The caller twelvemonth kicked disconnected connected a blessed enactment with bitcoin (BTC) moving towards $100,000, putting down the anemic terms of December. Amid the cheer, CoinDesk warned against being excessively optimistic, noting the undercurrents of sellers looking to reassert themselves.

A week later, BTC has pulled backmost to $93,000 aft failing to support gains supra $100,000 connected Monday, CoinDesk information show.

The latest downturn comes astatine a clip of accrued volatility successful the U.S. Treasury market, wherever semipermanent yields person extended the Q4 2024 rally to deed multi-month highs owed to economical information pointing to stubborn ostentation successful the U.S.

It is not conscionable nominal enslaved yields, the existent oregon inflation-adjusted yields are creeping up too. The output connected the 10-year U.S. inflation-indexed information has jumped to 2.29%, the highest since November 2023, according to charting level TradingView.

When the output offered by fixed-income products starts to look much charismatic successful existent terms, the inducement to put successful hazard assets diminishes. It's peculiarly existent erstwhile the uptick successful the output is driven by hawkish Fed expectations alternatively than economical growth.

That's precisely the lawsuit this week. With information pointing to sticky inflation, traders person pushed the timing of the adjacent Fed complaint chopped to June.

"This morning's descent successful the spot bitcoin terms appears to beryllium successful effect to higher yields successful the Treasury marketplace and the reduced likelihood of further complaint cuts this year. This has impacted the short-term marketplace outlook for crypto assets, which thin to fare amended successful much liquid conditions, "Thomas Erdosi, caput of merchandise astatine CF Benchmarks, told CoinDesk.

Note that the output spike is not conscionable a U.S.-centric issue. Yields are spiking crossed the large economies with Japan and the U.K. joining the fray. The U.K. is experiencing its highest long-end yields since 1998.

All this is impacting stocks, akin to what's happening with BTC. Major indices similar the Nasdaq and the S&P 500 person besides mislaid their New Year gains.

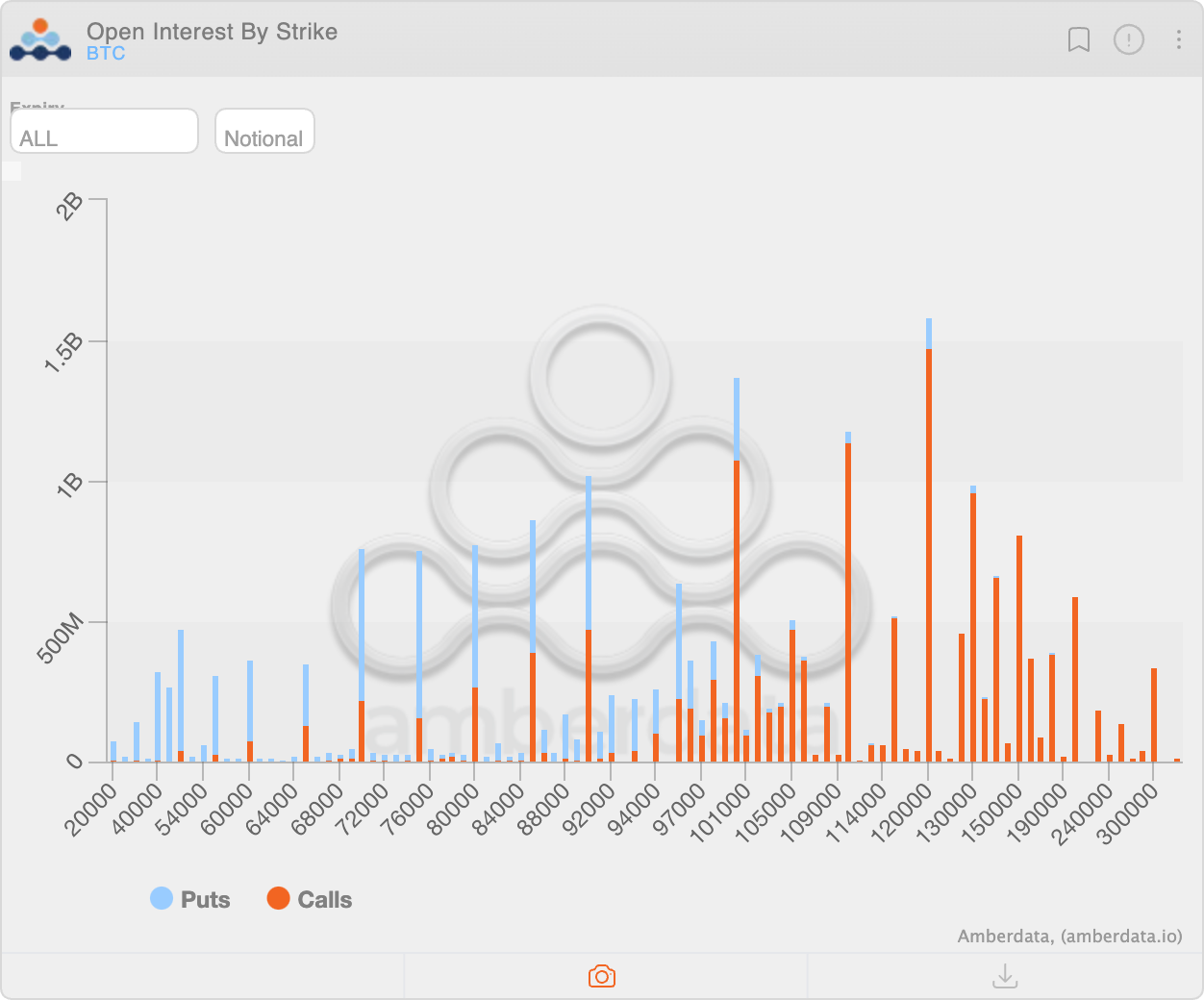

But present is simply a twist: Despite the macro uncertainties, BTC's Deribit-listed options marketplace remains optimistic, with the dollar worth of progressive calls tallying $14.87 cardinal astatine property time, astir doubly the worth of progressive puts, according to information root Amberdata.

A telephone purchaser is implicitly bullish connected the marketplace portion a enactment purchaser is bearish.

Moreover, the $120,000 onslaught telephone enactment remains the astir popular, with a notional unfastened involvement of $1.47 billion. Calls astatine strikes $101,000 and $110,000 besides boast an unfastened involvement of implicit $1 cardinal each. Meanwhile, the astir fashionable enactment enactment astatine $75,000 has an unfastened involvement of $595 million.

Overall, calls expiring aft January proceed to commercialized astatine a notable premium to puts, reflecting a bullish bias.

"We could perchance spot a alteration successful marketplace fortunes by the extremity of this month. The inauguration of President Trump connected Jan. 20, heralding an accrued likelihood of a overmuch much favorable regulatory situation for crypto, could beryllium a cardinal operator successful crypto marketplace sentiment," Erdosi added.

8 months ago

8 months ago

English (US)

English (US)