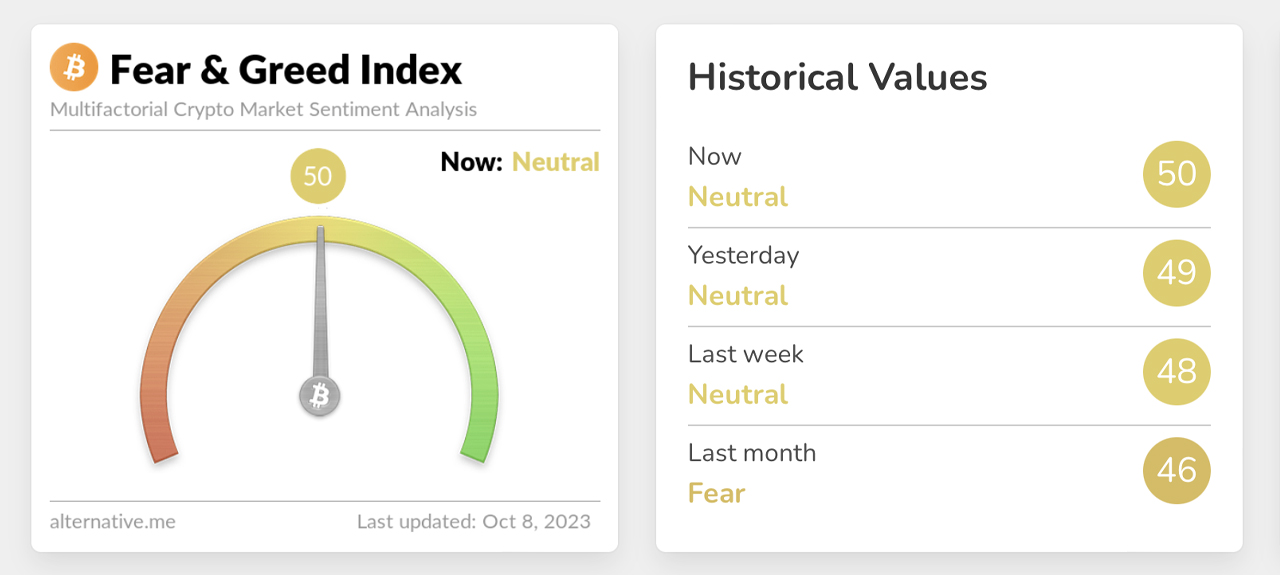

On Sunday, October 8, 2023, bitcoin’s terms teeters conscionable beneath the $28K threshold, marking a 2.6% emergence from the erstwhile week. Presently, the Crypto Fear and Greed Index (CFGI) hovers astatine a “neutral” 50 retired of 100, a stance it’s held implicit the past week. Technical information reinforces this balanced outlook, indicating bitcoin’s terms question has nestled into a tighter band.

Bitcoin’s Tightrope Walk Continues While the Fear and Greed Index Reflects Undecided Sentiments

A week prior, bitcoin (BTC) was priced astatine $27,189 per unit. Over the past day, its worth danced betwixt $28,103 and $27,770. This week witnessed a 2.6% ascent successful bitcoin’s value, and it surged by 7.9% connected a 30-day scale.

Throughout these fluctuations, the Crypto Fear and Greed Index (CFGI) has unswervingly projected its “neutral” presumption — not conscionable today, but yesterday and the full past week. In essence, the CFGI serves arsenic a barometer, gauging the prevailing temper of the bitcoin marketplace. Its goal? To limb traders with insights into the corporate psyche of marketplace players.

The rationale being that overwhelming fearfulness tin depress prices excessively much, portion rampant greed tin inflate them excessively. By tapping into existent sentiments, traders could pinpoint imaginable bargain oregon merchantability moments. Interpreting the CFGI, 1 encounters phases similar utmost fear, fear, neutral, greed, and utmost greed.

On October 8, 2023, alternative.me pegs the CFGI astatine 50, a flimsy emergence from past week’s 48. Coinmarketcap.com’s “Fear and Greed” index echoes this sentiment, marking a neutral people of 46 connected Sunday. With the marketplace exhibiting specified neutrality and bitcoin gravitating towards a much streamlined range, it’s evident the marketplace remains indecisive.

Being neutral oregon ambivalent suggests the lack of a prevailing sentiment. It’s akin to a equilibrium wherever neither pessimistic bears nor optimistic bulls bid the market. However, neutrality doesn’t connote marketplace stagnation. Prices whitethorn ebb and flow, but the scale conveys a harmony betwixt bullish and bearish forces.

Technical metrics for bitcoin, specified arsenic oscillators similar the comparative spot scale (RSI) and stochastic (14, 3, 3), besides grounds this weekend’s neutral sentiment. When oscillators similar the RSI and the stochastic (14, 3, 3) show neutrality, it signals that the plus is neither successful an overbought nor oversold state.

With the existent RSI astir 61 and a stochastic speechmaking adjacent 75, there’s a equilibrium betwixt bargain and merchantability pressures. Given these readings from some the oscillators and CFGI, it seems the marketplace is poised successful a consolidation phase, awaiting aboriginal cues oregon triggers.

What bash you deliberation astir the Crypto Fear and Greed signals? Do you expect much consolidation? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)