Bitcoin’s terms jumped from $35,708 to $36,718 betwixt Nov. 8 and Nov. 9, triggering a monolithic effect from the futures market.

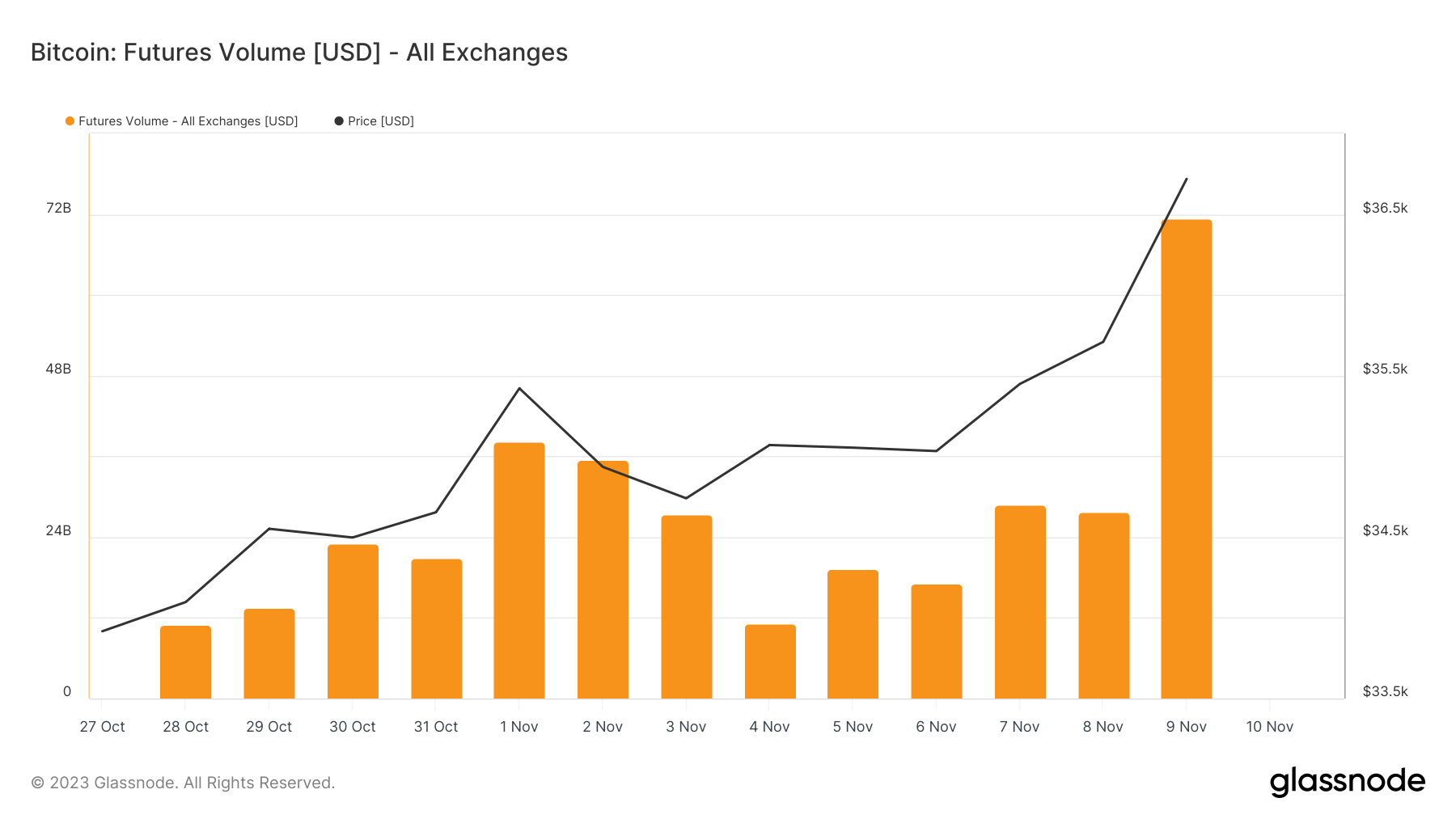

The full measurement of Bitcoin futures traded crossed each exchanges leaped from $27.69 cardinal to $71.29 billion, showing a notable summation successful speculative enactment successful Bitcoin.

