The crypto rally took a long-overdue intermission connected Thursday arsenic traders took immoderate profits pursuing weeks of relentless beforehand that lifted bitcoin BTC adjacent to grounds prices.

The consolidation occurred amid a slew of U.S. economical information releases. April retail income missed expectations, shaper prices roseate little than forecast, jobless claims stayed connected track, portion the NY Empire State Manufacturing Index and Philadelphia Fed Manufacturing Survey showed softening concern activity—signals that did small to rattle accepted markets. The S&P 500 added 0.4%, portion the Nasdaq finished flat.

Bitcoin pulled backmost to $101,000 aboriginal successful the U.S. league earlier rebounding supra $103,000 later, modestly down implicit the past 24 hours.

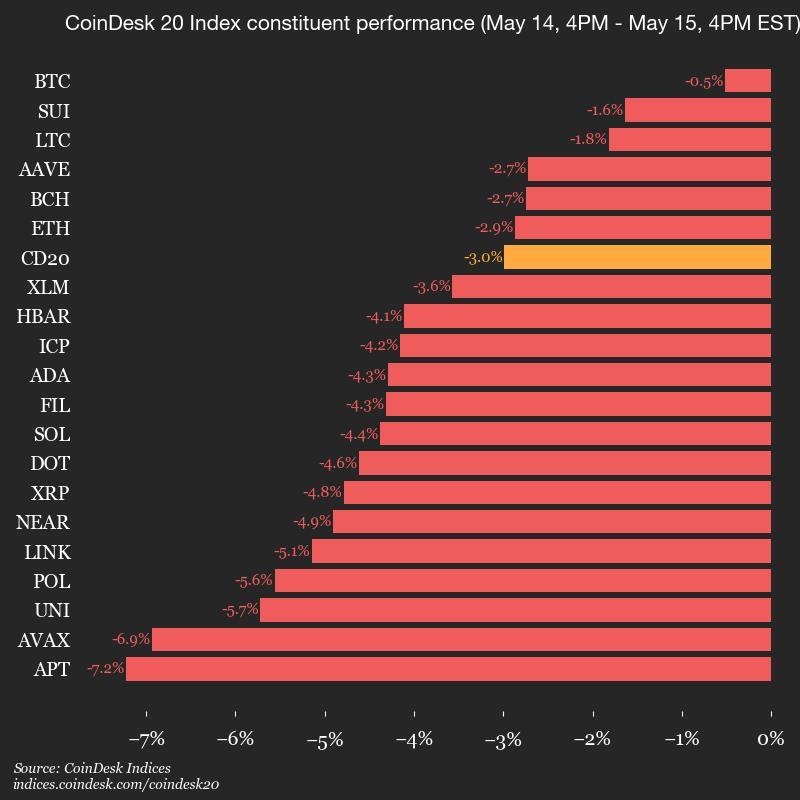

Altcoins fared worse with the broad-market CoinDesk 20 Index declining 3% during the aforesaid period. Native tokens of Aptos APT, Avalanche AVAX and Uniswap UNI tumbled 6%-7%.

Crypto investors shouldn't sweat today's pullback, analysts told CoinDesk.

"The existent pullback appears to beryllium a correction wrong a broader medium-term uptrend," said Ruslan Lienkha, main of markets astatine YouHodler.

The upward momentum successful equity markets moderated aft the China-U.S. tariff delay, and short-term traders began locking successful profits, helium said. "This displacement successful sentiment has spilled implicit into riskier assets, including BTC."

"Anything beneath 5% [price move] tin often beryllium considered conscionable marketplace noise," said Kirill Kretov, trading automation adept astatine CoinPanel. "Some of this question apt comes from profit-taking, arsenic traders unafraid gains aft the caller rally. With liquidity truthful thin, adjacent humble sell-offs tin rapidly construe into noticeable corrections."

Backing distant from short-term movements, the broader terms enactment seems steadfast with nary wide signs of an imminent top.

Vetle Lunde, elder expert astatine K33 Research, said BTC conscionable exited 1 of its longest periods of below-neutral backing rates, a awesome of antiaircraft positioning

"This resembles the risk-averse patterns from October 2023 and 2024 and is acold from resembling terms enactment adjacent past section marketplace peaks," wrote Lunde, who was optimistic that the deficiency of froth with BTC supra $100,000 BTC paves the mode for imaginable caller grounds highs.

According to Steno Research, crypto tailwinds stem from a stealth enlargement successful backstage credit—especially successful the U.S. and Europe. In past bull runs, crypto thrived connected basal wealth expansion: monolithic injections of reserves by cardinal banks that fueled plus ostentation crossed the board. This time, however, the equilibrium sheets of the Fed and European Central Bank person continued shrinking done quantitative tightening.

“Many person pointed to China’s liquidity injections arsenic the superior operator of the rally,” Samuel Shiffman wrote successful a Thursday report. “But that misses the mark. The existent enactment is coming from Western slope recognition growth—a quieter, little disposable motor down this move.”

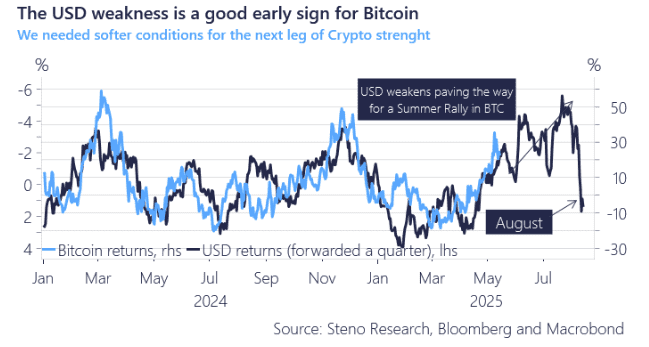

He said that forward-looking indicators task planetary fiscal conditions improving into the summertime months, driven chiefly by the U.S. dollar weakening. This has historically pb to higher BTC prices.

"We’ve apt got country done June and into aboriginal July earlier the representation begins to change," Shiffman said. "But erstwhile we attack the backmost fractional of July, the setup gets trickier. Our starring indicators suggest that the highest successful fiscal easing mightiness not past past August."

5 months ago

5 months ago

English (US)

English (US)