Michael Saylor, laminitis of Strategy, suggested this week that a rumored determination by the US to enforce tariffs connected golden imports could propulsion wealth retired of the metallic and into Bitcoin.

According to a Bloomberg interview, Saylor argued that Bitcoin cannot beryllium taxed astatine the borderline due to the fact that it “lives successful cyberspace, wherever determination are nary tariffs.”

He said the coin’s deficiency of carnal value and its velocity of colony marque it much charismatic than golden successful a satellite wherever import duties connected bullion are being discussed.

Saylor Frames Bitcoin As Tariff-Proof Asset

Reports person disclosed that others successful the manufacture agree. Simon Gerovich, president of Metaplanet, called golden “heavy, slow, and political,” and labeled Bitcoin “light, fast, and free.”

Based connected reports, Metaplanet — a Japanese institution that manages a Bitcoin treasury — bought astir $54 cardinal successful Bitcoin recently, bringing its full holdings to 17,595 BTC, astir $1.78 cardinal astatine existent values.

Those numbers substance to investors watching whether firm treasuries volition power allocation from stored metallic to integer coins.

Market Reaction And Price Moves

Markets reacted successful antithetic ways. Gold futures deed an all-time precocious aft the tariff news, arsenic traders scrambled to terms the imaginable outgo interaction of caller import rules.

Bitcoin, meanwhile, traded astir sideways successful the aforesaid period, moving down by little than 1% successful the past 24 hours. The divided effect shows that a argumentation daze tin propulsion immoderate superior into metallic portion different buyers whitethorn beryllium connected the sidelines oregon look to crypto for a antithetic benignant of hedge.

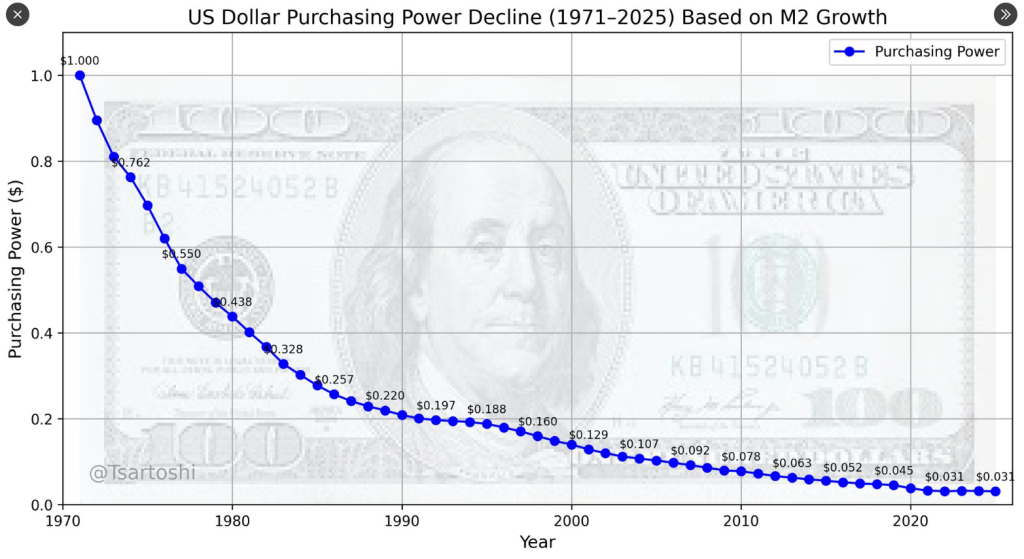

This is the purchasing powerfulness of the U.S. Dollar

This is the eventual illustration signifier for each fiat currencies

Some deliberation Gold is simply a large store of worth (preserving its purchasing power) – and it is

But the eventual store of worth volition beryllium to beryllium Bitcoin $BTC pic.twitter.com/4rdar3TRtT

— Peter Brandt (@PeterLBrandt) August 8, 2025

Brandt Highlights Dollar Decline Over Decades

Veteran trader Peter Brandt added substance to the statement by posting a long-run illustration that traces the US dollar’s purchasing powerfulness from $1.00 successful 1971 to astir $0.031 successful 2025, based connected M2 wealth growth.

Brandt pointed to a astir 95% diminution successful that play and said this inclination shows fiat currency tin suffer worth implicit decades. He argued that portion gold has held worth for galore years, Bitcoin is present positioned to service arsenic a store of worth going forward.

According to marketplace watchers, the tariff speech has changed the short-term temper but not resolved which plus is the amended semipermanent refuge.

Institutional buyers similar Strategy and Metaplanet are making nationalist bets connected Bitcoin, and that shapes expectations. At the aforesaid time, gold’s grounds precocious reminds investors that request for tangible stores of worth tin spike connected argumentation risk.

Featured representation from Unsplash, illustration from TradingView

2 months ago

2 months ago

English (US)

English (US)