Hashprice, a metric coined by Luxor that gauges mining profitability, estimates the regular income of miners comparative to their estimated publication to the Bitcoin network's hash power. In different words, it is the expected worth miners tin expect from 1 TH/s of hashing powerfulness per day.

According to Glassnode, hashprice is hovering supra $62 PH/s, astir the highest level since mid-December.

What's driving the summation successful hashprice? Well bitcoin (BTC) has surged to good implicit $100,000, a 56% summation successful 3 months and has fixed the miners immoderate relief. The web has besides seen a flimsy summation successful miner fees of late, astir 12 BTC per day, the highest magnitude for implicit a month, partially driven by the network's inscription activity.

Due to the halving successful April 2024, wherever the mining rewards get chopped successful half, the hashprice had dropped from astir $115 PH/s.

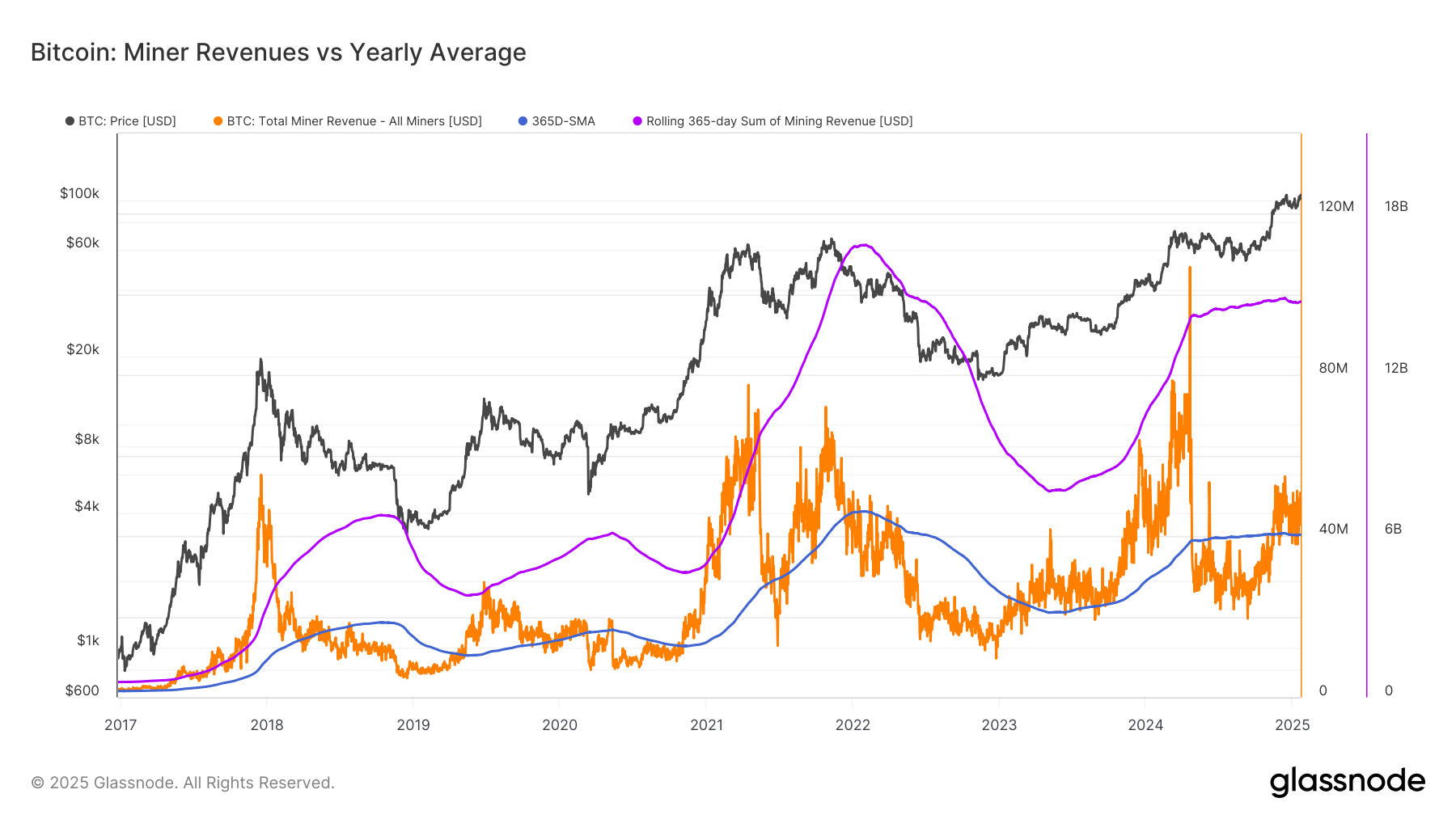

As a effect of the halving, miners struggled successful stock terms appreciation connected mean past year; portion mining gross for overmuch of 2024 was beneath the rolling 365-simple moving mean (SMA). Only since November has it reclaimed this moving average, which is simply a historically bullish signal.

While the hash rate, the computational powerfulness successful bid to excavation connected a proof-of-work blockchain, precocious deed all-time highs, arsenic a effect sent the network difficulty to all-time highs, which eats into mining profitability, arsenic it becomes harder for miners to person rewards.

European caput of probe astatine Bitwise, Andre Dragosch, told CoinDesk exclusively astir miners being successful a healthier presumption than past year.

"We person precocious seen a diminution successful web hash complaint since the all-time highs successful aboriginal January. Meanwhile, the terms of bitcoin has increased, and the wide transaction number has picked up again. This has led to a betterment successful hash price, which should technically incentivize miners to proceed ramping up their hash rate".

Dragosch says, "overall, bitcoin miners look to beryllium good capitalized judging by the continued summation successful bitcoin miner holdings since the opening of the twelvemonth which implies that miners are selling little than they are mining connected a regular basis".

8 months ago

8 months ago

English (US)

English (US)