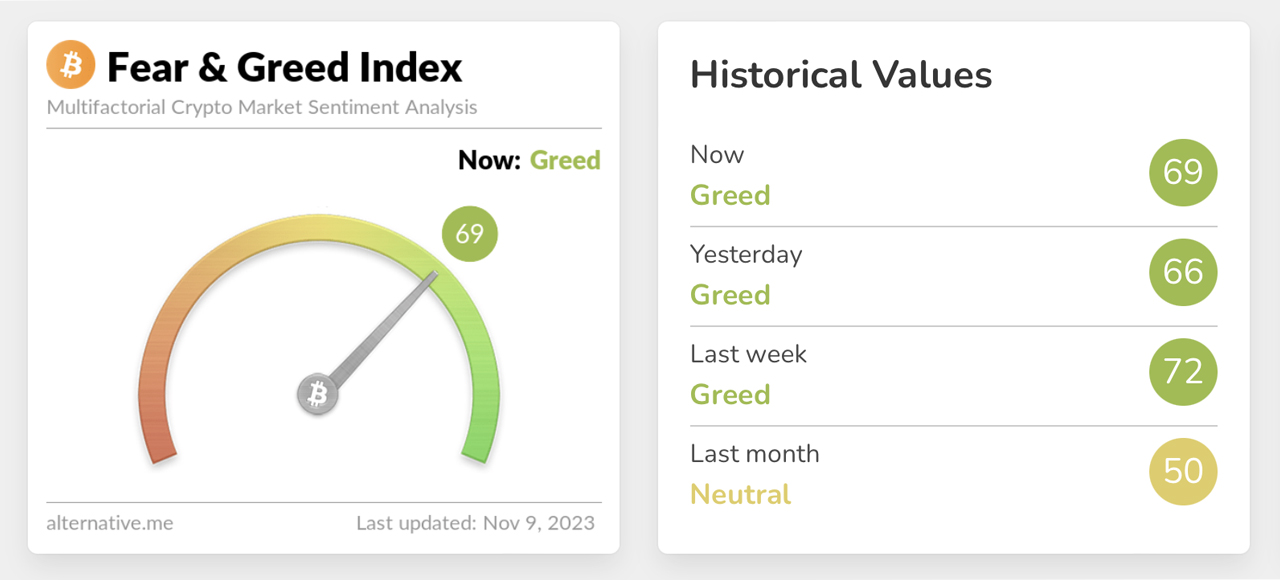

The Crypto Fear and Greed Index (CFGI) presently reveals a temper of “greed” wrong the cryptocurrency market, scoring a 69 retired of 100. As of November 9, 2023, astatine 5:20 a.m. Eastern Time, the terms of bitcoin peaked supra $37K — a highest not observed since the archetypal week of May 2022, stretching implicit a span of much than 550 days.

Bitcoin Rises Above $37K Zone; Shorts Crushed With $96 Million Loss

The valuation of bitcoin (BTC) has escalated by 4.4% against the U.S. dollar this Thursday, marking a beardown 34% appreciation implicit the erstwhile month. Bitcoin is present trading conscionable supra the $37K threshold, a level past witnessed connected May 6, 2022.

This indicates that for an extended play of implicit a year, oregon conscionable beyond 550 days, bitcoin’s terms lingered beneath the $37K mark. It has been 238 days since BTC’s worth dipped beneath $25,000, which occurred connected March 16, 2023, and 299 days since it fell nether the $20,000 people connected January 14, 2023.

Further, bitcoin has not been priced astatine $10,000 oregon little since July 27, 2020, which dates backmost astir 1,200 days. From 2020 to 2023, bitcoin’s terms remained beneath $10,000 for a duration of 202 days, beneath $20,000 for 471 days, and nether $25,000 for 637 days successful total.

This week, bitcoin’s terms has maintained a coagulated presumption supra $35K, signaling a bullish outlook arsenic suggested by the latest method oscillators and moving averages. The 10-day short-term exponential moving mean (EMA) and elemental moving mean (SMA) are flashing bullish signals, indicative of a beardown terms trajectory successful caller times.

Despite these affirmative indications, the Crypto Fear and Greed Index (CFGI) continues to suggest a tilt towards “greed.” The scale mirrored this sentiment past week and the time anterior arsenic well, portion it reflected “neutral” feelings past period arsenic reported by alternative.me.

According to the CFGI, “extreme fear” whitethorn hint astatine wide interest among traders and investors, perchance marking a premier introduction juncture. Conversely, “extreme greed” suggests that the crypto marketplace mightiness beryllium ripe for a terms correction.

Nonetheless, caller statistic item that those who wagered connected a crypto downturn by positioning abbreviated bets person incurred losses amounting to $162 million successful the past time alone, with bitcoin’s swift ascent towards $37K causing the liquidation of implicit 59% of these shorts, equating to astir $96 million.

What bash you deliberation astir the Crypto Fear and Greed Index? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)