Graph showing the full measurement of Bitcoin futures traded crossed each exchanges from Oct. 28 to Nov. 9, 2023 (Source: Glassnode)

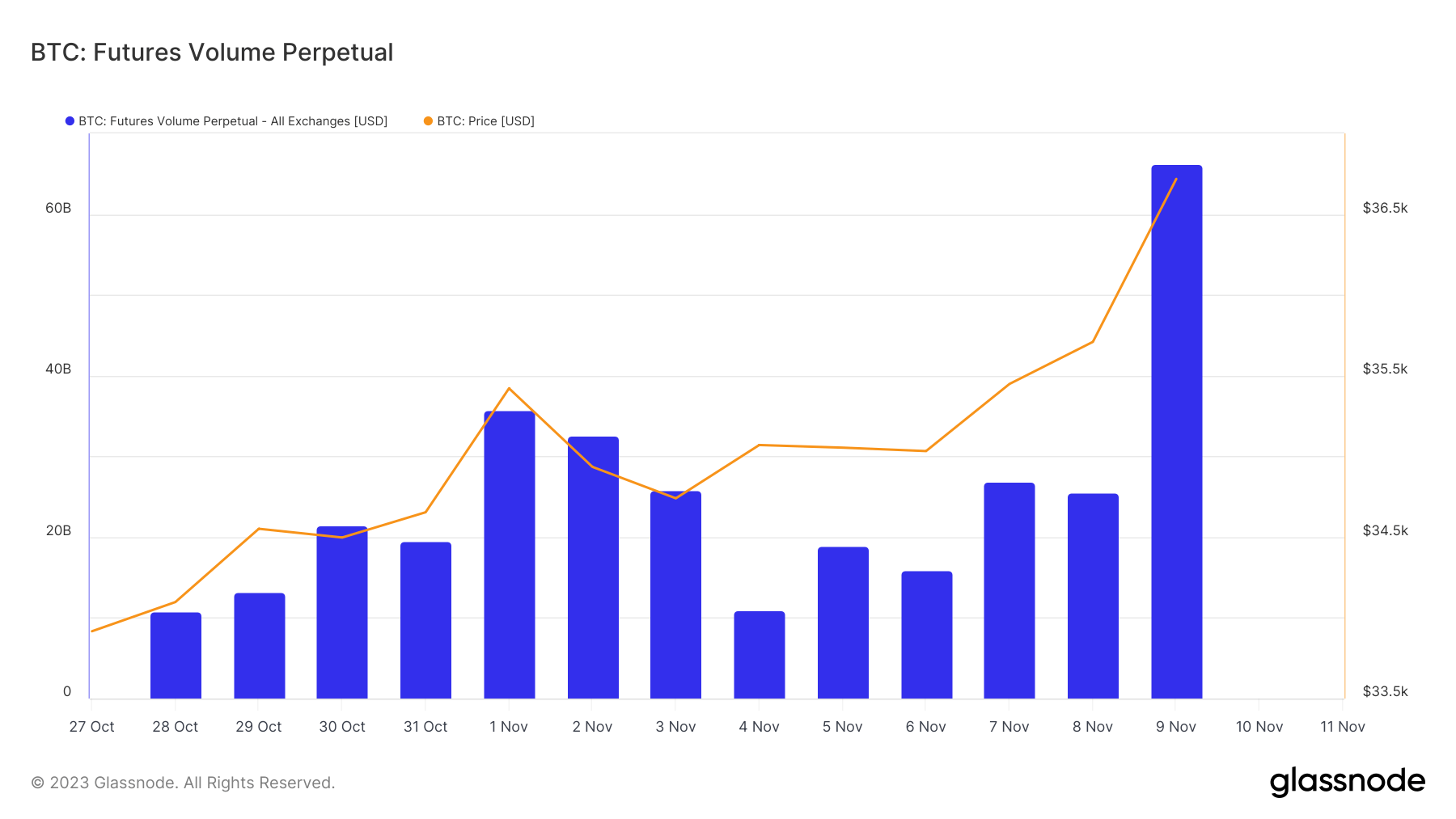

Graph showing the full measurement of Bitcoin futures traded crossed each exchanges from Oct. 28 to Nov. 9, 2023 (Source: Glassnode)This was followed by a akin inclination successful perpetual futures volume, which grew from $25.06 cardinal connected Nov. 8 to $66.31 cardinal connected Nov. 9. Such a precocious measurement successful perpetual futures is peculiarly noteworthy arsenic it indicates ongoing involvement and a speculative temper among traders owed to their non-expiry nature.

