Bitcoin is trading astir $107,000 aft its caller flash crash, maintaining stableness to forestall further diminution but is yet to instrumentality to trading supra $110,000. Notably, fashionable crypto expert Titan of Crypto shared a elaborate Gaussian Channel investigation connected X that points to Bitcoin’s macro bull operation remaining intact despite short-term volatility. His post, which was accompanied by a Bitcoin terms chart, shows however Bitcoin’s presumption comparative to the Gaussian Channel offers a wide presumption of the ongoing cycle.

Bull Market Intact Above Gaussian Channel

Titan of Crypto noted that Bitcoin’s placement supra the Gaussian Channel represents spot successful the semipermanent trend. As shown successful the play candlestick terms illustration below, the greenish transmission corresponds to bullish phases, portion reddish regions correspond bearish downturns, a premier illustration being the 2022 carnivore market.

At the clip of writing, the precocious set is positioned astir $101,300 and trending upward. Therefore, Bitcoin’s terms enactment astir $107,000 means that it is yet to interruption into the Gaussian transmission and its wide marketplace operation is inactive solid. From this, it tin beryllium inferred that Bitcoin’s existent pullback from the October 6 all-time precocious supra $126,000 is lone a impermanent intermission within a larger bull market.

Bitcoin Gaussian Channel. Source: Titan of Crypto connected X

However, though the Gaussian Channel speechmaking looks favorable, Titan of Crypto noted that the indicator should not beryllium treated arsenic a trading trigger. “It’s not a bargain signal, it’s a macro discourse indicator,” he stated. Being supra the Gaussian Channel doesn’t needfully equate to buying more. It simply means the bull marketplace operation is inactive intact.

The Gaussian Channel works champion when combined with different indicators specified arsenic trading volume, moving averages, and on-chain accumulation trends to corroborate directional momentum.

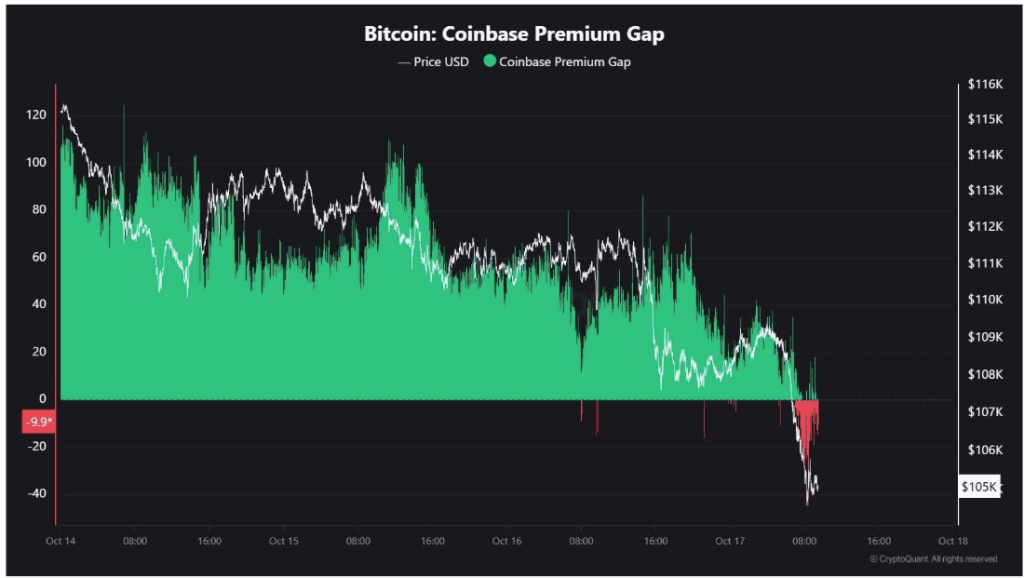

Coinbase Premium Gap Turns Red

Speaking of different indicators, on-chain information from CryptoQuant shows that the Coinbase Premium Gap, a metric comparing Bitcoin’s terms connected Coinbase versus different exchanges, has turned red. As shown successful the illustration below, Coinbase’s Premium Gap went connected a crisp diminution from affirmative premium levels supra +60 earlier successful the week to arsenic debased arsenic -40 erstwhile the Bitcoin terms fell to $101,000.

Interestingly, the Coinbase Premium Gap has accrued to astir -10 astatine the clip of writing, meaning US investors are starting to crook bullish again. This tin beryllium seen arsenic a bullish signal, arsenic akin dips successful US request were recorded betwixt March and April earlier the Bitcoin terms yet rallied much than 60% to scope caller all-time highs.

However, a reddish Coinbase Premium Gap unsocial is not decisive. It should be interpreted alongside other information points, including ETF inflows, trading volume, liquidity, and derivatives backing rates. At the clip of writing, Bitcoin was trading astatine $107,120.

Featured representation from Vecteezy, illustration from TradingView

5 hours ago

5 hours ago

English (US)

English (US)