Key takeaways:

Bitcoin’s semipermanent CAGR of 42.5% outpaces the Nasdaq and gold, but is projected to driblet to 30% by 2030.

The power-law and quantile models support BTC’s Q4 2025 people betwixt $150,000–$200,000, with $1.2million to $1.5 cardinal imaginable by 2035.

The semipermanent maturation of Bitcoin (BTC) remains exceptional, according to a caller Bitcoin Intelligence Report, noting that adjacent successful the discourse of different large assets, its trajectory stands out.

The study compared the Nasdaq’s 10-year rolling compound yearly maturation complaint (CAGR), which typically sits successful the mid-single to low-teens, with the latest decennary delivering 16%. Gold has averaged 10.65% implicit the past decade, rising to 12.88% erstwhile adjusted for its 2% yearly proviso growth.

Meanwhile, the US M2 wealth proviso has expanded astatine astir 6% annually implicit the aforesaid period. Against this backdrop, Bitcoin’s modeled CAGR of 42.5% underscores its outsized performance.

The firm’s power-law model, which has tracked Bitcoin with “unprecedented consistency” for 16 years, projects a gradual, adoption-driven deceleration toward 30% by 2030, inactive triple gold’s supply-adjusted maturation rate.

“Bitcoin remains the cleanest barometer of planetary liquidity,” the study states, citing its smaller marketplace size and relation arsenic a “liquidity sponge” successful a structurally expansive monetary regime.

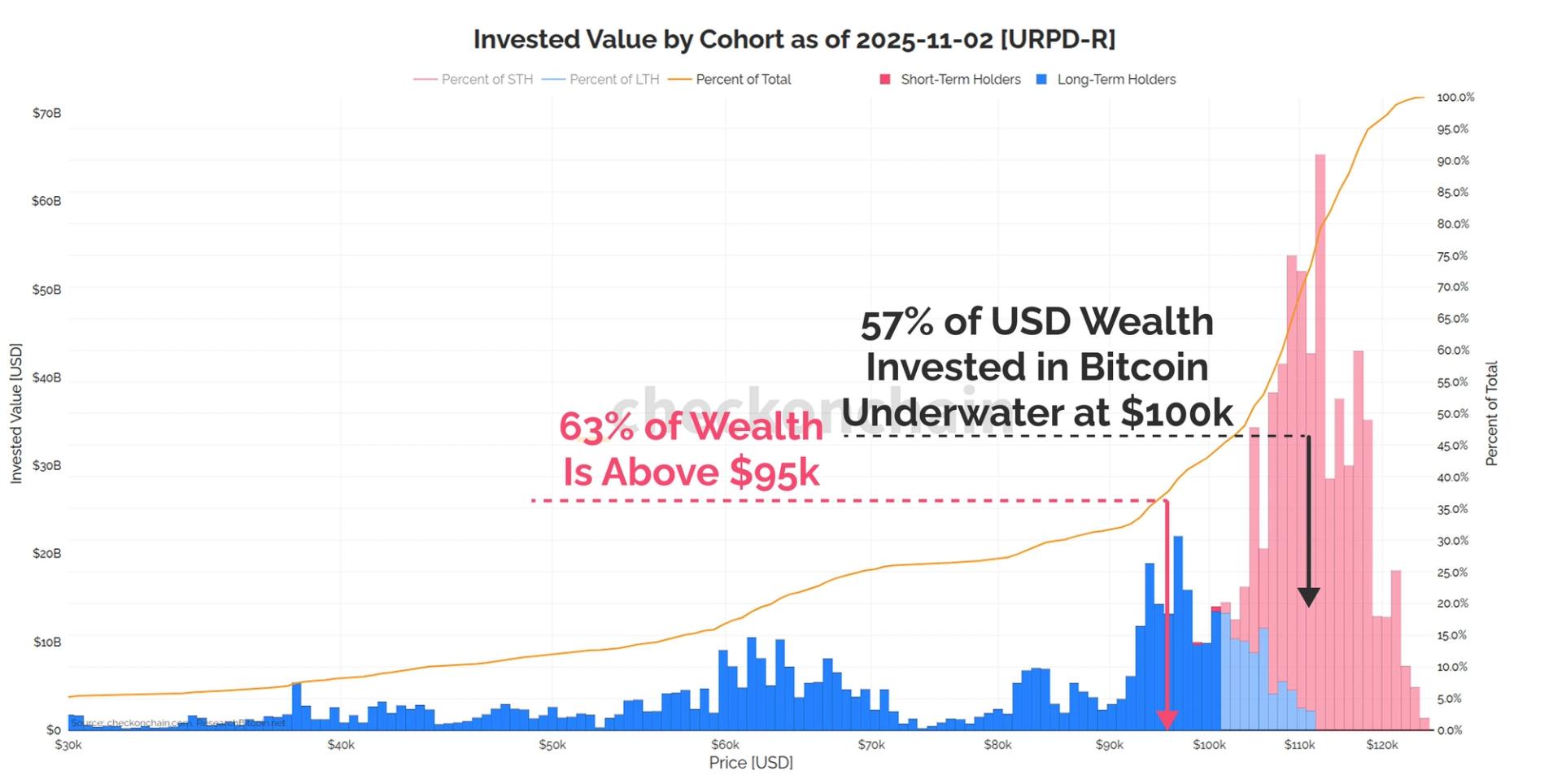

The study shows that the $114,000–$117,000 accumulation portion proved resilient, triggering a spot-led rebound to $122,000.

Bitcoin $200,000 people by Q4 remains connected track

While the contiguous absorption lies conscionable supra $130,000, the year-end people for Bitcoin remains adjacent to $200,000. Its terms projection combines the power-law attack with quantile investigation to way Bitcoin’s humanities growth.

According to the model, the basal inclination for Bitcoin by the extremity of 2025 sits astir $120,000. Factoring successful the cyclical bull phase, the terms could realistically ascent to betwixt $150,000 and $200,000. Looking further out, by 2035, the exemplary anticipates Bitcoin could scope $1.2 cardinal to $1.5 million, a forecast based connected exponential, network-like maturation alternatively than speculative hype.

The illustration shows that each 50% summation successful Bitcoin’s property has historically driven astir a 10x leap successful price, a signifier the exemplary has tracked with beardown accuracy (R² > 0.95). This data-backed trend, paired with coagulated onchain spot and supportive macroeconomic conditions (future involvement complaint cuts), suggests the champion whitethorn inactive beryllium up for Bitcoin successful 2025.

Bitwise main concern serviceman Matthew Hougan indicates a akin outcome. In an interrogation with Cointelegraph, Hougan said that Bitcoin’s supply-demand equilibrium is progressively skewed toward demand, with miners producing less coins than publically traded companies and ETFs are collectively buying. In May, Hougan said,

“I deliberation yet that volition exhaust sellers astatine the $100,000 level wherever we person been stuck, and I deliberation the adjacent stopping constituent supra that is $200,000.”Related: Bitcoin bulls complaint astatine all-time highs arsenic trader says $126K 'pivotal'

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 months ago

2 months ago

English (US)

English (US)