Graph showing the full measurement of perpetual Bitcoin futures traded crossed each exchanges from Oct. 28 to Nov. 9, 2023 (Source: Glassnode)

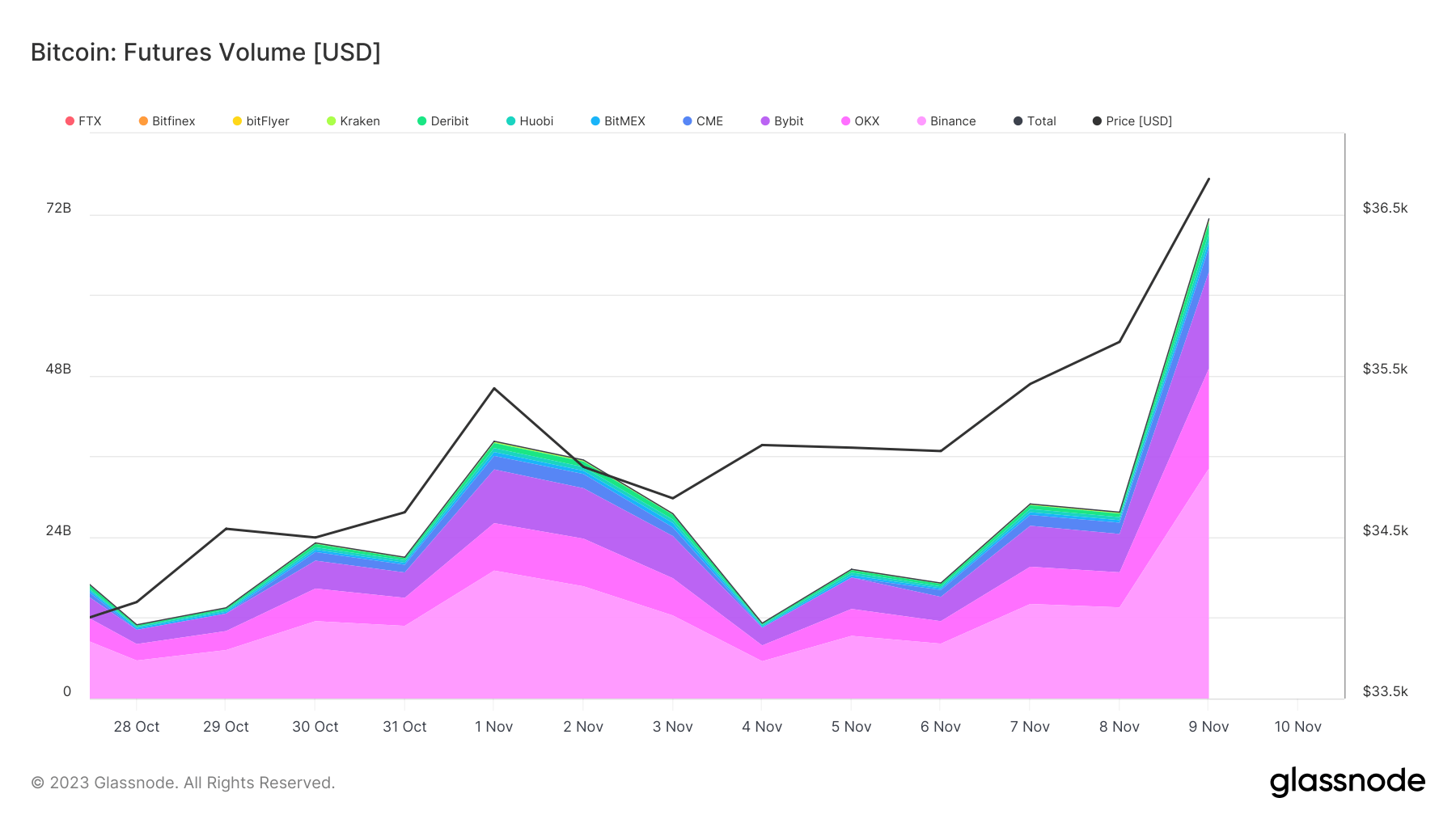

Graph showing the full measurement of perpetual Bitcoin futures traded crossed each exchanges from Oct. 28 to Nov. 9, 2023 (Source: Glassnode)The organisation of this accrued measurement crossed large exchanges similar Binance, OKX, Bybit, and CME provides penetration into the market’s breadth. Binance, for instance, saw its futures measurement much than double, reaching $34.19 billion. This broad-based summation is indicative of wide trader information and interest.

