Bitcoin OG Willy Woo said Bitcoin is the “perfect asset” for the adjacent 1,000 years, but says it won’t overtake the US dollar and golden unless it attracts importantly much capital.

“The happening is, you dont get to alteration the satellite unless this monetary plus — successful my opinion, the cleanable plus for the adjacent 1000 of years — does not get to bash its occupation unless superior flows successful and gets large capable to rival the US dollar,” the Bitcoin capitalist said astatine the Baltic Honeybadger league successful Riga, Latvia, connected Sunday.

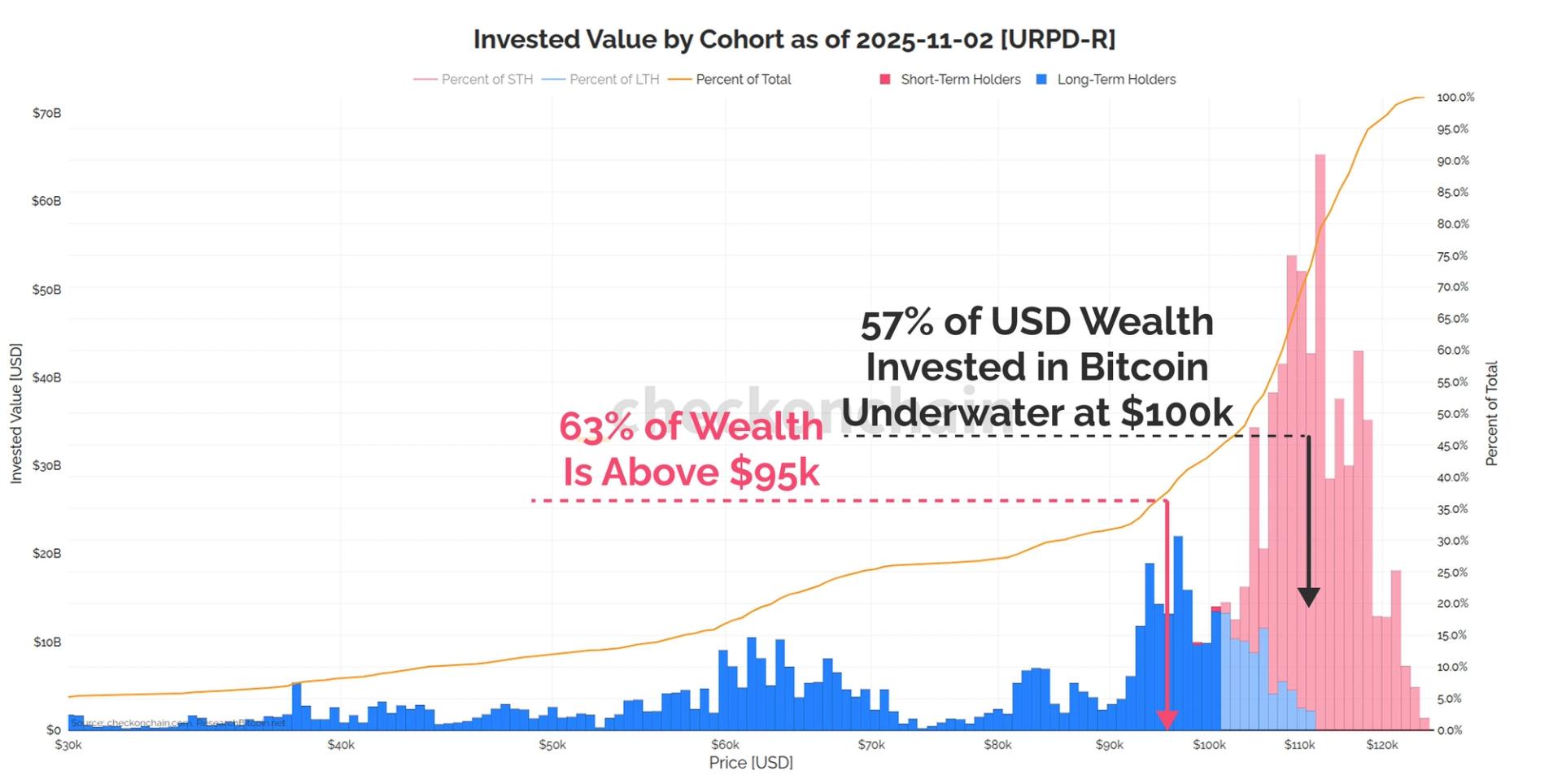

Bitcoin’s marketplace headdress presently sits astatine $2.42 trillion, little than 11% of gold’s $23 trillion marketplace cap, portion the US dollar wealth proviso sits astatine $21.9 trillion.

Bitcoin treasury firms boost adoption, but with risks

Woo said determination are astatine slightest 2 obstacles preventing Bitcoin from toward becoming a satellite reserve asset.

While Bitcoin treasury firms are accelerating adoption, small is known astir however they operation their indebtedness — a hazard that could pb to a Bitcoin treasury bubble burst.

“No one's truly publically looked profoundly into the indebtedness structuring, truthful I perfectly deliberation the anemic ones volition stroke up, and radical tin suffer a batch of money,” Woo said, adding that altcoin treasuries are present practicing the aforesaid playbook that could “create different bubble.”

He expressed interest implicit however the Bitcoin treasury adoption volition unfold should a important marketplace correction oregon carnivore marketplace ensue:

“What happens to the carnivore market? Who's swimming bare and however galore coins get slapped backmost retired into the market?”Bitcoin astatine hazard of nation-state meddling

Meanwhile, reliance connected spot Bitcoin exchange-traded funds and pension funds for Bitcoin vulnerability — arsenic opposed to self-custody — could ore much Bitcoin (BTC) wrong arm’s scope of nation-states, expanding the hazard of a government-led rug-pull, helium said.

Woo noted that portion Bitcoin is attracting flows, the investors with the “money bags” aren’t opting to self-custody.

Instead, they are seeking vulnerability done spot Bitcoin ETFs oregon Bitcoin treasury companies similar Strategy, Woo said, adding that pension funds are relying connected organization solutions similar Coinbase Custody.

Related: Michael Saylor is not sweating the emergence of Ethereum treasury companies

While these Bitcoin on-ramps unfastened the floodgates for much capital, investors are taking connected the hazard of “being rugged astatine a nation-state level,” Woo said.

Woo was speaking alongside different panelists including Blockstream CEO Adam Back, big of What Bitcoin Did Danny Knowles, Bitcoin expert Leon Wankum and Max Kei.

Kei, laminitis and CEO of Bitcoin self-custody level Debifi, said self-custodying Bitcoin volition dispersed progressively — from custodians similar Coinbase to mundane businesses and yet to individuals.

“[The companies will] larn however to self-custody, and they're going to bash self-custody. Then there's individuals wrong these companies [who will] larn astir that. And past efficaciously it's conscionable going to dispersed retired massively.”

Companies inactive the astir ‘logical’ spot for Bitcoin adoption

Despite Woo’s concerns astir firm Bitcoin adoption risks, Back said companies stay the astir logical starting constituent for Bitcoin adoption.

Using Bitcoin’s expected aboriginal returns arsenic a “hurdle rate” for investments, helium said, “If a institution can’t bushed Bitcoin, they should adjacent up store and bargain Bitcoin.”

2 months ago

2 months ago

English (US)

English (US)