Graph showing the full measurement of Bitcoin futures stacked by exchanges from Oct. 28 to Nov. 9, 2023 (Source: Glassnode)

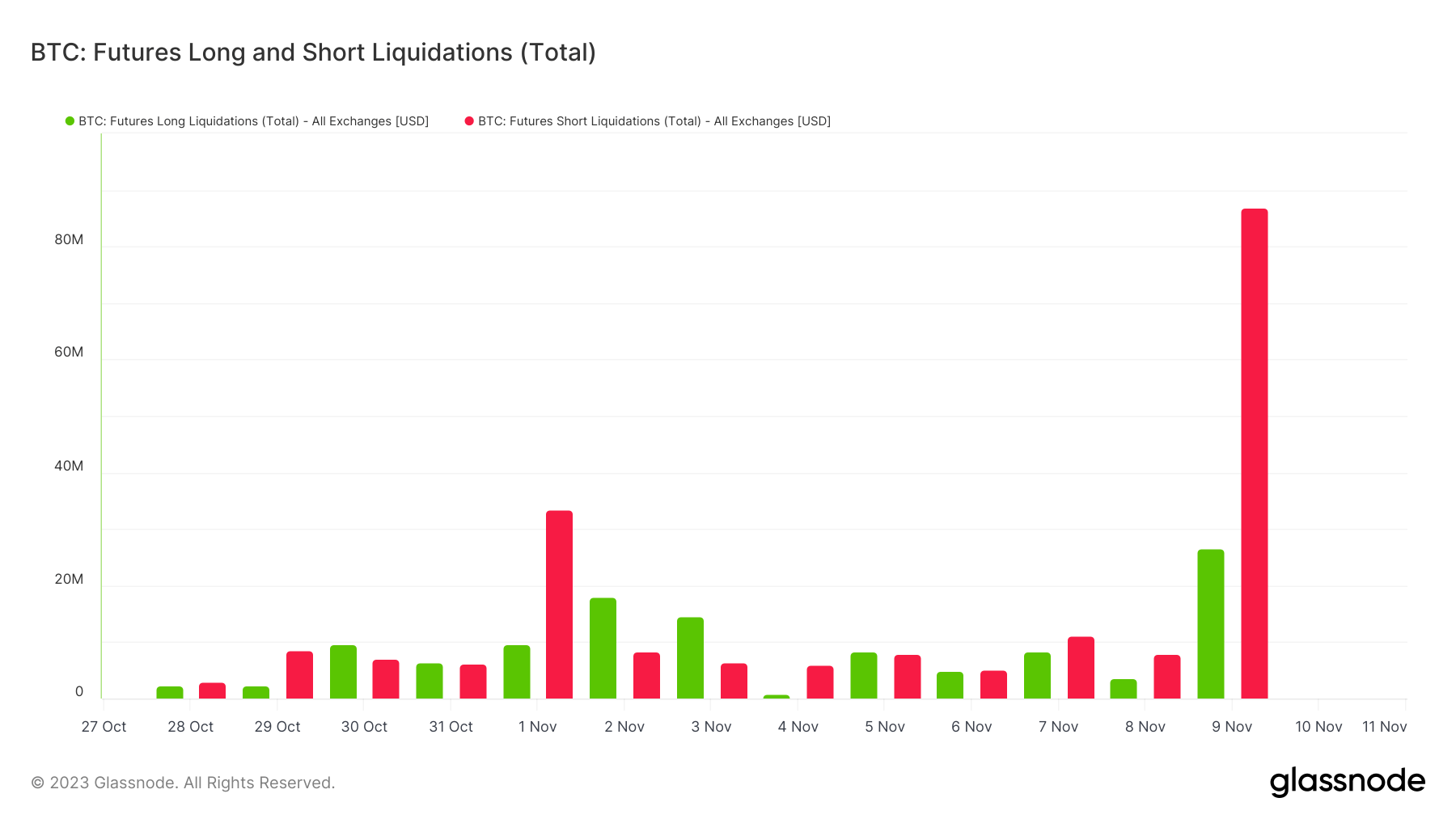

Graph showing the full measurement of Bitcoin futures stacked by exchanges from Oct. 28 to Nov. 9, 2023 (Source: Glassnode)An indispensable facet of this marketplace question is the signifier of liquidations. Long liquidations roseate from $3.72 cardinal to $26.5 million, but much dramatically, abbreviated liquidations accrued from $7.83 cardinal to $86.86 million. This suggests that galore traders who stake against Bitcoin were compelled to exit their positions, perchance fueling the upward terms momentum.

Graph showing the full agelong and abbreviated liquidations connected Bitcoin futures from Oct. 28 to Nov. 9, 2023 (Source: Glassnode)

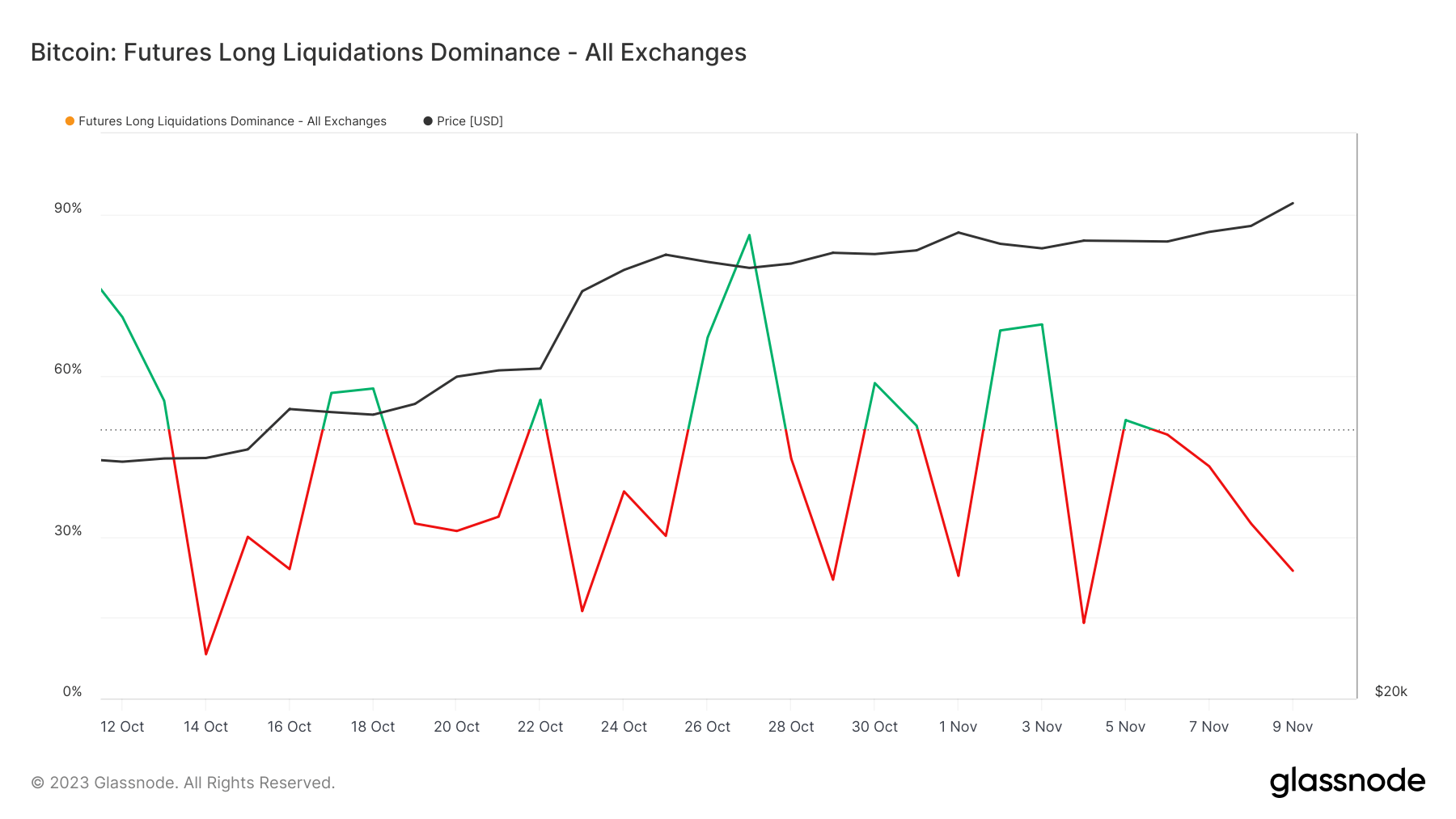

The agelong liquidations dominance astatine 23.73% connected Nov. 9 implies that portion determination were important agelong liquidations, the marketplace predominantly experienced a compression connected abbreviated positions.

Graph showing the dominance of agelong liquidations successful Bitcoin futures from Oct. 28 to Nov. 9, 2023 (Source: Glassnode)

Graph showing the dominance of agelong liquidations successful Bitcoin futures from Oct. 28 to Nov. 9, 2023 (Source: Glassnode)Monitoring the futures marketplace is captious arsenic it indicates trader sentiment and imaginable terms movements. The emergence successful liquidations, peculiarly the crisp summation successful abbreviated liquidations, tin awesome a displacement successful marketplace sentiment and often precedes a terms movement, arsenic seen successful this instance. Similarly, the emergence successful volume, particularly successful a marketplace similar Bitcoin’s, tin denote heightened capitalist involvement oregon speculative trading, some of which tin importantly interaction the price.

The important summation successful abbreviated liquidations indicates a beardown marketplace correction against bearish bets, reinforcing the bullish trend.

The station Bitcoin futures measurement surges 157% arsenic BTC reaches $36.6k appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)